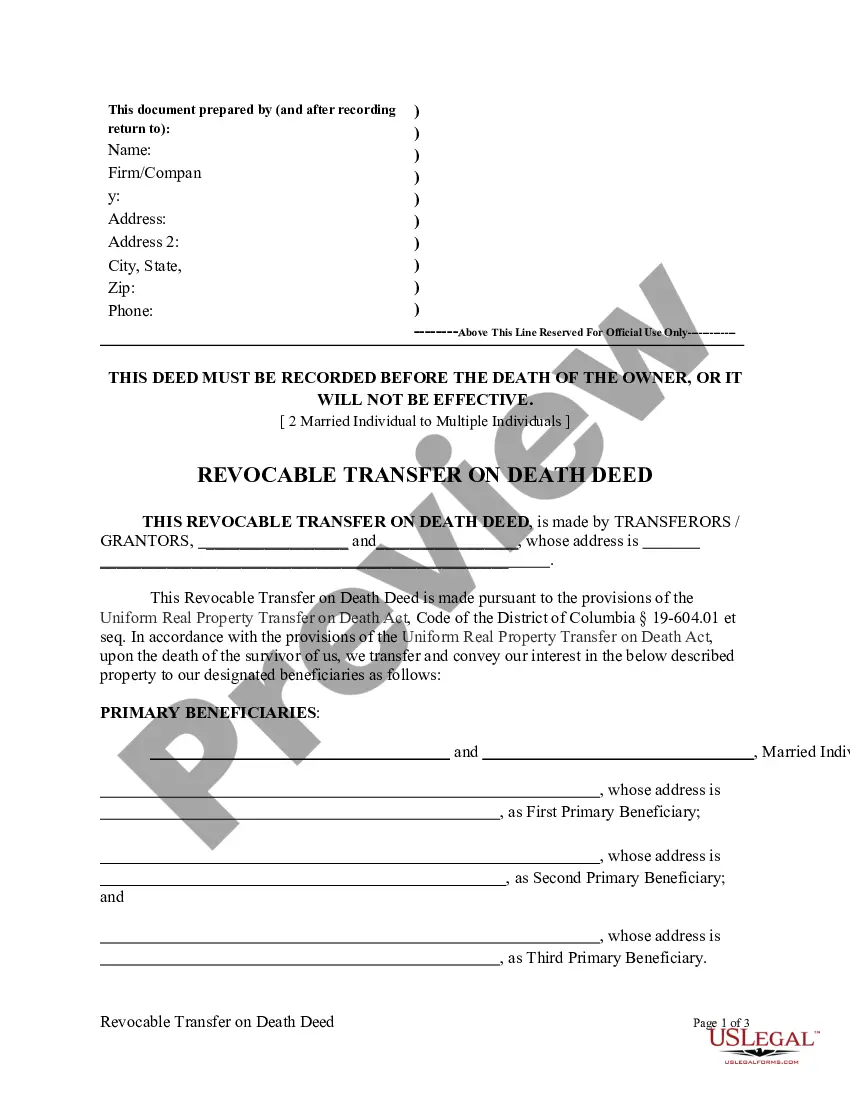

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Multiple Individuals

Description

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Multiple Individuals?

Utilize US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to Several Individuals.

Our legally acceptable forms are crafted and frequently revised by expert attorneys.

We have the largest Forms repository available online and offer economical and precise templates for clients, legal practitioners, and small to medium-sized businesses.

Select Buy Now if it meets your requirements. Create your account and pay via PayPal or credit card. Download the form to your device and feel free to reuse it as needed. Use the Search box if you need to locate another template. US Legal Forms offers a plethora of legal and tax documents and packages for both business and personal requirements, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to Several Individuals. More than three million users have successfully utilized our service. Choose your subscription option and receive high-quality documents in just a few clicks.

- The documents are categorized by state and many can be previewed before downloading.

- To access samples, users need to maintain a subscription and must Log In to their account.

- Click Download beside any template you require and locate it in My documents.

- For users without a subscription, follow the guidelines below to effortlessly search for and download the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to Several Individuals.

- Verify that you are selecting the correct form applicable to the state needed.

- Examine the form by reading its description and utilizing the Preview function.

