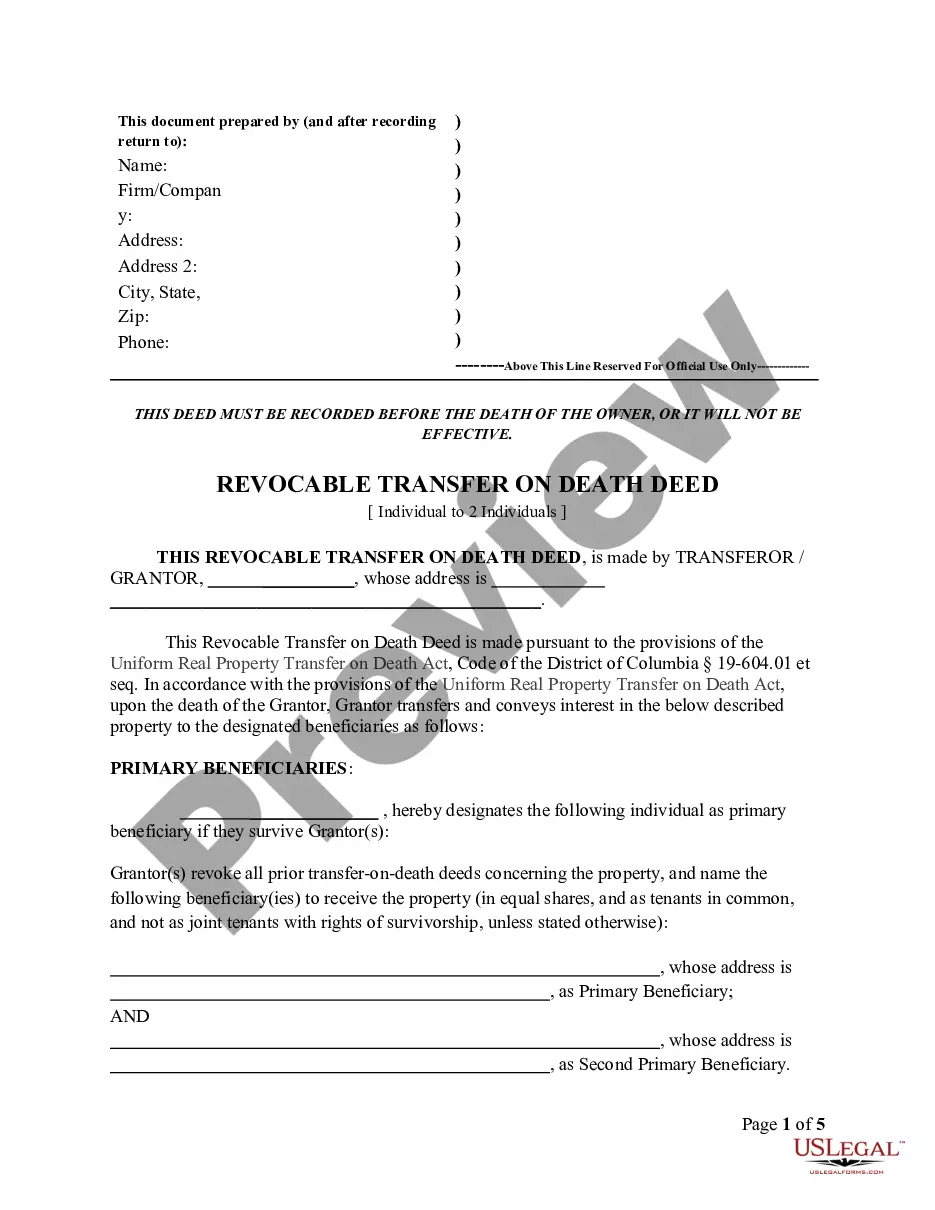

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals

Description District Of Columbia Life Estate Deed Form

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Two Individuals?

