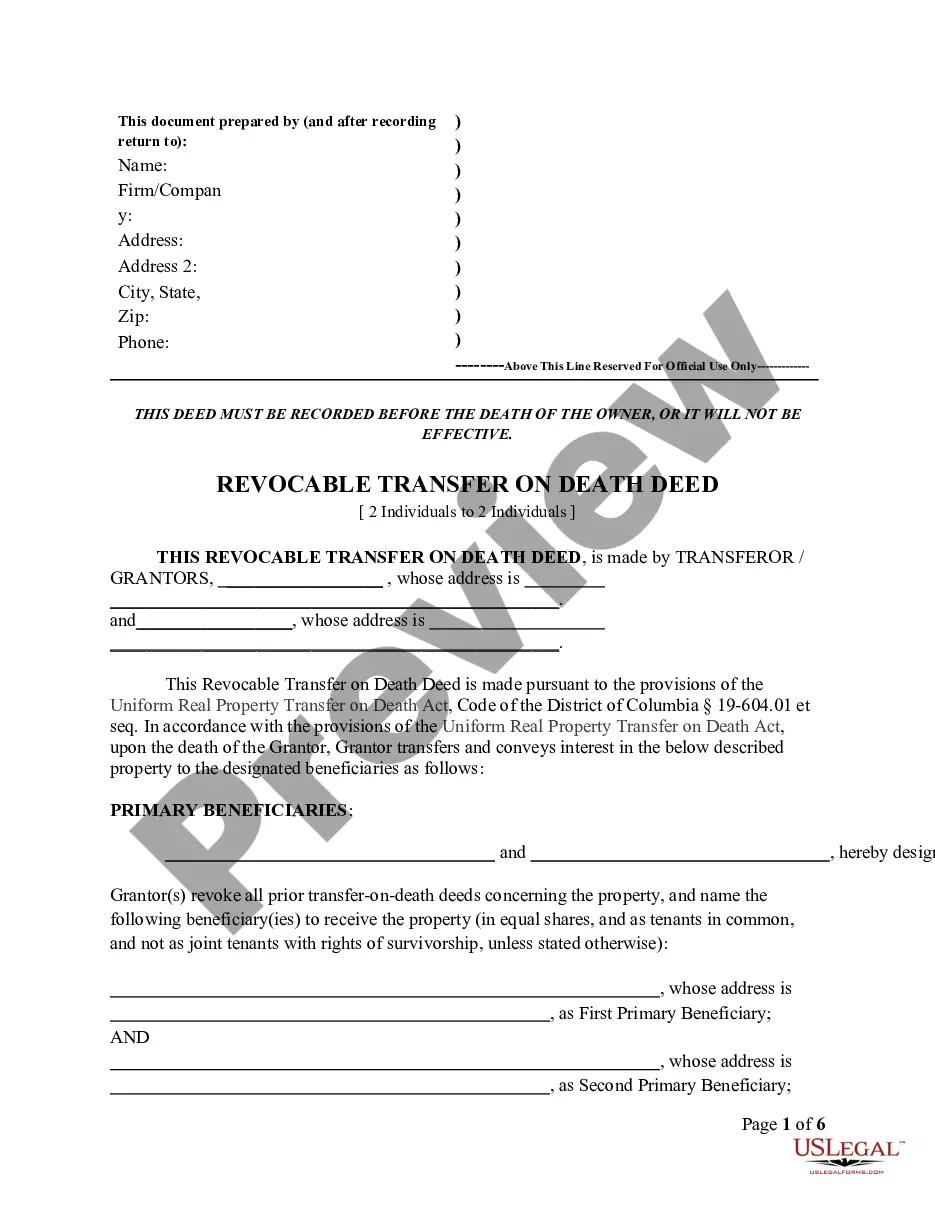

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals

Description

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To Two Individuals?

Utilize US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Parties to Two Parties.

Our legally acceptable forms are crafted and frequently refreshed by qualified attorneys.

Ours is the most comprehensive compilation of forms available online and offers affordable and precise templates for clients, legal practitioners, and small to medium-sized businesses.

