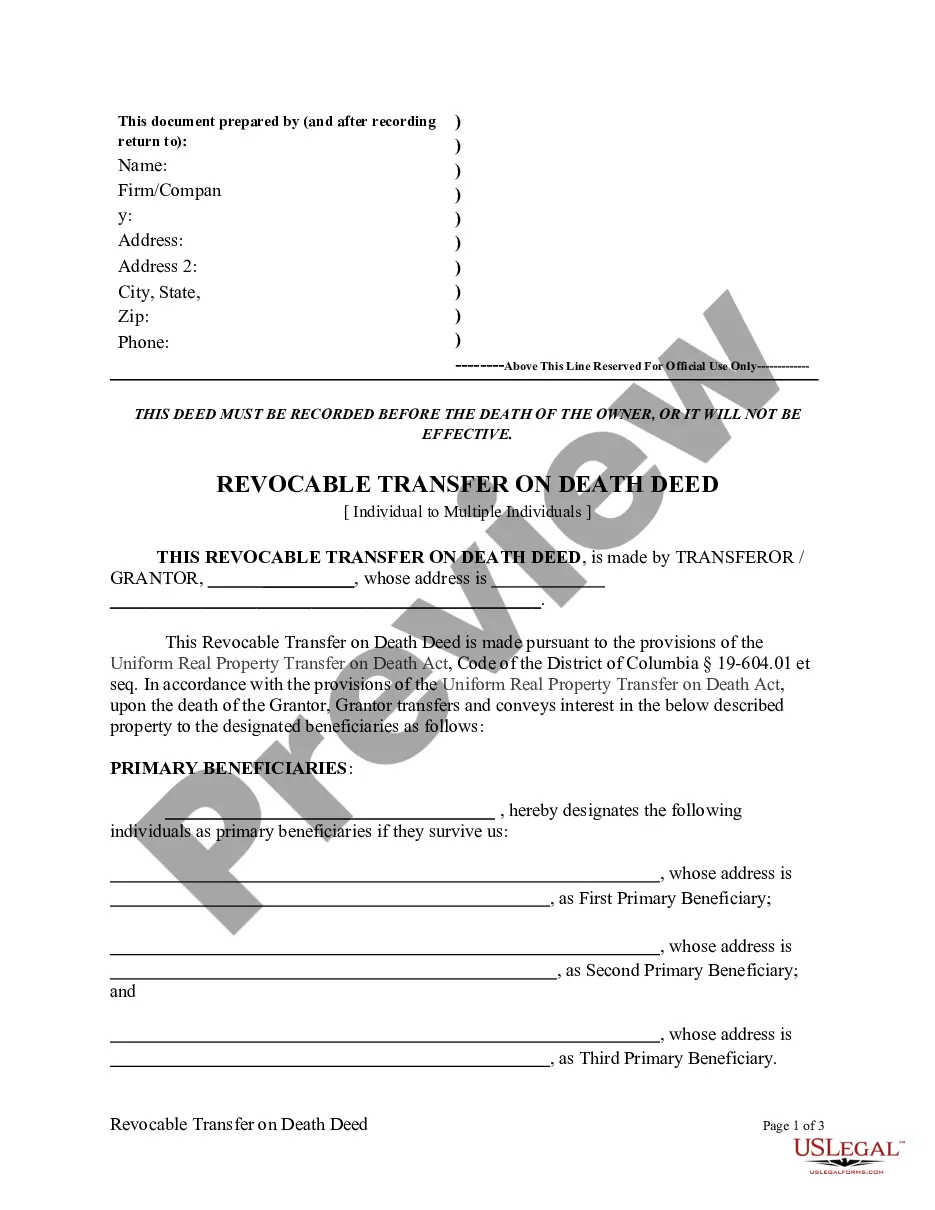

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals

Description

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Multiple Individuals?

Use US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals. Our court-admissible forms are drafted and regularly updated by skilled attorneys. Our’s is the most comprehensive Forms library online and provides affordable and accurate templates for consumers and legal professionals, and SMBs. The documents are grouped into state-based categories and a few of them can be previewed before being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For those who don’t have a subscription, follow the following guidelines to quickly find and download District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals:

- Check to ensure that you have the proper template with regards to the state it is needed in.

- Review the document by reading the description and using the Preview feature.

- Click Buy Now if it’s the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Make use of the Search field if you want to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals. Above three million users have already utilized our service successfully. Choose your subscription plan and have high-quality documents within a few clicks.

Form popularity

FAQ

Yes, you can transfer a deed without an attorney, especially when using the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals. Many people handle this process independently using tools available online. Uslegalforms simplifies this process by offering easy-to-use resources that guide you through every step of the deed transfer.

You do not necessarily need an attorney to create a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals. Many individuals successfully prepare these deeds themselves using reliable templates. However, if your situation involves complexity, seeking legal advice can provide peace of mind and ensure compliance with all legal nuances.