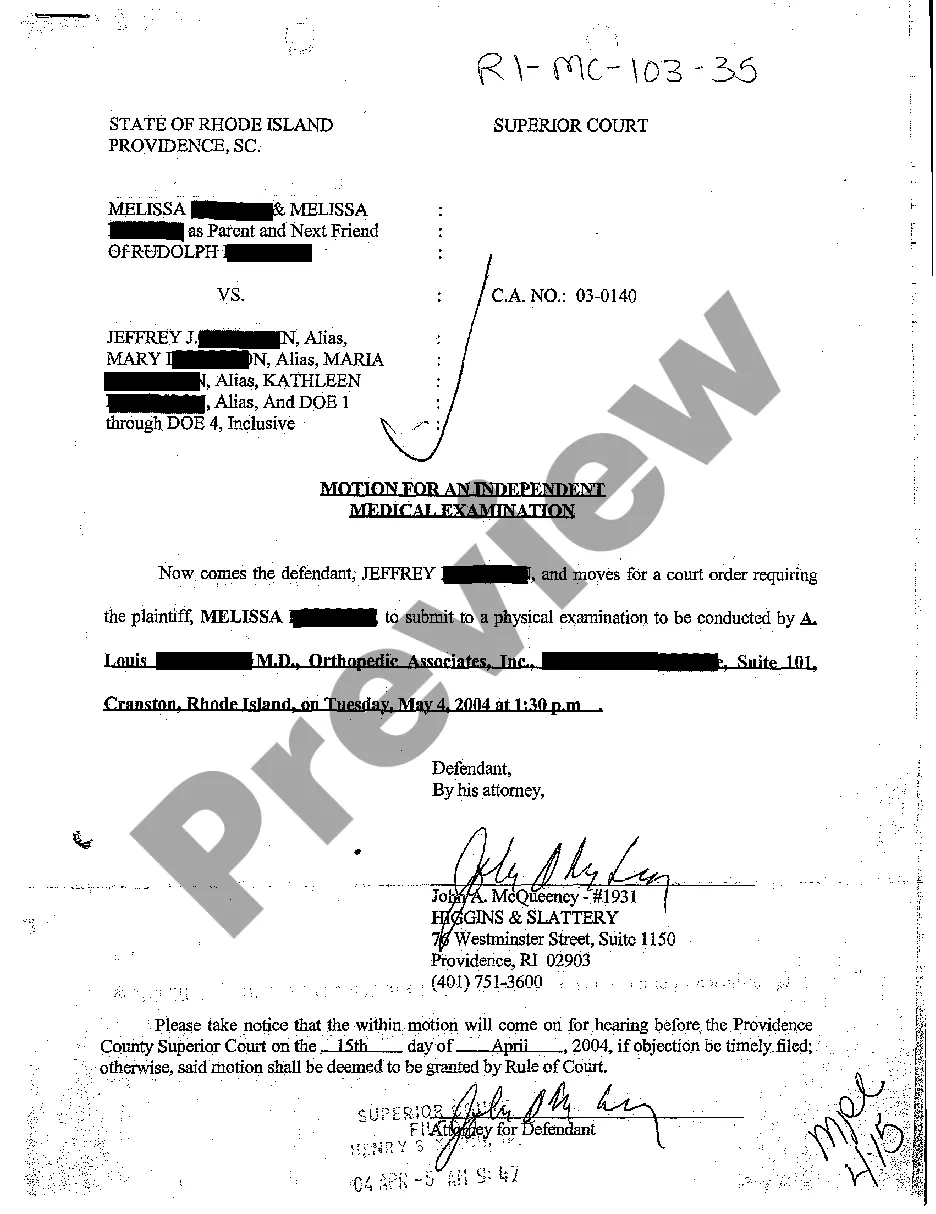

Use US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms library on the internet and provides reasonably priced and accurate samples for consumers and attorneys, and SMBs. The documents are categorized into state-based categories and a few of them might be previewed before being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For people who do not have a subscription, follow the following guidelines to quickly find and download District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals:

- Check to ensure that you get the proper form with regards to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Press Buy Now if it’s the template you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search engine if you need to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals. More than three million users have already used our service successfully. Choose your subscription plan and obtain high-quality forms in just a few clicks.

