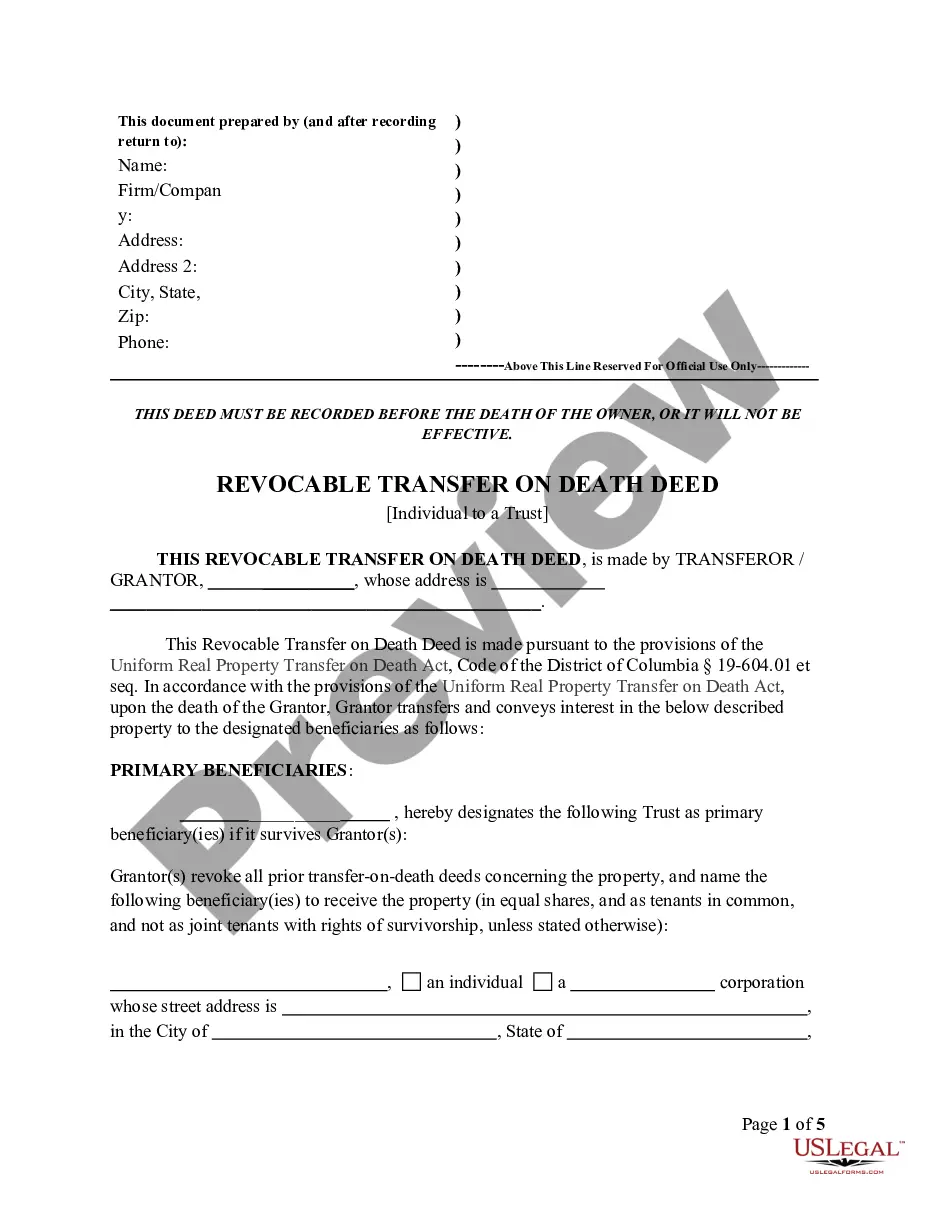

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust

Description District Of Columbia Tod Deed Form

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To A Trust?

Use US Legal Forms to get a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most comprehensive Forms catalogue on the internet and provides affordable and accurate samples for consumers and attorneys, and SMBs. The templates are grouped into state-based categories and many of them can be previewed prior to being downloaded.

To download templates, users must have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For people who do not have a subscription, follow the tips below to quickly find and download District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust:

- Check to ensure that you get the proper form in relation to the state it’s needed in.

- Review the form by reading the description and by using the Preview feature.

- Press Buy Now if it’s the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Use the Search field if you need to get another document template.

US Legal Forms offers a large number of legal and tax samples and packages for business and personal needs, including District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust. Over three million users have utilized our service successfully. Choose your subscription plan and get high-quality forms in a few clicks.

