Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN)

Description

How to fill out Delaware GARNISHMENT Of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN)?

Dealing with official documentation requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN) template from our service, you can be sure it complies with federal and state laws.

Working with our service is straightforward and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to obtain your Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN) within minutes:

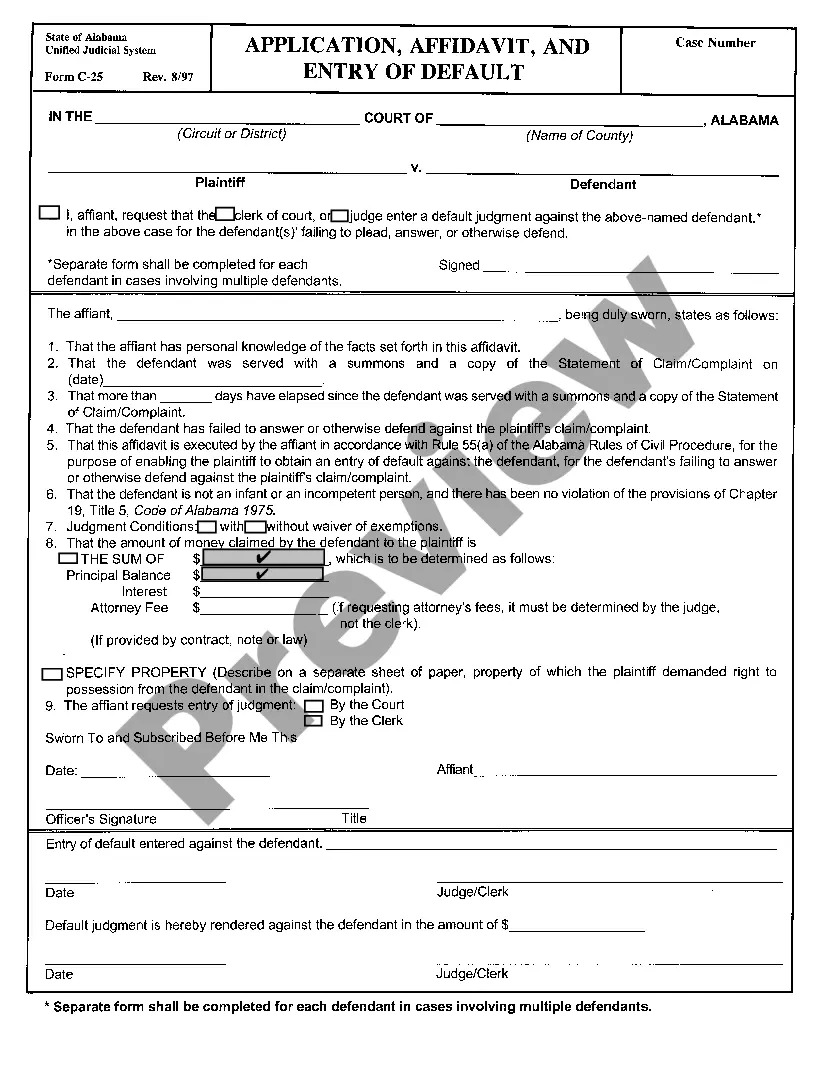

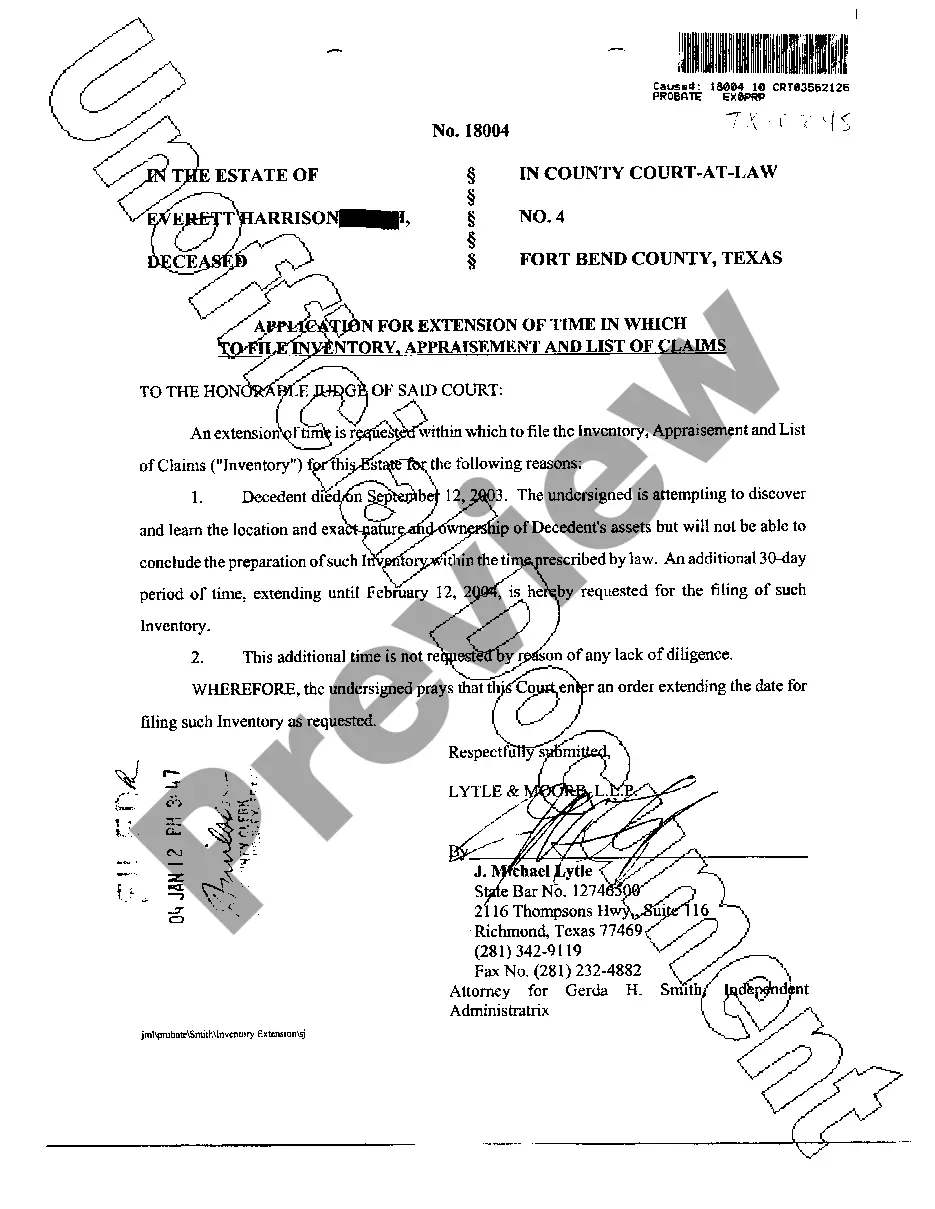

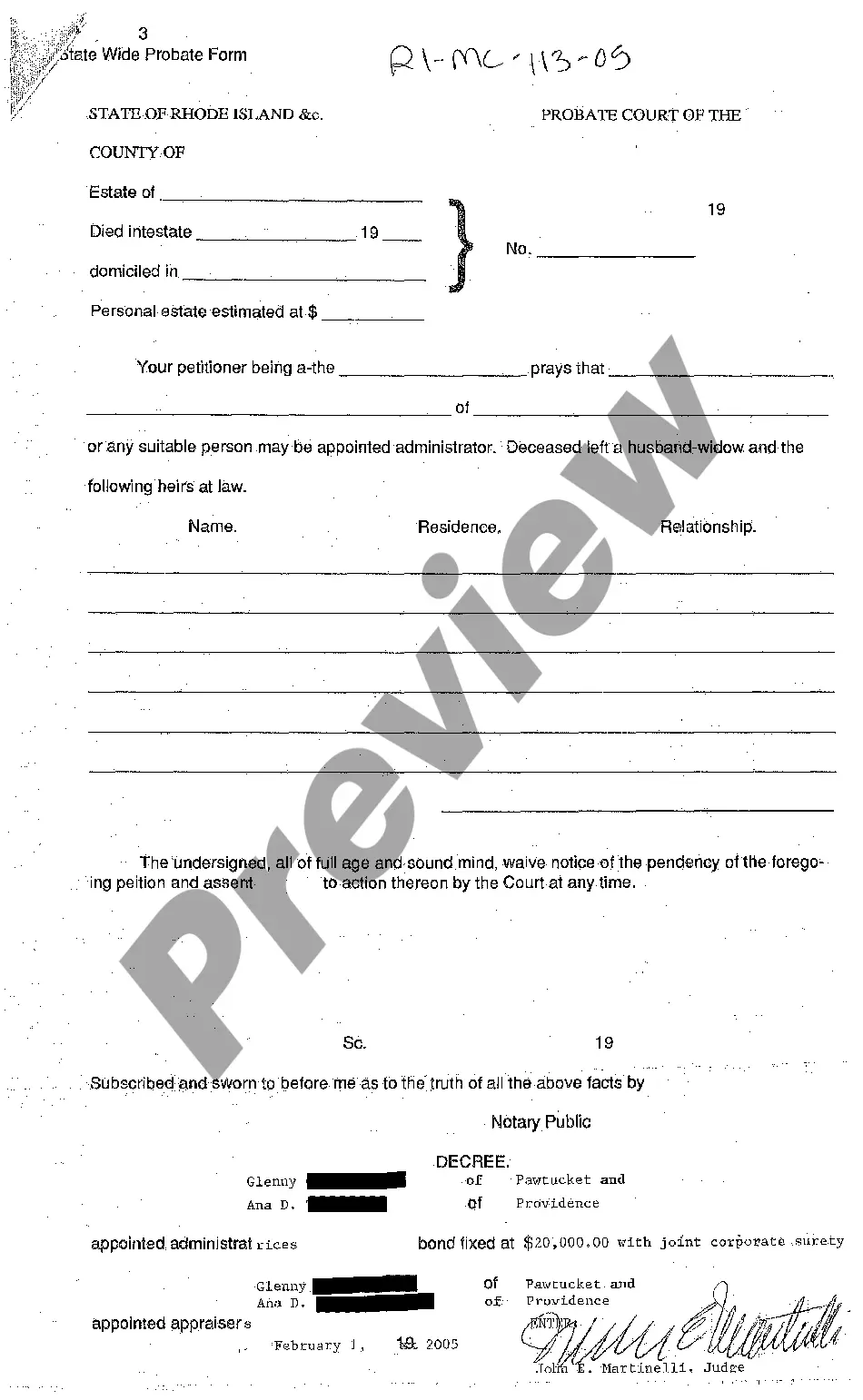

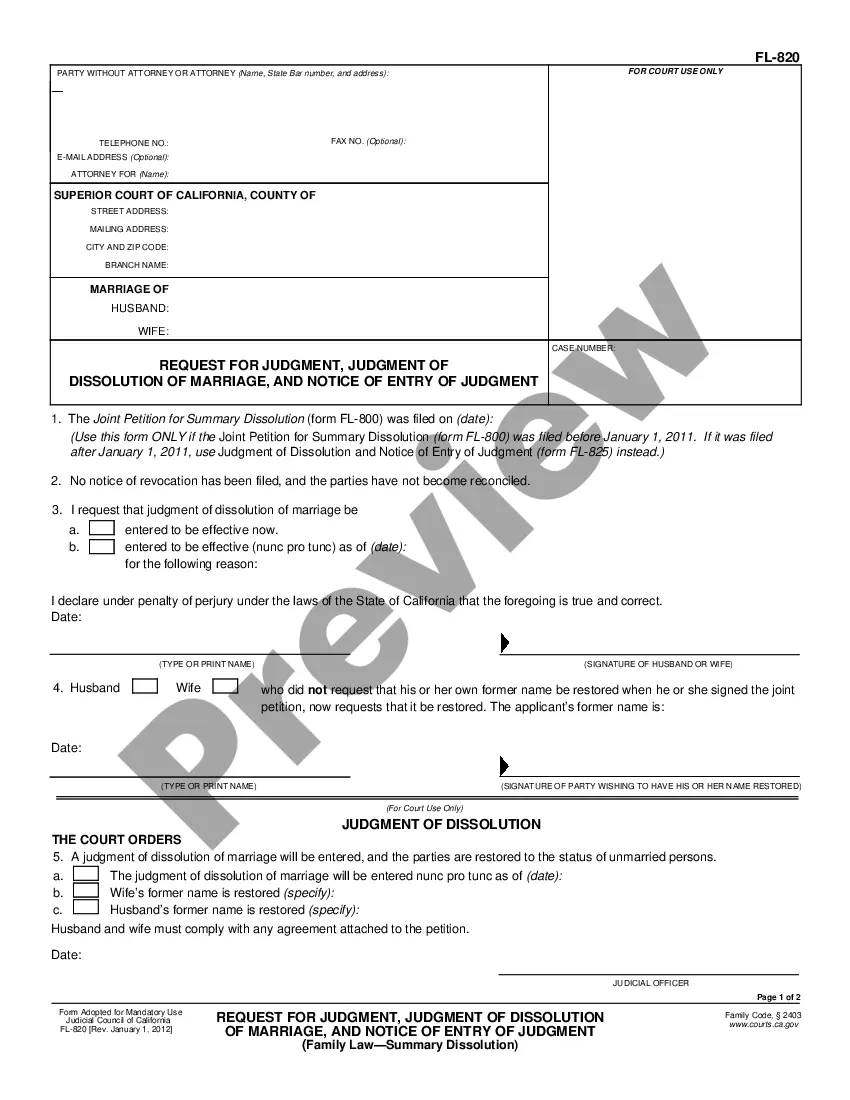