District Of Columbia Deed Upon Death Form popularity

District Of Columbia Life Estate Deed Other Form Names

FAQ

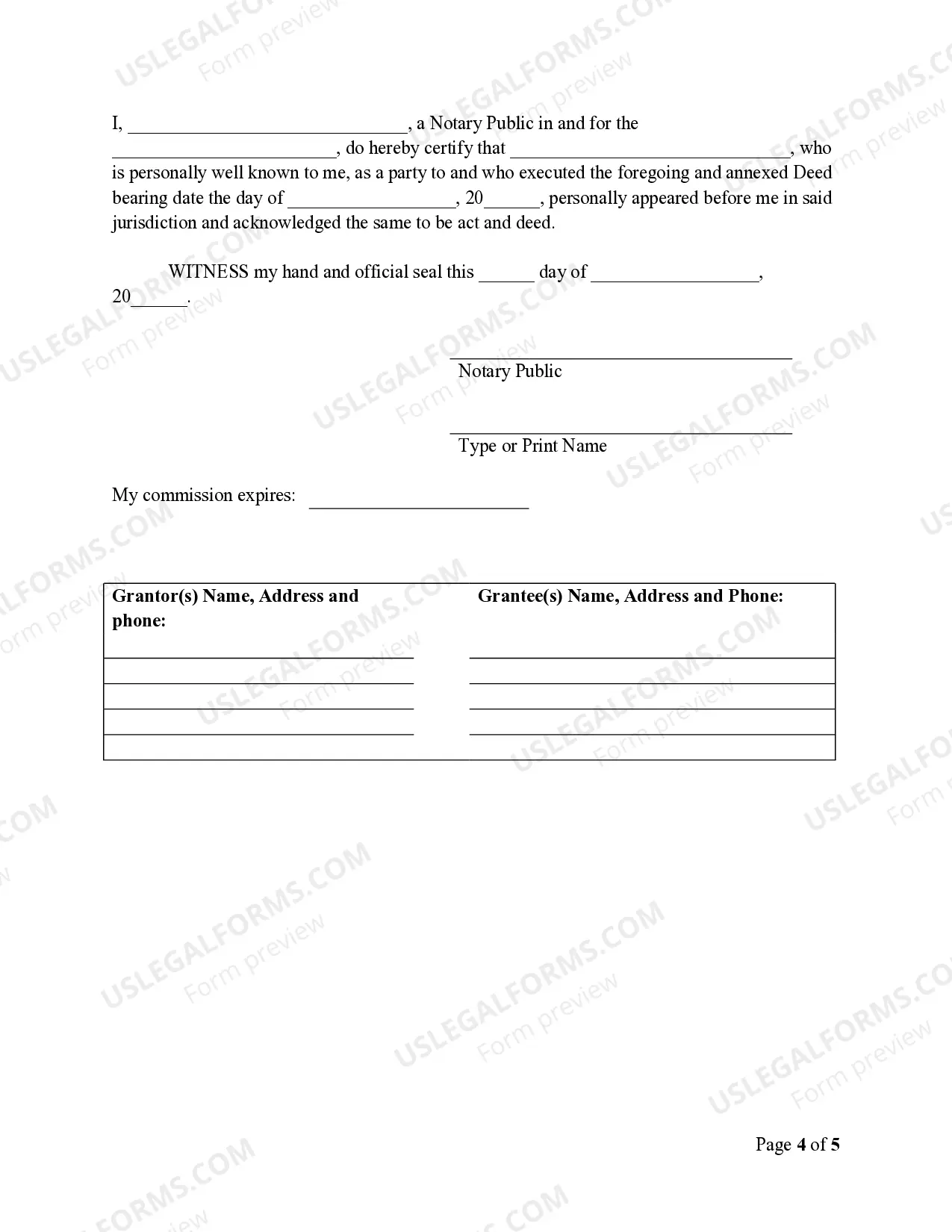

New York does not currently allow the use of a Transfer on Death Deed, unlike the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals. In New York, property owners must explore alternative methods to transfer property upon their death. Understanding your state's regulations is essential for effective estate planning. Using uslegalforms can help you find the right tools and information to navigate property transfer options in New York.

