Financing Statement Amendment Addendum form for amending a Financing Statement filed with the District of Columbia filing office.

District of Columbia UCC3 Financing Statement Amendment

Description District Of Columbia Ucc Filing Search

How to fill out District Of Columbia UCC3 Financing Statement Amendment?

The more documents you need to make - the more anxious you become. You can find thousands of District of Columbia UCC3 Financing Statement Amendment blanks online, nevertheless, you don't know those to trust. Remove the headache to make getting exemplars more convenient using US Legal Forms. Get accurately drafted forms that are composed to satisfy state requirements.

If you currently have a US Legal Forms subscription, log in to your account, and you'll find the Download button on the District of Columbia UCC3 Financing Statement Amendment’s page.

If you’ve never applied our platform earlier, finish the signing up procedure using these guidelines:

- Ensure the District of Columbia UCC3 Financing Statement Amendment applies in the state you live.

- Re-check your option by studying the description or by using the Preview mode if they are provided for the selected document.

- Simply click Buy Now to begin the sign up process and select a costs program that meets your preferences.

- Insert the asked for data to make your profile and pay for your order with the PayPal or bank card.

- Choose a handy file formatting and have your copy.

Access each document you get in the My Forms menu. Simply go there to prepare fresh duplicate of your District of Columbia UCC3 Financing Statement Amendment. Even when having expertly drafted web templates, it is still vital that you think about asking the local legal representative to double-check completed sample to be sure that your document is accurately filled out. Do more for less with US Legal Forms!

District Of Columbia Ucc Filing Form popularity

FAQ

UCC-1 Financing Statements are commonly referred to as simply UCC-1 filings. UCC-1 filings are used by lenders to announce their rights to collateral or liens on secured loans and are usually filed by lenders with your state's secretary of state office when a loan is first originated.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

Security interest filings in Washington, DC are filed with the Recorder of Deeds (ROD). If you have a UCC against real property, better known as a fixture filing, this would be filed in the land records of the ROD, while others are found in the chattel records (yes, DC still uses the word chattel).

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

Assignment When a secured party needs to assign or transfer all or a portion of its rights to the collateral listed in a UCC-1 financing statement. It is considered an alteration of the previous filing.

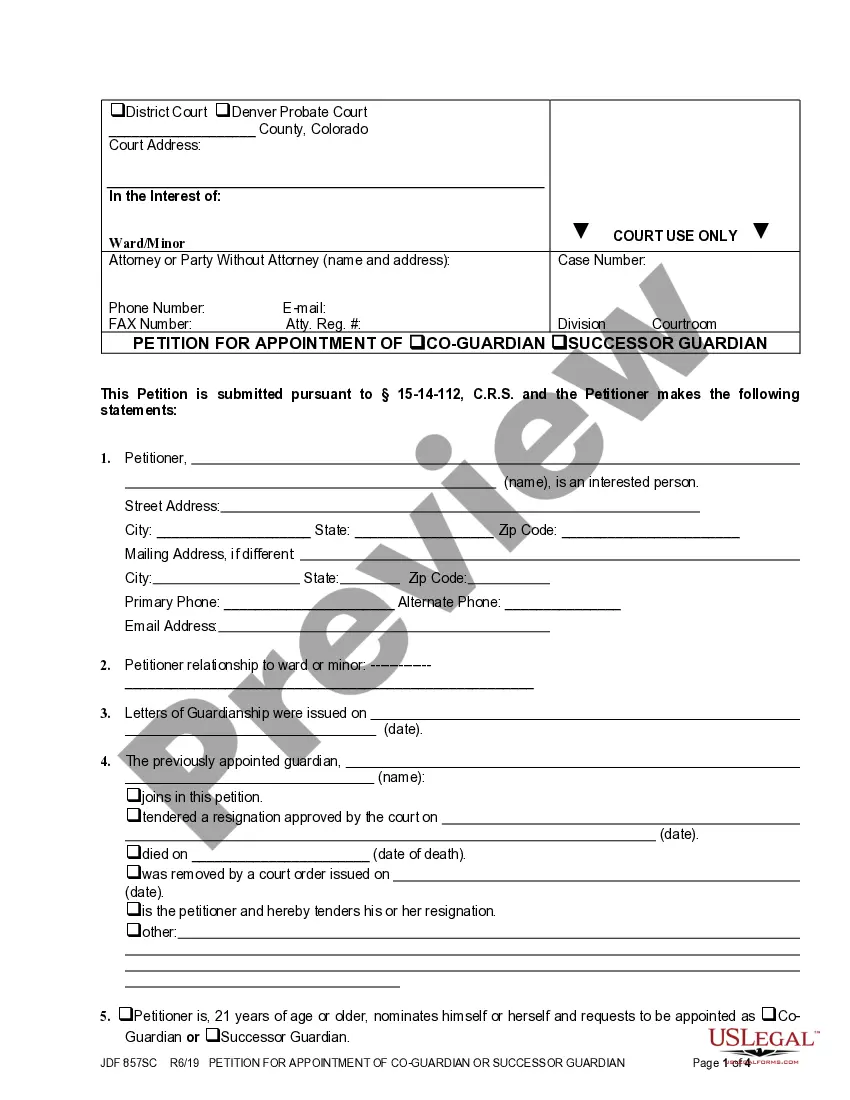

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

You should file a UCC-1 Financing Statement with the secretary of state's office in the state where the debtor is incorporated or located. If the collateral is real property, then you should also file a UCC-1 with the county recorder's office in the county where the debtor's real property is located.