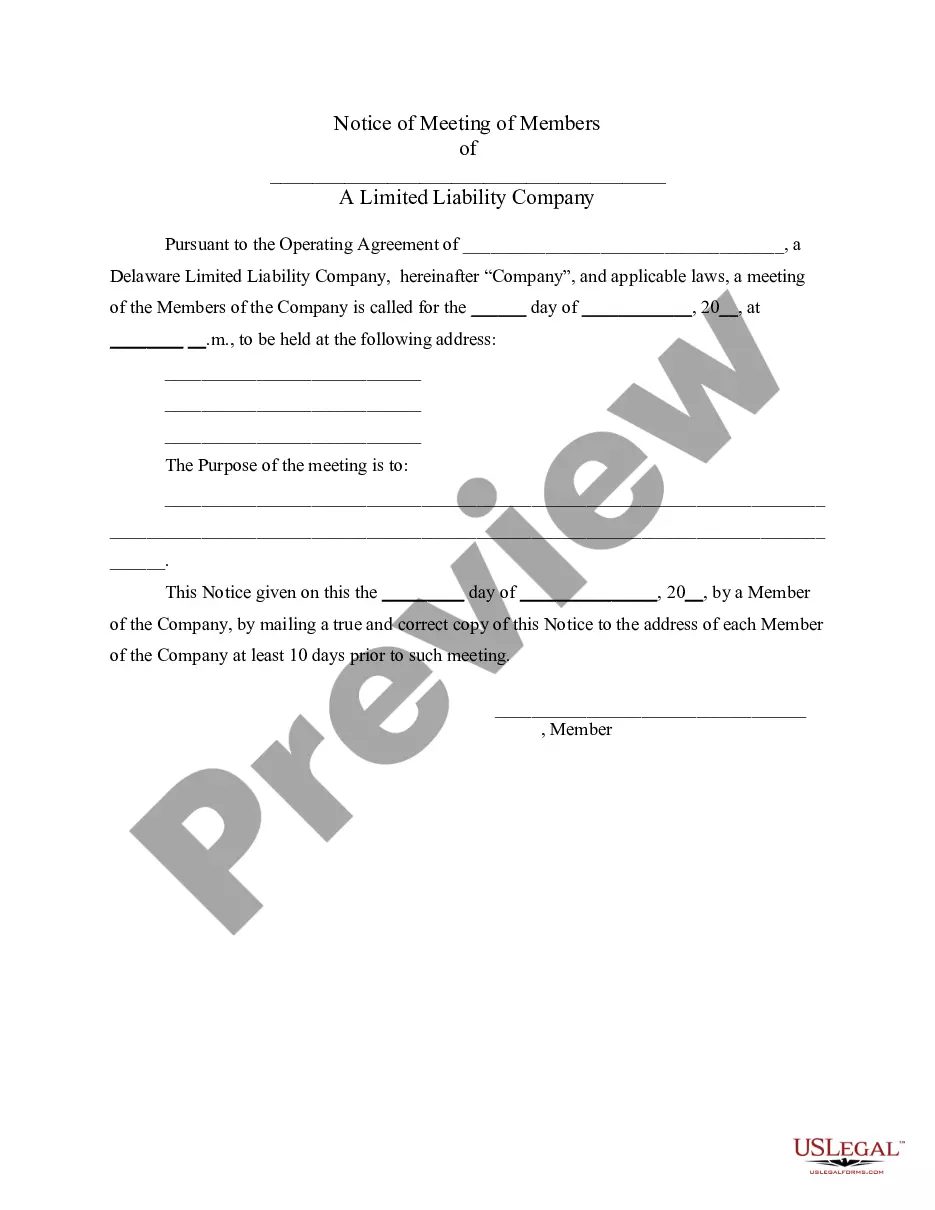