Form popularity

FAQ

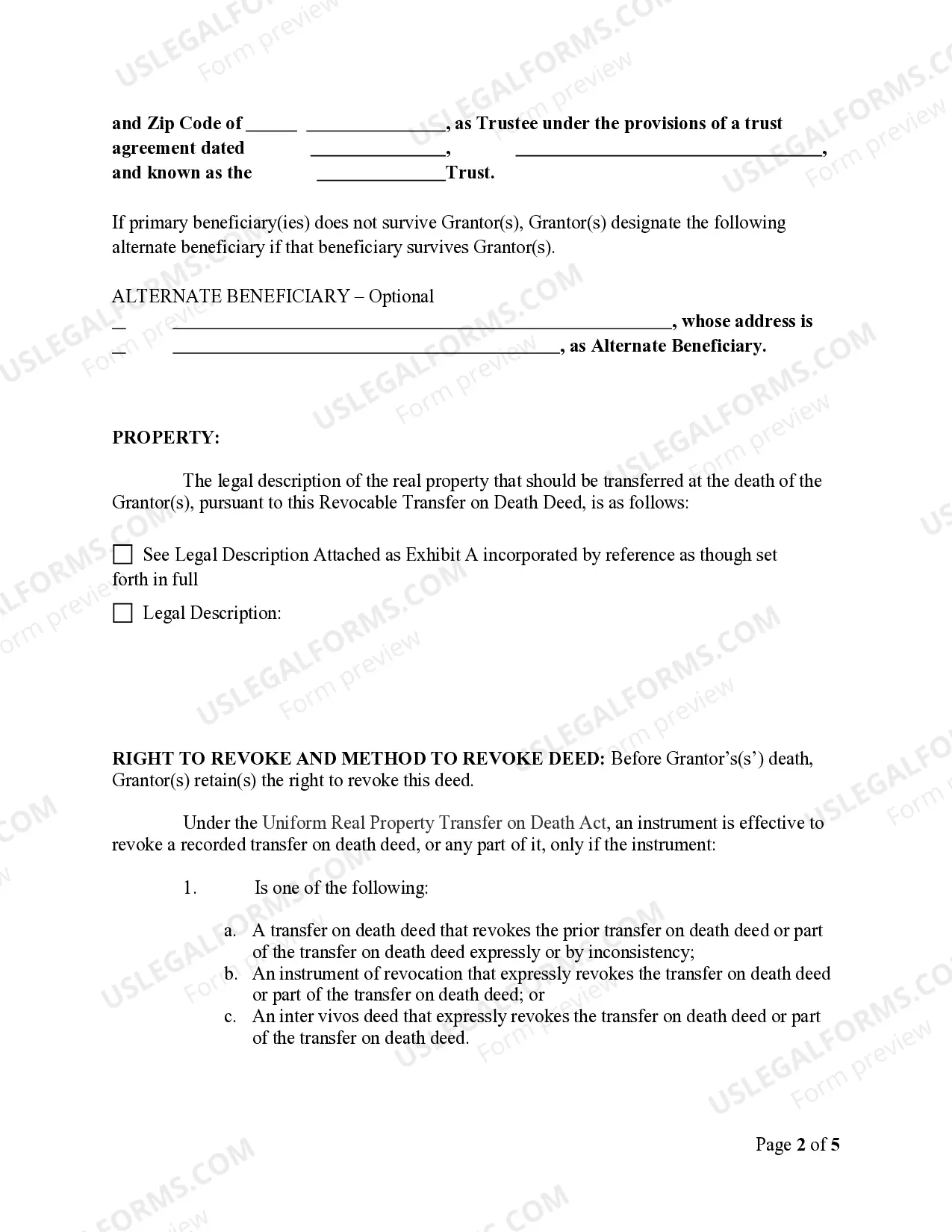

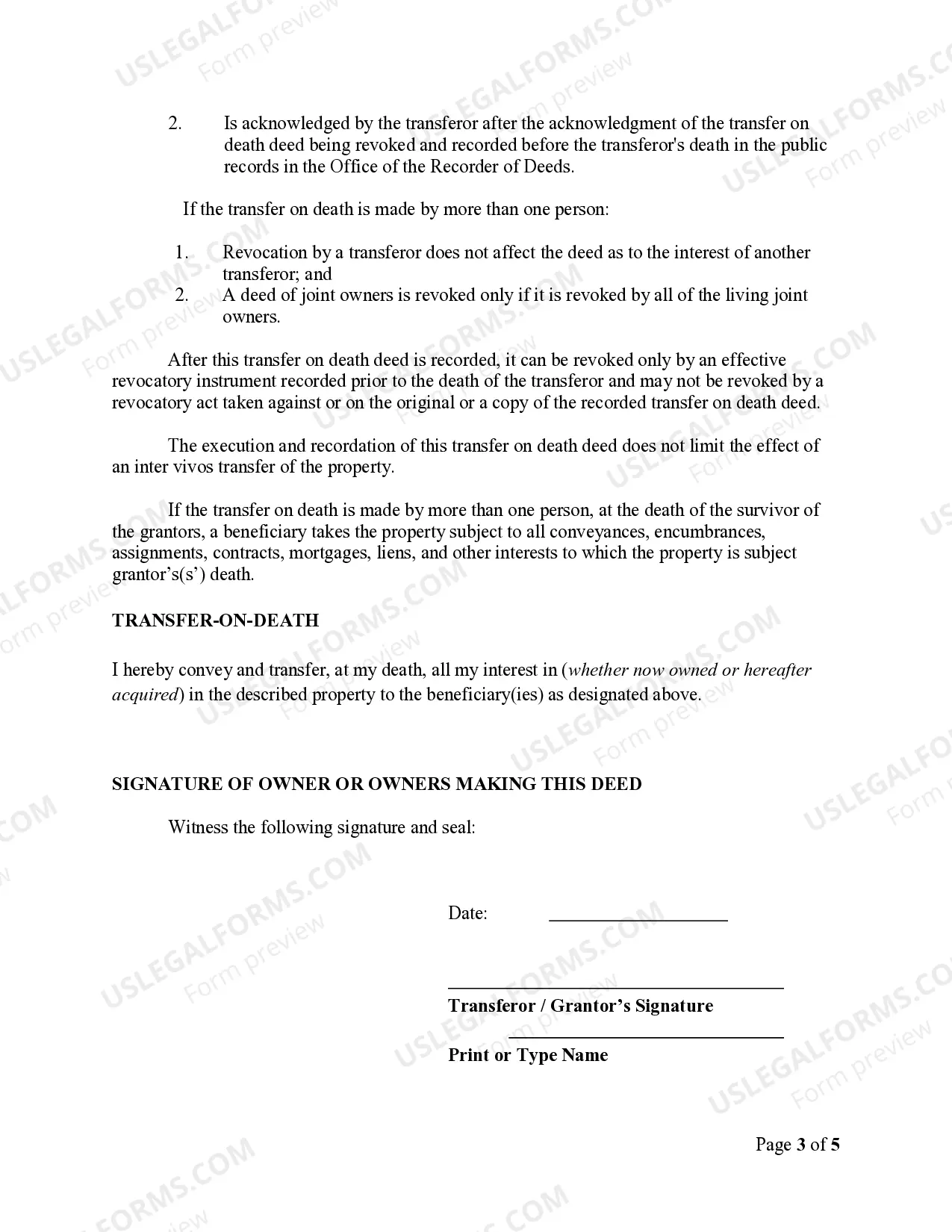

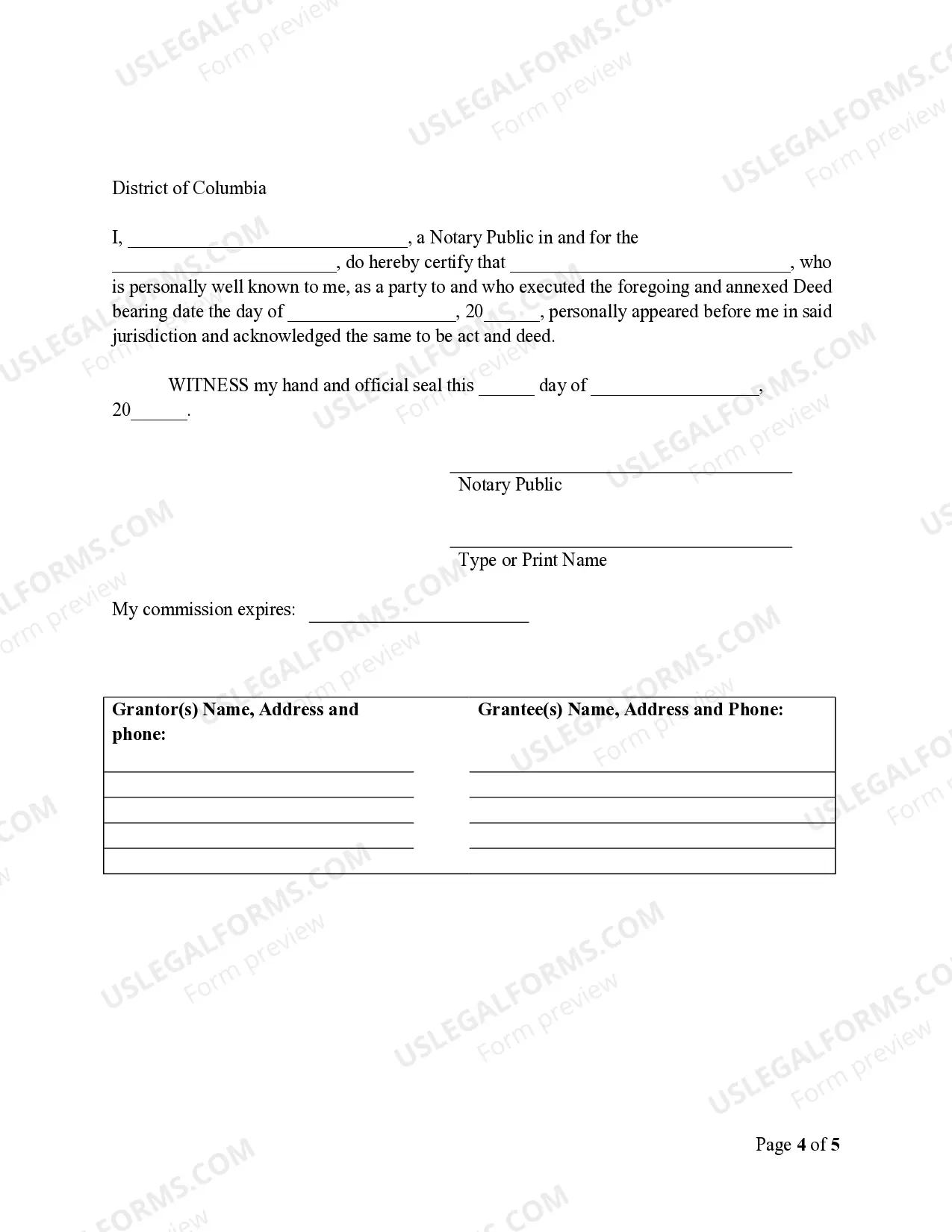

Yes, the District of Columbia does allow the use of transfer on death deeds. This legal tool permits property owners to designate transfer of their property to a beneficiary without the need for probate. The District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust simplifies estate planning and provides a straightforward way to pass on property. Be sure to follow local rules and procedures when executing these deeds.

You do not necessarily need a lawyer for creating a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust. Many individuals successfully draft and file these deeds independently using online legal resources. However, consulting with a legal professional can provide peace of mind and clarity on any complex issues you might face. Ultimately, it's important to understand your own capacity to handle the legalities involved.

Yes, you can transfer a deed without an attorney in the District of Columbia. Using resources like uslegalforms, you can find the necessary forms and guidelines to complete the process yourself. However, understanding the legal ramifications and requirements is crucial to avoid potential issues. Make sure to do your research and proceed with caution to ensure a smooth transfer.

