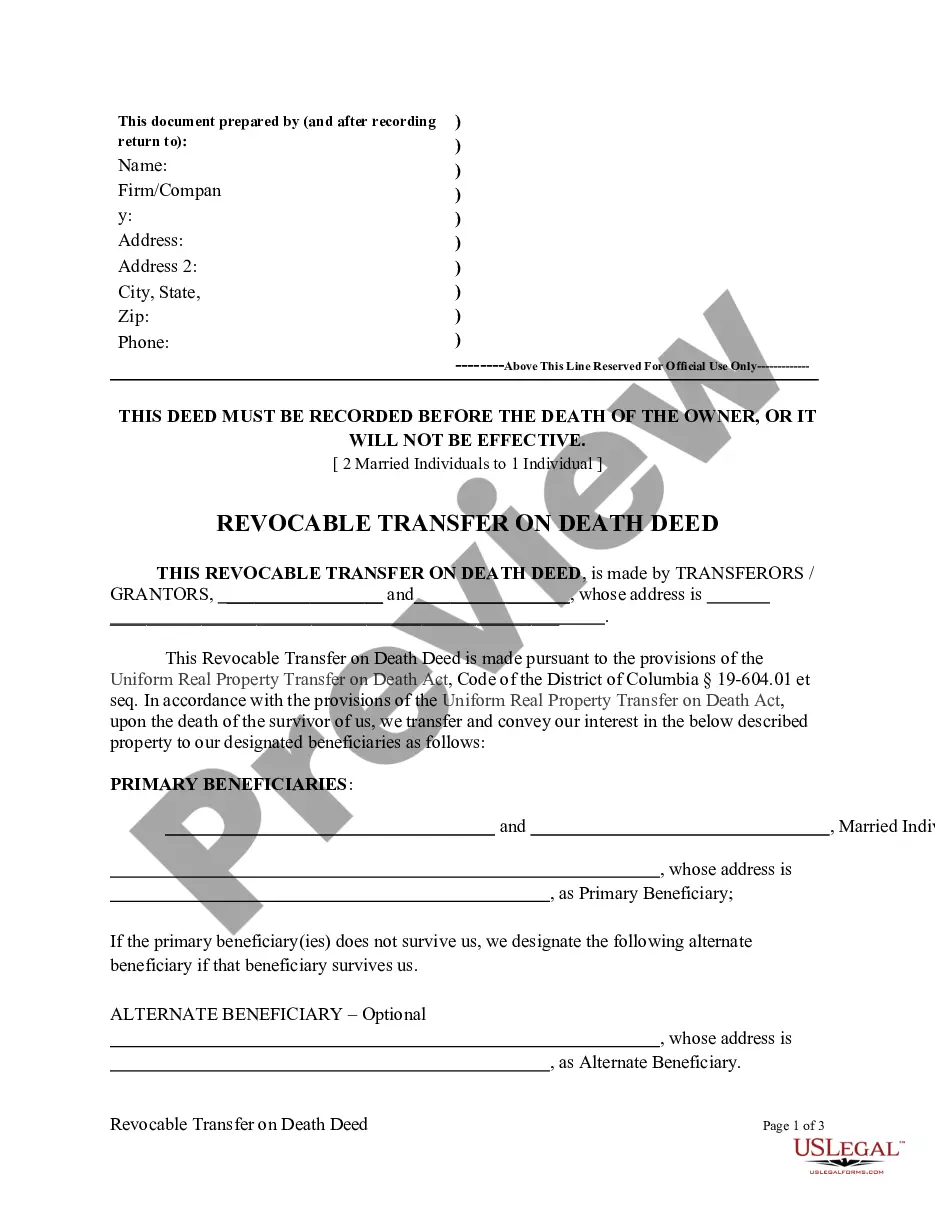

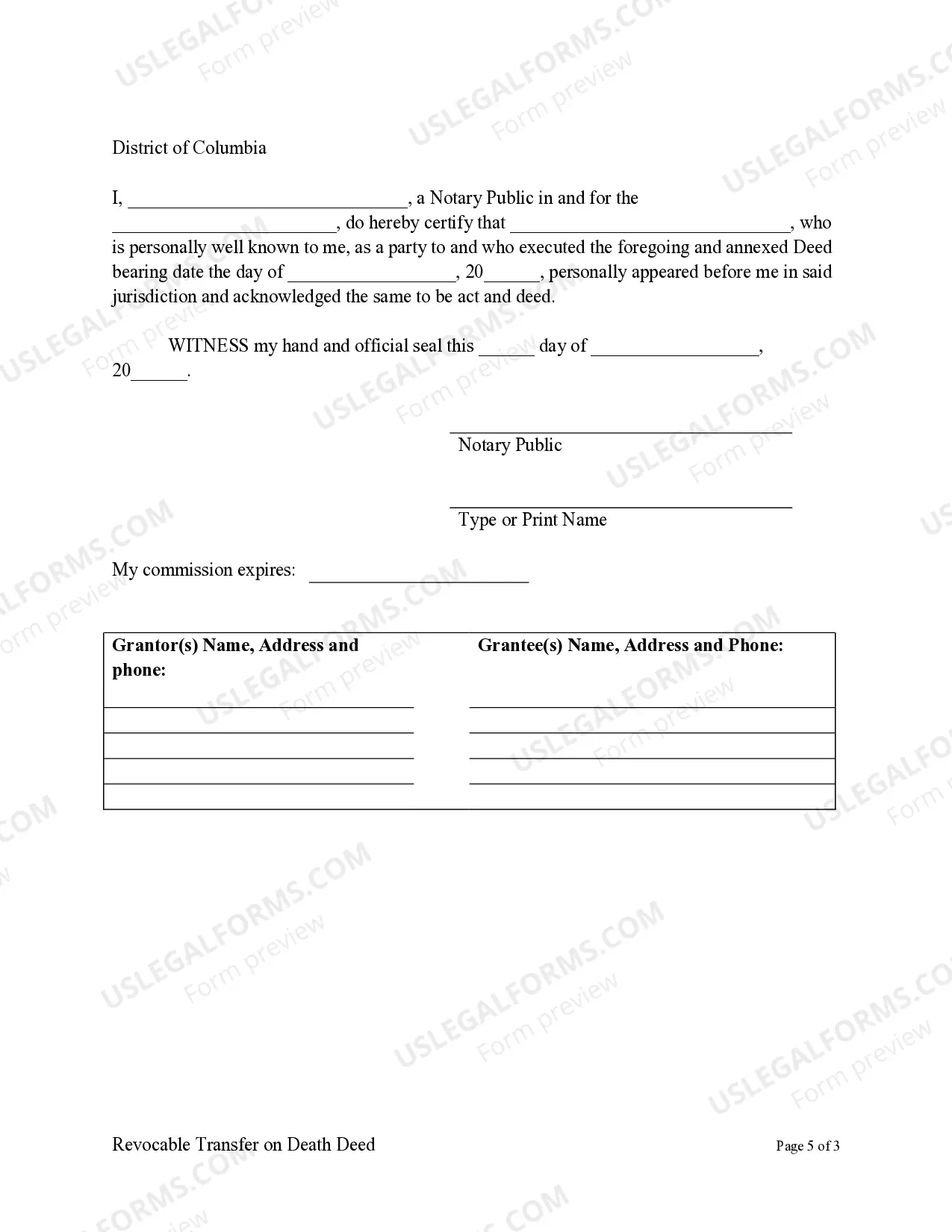

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual

Description District Of Columbia Tod Deed

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Individual?

