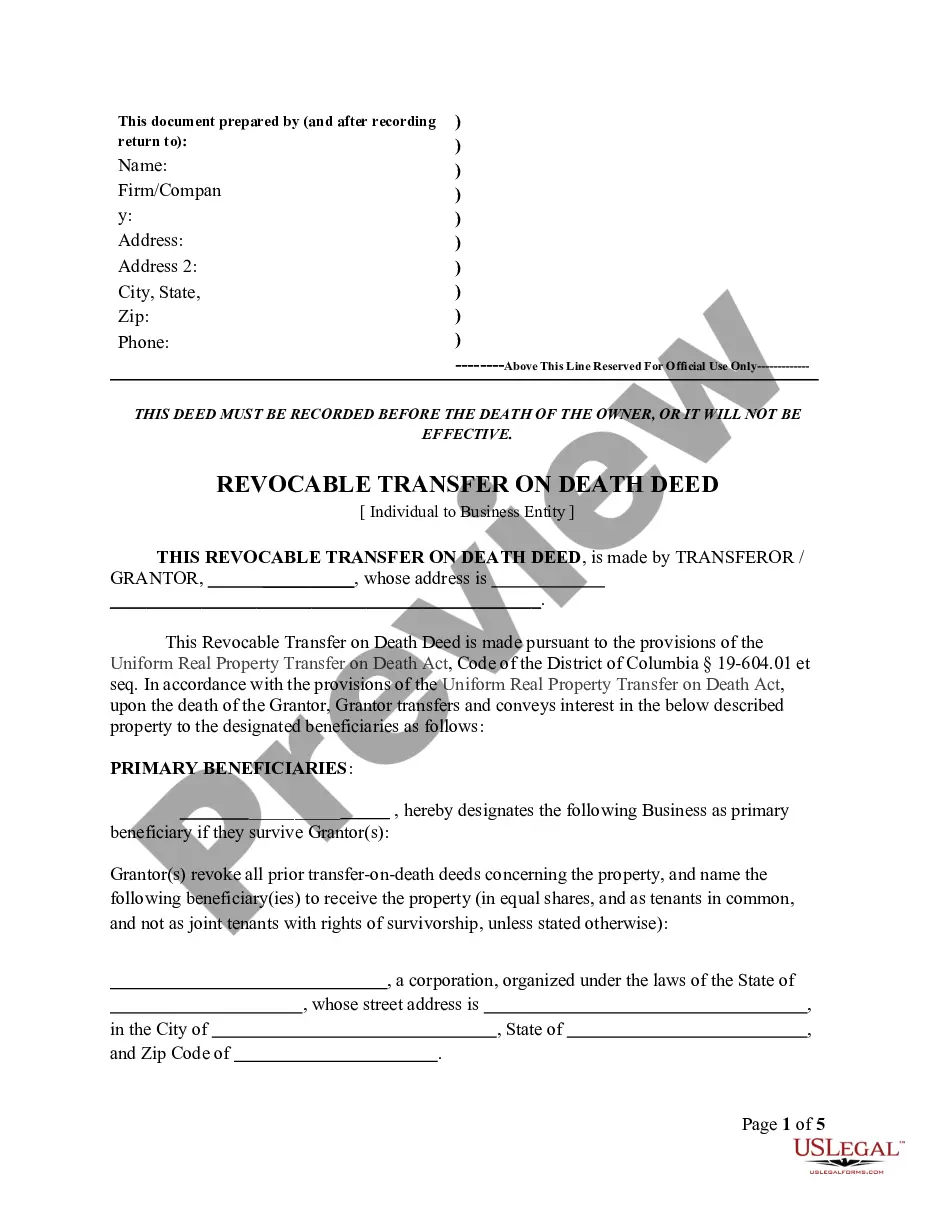

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity

Description Tod Deed Form District Of Columbia

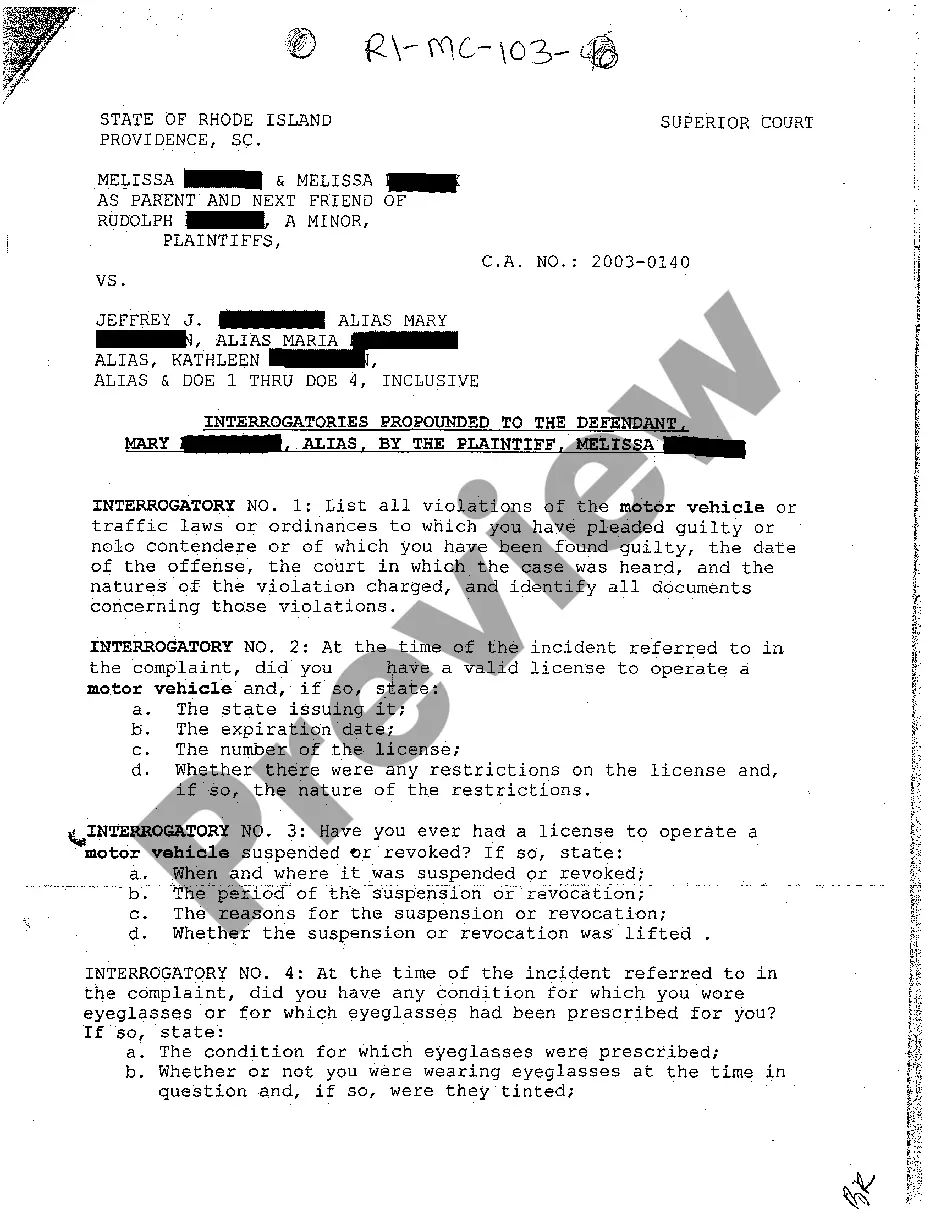

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To A Business Entity?

Use US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms library online and provides reasonably priced and accurate templates for customers and attorneys, and SMBs. The documents are grouped into state-based categories and some of them might be previewed prior to being downloaded.

To download samples, users must have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For those who do not have a subscription, follow the tips below to quickly find and download District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity:

- Check out to ensure that you have the correct template in relation to the state it’s needed in.

- Review the form by looking through the description and by using the Preview feature.

- Click Buy Now if it’s the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search field if you want to get another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity. More than three million users already have utilized our platform successfully. Choose your subscription plan and get high-quality forms in a few clicks.

