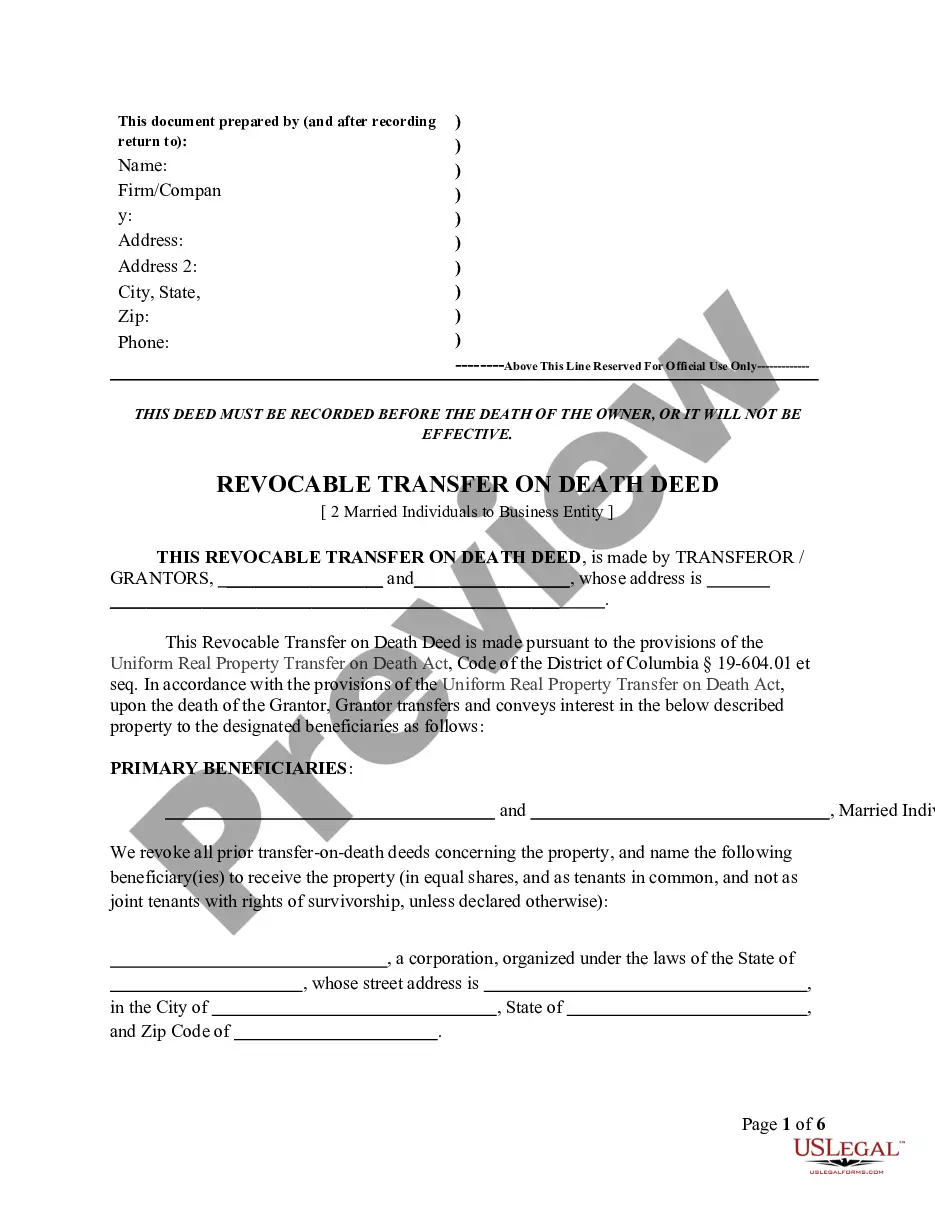

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Business Entity

Description

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To A Business Entity?

Utilize US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to a Business Entity.

Our court-valid forms are crafted and routinely revised by licensed attorneys.

Ours is the most extensive Forms catalog available online, providing economical and precise templates for clients, lawyers, and small to medium-sized businesses.

Employ the Search field if you seek another document template. US Legal Forms offers a wide array of legal and tax documents and packages for both business and personal requirements, including the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to a Business Entity. Over three million users have successfully used our service. Select your subscription plan and gain access to high-quality documents in just a few clicks.

- The documents are organized into state-specific categories, and several can be previewed before downloading.

- To access samples, clients must possess a subscription and Log In to their profile.

- Press Download next to any template you desire and locate it in My documents.

- For individuals without a subscription, adhere to these steps to swiftly locate and download the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Spouses to a Business Entity.

- Ensure you select the correct form pertaining to the required state.

- Examine the document by reviewing the description and utilizing the Preview function.