Ensure you have the correct template for the required state, examine the form by reading the overview and using the Preview function, click Buy Now if it is the correct document, create your account and settle payment via PayPal or credit card, download the form to your device, and feel free to reuse it multiple times. Use the search engine if you need to locate another document template. US Legal Forms offers a vast array of legal and tax templates and bundles for both business and personal requirements, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Parties to Two Parties. Over three million users have successfully leveraged our platform. Select your subscription plan and obtain premium documents with just a few clicks.

- The documents are categorized by state.

- Many of the documents can be previewed before download.

- To download samples, users must hold a subscription.

- Log in to your account.

- Select Download next to each desired form to access it in My documents.

- For those without a subscription, adhere to the following steps to locate and download the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Parties to Two Parties.

Form popularity

FAQ

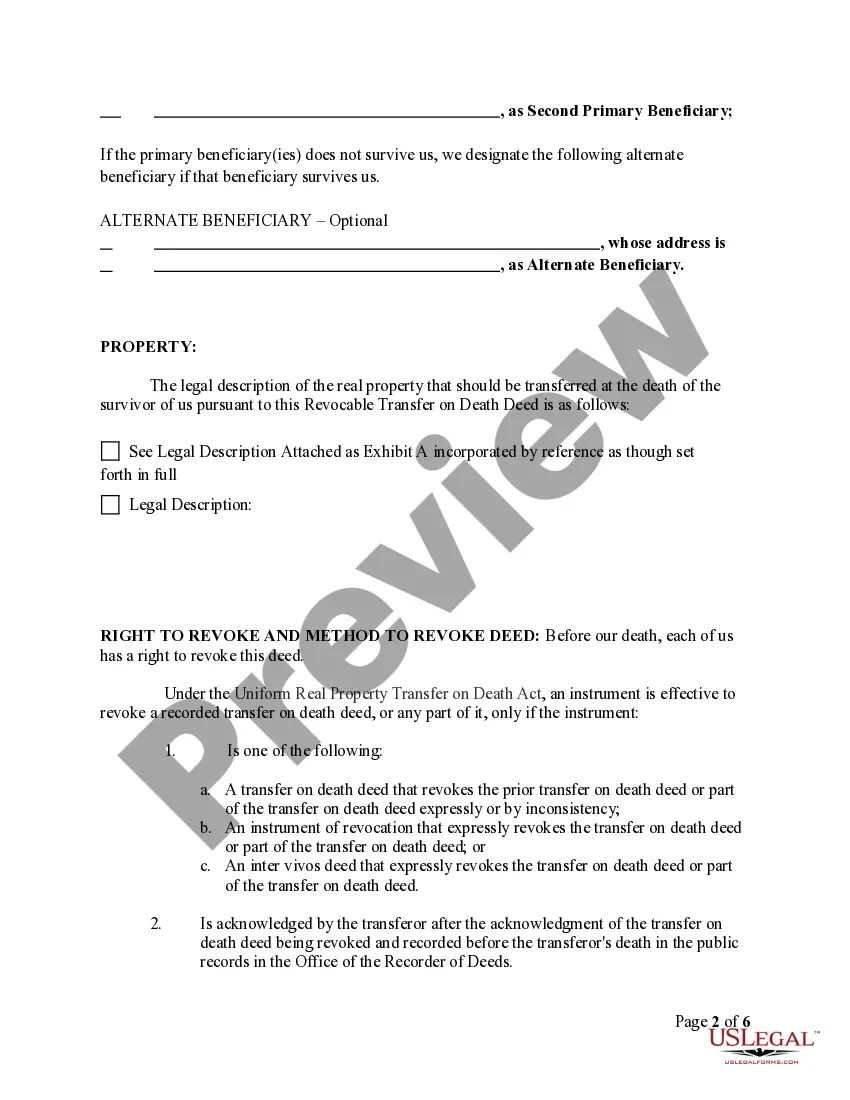

Whether the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals is a good idea often depends on individual circumstances. For many, it offers a straightforward method for transferring property outside of probate. However, it’s essential to evaluate personal situations, including family dynamics and financial implications, before proceeding.