Form popularity

FAQ

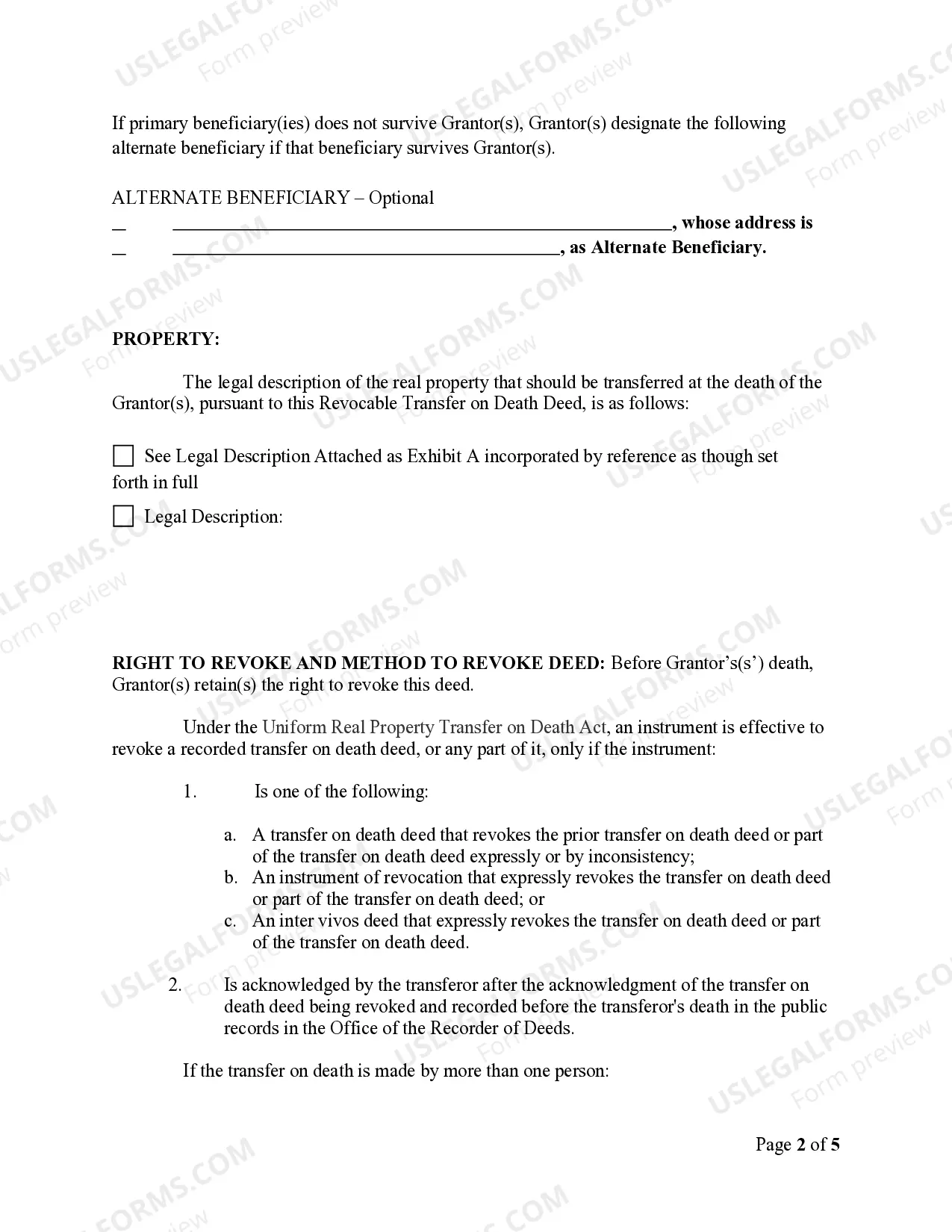

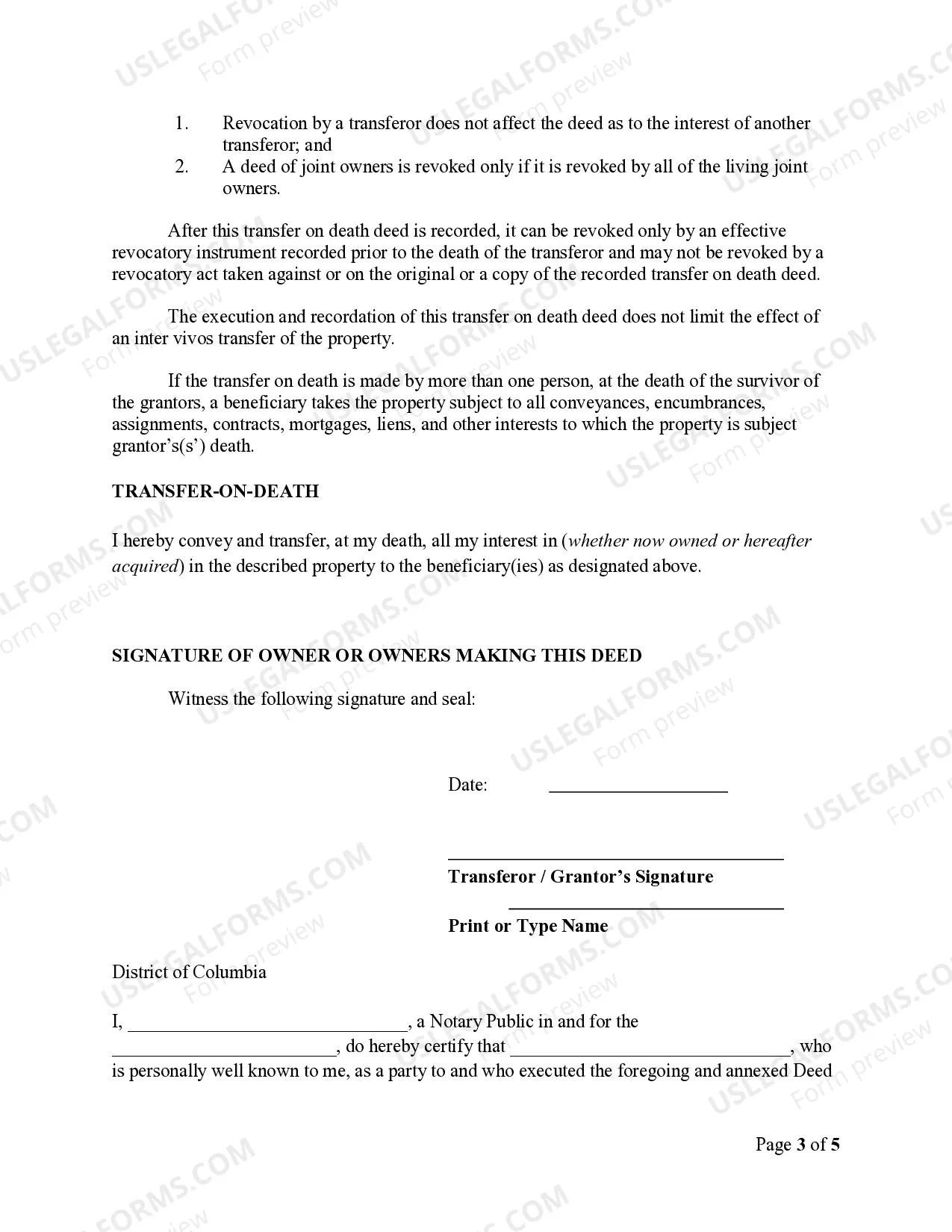

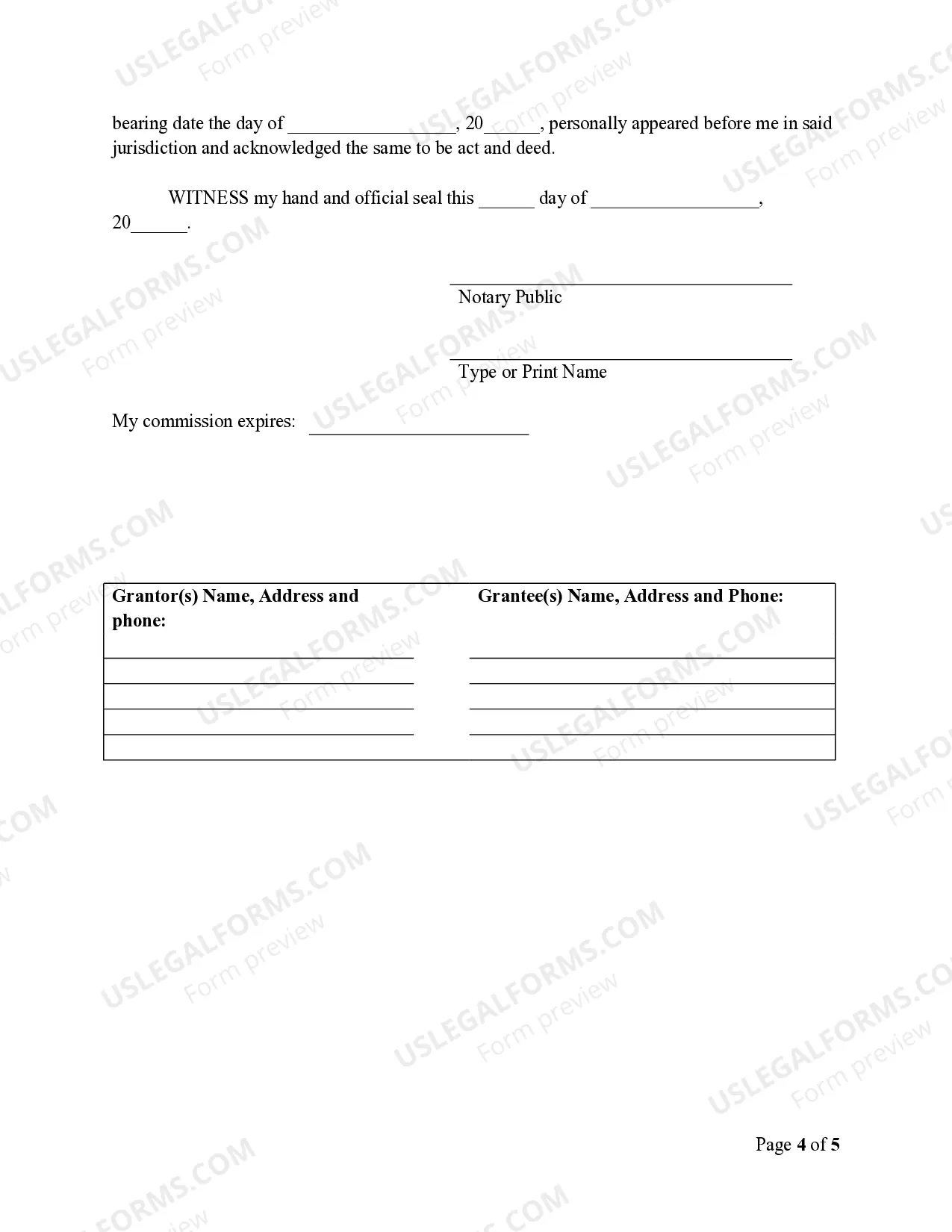

Filling out a transfer on death designation affidavit requires you to provide essential information about yourself, your property, and the designated beneficiary. First, specify the property you want to transfer and include all relevant details. After that, fill in your beneficiary’s information and sign the document. To avoid complications, consider using platforms like uslegalforms that guide you through this process thoroughly.

Yes, the District of Columbia does allow transfer on death deeds. This provision helps streamline the transfer of property upon your death, bypassing the probate process. You can confidently use this method to name a beneficiary, ensuring your property passes to them seamlessly.

One disadvantage of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity is that it may not be recognized in every jurisdiction. Additionally, once you name a beneficiary, you cannot change this designation easily without following specific procedures. Also, if your beneficiary predeceases you and you haven't made alternative arrangements, the deed may become invalid.