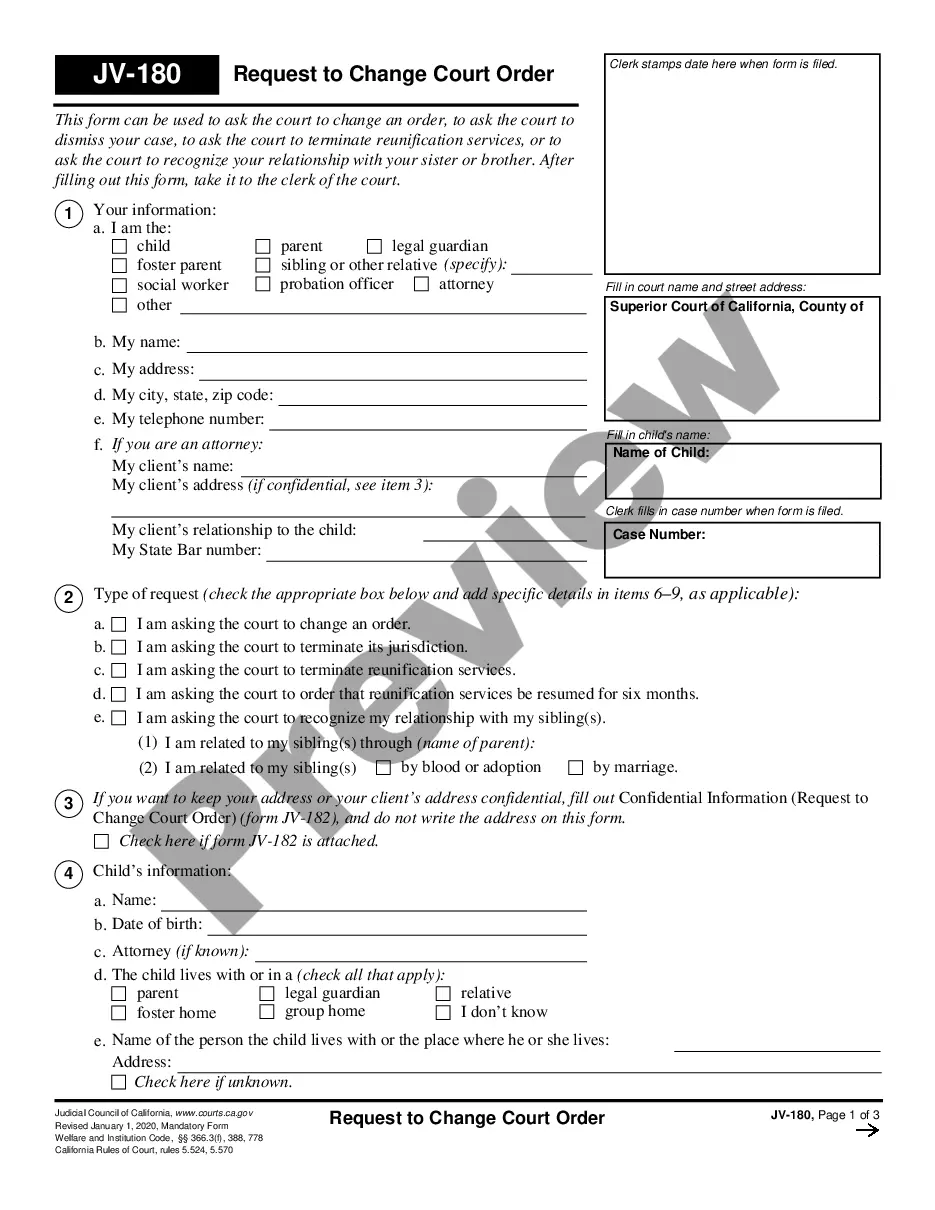

Use US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue on the internet and offers reasonably priced and accurate samples for customers and lawyers, and SMBs. The templates are grouped into state-based categories and some of them might be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For people who don’t have a subscription, follow the following guidelines to quickly find and download District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual:

- Check to make sure you get the correct template with regards to the state it is needed in.

- Review the form by reading the description and using the Preview feature.

- Click Buy Now if it is the document you want.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Make use of the Search field if you want to find another document template.

US Legal Forms offers thousands of legal and tax samples and packages for business and personal needs, including District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual. More than three million users have utilized our platform successfully. Select your subscription plan and get high-quality documents in just a few clicks.

