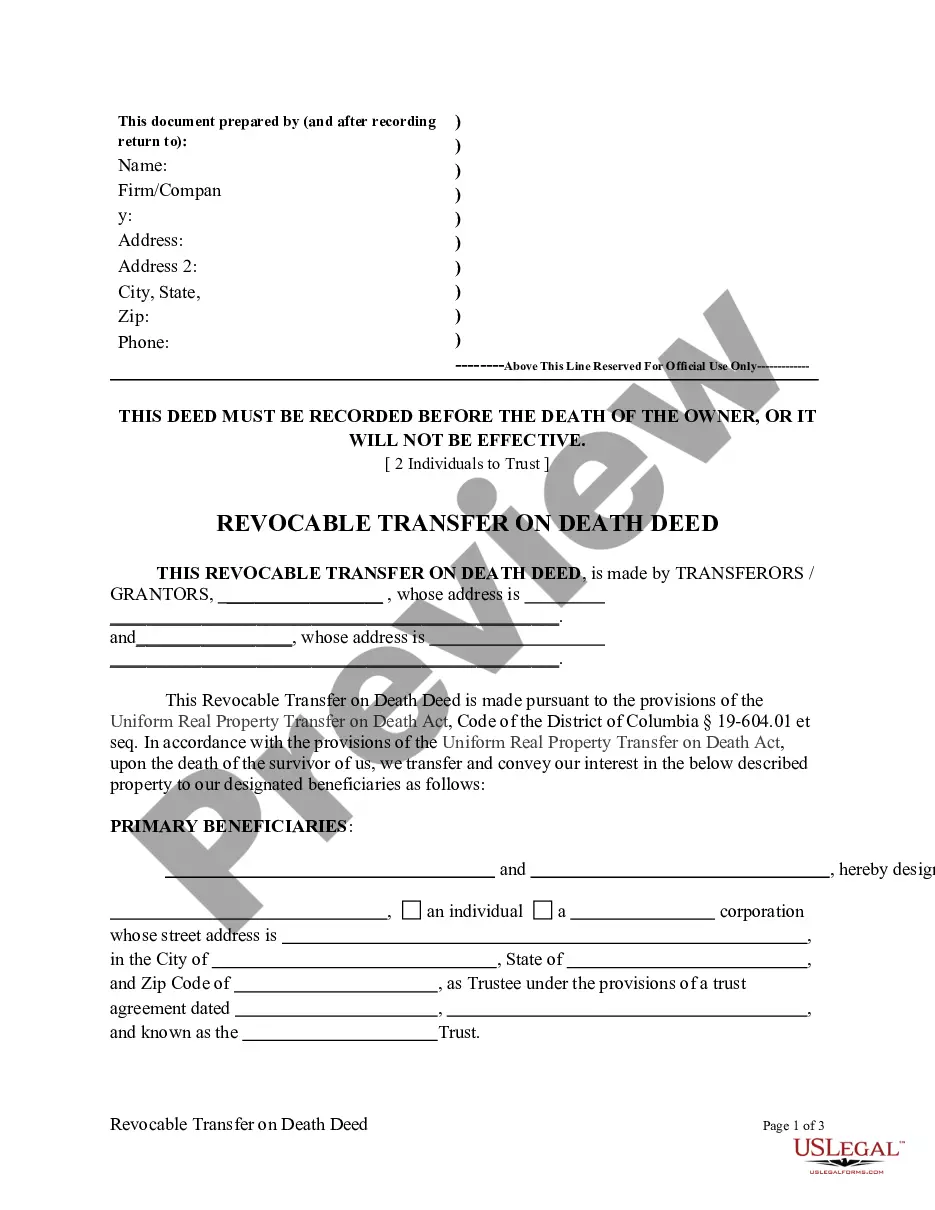

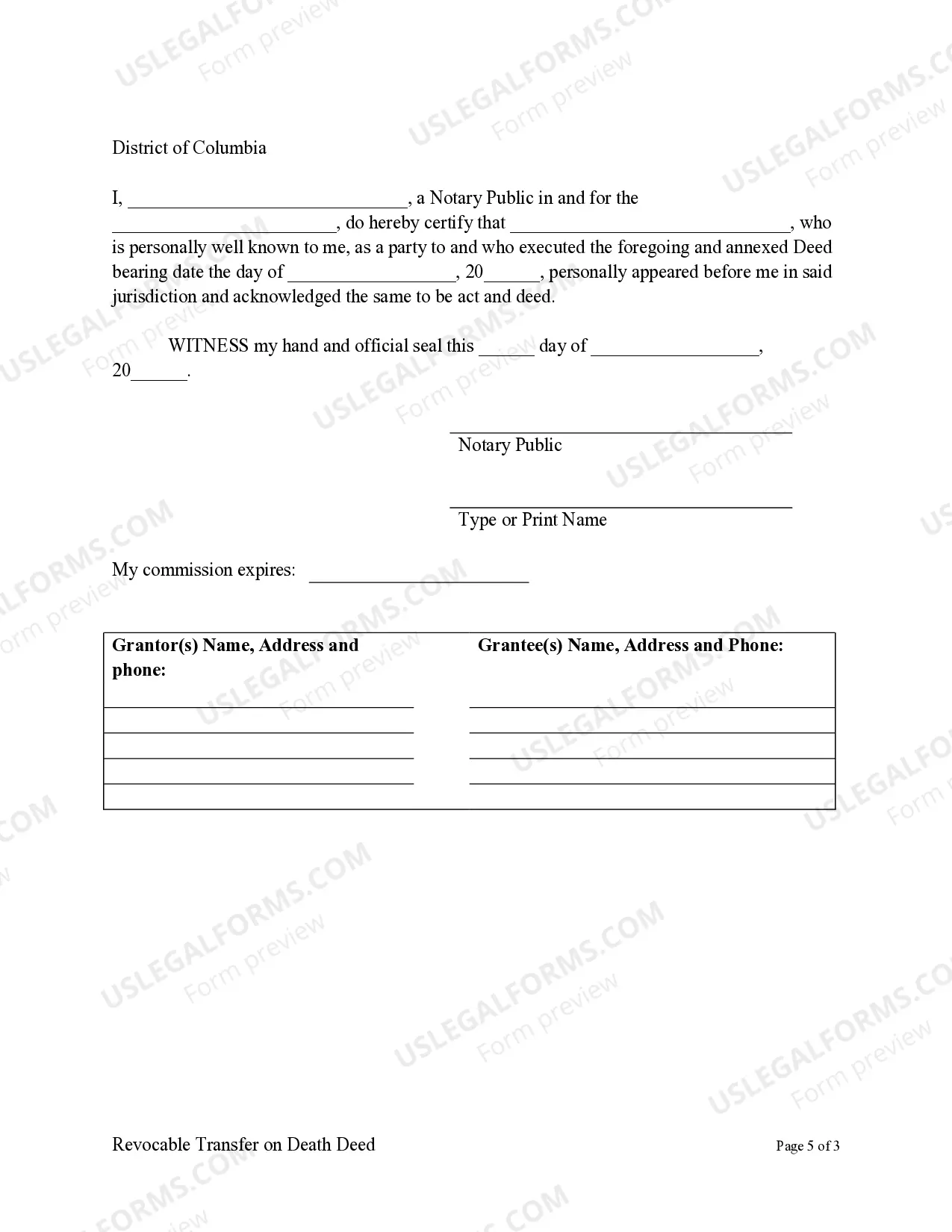

District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust

Description

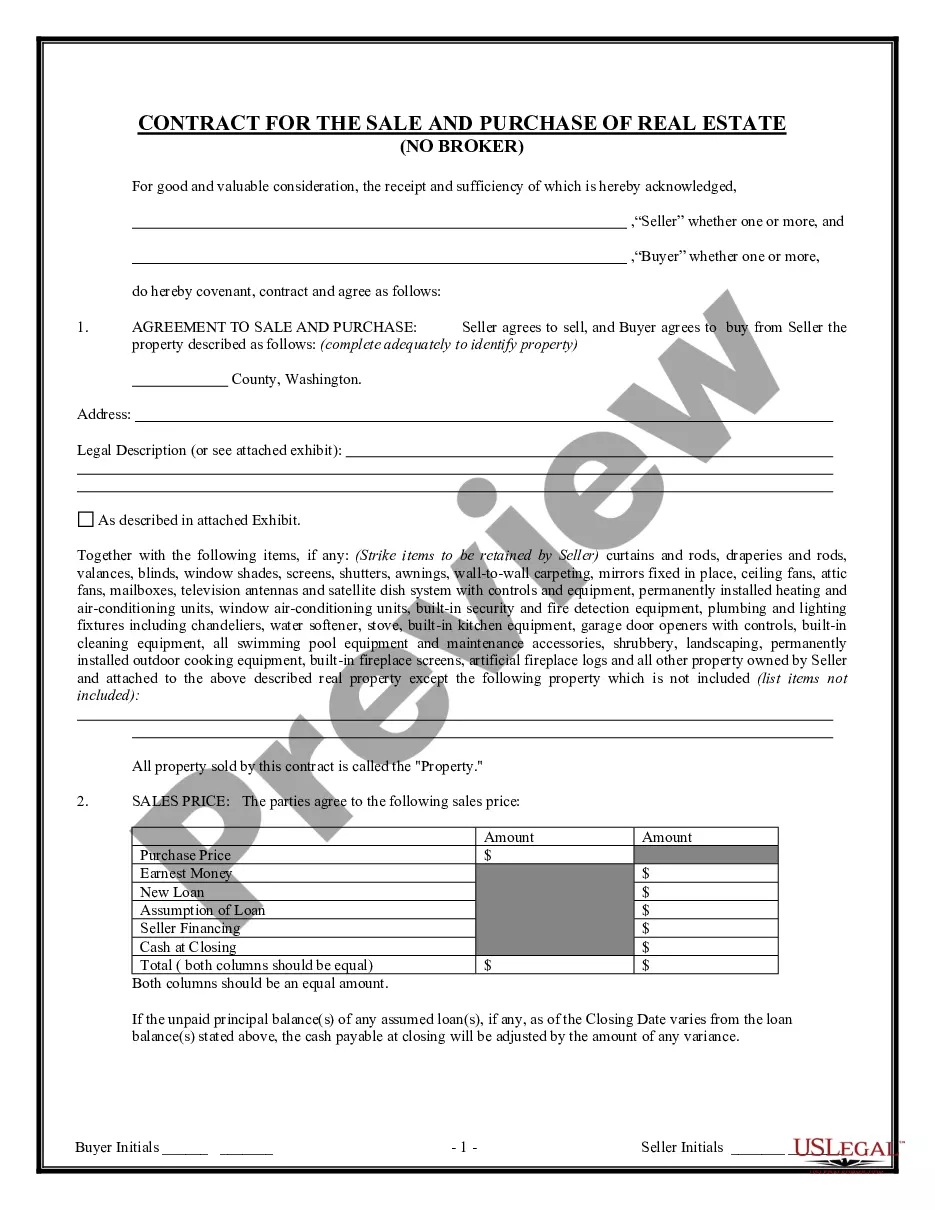

How to fill out District Of Columbia Transfer On Death Deed Or TOD - Beneficiary Deed For Two Individual To A Trust?

Use US Legal Forms to obtain a printable District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most complete Forms library online and provides reasonably priced and accurate templates for customers and lawyers, and SMBs. The documents are grouped into state-based categories and many of them can be previewed before being downloaded.

To download templates, customers must have a subscription and to log in to their account. Hit Download next to any template you want and find it in My Forms.

For individuals who do not have a subscription, follow the following guidelines to quickly find and download District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust:

- Check out to make sure you have the right form with regards to the state it’s needed in.

- Review the form by reading the description and using the Preview feature.

- Press Buy Now if it is the document you need.

- Create your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust. More than three million users have used our service successfully. Select your subscription plan and obtain high-quality forms within a few clicks.

