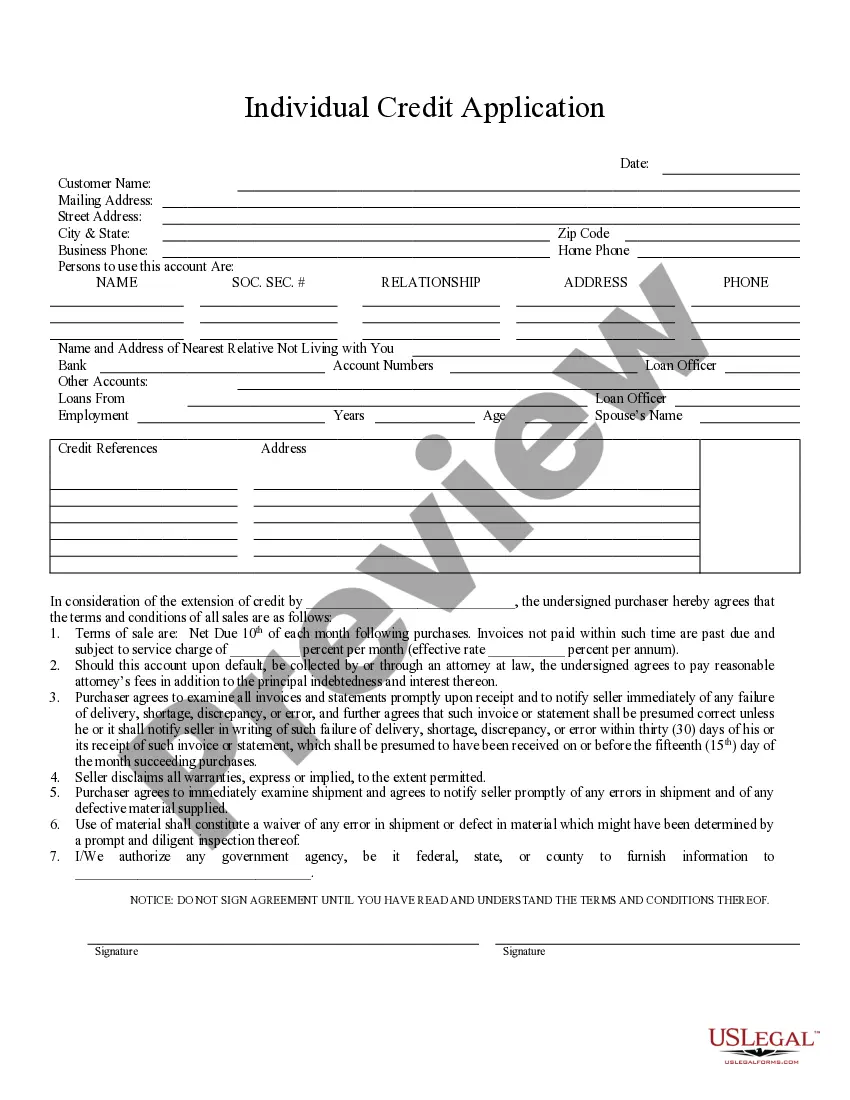

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Delaware Individual Credit Application

Description

How to fill out Delaware Individual Credit Application?

The more documents you need to produce - the more anxious you become.

You can find numerous Delaware Individual Credit Application templates online, but you're uncertain which ones to trust.

Eliminate the stress to make finding samples significantly easier with US Legal Forms. Obtain professionally crafted documents that are designed to meet state requirements.

Input the required details to set up your account and pay for the order using PayPal or credit card. Choose a convenient file format and get your copy. Locate each template you receive in the My documents section. Just go there to prepare a new copy of the Delaware Individual Credit Application. Even when utilizing professionally drafted templates, it’s still crucial to consider consulting a local attorney to verify that your document is accurately completed. Achieve more for less with US Legal Forms!

- If you already have a US Legal Forms subscription, Log In to your account, and you'll discover the Download button on the Delaware Individual Credit Application’s page.

- If you have never used our site before, complete the registration process by following these steps.

- Ensure the Delaware Individual Credit Application is acceptable in your state.

- Double-check your choice by reviewing the description or utilizing the Preview feature if available for the chosen document.

- Simply click Buy Now to initiate the registration process and select a payment plan that suits your needs.

Form popularity

FAQ

If you earn income in Delaware but reside in another state, you must file a Delaware nonresident tax return. This requirement ensures that you are appropriately taxed on the income generated within Delaware. Submitting a Delaware Individual Credit Application can help you claim any credits you qualify for, reducing your overall tax liability. It's crucial to be aware of these requirements to avoid potential penalties.

Various states, including Delaware, provide the Child Tax Credit based on federal guidelines. The availability of CTC can vary, so it's important to check for specific state benefits. Many families use the Delaware Individual Credit Application to ensure they receive their full eligible credits. Stay updated with local tax regulations to maximize your benefits.

In Delaware, certain groups may be exempt from paying property taxes. This includes senior citizens, veterans, and individuals with disabilities, among others. You can determine your eligibility by submitting a Delaware Individual Credit Application, which outlines applicable exemptions. It is always wise to consult local tax authorities to ensure you receive all possible benefits.

Yes, Delaware residents may qualify for the Child Tax Credit. The state has provisions that align with the federal guidelines for the CTC. To ensure you receive your maximum benefit, consider using the Delaware Individual Credit Application as part of your tax filing process. This application helps streamline your claims and makes it easier to access the tax support you deserve.

Yes, the $3600 Child Tax Credit was approved, offering significant financial support for families with children under 6. It's essential to understand how this credit can be applied. Completing the Delaware Individual Credit Application can ensure you benefit from available credits and deductions. Always confirm the specifics with updated government resources to avoid confusion.

The Child Tax Credit (CTC) is subject to annual changes. For the current year, families should check the latest updates regarding eligibility and amounts. If you qualify, the Delaware Individual Credit Application might help you maximize your benefits. Be sure to stay informed through reliable sources or consult with a tax professional.

To apply for the homestead exemption in Delaware, you must file a Delaware Individual Credit Application. This application can be submitted online or through your local government office. Make sure to provide necessary information about your property and residency status. By doing this, you can enjoy potential savings on your property taxes.

The $8,000 homebuyer tax credit was a federal incentive designed to assist first-time homebuyers in purchasing a home. While this specific program may no longer be available, Delaware offers various credits for new buyers. Utilizing the Delaware Individual Credit Application can help you identify current opportunities for financial support.

The first-time home buyer credit in Delaware helps new homeowners offset costs associated with buying a home. This credit is available through the Delaware Individual Credit Application and can significantly support your financial planning. Informed decisions can lead to greater savings on your journey to homeownership.

The first-time homebuyer tax credit in Delaware is a financial incentive designed to reduce the tax burden for those purchasing their first home. By completing the Delaware Individual Credit Application, eligible buyers can claim this credit. It is a valuable resource that can make homeownership more accessible.