You can obtain a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals from various sources including legal websites, local government offices, or law firms. Platforms like uslegalforms provide user-friendly templates and guidance to assist you in preparing a TOD deed. This ensures you have a valid document that meets all necessary requirements.

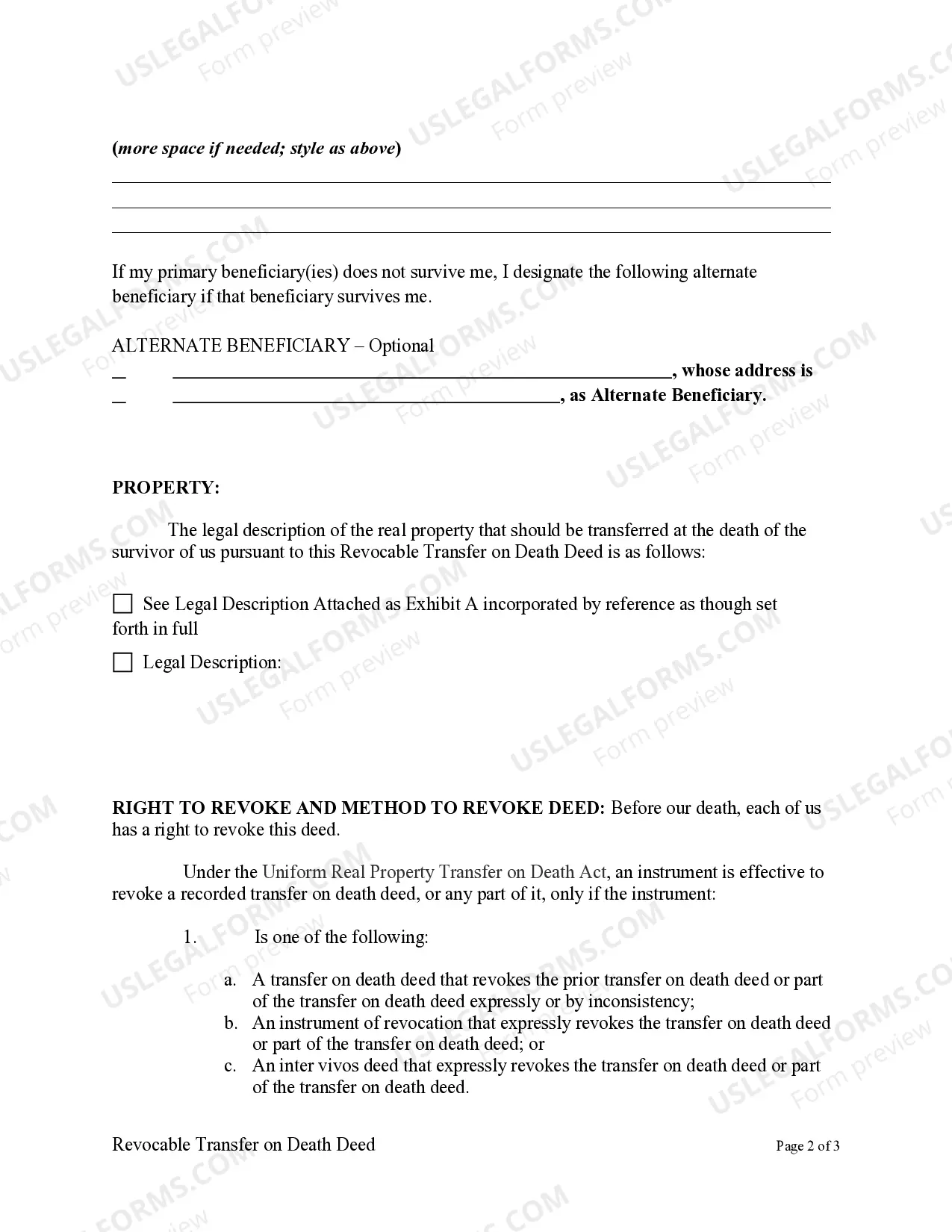

While the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals offers benefits, it also has disadvantages. One key concern is that it does not provide protection from creditors, as those debts can still affect the property. Additionally, if the beneficiaries do not coordinate effectively, disputes may arise among them after your passing. Overall, you should consider all implications before deciding.

To fill out an affidavit of death and heirship in the District of Columbia, start by collecting necessary information about the deceased and their heirs. Clearly outline the family relationships and provide required documentation to support your claims, such as death certificates or wills. Make sure to follow the applicable legal guidelines to avoid rejection or complications. If you need help, USLegalForms offers templates that streamline this task.

Some disadvantages of a District of Columbia Transfer on Death Deed include potential disputes among heirs or complications if the property owner has outstanding debts. Additionally, beneficiaries may face tax implications upon inheriting property, which can add to the overall burden. It's important to weigh these factors when considering estate plans. Opting for professional assistance can help clarify potential challenges.