- Click Buy Now if it’s the template you wish to purchase.

- Establish your account and settle payment via PayPal or credit card.

- Download the template to your device and feel free to use it repeatedly.

Form popularity

FAQ

To fill out a transfer on death designation affidavit for the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Business Entity, start by gathering all necessary information regarding the property and beneficiaries. Follow the instructions provided with the form carefully to ensure accuracy. If you have any questions, consider using resources from US Legal Forms to guide you through the process.

You can obtain a TOD deed from various sources, including online legal services or state government websites. For a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Business Entity, platforms like US Legal Forms offer easy access to compliant forms. These services often include instructions, making it easier for you to manage your estate planning.

Yes, you can transfer a deed without an attorney when dealing with a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Business Entity. However, ensure that you follow all legal procedures correctly to avoid complications. Resources like US Legal Forms provide templates and guidance that can make this process straightforward and prevent common mistakes.

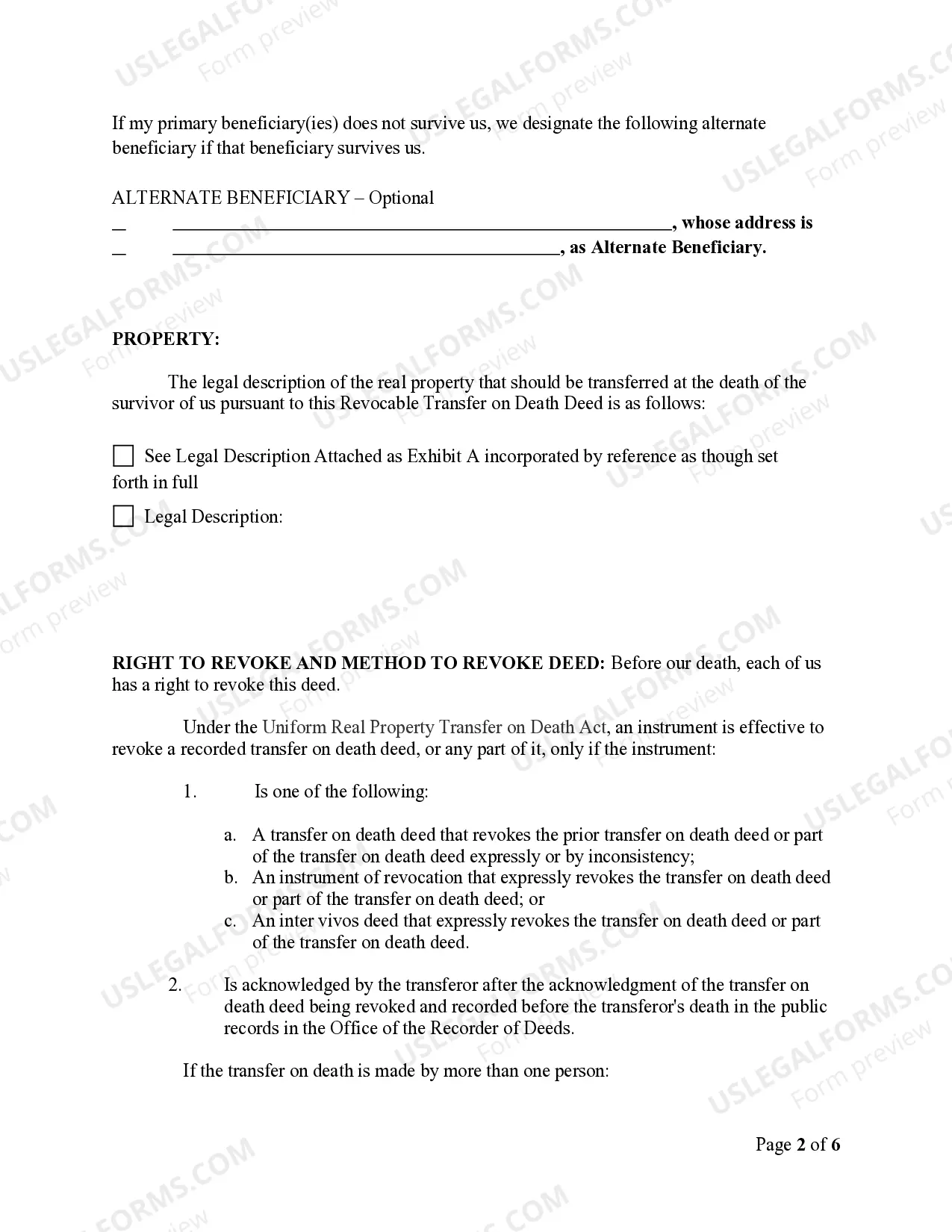

One disadvantage of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Business Entity is that it does not provide protection from creditors. Additionally, if the property appreciates significantly, it may lead to a larger tax liability for beneficiaries. Understanding these implications is crucial, so consider discussing them with a legal expert.