Many states in the U.S. recognize transfers on death deeds, including California, Nevada, and Maryland, to name a few. The District of Columbia also allows this option. This means you can specify a beneficiary to receive your property outside of probate when you pass away, giving your loved ones an efficient way to inherit your assets.

Yes, the District of Columbia does allow for a Transfer on Death Deed. This method enables individuals to transfer their real estate assets directly to a designated beneficiary upon their passing, bypassing the often complex probate process. Utilizing a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity can streamline your estate planning and provide peace of mind.

While it is not legally required to enlist a lawyer for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity, having legal guidance can make the process easier. A lawyer can help ensure that the deed is executed properly, reducing the risk of future complications related to your estate. It’s worth considering consultation to protect your interests.

TOD accounts can be beneficial for many individuals. They allow seamless asset transfer, avoiding the probate process, which can be lengthy and costly. However, whether they are a good idea for you depends on your individual situation and estate planning goals, particularly when it comes to a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity. Consulting with professionals can provide tailored advice.

While a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity simplifies asset transfer, it could expose your property to your beneficiaries' creditors after your passing. Moreover, if beneficiaries disagree on property management or sale, disputes may arise, complicating the transition. It's crucial to weigh these potential pitfalls when considering the use of a TOD.

One potential disadvantage of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity is that it does not provide control over the asset after your passing. This could lead to complications if your beneficiary's situation changes or if they are not prepared to manage the property. Additionally, the deed may not account for changes in your beneficiary's life circumstances or your own estate plans.

The main difference lies in what each term signifies. A District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Business Entity specifically allows an individual to transfer real property to a designated beneficiary upon death. Conversely, a beneficiary generally refers to anyone who receives assets, not limited to property, which could include bank accounts or life insurance proceeds. Understanding these differences can help you make more informed estate planning choices.