Form popularity

FAQ

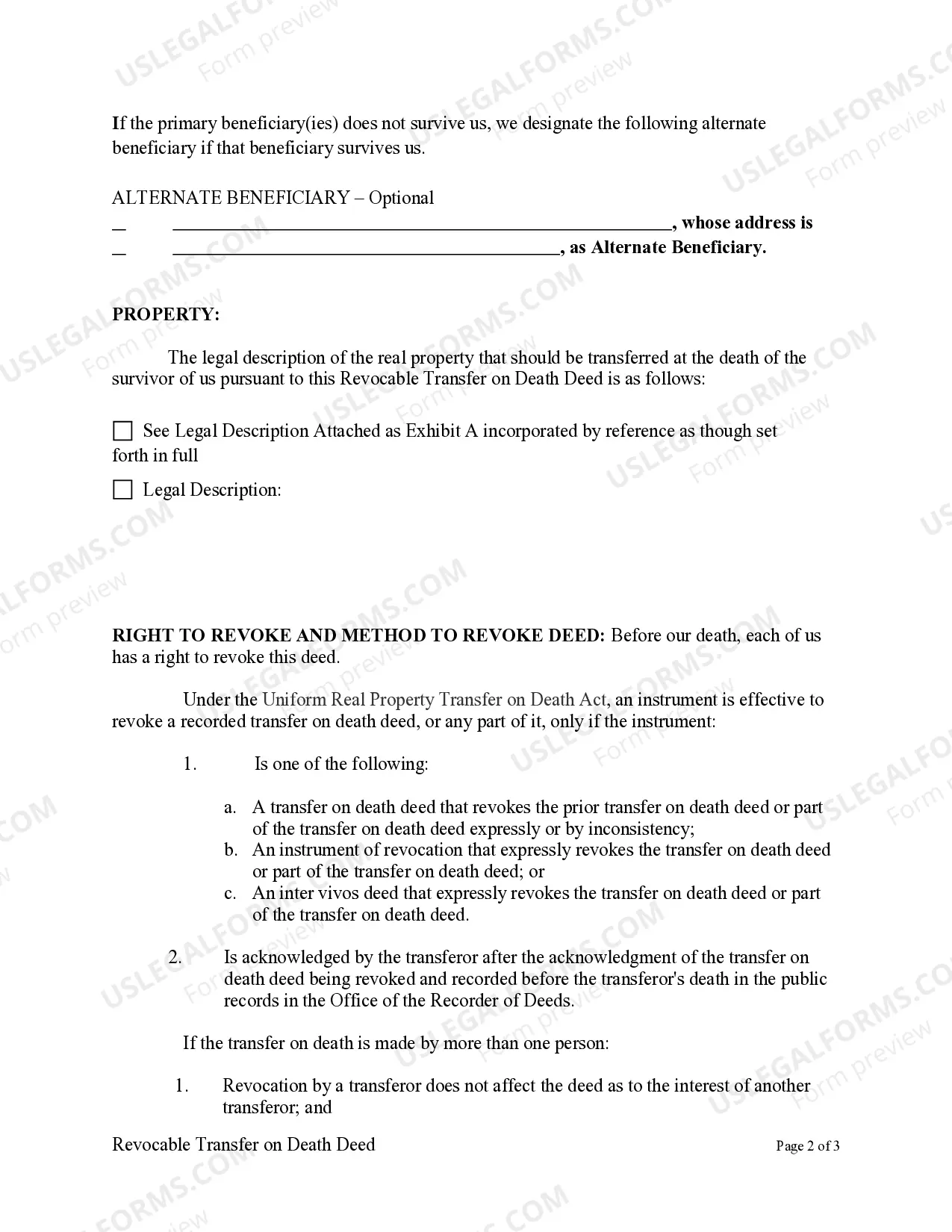

To transfer a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust to two beneficiaries, you need to clearly list both names on the deed. Ensure that both beneficiaries understand their rights and responsibilities regarding the property. It’s also beneficial to consult a legal platform like uslegalforms to ensure the deed is correctly drafted and compliant with state laws.

Yes, you can name two beneficiaries on a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust. This allows both beneficiaries to inherit the property upon your passing, providing a straightforward transfer without going through probate. Naming multiple beneficiaries can help ensure that your assets are distributed according to your wishes, offering peace of mind.