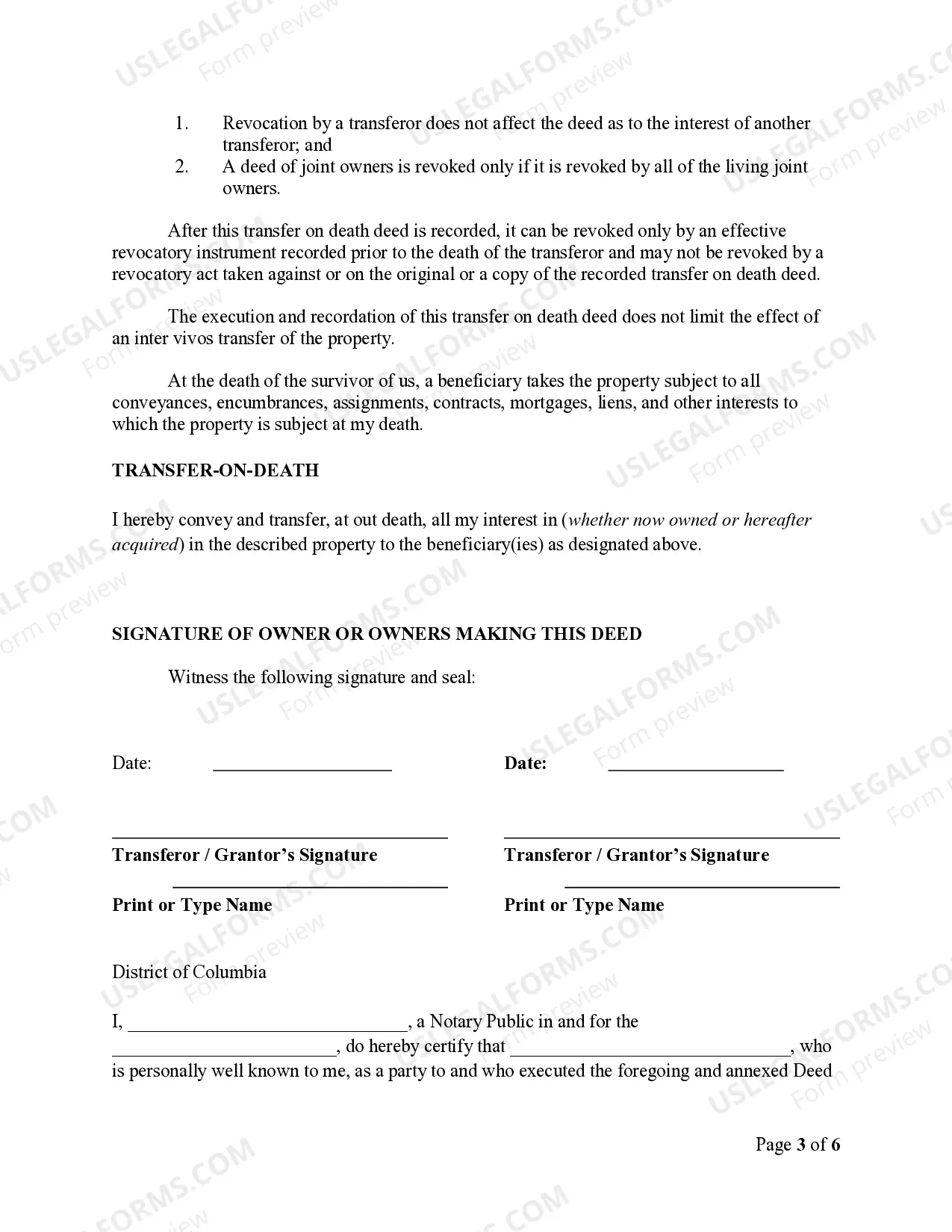

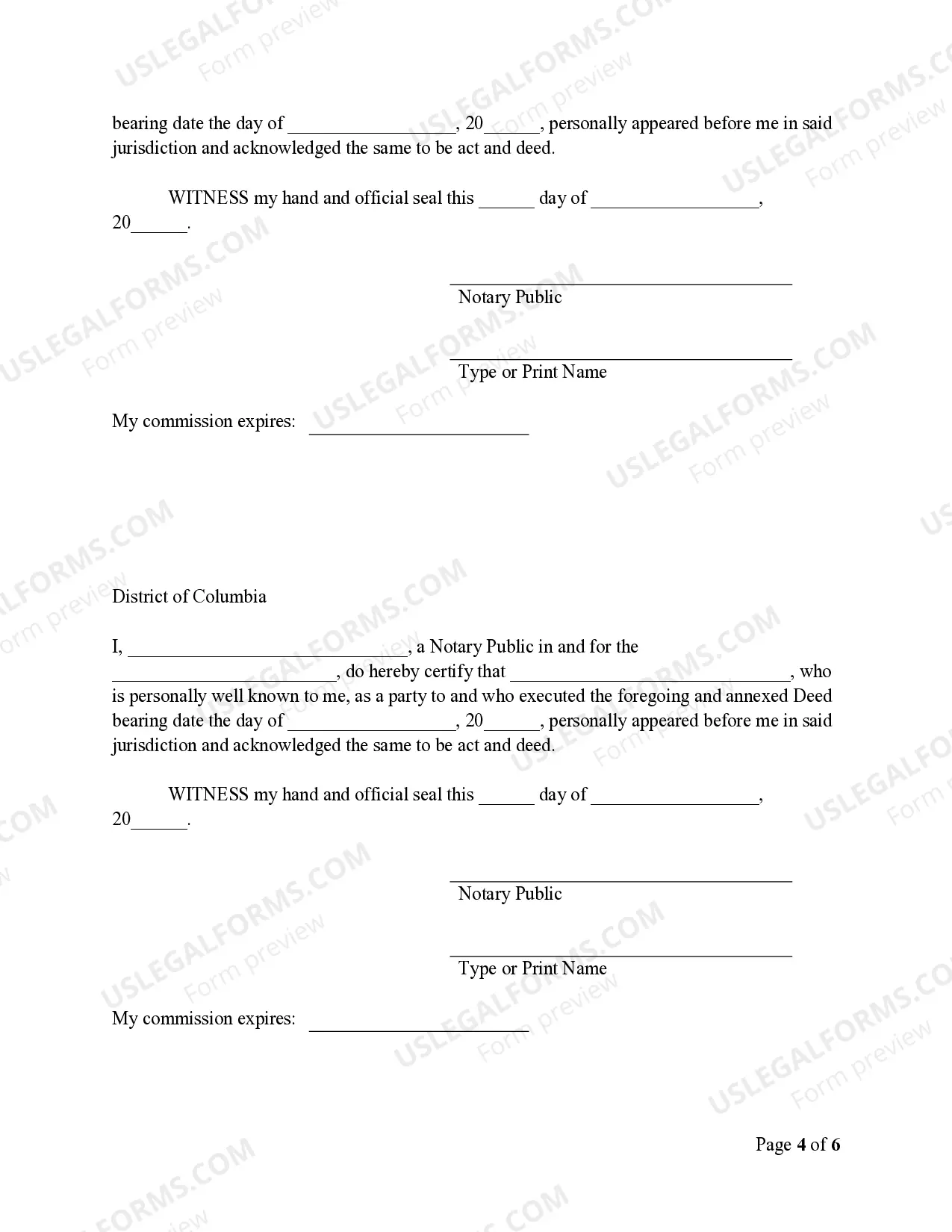

You do not need an attorney for a Transfer on Death deed in the District of Columbia, but having one can simplify the process. An attorney can assist with understanding the legal terminology and ensuring that the beneficiaries are properly named. While you can do it yourself through available resources, professional help often clarifies nuances that could impact your estate.

While it's not legally required to have a lawyer for a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Business Entity, seeking legal advice can be beneficial. A lawyer can help ensure that the document meets all legal requirements and handles any complexities that may arise. This guidance can provide peace of mind and may prevent issues in the future.

While you do not technically need an attorney to execute a transfer on death deed, seeking legal advice is highly recommended. An attorney ensures that the deed complies with local laws and aligns with your overall estate plan. The District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Business Entity can be complex, and expert guidance helps avoid mistakes. UsLegalForms provides resources and templates to simplify the process if you choose to proceed without an attorney.

Several states recognize transfers on death deeds, offering similar provisions to the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Business Entity. As of now, states like Indiana, Nevada, and Texas have laws permitting such deeds. This recognition varies by state, so it is important to check local laws. Many individuals use these deeds as an efficient estate planning strategy across various jurisdictions.

Yes, the District of Columbia allows the use of transfer on death deeds, also known as the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to a Business Entity. This form of deed enables individuals to transfer property to beneficiaries upon their death without going through probate. Utilizing this deed offers a straightforward way to ensure your property goes directly to your chosen beneficiaries. It is a valuable tool for estate planning in D.C.

The primary difference between a Transfer on Death deed and a beneficiary designation lies in their application. A TOD deed specifically transfers real estate, while beneficiary designations apply to financial accounts and certain assets. Understanding how a District of Columbia Transfer on Death Deed functions can help you make informed decisions when planning inheritance for a husband and wife to a business entity. Each serves its purpose, so evaluate your options.