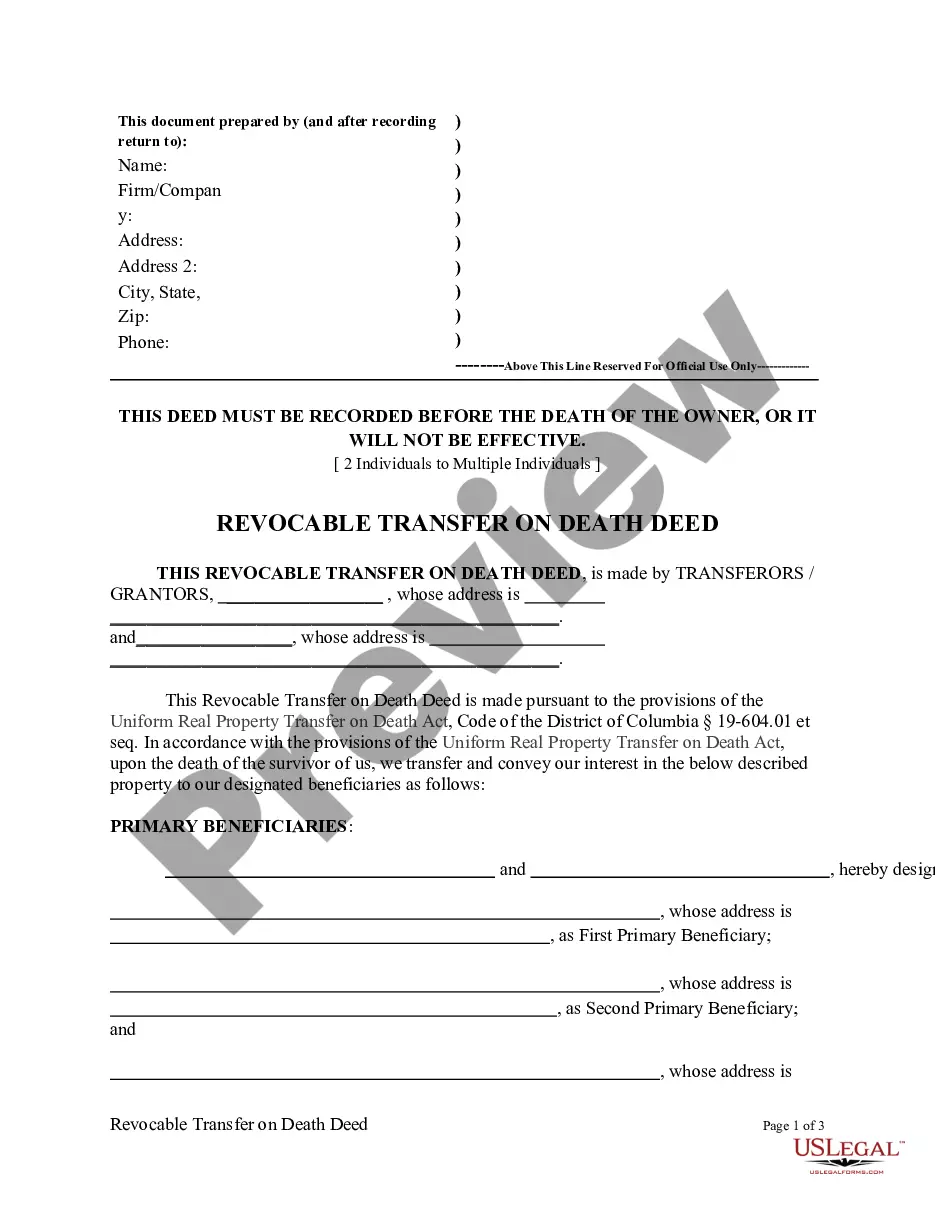

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals

Description District Of Columbia Deed Upon Death

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individuals To Multiple Individuals?