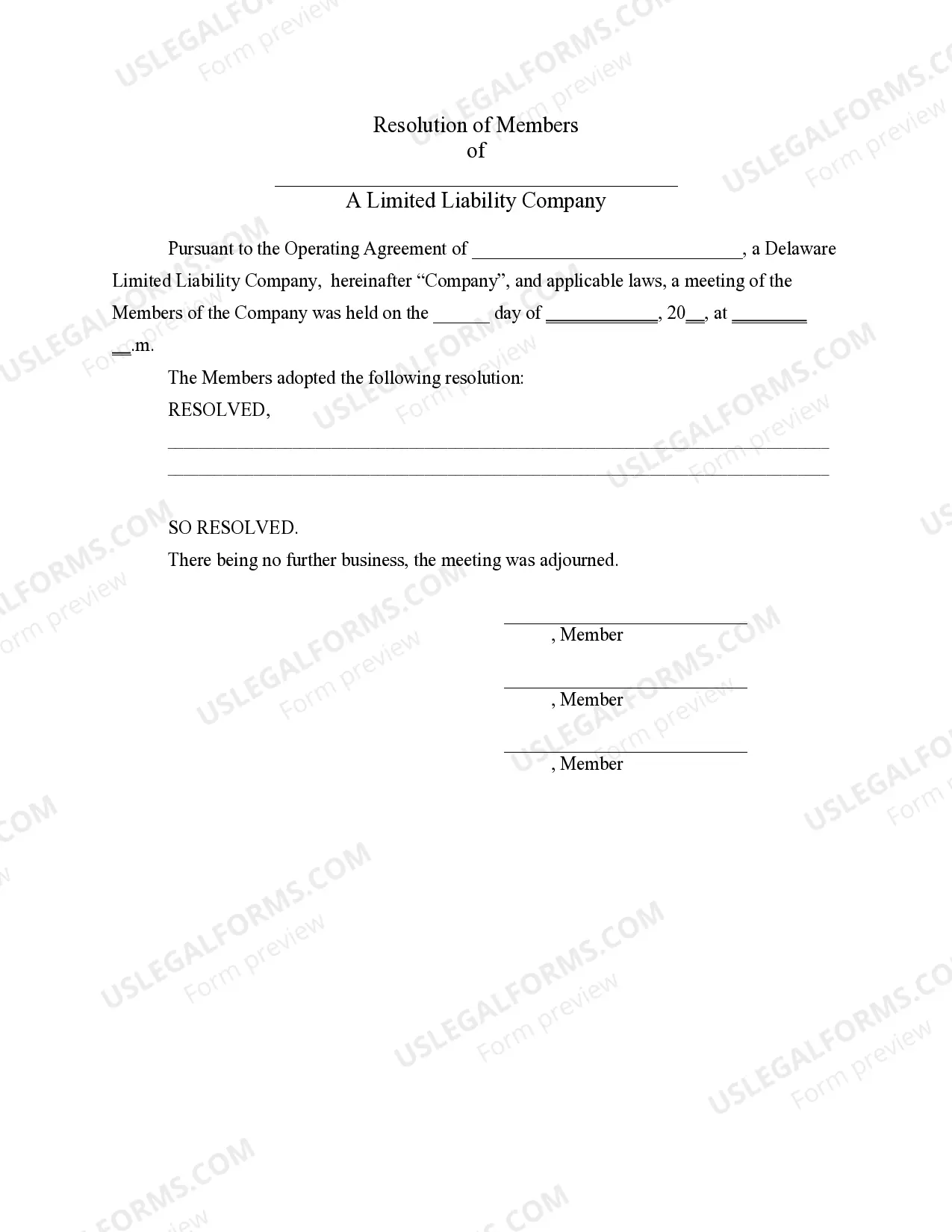