District Of Columbia Tod Form popularity

FAQ

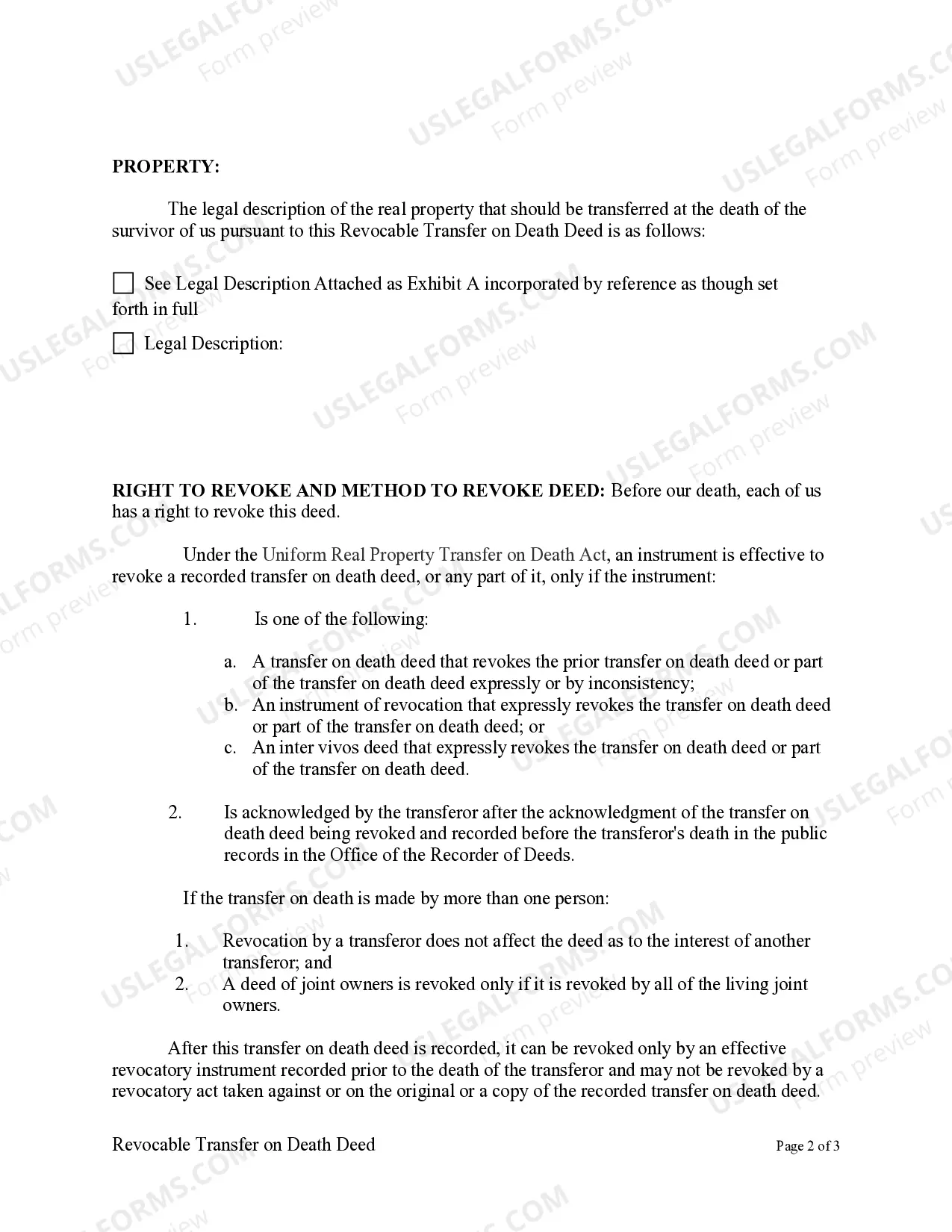

The choice between a transfer on death deed and a beneficiary designation depends on your specific situation. A TOD deed provides direct property transfer while avoiding probate, making it advantageous in many cases. However, beneficiary designations may offer flexibility for accounts and financial assets. Evaluating your unique needs can guide you in selecting the best path between a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual and other methods.

A transfer on death deed may not address all potential complications related to estate planning. For instance, it does not provide protection against creditors after the owner’s death, which could diminish the value of the estate for beneficiaries. Furthermore, a TOD deed may lead to misunderstandings among heirs if not properly communicated. Engaging with resources like uslegalforms can help clarify these issues surrounding the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual.

While transfer on death deeds offer notable benefits, they also have disadvantages. One significant concern is that they do not account for changes in your financial situation or relationships; they cannot be revoked or modified easily without proper legal strategies. Additionally, if the named beneficiaries predecease the property owner, it could lead to unintended consequences. Understanding these factors is essential when considering a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual.

Many states in the U.S. recognize transfers on death deeds, including Washington, Missouri, and Nevada. Each state has its own laws governing the use of these deeds, so it's crucial to check local regulations. These deeds offer a straightforward way to pass property without probate. If you reside in the District of Columbia, the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual can be a beneficial option.

Indeed, DC permits the use of transfer on death deeds. Such deeds facilitate a smoother transition of property ownership by allowing you to pass on your real estate directly to your chosen beneficiaries. This process is advantageous as it avoids the lengthy and often costly probate process. A well-structured District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual can be a vital part of your estate plan.