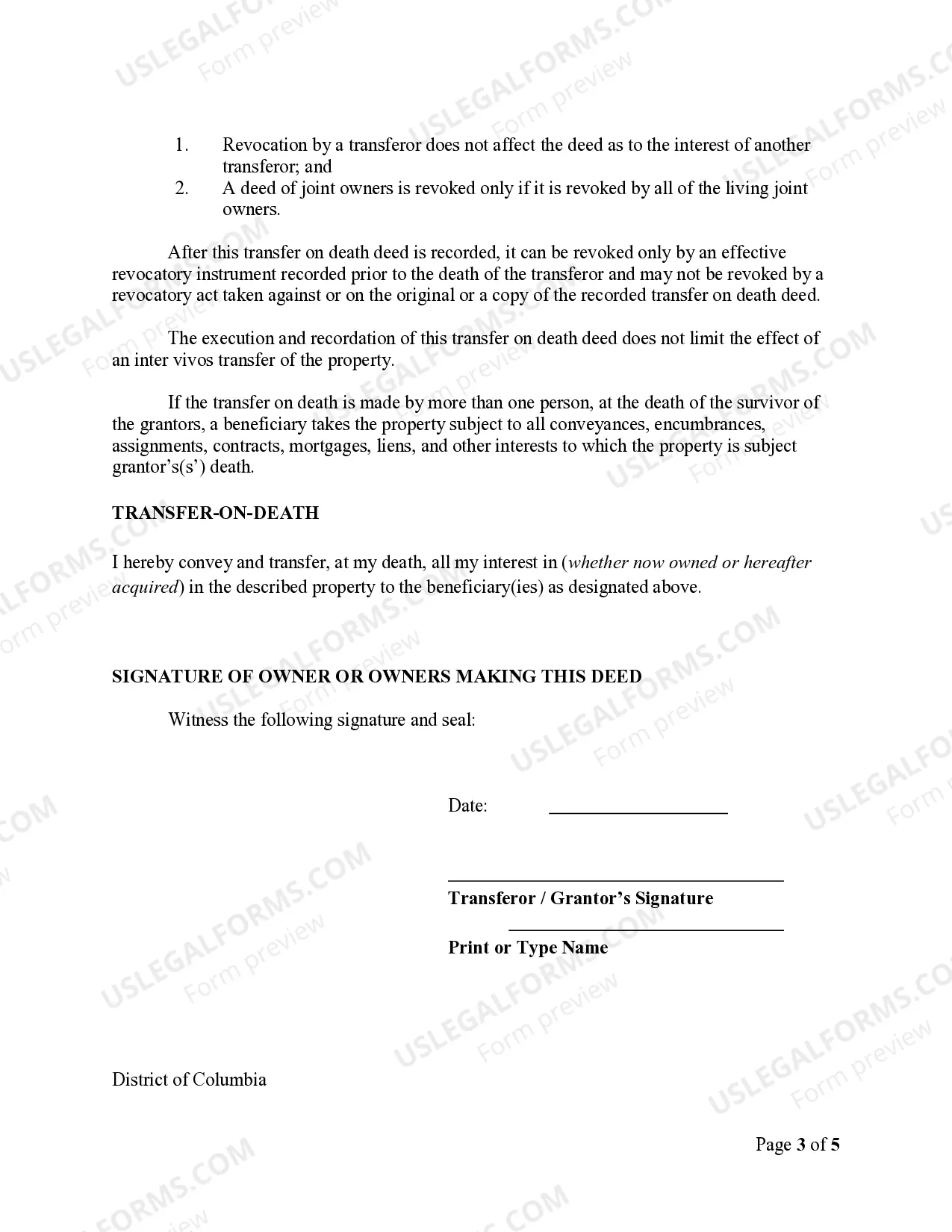

Yes, you can transfer a deed without an attorney in many cases, including when using a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals. Many individuals successfully navigate the process on their own by utilizing online resources and templates. Nonetheless, seeking legal assistance can help prevent potential mistakes that could complicate the transfer. Resources available on uslegalforms can support you in completing the necessary documentation accurately.

You do not necessarily need a lawyer to execute a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals. However, having legal guidance can help ensure that all forms are filled out correctly and comply with local laws. It can also provide peace of mind knowing that you are making informed decisions regarding your property transfer. Using platforms like uslegalforms can simplify the process and provide essential resources.