Form popularity

FAQ

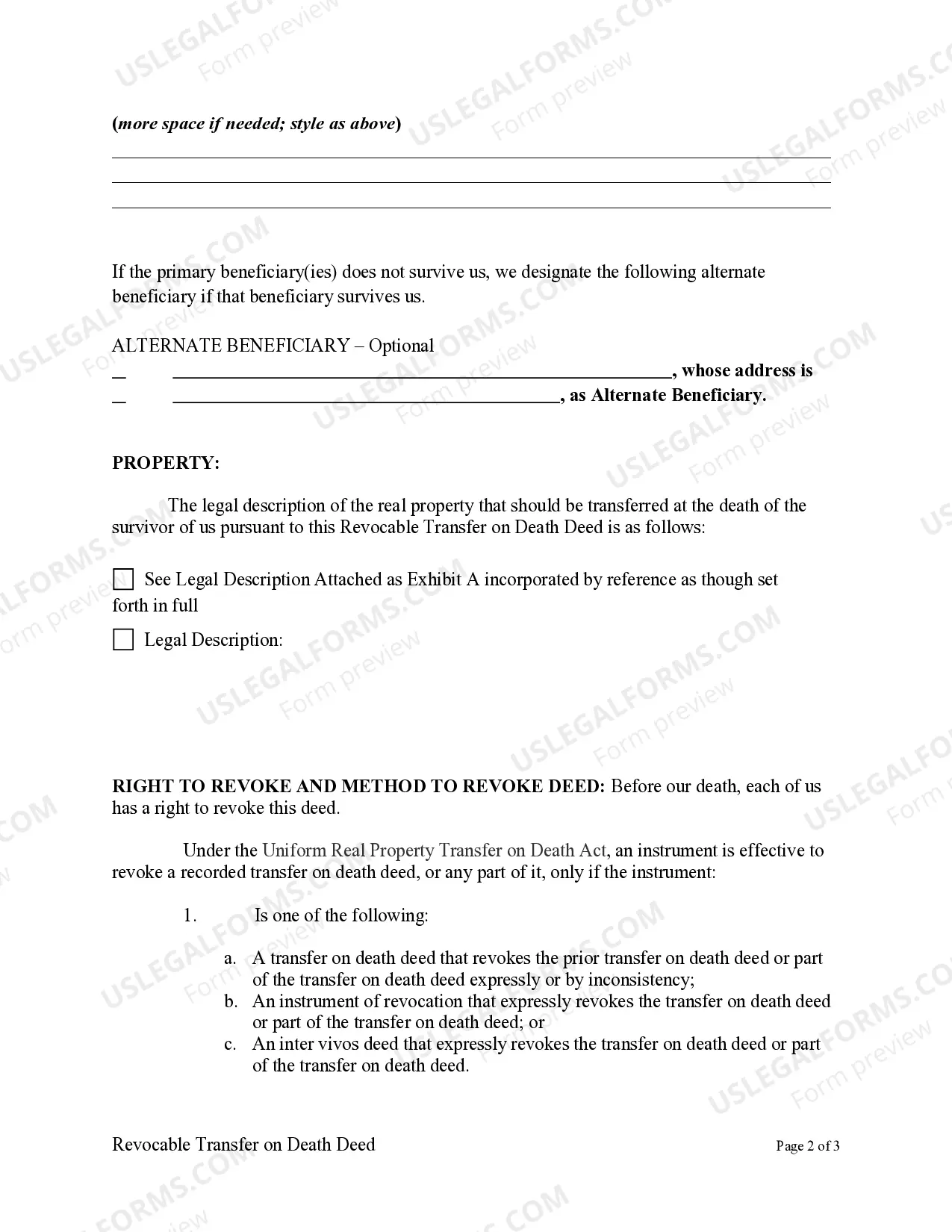

Yes, you can designate two beneficiaries on a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Multiple Individuals. Listing multiple beneficiaries allows for straightforward property division among heirs. Be sure to clarify how ownership will be shared, to prevent any future disputes.

Yes, the District of Columbia does allow for the use of a Transfer on Death Deed. This legal tool enables property owners to designate beneficiaries who will receive the property upon their death without going through the probate process. It is a practical option for many couples and individuals looking to simplify their estate planning.

A significant disadvantage of a District of Columbia Transfer on Death Deed is that it does not give you control over the property during your lifetime. Once recorded, the deed cannot be changed or revoked easily. Furthermore, if beneficiaries have difficulties or disagreements, it can complicate the process, leading to delays in the transfer of ownership after your passing.

There are several disadvantages to consider when using a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Multiple Individuals. For instance, this type of deed does not avoid probate if not correctly executed or if the beneficiaries predecease you. Other limitations include the potential for disagreements among beneficiaries and lack of control over what beneficiaries do with the property after your death.