Absolutely, the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals allows for multiple beneficiaries. You can designate two individuals or even more as beneficiaries. This flexibility can be particularly advantageous when property ownership needs to transfer to multiple parties.

While the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals has many benefits, there are some drawbacks. For instance, it doesn’t provide protection against unintended beneficiaries if formal documentation is not correctly managed. Moreover, property owners must ensure that the deed is recorded properly to be valid on their death.

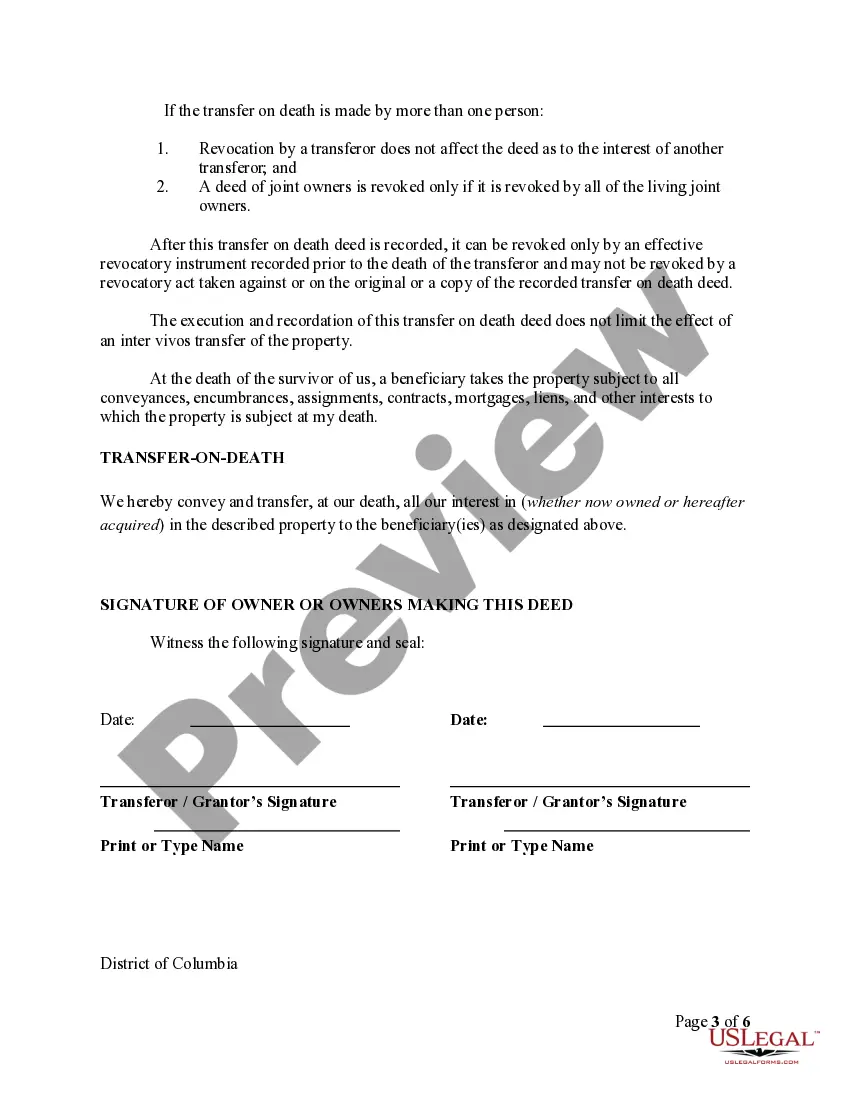

Yes, one of the primary advantages of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals is that it allows assets to bypass probate. This means that upon the owner's passing, the beneficiaries can directly receive the property without lengthy court proceedings. This feature simplifies the transfer process and can save time and legal fees.

Generally, the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals does not inherently avoid capital gains tax. When a property is sold, any increase in value can lead to capital gains tax liabilities. However, if the beneficiaries inherit the property, they may benefit from a step-up in basis, which can minimize tax implications.

One significant disadvantage of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals is that it does not provide protection from creditors. If the property owner has outstanding debts, creditors can still claim the property. Additionally, the deed does not allow for complete control over the property once the owner passes away.