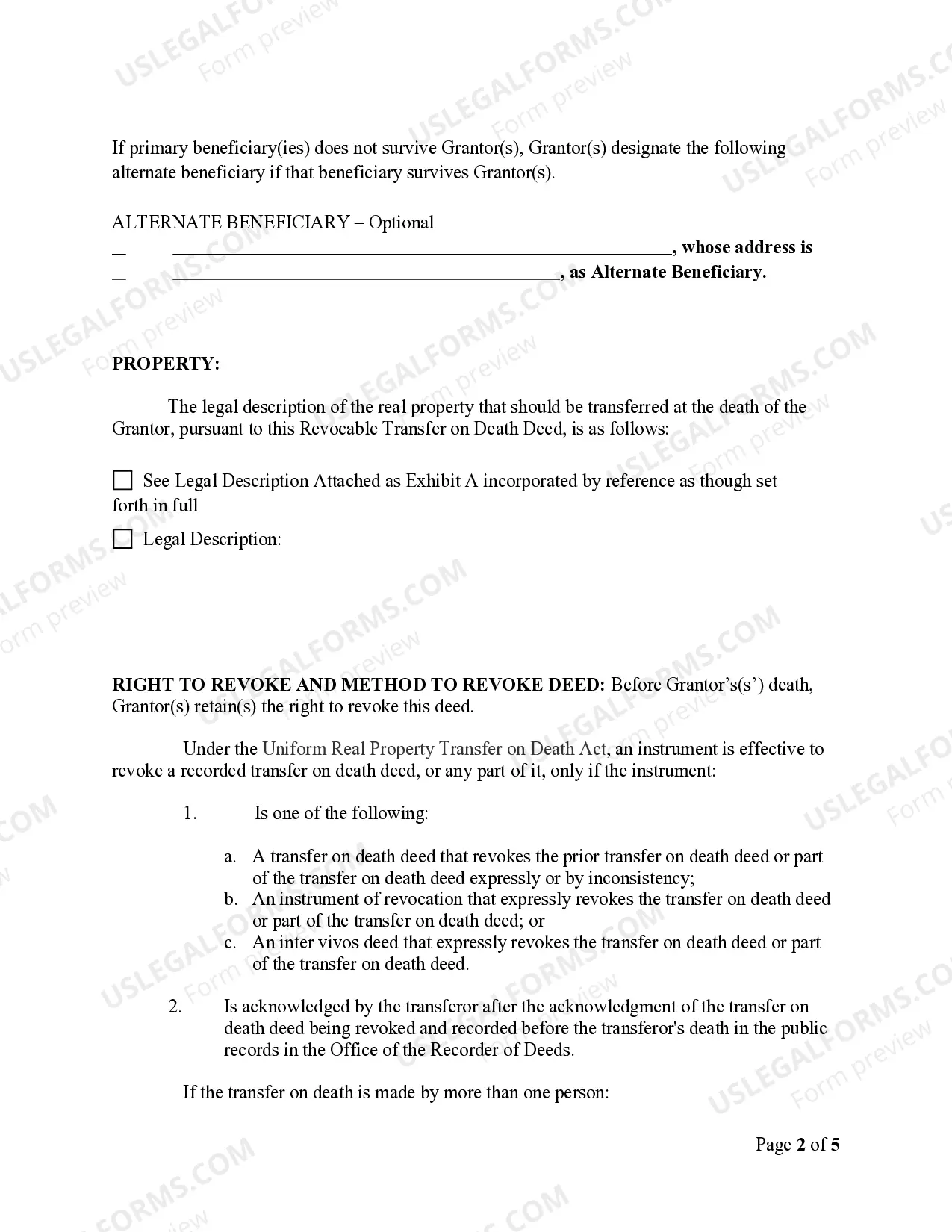

The disadvantages of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals can include potential complications with joint ownership and the risk of unintended heirs. If your beneficiary predeceases you without an alternative beneficiary named, their share may not transfer as intended. Furthermore, TOD deeds do not account for other estate considerations, meaning additional planning might be necessary. Using uslegalforms can help clarify these complexities while preparing your deed.

One potential disadvantage of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals is that it may not fully protect your assets from creditors. Despite being a simple way to transfer property, there are limitations regarding how it interacts with estate planning. Additionally, if your beneficiaries face legal issues, your assets may still be at risk. Therefore, it’s essential to consider these factors in conjunction with your overall estate plan.

While it is not mandatory to have an attorney for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals, consulting one can provide valuable guidance. An attorney can help ensure that the deed complies with state laws, thus preventing future complications. However, you can use user-friendly platforms like uslegalforms to facilitate the process, making it accessible even if you choose to go without legal representation.

Yes, you can name two beneficiaries on a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals. This option allows you to divide your estate among the beneficiaries as you see fit. Having multiple beneficiaries can simplify the transfer process and ensure that your wishes are carried out. By clearly specifying this in the deed, you help prevent potential disputes later on.

Yes, the District of Columbia does permit the use of Transfer on Death Deeds. This allows property owners to designate beneficiaries who will inherit real estate directly upon their passing, avoiding the lengthy probate process. It’s an excellent option for individuals who want to manage their estate simply and efficiently.

Several states in the U.S. recognize Transfer on Death Deeds, including but not limited to California, Nevada, and Texas, among others. Each state's laws regarding a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals can vary. It's beneficial to consult local laws or legal experts to understand how these deeds work in your state.

Yes, Washington, D.C. allows the execution of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Two Individuals. This option provides property owners the right to transfer real estate upon their death without probate. It’s a convenient way for individuals to manage their estate and ensure their beneficiaries receive designated assets directly.