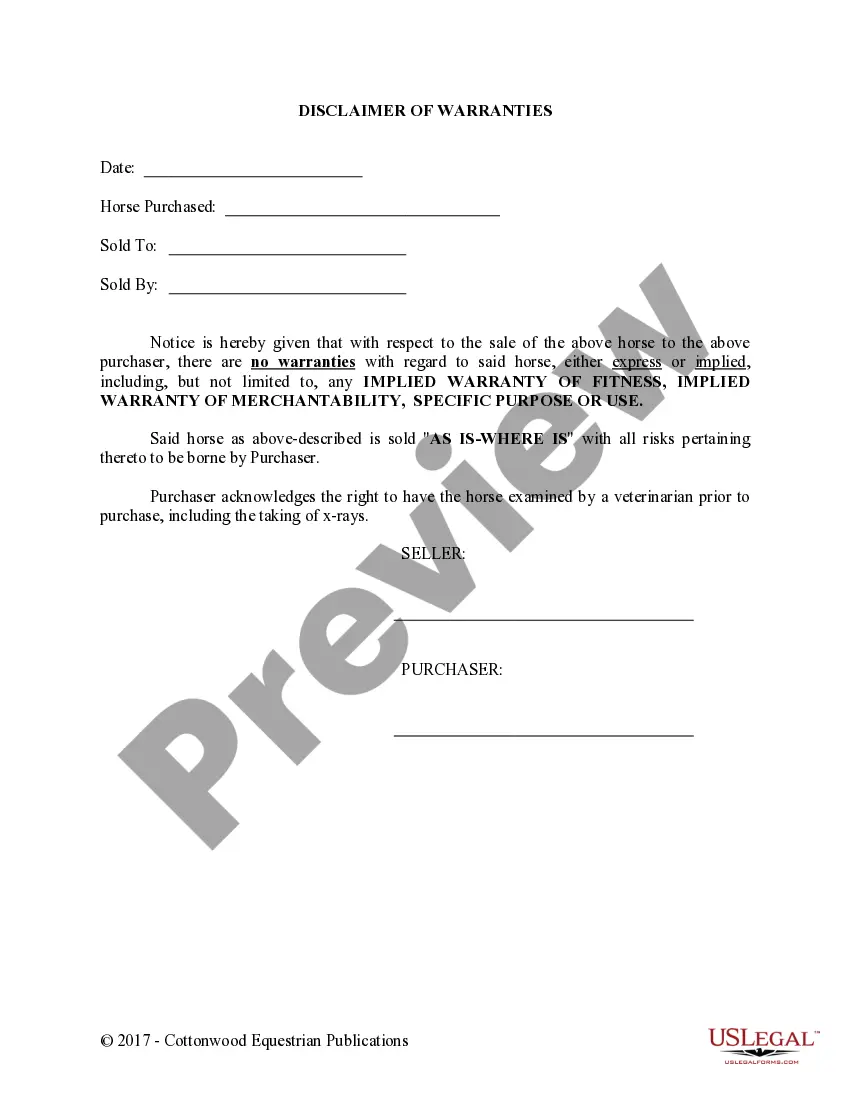

This Disclaimer of Warranties Horse Equine form is a discliamer of warranties, express and implied, in connection with the sale of a horse to be signed by the Seller and Purchaser.

Delaware Disclaimer of Warranties - Horse Equine Forms

Description

How to fill out Delaware Disclaimer Of Warranties - Horse Equine Forms?

The greater number of papers you need to make - the more anxious you become. You can get a huge number of Delaware Disclaimer of Warranties - Horse Equine Forms blanks on the web, but you don't know which ones to rely on. Eliminate the hassle to make finding samples more convenient employing US Legal Forms. Get expertly drafted forms that are written to go with the state requirements.

If you already have a US Legal Forms subscription, log in to the account, and you'll see the Download key on the Delaware Disclaimer of Warranties - Horse Equine Forms’s webpage.

If you’ve never applied our website before, complete the registration process with the following instructions:

- Check if the Delaware Disclaimer of Warranties - Horse Equine Forms is valid in your state.

- Re-check your choice by studying the description or by using the Preview mode if they are available for the chosen document.

- Click on Buy Now to get started on the registration procedure and select a rates plan that meets your requirements.

- Provide the requested information to create your profile and pay for the order with your PayPal or credit card.

- Pick a prefered document formatting and acquire your duplicate.

Access every file you obtain in the My Forms menu. Simply go there to prepare new version of your Delaware Disclaimer of Warranties - Horse Equine Forms. Even when having expertly drafted forms, it is nevertheless vital that you consider requesting the local lawyer to twice-check completed sample to make sure that your document is accurately completed. Do much more for less with US Legal Forms!

Form popularity

FAQ

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

Disclaimer may be revoked if procured by undue influence The disclaimed property passed to the disclaimant's nephew who was the contingent beneficiary of the will and the executor. The disclaimant then filed a document with the court purporting to revoke the disclaimer. The nephew objected and won summary judgment.

A "Disclaimer Will", sometimes referred to as a "Disclaimer Trust", is a flexible estate planning tool that can be implemented to benefit married couples whose combined estates are approaching or exceed the lifetime exemption amount for federal estate tax, resulting in substantial tax savings to the estate of the