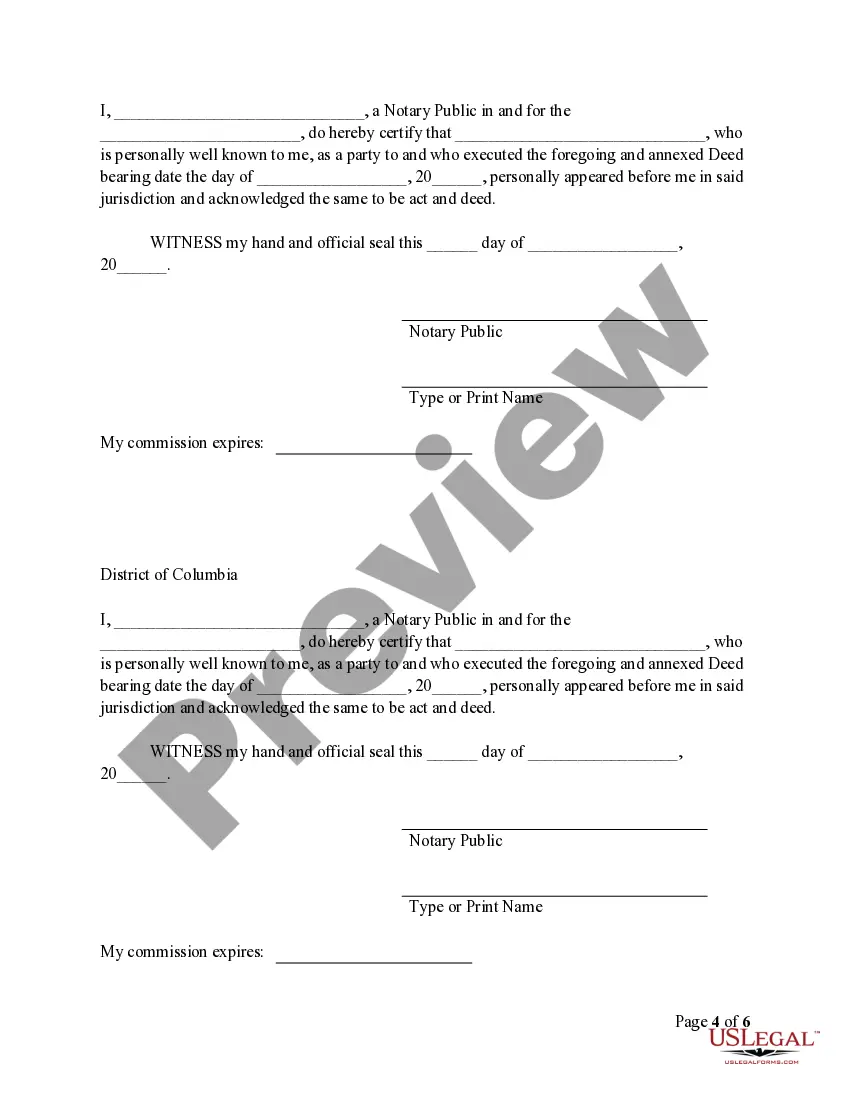

Yes, you can transfer a deed without an attorney by utilizing a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals. The process involves filling out the correct forms and recording them with the appropriate local offices. However, it might be wise to seek legal advice for complex situations. US Legal Forms helps you access the necessary templates, empowering you to complete this process independently.

To fill out a transfer on death designation affidavit, first obtain the form, which is specific to the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals. Complete the form by providing the necessary information about the property and the beneficiaries. Be sure to follow the instructions carefully, as inaccuracies can lead to complications. Using resources from US Legal Forms can make this step easier and more straightforward.

You do not necessarily need a lawyer to create a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals. However, hiring one can provide clarity regarding your responsibilities and future implications. Platforms like US Legal Forms offer resources that may assist you in navigating the deed creation process without legal assistance.

While it's possible to handle a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Two Individuals without an attorney, consulting one can be beneficial. An attorney can provide guidance on the legal implications and ensure the deed complies with local laws. US Legal Forms can help you create the deed properly, making the process smoother if you choose to proceed without legal representation.