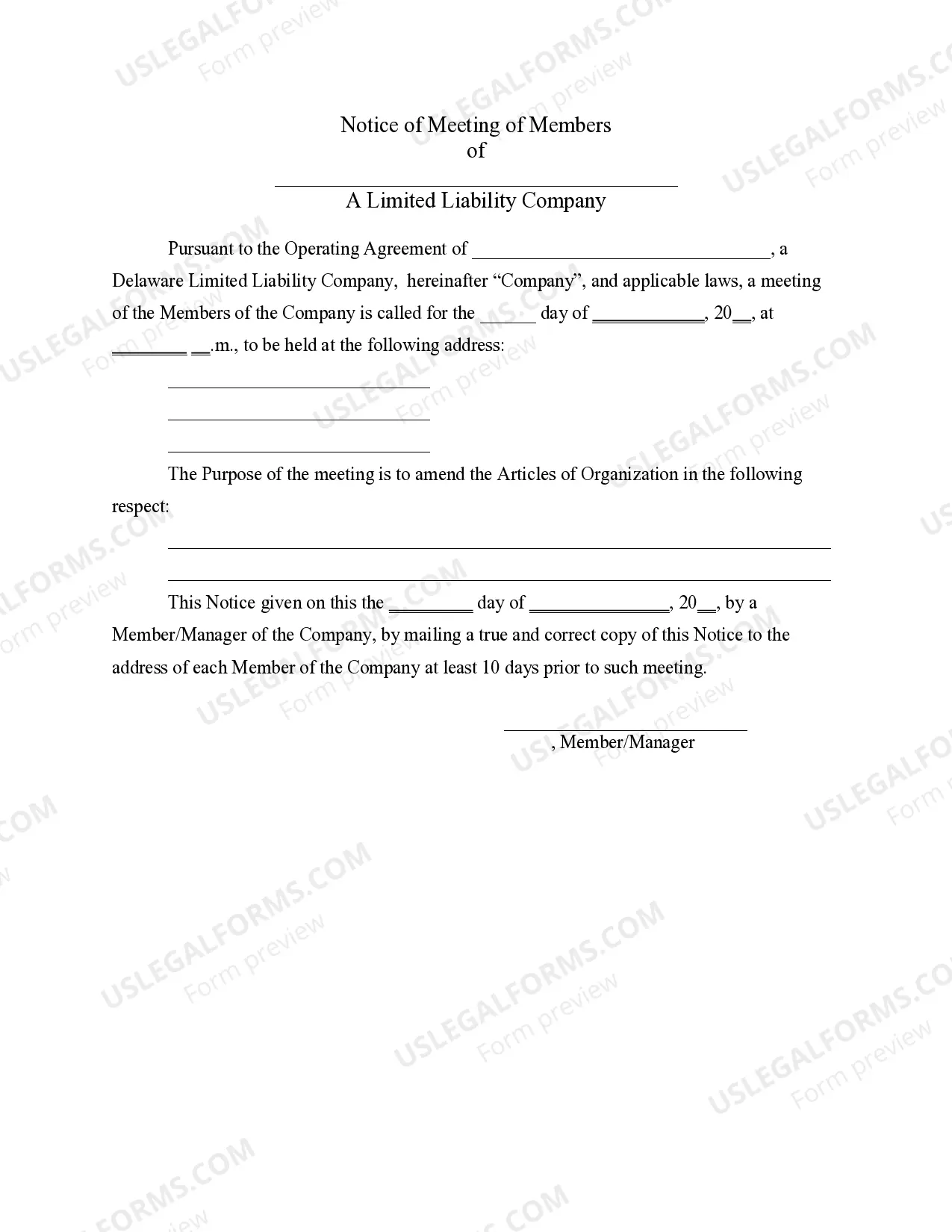

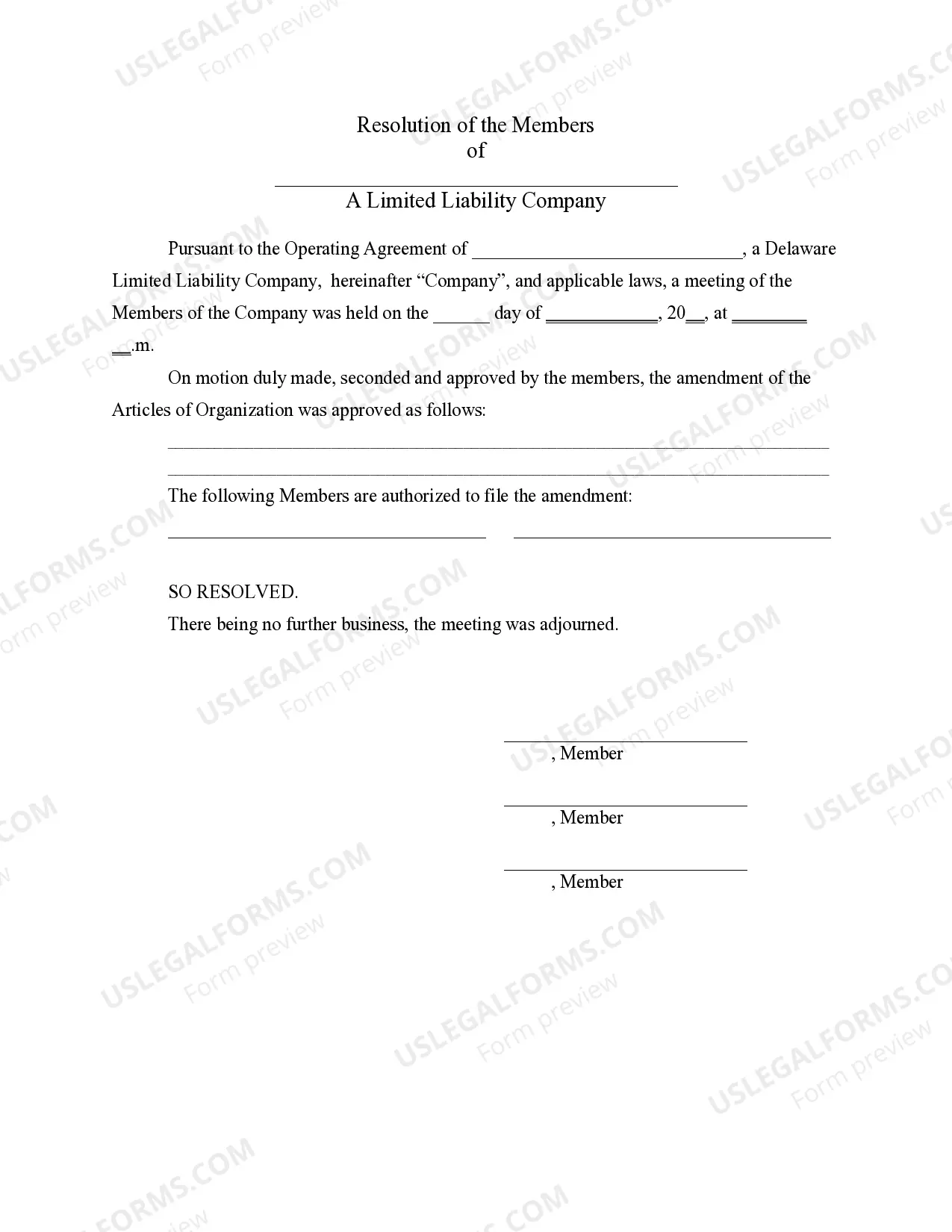