To transfer a property using a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Multiple Individuals to two beneficiaries, you must list both names on the deed. Make sure to include the correct legal descriptions of the property, and specify how you want the property divided. It is crucial to execute this deed correctly to ensure a smooth transfer upon your passing.

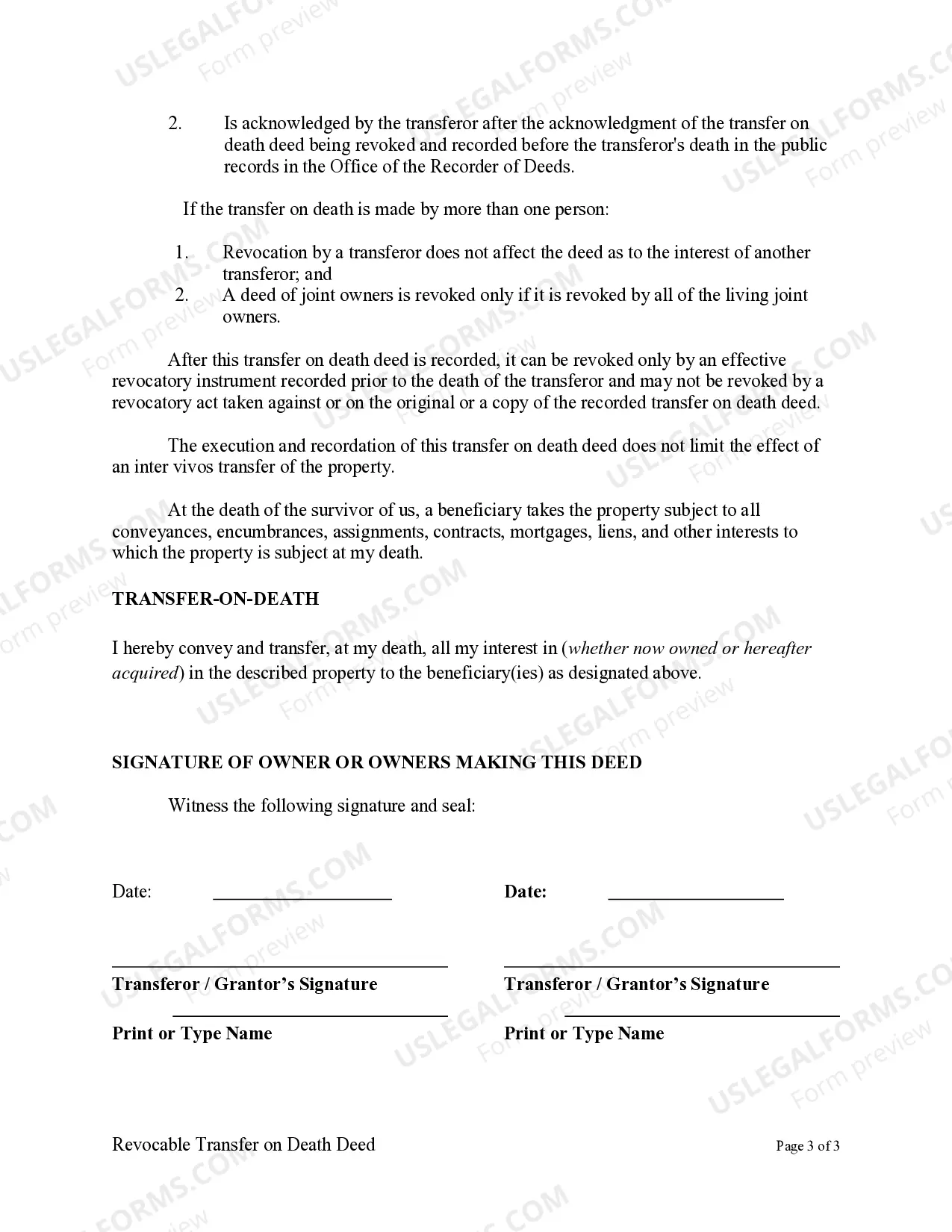

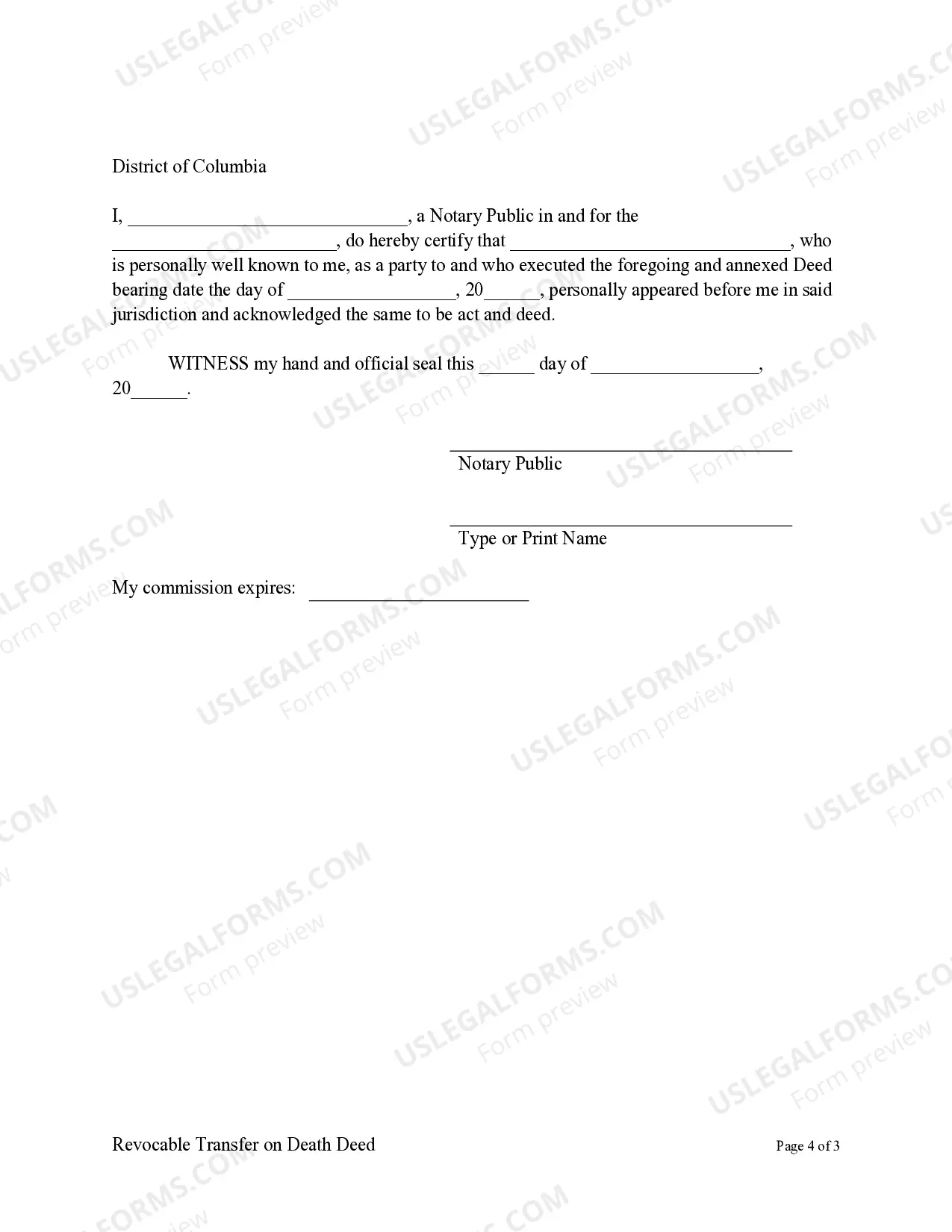

While you can complete a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Multiple Individuals without an attorney, it is advisable to seek legal assistance. An attorney can ensure that you comply with all legal requirements, helping you avoid potential mistakes. Additionally, they can provide guidance tailored to your unique situation.

While it is not strictly necessary to hire a lawyer for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Multiple Individuals, consulting with a legal professional can be very beneficial. A lawyer can help ensure that the deed is properly executed and complies with all relevant laws. This can prevent potential pitfalls and provide clarity in your estate planning.

While a District of Columbia Transfer on Death Deed or TOD can be advantageous, there are a few drawbacks to consider. One significant issue is that it may not cover all aspects of estate planning, necessitating additional legal documents. Additionally, if the property owner incurs debt, creditors may still come after the estate, which is something to keep in mind.

Generally, using a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Multiple Individuals is a beneficial strategy. It provides a simple way to transfer property outside of probate, which can save time and costs. However, each person's situation is unique, so it's essential to consult with a professional to determine whether a TOD is the right fit for your estate planning needs.

Yes, a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Multiple Individuals can help avoid probate. This means that when one spouse passes away, the property transfers directly to the beneficiaries named in the deed. Consequently, this process simplifies the transfer of ownership and saves time and expenses associated with probate court.