Delaware Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Delaware Assignment Of Mortgage By Individual Mortgage Holder?

The greater the number of documents you require, the more anxious you become.

You can find numerous Delaware Assignment of Mortgage by Individual Mortgage Holder templates online, but you may be uncertain which ones to trust.

Eliminate the hassle of locating samples with US Legal Forms.

Select Buy Now to initiate the sign-up procedure and pick a pricing plan that aligns with your needs. Enter the necessary information to create your profile and pay for your order using PayPal or a credit card. Choose a preferred file format and download your template. Access all the samples you obtain from the My documents section. Simply navigate there to fill out a new version of the Delaware Assignment of Mortgage by Individual Mortgage Holder. Despite using professionally drafted forms, it is still essential to consider asking your local attorney to review the completed template to ensure your document is accurately filled out. Achieve more for less with US Legal Forms!

- Obtain expertly constructed documents that comply with state regulations.

- If you are already a subscriber to US Legal Forms, Log In to your account, and you will see the Download option on the Delaware Assignment of Mortgage by Individual Mortgage Holder’s page.

- If you are new to our service, complete the registration following these steps.

- Confirm that the Delaware Assignment of Mortgage by Individual Mortgage Holder is acceptable in your state.

- Review your selection by examining the description or utilizing the Preview feature, if available for your selected record.

Form popularity

FAQ

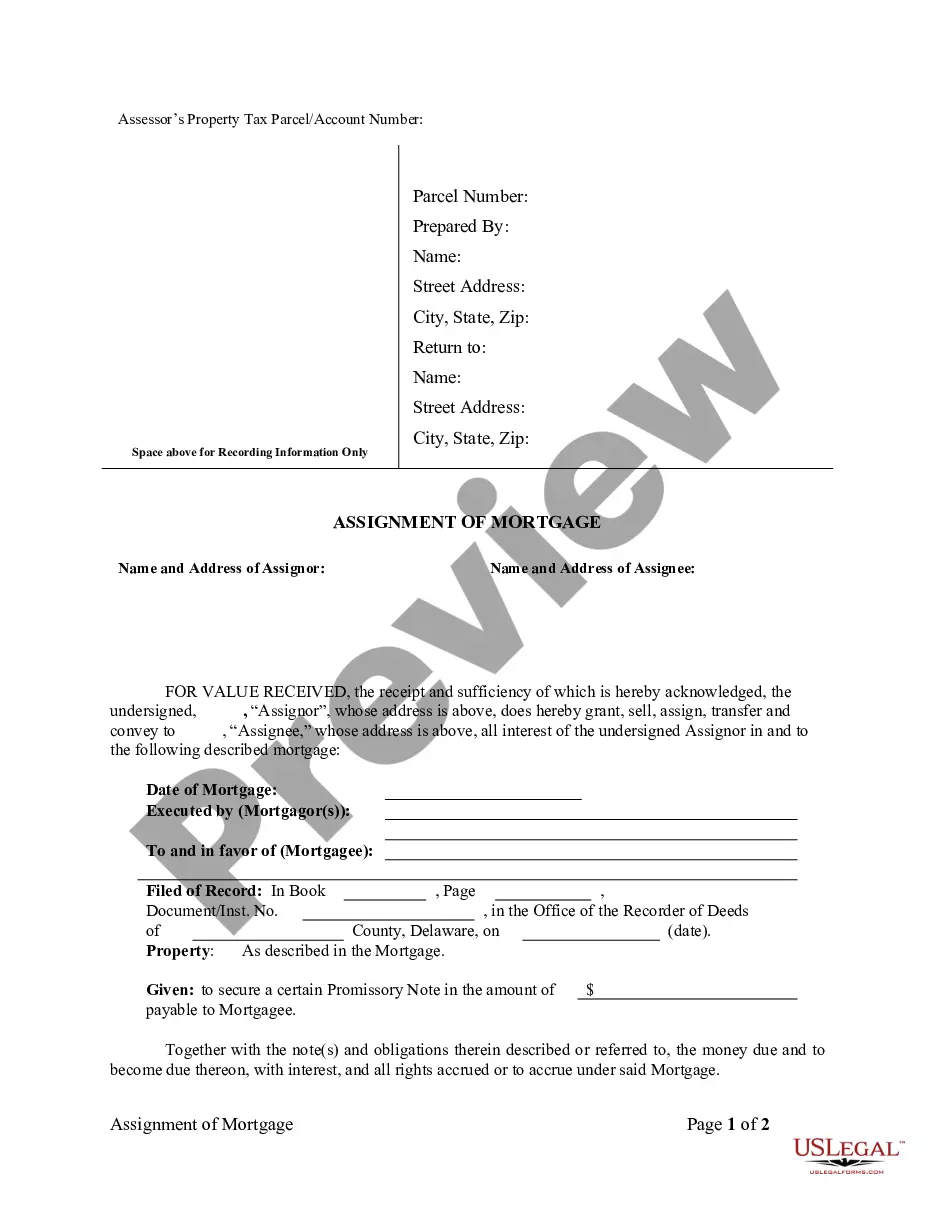

When a mortgage is assigned, the promissory note accompanies it. This assignment confirms that the holder of the note and the mortgage has transferred their rights to another party. Clarity in the assignment process is vital for the integrity of the Delaware Assignment of Mortgage by Individual Mortgage Holder, ensuring all parties are aware of their obligations.

Yes, you can assign a mortgage to someone else, but it typically requires consent from the lender and must be documented formally. This assignment allows the new individual to take over the mortgage obligations. It's vital to review the specific terms of your mortgage agreement first. To ensure you meet all legal requirements in a Delaware Assignment of Mortgage by Individual Mortgage Holder, consider leveraging the services provided by US Legal Forms.