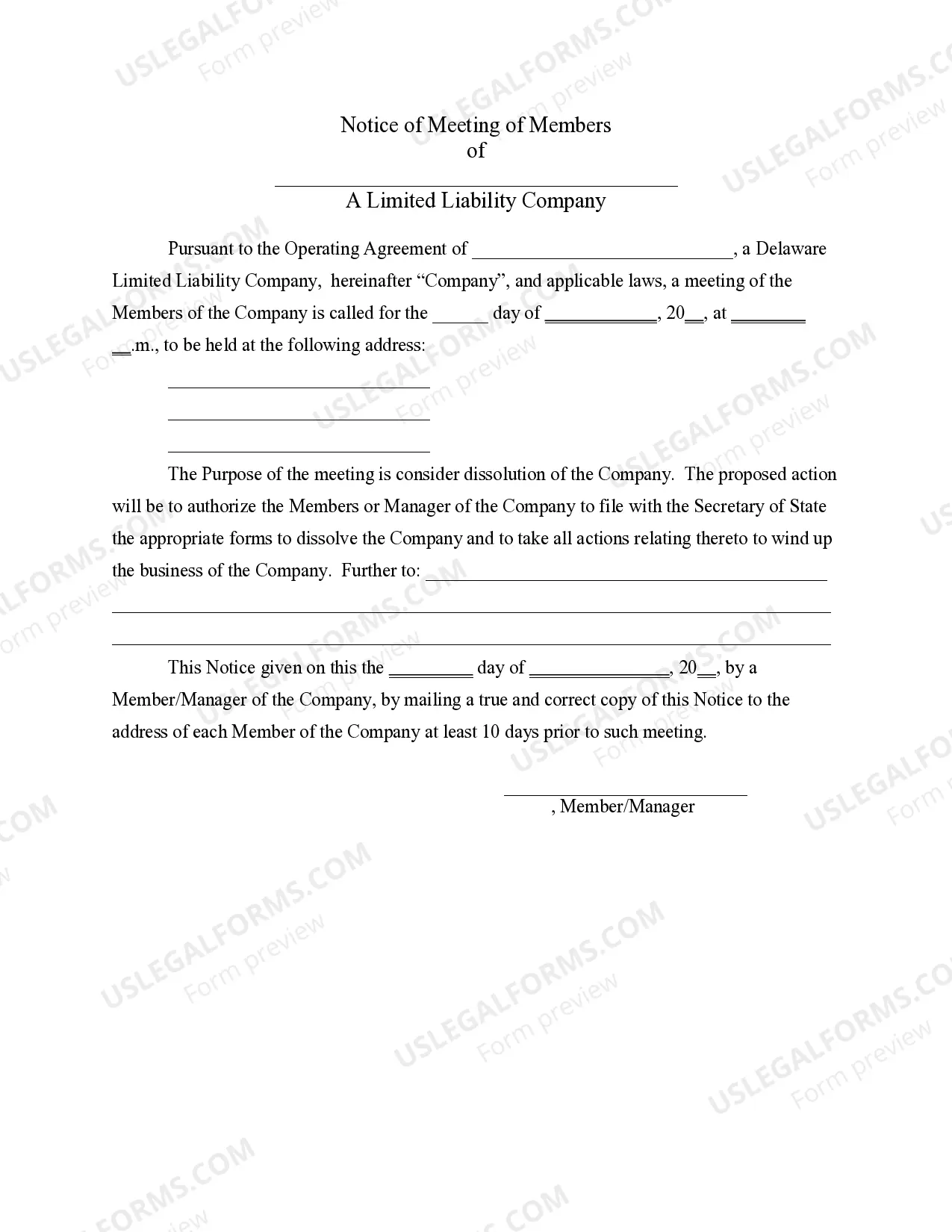