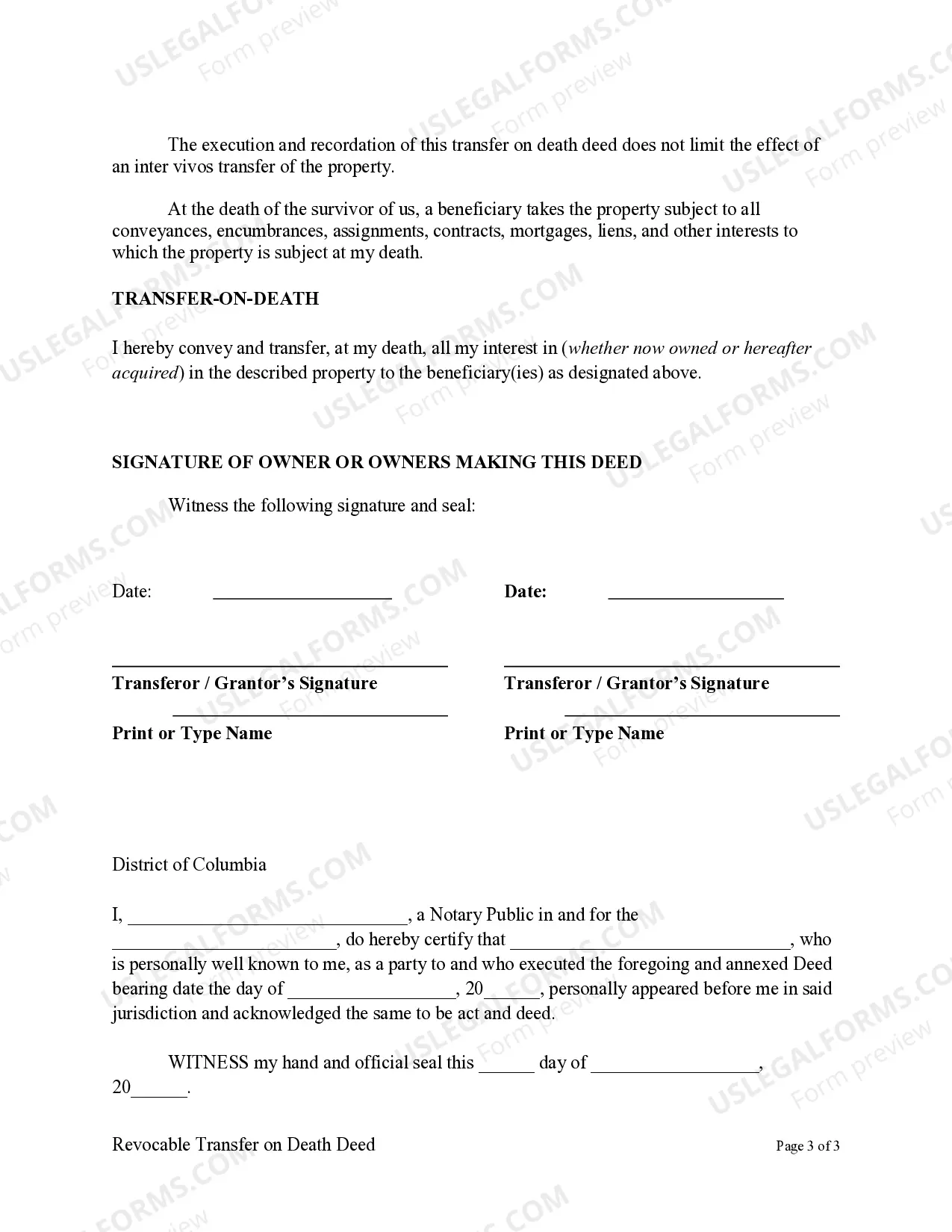

Yes, the District of Columbia does allow transfer on death deeds, often referred to as TOD deeds. This legal tool enables a property owner to designate beneficiaries who will inherit the property upon their death without going through probate. To ensure the deed is valid, it must meet specific legal requirements outlined by DC law. Utilizing a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual can simplify estate planning.

Hiring an attorney for a Transfer on Death Deed, or TOD, is not mandatory in D.C., but it can be beneficial. Navigating legal documents can be complex, and an attorney can clarify any uncertainties you may have. The District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual is a powerful estate planning tool, and professional help can enhance your understanding and security as you make this important decision.

You can transfer a deed without an attorney in Washington, D.C., especially with tools like USLegalForms that guide you through the process. However, handling such legal documents yourself requires an understanding of the relevant laws and procedures. The District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual can be easily managed, but be sure to read the instructions carefully to ensure everything is completed accurately.

While it's not legally required to hire a lawyer for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, consulting an attorney can provide valuable guidance. A lawyer can help you understand the implications of setting up the deed, ensuring it aligns with your estate planning goals. Additionally, they can assist with any complex situations that may arise, which can help you avoid potential pitfalls.