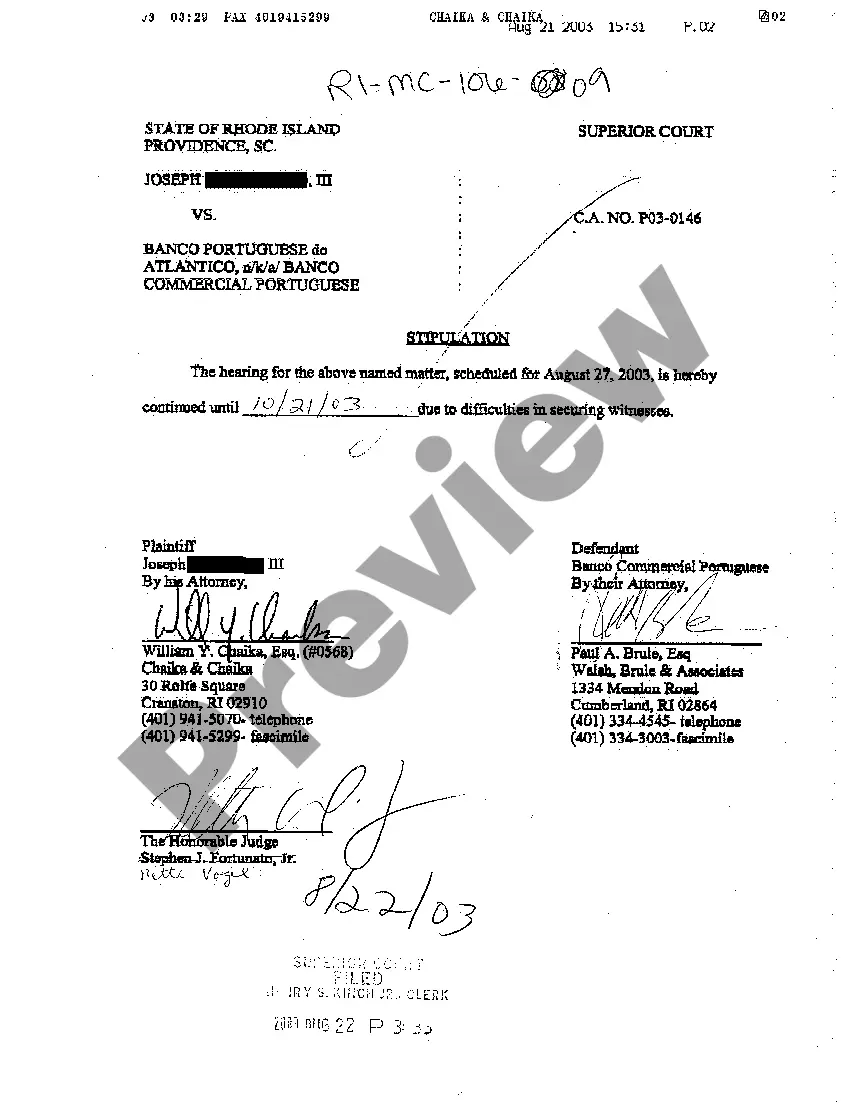

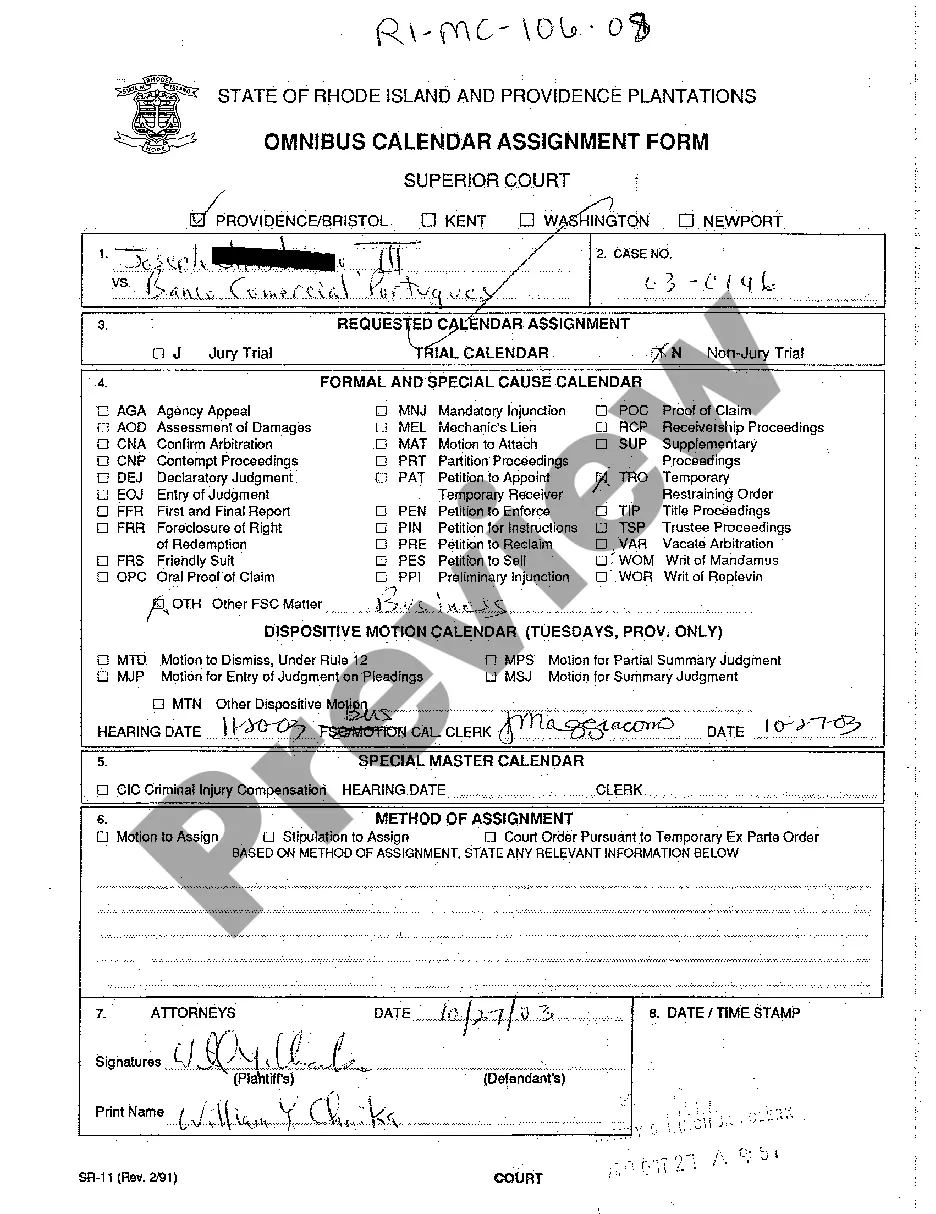

Use US Legal Forms to get a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most extensive Forms library on the internet and provides reasonably priced and accurate samples for customers and legal professionals, and SMBs. The documents are categorized into state-based categories and some of them can be previewed before being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Click Download next to any form you want and find it in My Forms.

For those who don’t have a subscription, follow the tips below to easily find and download District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals:

- Check out to make sure you have the proper template in relation to the state it is needed in.

- Review the document by reading the description and by using the Preview feature.

- Click Buy Now if it is the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search engine if you want to get another document template.

US Legal Forms provides thousands of legal and tax templates and packages for business and personal needs, including District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals. More than three million users already have used our service successfully. Select your subscription plan and have high-quality forms within a few clicks.

Transfer On Death Deed Form Form popularity

FAQ

One notable disadvantage of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals is that it does not shield assets from creditors. Once you pass away, creditors may still seek payment from your estate, which could affect your beneficiaries' inheritance. Additionally, if the named beneficiaries do not survive you, the property may revert to your estate. Using the services of uslegalforms can help you navigate these concerns effectively.