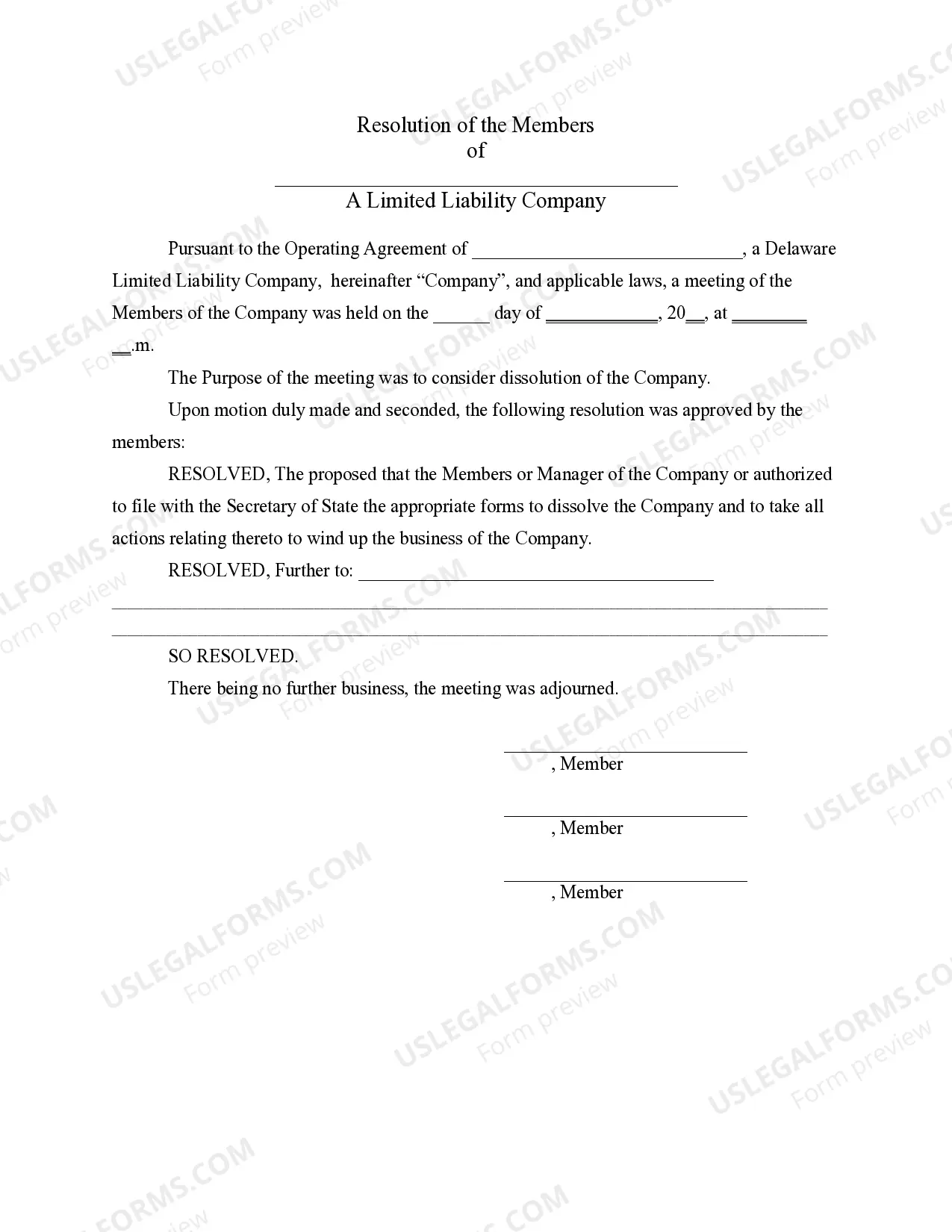