- Make sure to attentively look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN) in the format you prefer. If it’s your first time with our service, click Buy now to proceed.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the Delaware GARNISHMENT of WAGES AND/OR PROPERTY ATTACHMENT (FILL-IN) you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

The following are methods by which you may attempt to collect your judgment. Agreement by both parties.Collecting from the Defendant's Wages.Collecting from the Defendant's property.File a Lien on Real Property.

If the married couple or joint owners of a property do not have a tenancy by the entireties title, any lien can attach to the person's interest in the property. Whether it's judgment or confessed judgment, the lien will attach to the homeowner's interest, making the lienor a co-owner of the property.

Scire Facias on Judgments. § 5071. Issuance for execution on judgments and recognizances; parties. A writ of scire facias may be sued upon a judgment in a personal, or mixed action, as well as upon a judgment in a real action, as also upon all recognizances, to obtain execution of such judgment, or recognizances.

Judgments are presumed valid for 20 years Judgment Liens on Real Property expire 10 years after entry Judgment Liens can be: a) renewed prior to the 10 year lien expiration or b) revived after the expiration of 10 years unless the judgment debtor shows good cause as to why the lien should not be renewed.

Summary judgment is a judgment given on the basis of pleadings, affidavits, and exhibits presented for the record without any need for a trial. It is used when there is no dispute as to the facts of the case and one party is entitled to a judgment as a matter of law.

Judgments are presumed valid for 20 years Judgment Liens on Real Property expire 10 years after entry Judgment Liens can be: a) renewed prior to the 10 year lien expiration or b) revived after the expiration of 10 years unless the judgment debtor shows good cause as to why the lien should not be renewed.

A defendant against whom a default judgment has been entered may file a motion to vacate the default judgment. The motion should be on a Civil Form 11 (Request for Motion Hearing). If you are using a Form 11 that you obtained online, you should make four copies of the Form.