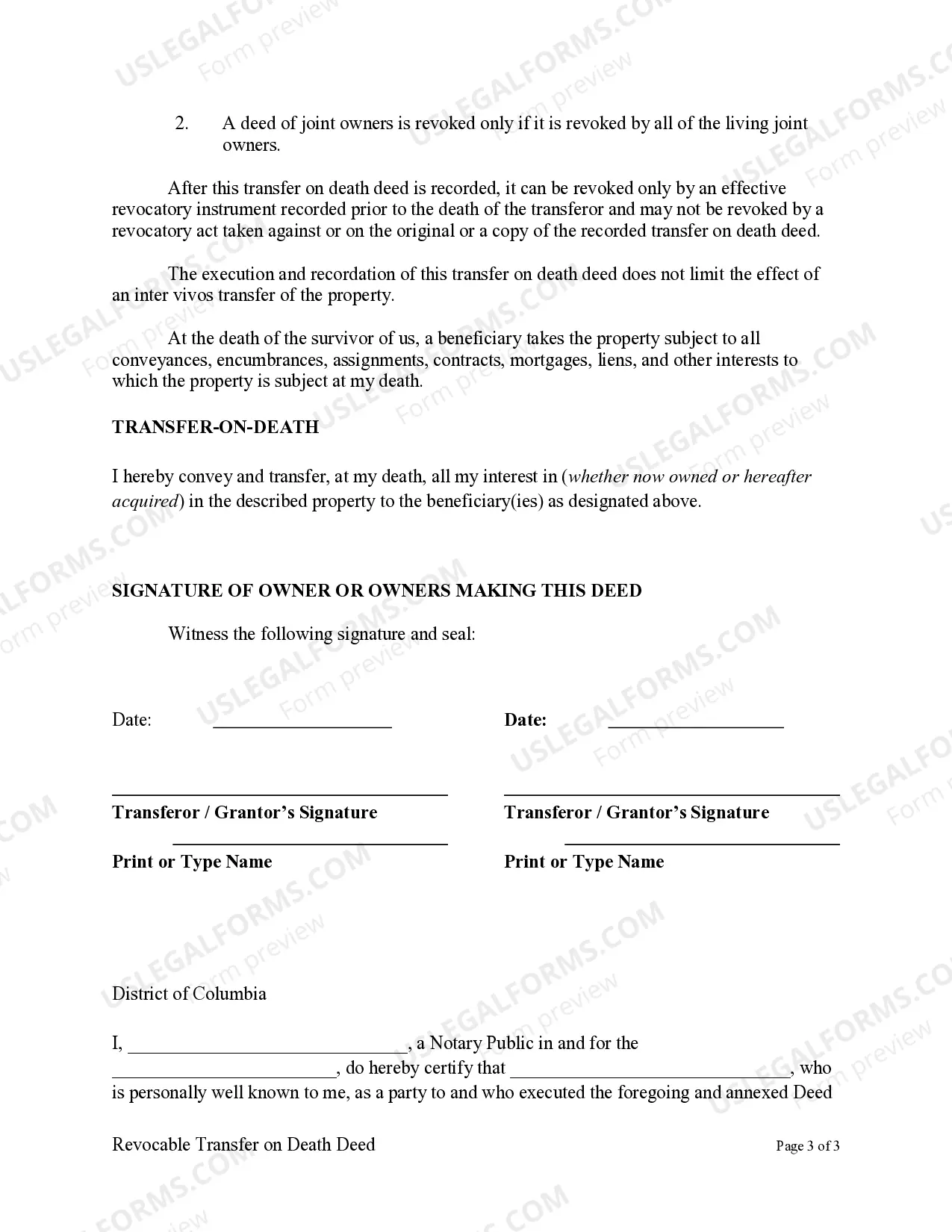

While you can complete a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust without an attorney, it is wise to consult one. An attorney can help ensure that the deed meets all legal requirements and effectively addresses your wishes. Even though it's possible to handle it yourself, expert guidance can save you time and prevent potential legal issues in the future.

The main disadvantage of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust is that it can complicate matters if you have multiple beneficiaries. In some cases, the deed may not override existing legal obligations such as debt or other claims against the property. Additionally, if ownership needs to be changed because of unforeseen circumstances, a TOD may not provide the flexibility you need.

Choosing between a TOD and a beneficiary designation depends on your specific circumstances. The District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust is often preferred for real estate, as it allows for direct transfer and avoids probate. In contrast, for financial accounts, a beneficiary designation may be more appropriate since it directly applies to those types of assets and can offer additional benefits for your heirs.

TOD accounts can be a good idea for many individuals, as they streamline the transfer process of assets upon death. They eliminate the need for probate, enabling beneficiaries to access assets more quickly. However, it is important to consider your overall estate plan and whether a District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust fits within your specific needs and goals.

The main difference lies in their function within estate planning. A District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust allows for direct transfer of property upon death, while a beneficiary designation typically applies to accounts or policies like life insurance. Essentially, TODs are specific to real estate, providing a seamless way to transfer ownership to named beneficiaries.

One disadvantage of the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individual to a Trust is that it may not address all estate planning needs. For example, it does not provide protections against creditors or taxes that might arise after death. Additionally, a TOD may create complications if there are disputes among beneficiaries, which can lead to legal challenges.

Filling out a Transfer on Death designation affidavit involves several critical steps. First, you need to accurately identify the property and the beneficiaries in the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust. USLegalForms offers easy-to-understand templates and instructions that simplify this process, ensuring you complete the affidavit correctly and efficiently.

While it is not mandatory to have an attorney for a Transfer on Death deed, consulting a legal expert ensures that you comply with all regulations. This is particularly important for the District of Columbia Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to a Trust, as every jurisdiction may have unique requirements. USLegalForms provides guidance and templates that can aid you if you choose to manage the process independently.