To release an assignment of a mortgage, you typically need to file a formal release document with the appropriate county recorder's office. This document informs the public that the mortgage assignment is no longer in effect. Many individuals find it helpful to use a professional service, such as US Legal Forms, to ensure they complete the release properly. This process is critical for anyone involved in a Delaware Assignment of Mortgage by Individual Mortgage Holder.

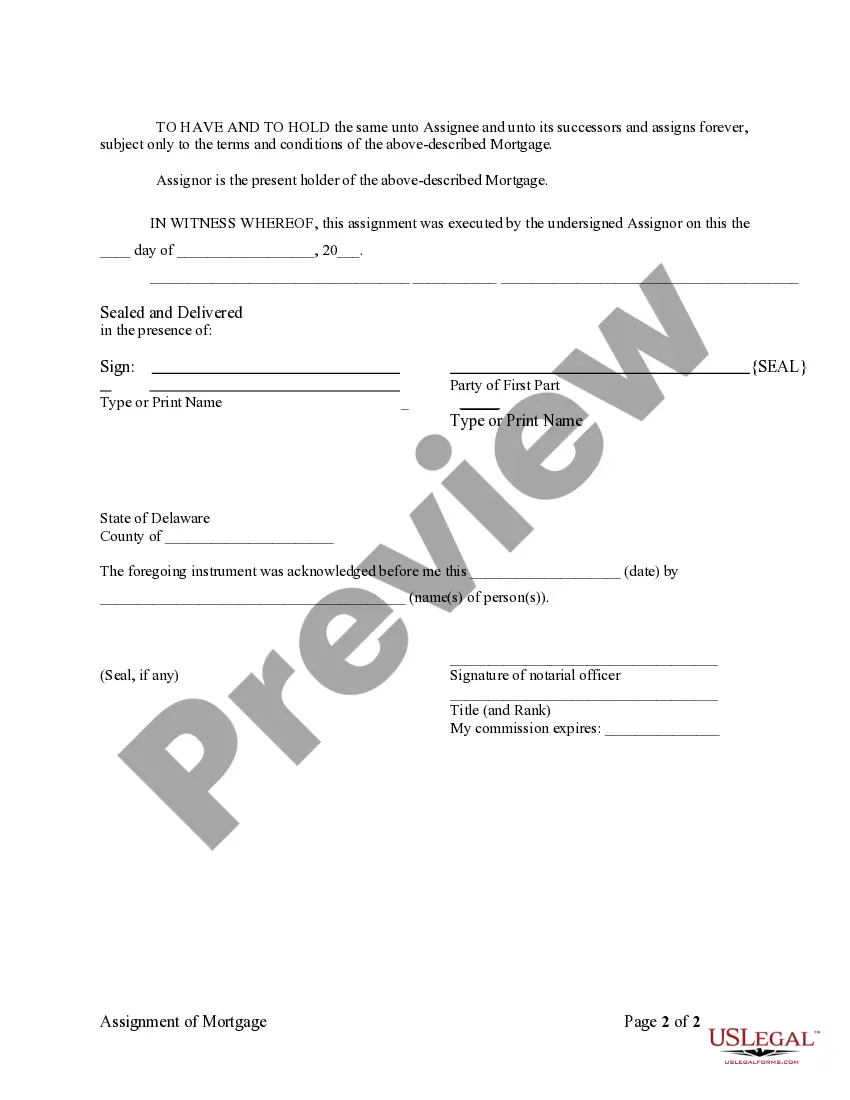

To complete an assignment of mortgage, you must first have the assignment document prepared, which includes details like the parties involved and mortgage information. After that, the mortgage holder needs to sign the document in front of a notary to validate it. Finally, you should file the assignment with the appropriate county office to ensure public record. For step-by-step assistance, check out US Legal Forms to streamline the process.

When a mortgage is assigned, the purchaser typically receives an assignment of the mortgage document and a note representing the debt. The assignment outlines the transfer of rights while the note serves as proof of the borrower's obligation to repay. Both documents are crucial for the purchaser's legal standing. For templates and detailed guidance, you may explore the offerings on US Legal Forms.

When a mortgage is assigned, the rights to collect payments on that mortgage are transferred from the original mortgage holder to the new holder. This means the new holder obtains the authority to enforce the terms of the mortgage. Additionally, the original holder no longer has any claim over the mortgage. If you want to understand this process better, you can rely on resources from US Legal Forms.

The assignment and transfer of lien are typically signed by the grantor, who is the mortgage holder assigning the lien. This signature confirms the grantor’s intention to transfer their interest. Following proper legal procedures during this process is vital to avoid complications. For assistance in drafting or signing these documents, consider utilizing US Legal Forms.

In the context of a Delaware Assignment of Mortgage by Individual Mortgage Holder, the grantor is the individual who currently holds the mortgage. This person transfers their interest and rights to the assignee. The grantor's signature is essential for legitimizing the assignment. If you are unsure about your role or the documentation needed, consider checking resources available on US Legal Forms.

In a Delaware Assignment of Mortgage by Individual Mortgage Holder, the individual mortgage holder typically signs the assignment. This action transfers the rights and interests in the mortgage to another party. It is crucial that the signature is done in accordance with state guidelines to ensure the assignment is valid. If you have any uncertainties, consider seeking legal assistance through platforms like US Legal Forms.

Yes, a mortgage can be assigned to another person through a process known as the Delaware Assignment of Mortgage by Individual Mortgage Holder. This legal transfer allows the new holder to assume the rights and responsibilities of the original mortgage holder. It's essential to ensure that the assignment is documented properly to avoid complications later. By utilizing platforms like US Legal Forms, you can simplify the process and access the necessary documents to facilitate this assignment smoothly.