One disadvantage of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust is that these deeds cannot provide protections against creditors after your death. Additionally, if the designated beneficiary is unable to manage the property, it could lead to complications. There are also potential tax implications to consider, which might affect the beneficiary. It's important to weigh these factors carefully.

While it is not mandatory to hire an attorney for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust, having professional guidance can be beneficial. Attorneys can help you navigate the process and ensure the deed meets all legal requirements. However, many individuals successfully complete the deed using resources like uslegalforms without legal representation. Ultimately, the choice depends on your comfort level and the complexity of your situation.

You can obtain a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust through various legal resources. Online platforms like uslegalforms provide templates and guidance for creating these deeds. Additionally, local courts and legal aid offices may offer assistance in acquiring the required forms. Always ensure you use the correct documents specific to the District of Columbia.

Yes, the District of Columbia does allow for transfer on death deeds, known as TODs. This beneficial option allows individuals to name beneficiaries to inherit property outside of the probate process, which can save time and reduce costs. The District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust provides an efficient way to manage your property after your passing. If you’re considering this option, visiting US Legal Forms can help you navigate the necessary steps and documentation.

Generally, a transfer on death deed serves as a directive for how your assets will be handled upon your passing. If a property is conveyed through a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust, it may not override the terms of a trust established beforehand, depending on how each document is drafted. It’s essential to understand how these two estate planning tools interact to ensure your wishes are executed as intended. For clarity, consult with an estate planning professional or legal platform like US Legal Forms.

The concept of transfers on death deeds, or TODs, is recognized by a variety of states across the country. States like Arizona, California, and Missouri allow these deeds, enabling property owners to transfer assets directly to beneficiaries without going through probate. The District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust is also part of this trend, simplifying the process of inheritance. For a complete list of states and their specific regulations, consider exploring resources that focus on estate planning.

Choosing between a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust and naming a beneficiary after death depends on your estate planning strategy. A TOD deed provides a quicker, more straightforward transfer to your chosen beneficiary, bypassing probate. However, if you prefer more comprehensive control and management of your assets, consider discussing your options with a legal professional.