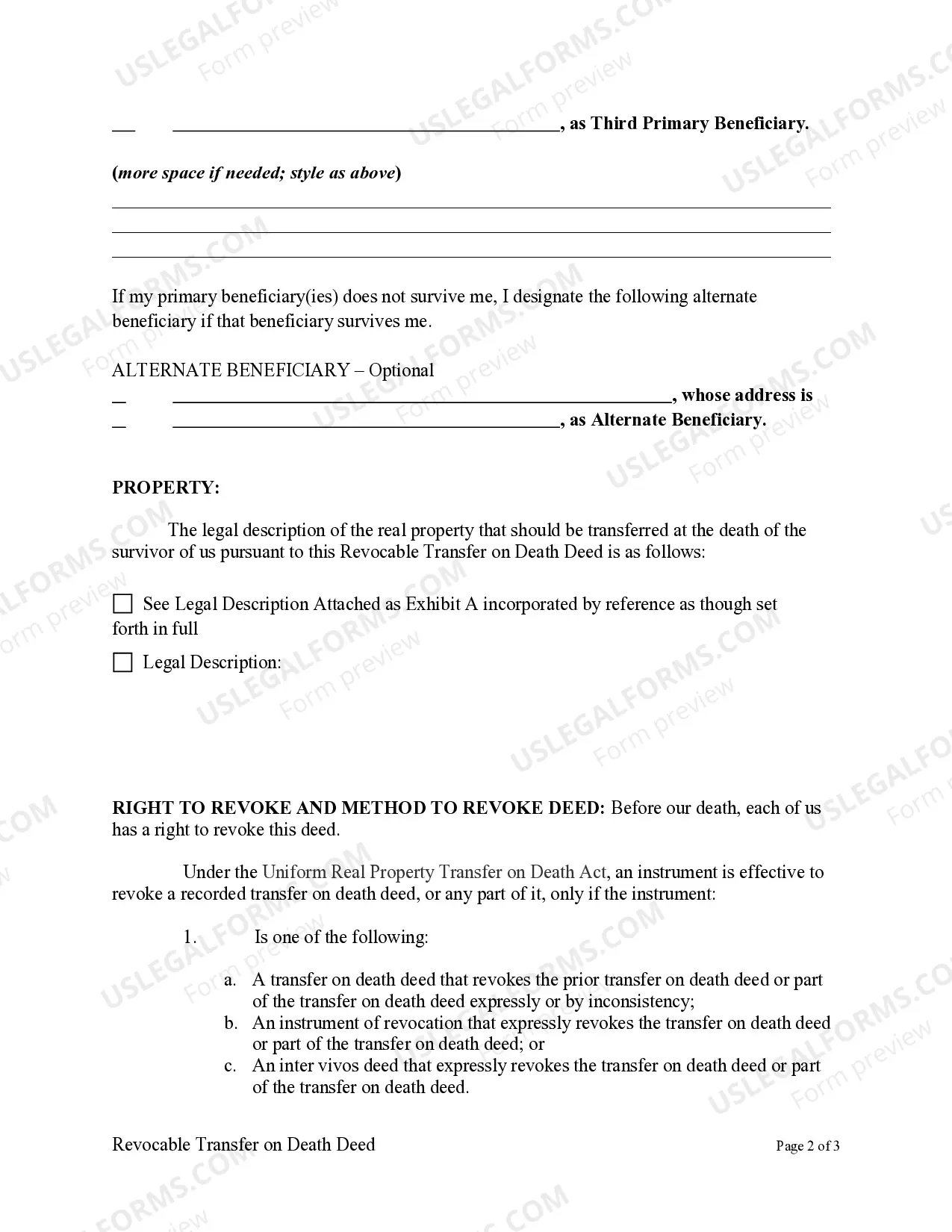

Absolutely, you can designate multiple beneficiaries on a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals. This arrangement allows you to specify how your assets will be divided among your chosen heirs. By selecting multiple beneficiaries, you can ensure that your property passes smoothly and according to your wishes. Always consider consulting legal guidance to avoid any potential disputes.

Yes, a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals can feature joint accounts. When both parties are listed, they can share ownership and designate beneficiaries. This means that if one owner passes away, the other retains full access to the account while ensuring a smooth transfer to beneficiaries. It's crucial to consult with a legal expert to draft this arrangement properly.

To fill out a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals, you will need to provide specific details about the property and the beneficiaries. Start by including your personal information, describe the property accurately, and list your beneficiaries clearly. If you find the paperwork confusing, using uslegalforms can guide you through the process and ensure everything is completed correctly.

One disadvantage of a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals is that it does not provide asset protection during your lifetime. Additionally, since the transfer only occurs after death, creditors may still claim against the property. It is vital to understand these potential drawbacks and consider your overall estate plan carefully.

While you do not necessarily need an attorney to complete a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals, having legal guidance can be beneficial. An attorney can help you ensure that the deed meets all legal requirements and that your intentions are clearly outlined. If you prefer a more straightforward process, consider using uslegalforms for clear instructions and templates.

Yes, you can designate two beneficiaries on a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals. This allows the property to pass to both beneficiaries upon your death. It's important to specify how the ownership will be shared, whether equally or in different proportions. Using a reliable platform like uslegalforms can make the process easier.

Yes, you can designate multiple beneficiaries on a transfer on death deed in the District of Columbia. This flexibility allows you to split the property among several individuals, ensuring that your wishes are honored. When considering a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals, it is important to clearly indicate your intentions to prevent misunderstandings later.

One disadvantage of a transfer on death deed is that it cannot be changed once the property owner passes away, unlike a will that can be updated pre-death. Additionally, if the beneficiary does not wish to inherit the property, they may have limited options to decline the deed. Understanding the implications of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals is crucial to avoid potential family disputes.

The choice between a transfer on death (TOD) deed and a beneficiary deed depends on your specific circumstances. A TOD allows direct transfer of property without probate, while a beneficiary deed can designate different beneficiaries for various properties. Consider the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Multiple Individuals for its streamlined process and potential tax benefits for your heirs.