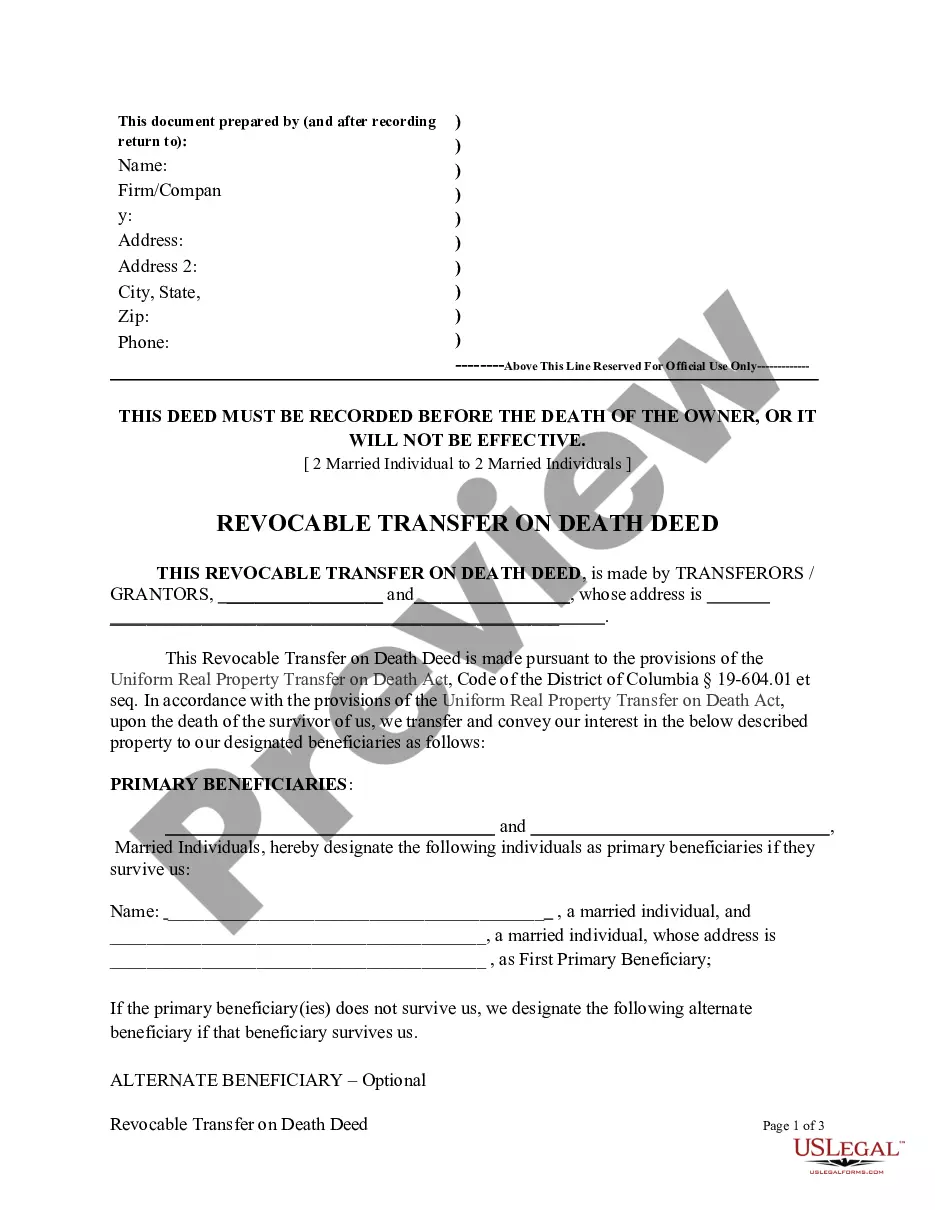

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries

Description

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Husband And Wife Beneficiaries?

Use US Legal Forms to get a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms library on the internet and provides cost-effective and accurate templates for customers and attorneys, and SMBs. The documents are categorized into state-based categories and a few of them can be previewed before being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Click Download next to any template you need and find it in My Forms.

For those who don’t have a subscription, follow the tips below to easily find and download District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries:

- Check to make sure you have the right template with regards to the state it is needed in.

- Review the document by reading the description and using the Preview feature.

- Click Buy Now if it’s the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Use the Search field if you want to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries. Over three million users already have utilized our service successfully. Choose your subscription plan and have high-quality documents in a few clicks.

Form popularity

FAQ

The choice between a trust and a Transfer on Death deed largely depends on individual circumstances. A trust can provide comprehensive asset management during your life and after death, while the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries directly transfers property upon death. Consult with a legal professional to determine which option best aligns with your estate planning goals.

Several states, including Virginia, Maryland, and California, allow Transfer on Death deeds, alongside Washington, D.C. This feature provides a flexible option for property owners seeking to designate beneficiaries while avoiding probate. If you are looking for guidance on how to navigate this process, the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries can be beneficial.

To avoid probate in Washington, D.C., consider using a Transfer on Death deed. This document allows for the direct transfer of property to beneficiaries without the need for court involvement after death. Furthermore, establishing a revocable living trust can be an effective alternative to ensure that your assets are distributed according to your wishes without going through probate.

While the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries simplifies property transfer, there are potential drawbacks. One concern is that it does not provide asset protection during the property owner's lifetime. Additionally, if the beneficiary predeceases the owner, alternative arrangements must be made to ensure the deed does not fail.

Yes, Washington, D.C. allows for Transfer on Death deeds. This legal option provides an efficient way to transfer real estate upon the death of the property owner, bypassing probate. Utilizing the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries ensures that your spouse or designated benefactors receive property swiftly.

No, you cannot transfer a deed to someone who has already passed away. Once an individual has died, their interests in property are typically handled through probate, unless otherwise specified. If you want to ensure a smooth transition of property to beneficiaries, consider utilizing the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries.

A District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries can be a very effective estate planning tool for many individuals. It offers a straightforward method for transferring property without the delays of probate. However, it’s crucial to evaluate your specific circumstances and possibly seek expert advice to determine if it aligns with your long-term estate goals.

A District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries does not inherently avoid capital gains tax. However, when the property is passed to beneficiaries, they typically receive a step-up in basis, which can reduce the capital gains tax liability if they sell the property later. It's wise to consult with a tax advisor for personalized guidance.

A notable disadvantage of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries lies in its limited flexibility. If circumstances change, such as the desire to change beneficiaries or if the property needs to be sold, it may require additional legal steps. It's important to consider these factors carefully before proceeding.

Yes, accounts established under a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Husband and Wife Beneficiaries typically avoid probate. This means that upon the death of the account holder, the designated beneficiary can claim the assets directly, allowing for a quicker and more straightforward transfer. This bypass can significantly reduce stress during an already difficult time.