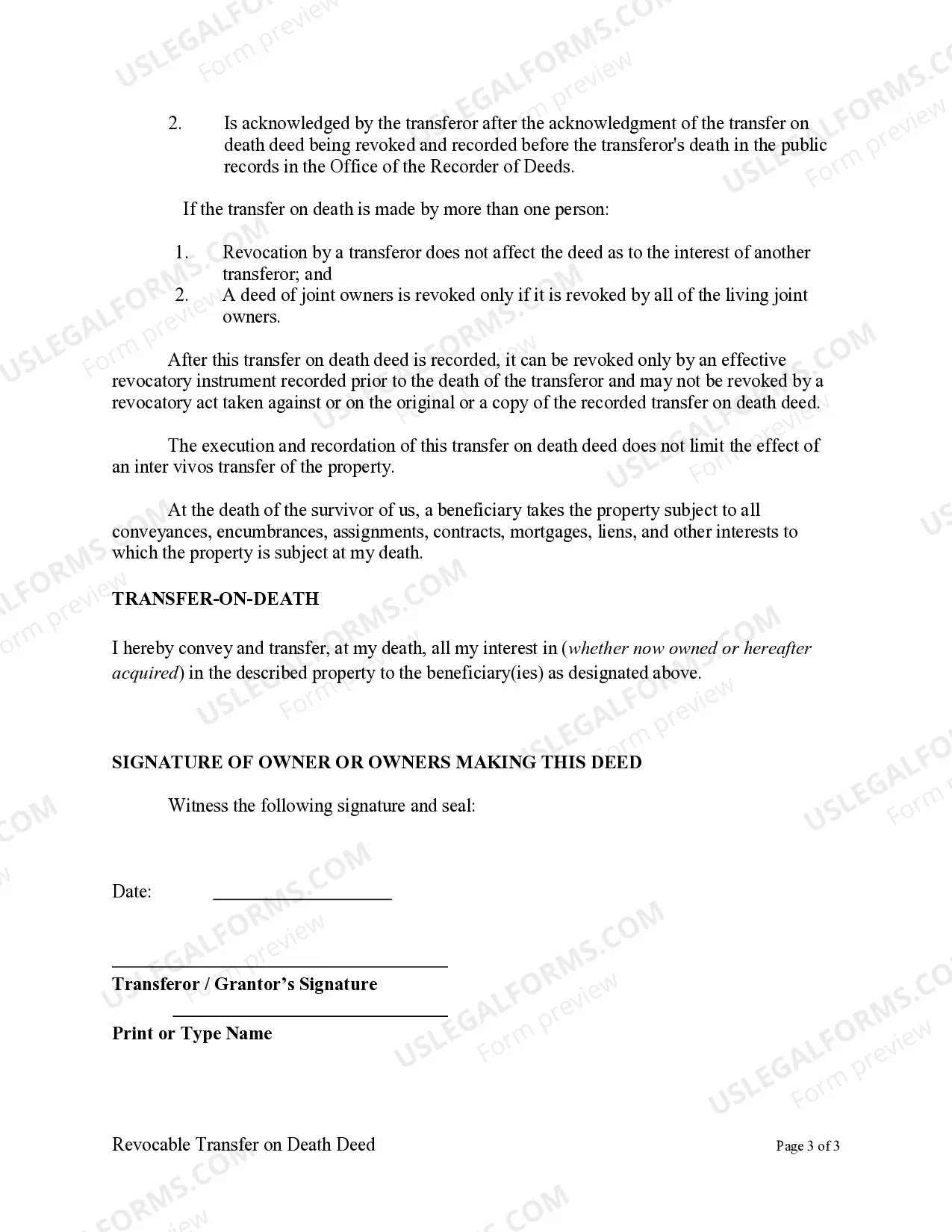

Yes, the District of Columbia does allow for transfer on death deeds. This legal mechanism enables property owners to designate beneficiaries who inherit real estate directly upon the owner's death, avoiding probate. Utilizing the TOD deed can significantly streamline the property transfer process, providing significant benefits for estate planning. Always ensure you follow specific local procedures when executing this deed.

One disadvantage of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Individuals is that it may not cover all potential estate complexities. For example, if you have debts or disputes among heirs, the deed may not fully resolve these issues, leading to complications. Additionally, if you change your mind, revoking or updating the deed can be a bit tricky without proper documentation. Understanding these limitations can help you make informed decisions.

Filling out a transfer on death designation affidavit for the District of Columbia is straightforward. Begin by gathering essential information about your property and the beneficiaries' details. After that, follow the provided guidelines that accompany the form, and ensure all information is accurate and complete. If you find the process confusing, consider using resources from platforms like USLegalForms, which offer templates and step-by-step assistance.

While it is not mandatory to have an attorney for a transfer on death deed in the District of Columbia, legal advice can be beneficial. A qualified attorney can help you navigate the intricacies of estate planning and ensure the transfer deed aligns with your wishes. Additionally, they can assist with any legal complications that may arise during the process. This support can provide you with peace of mind.