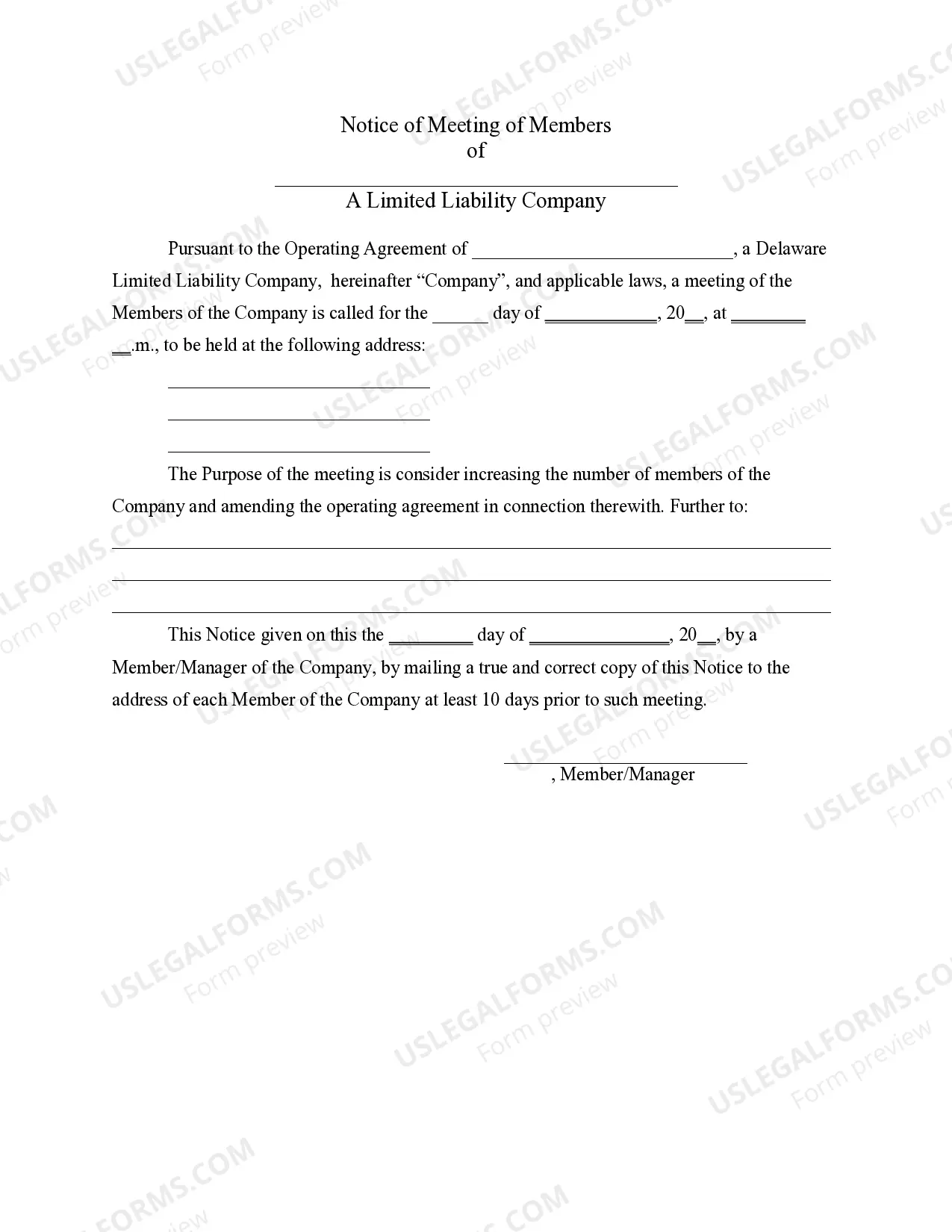

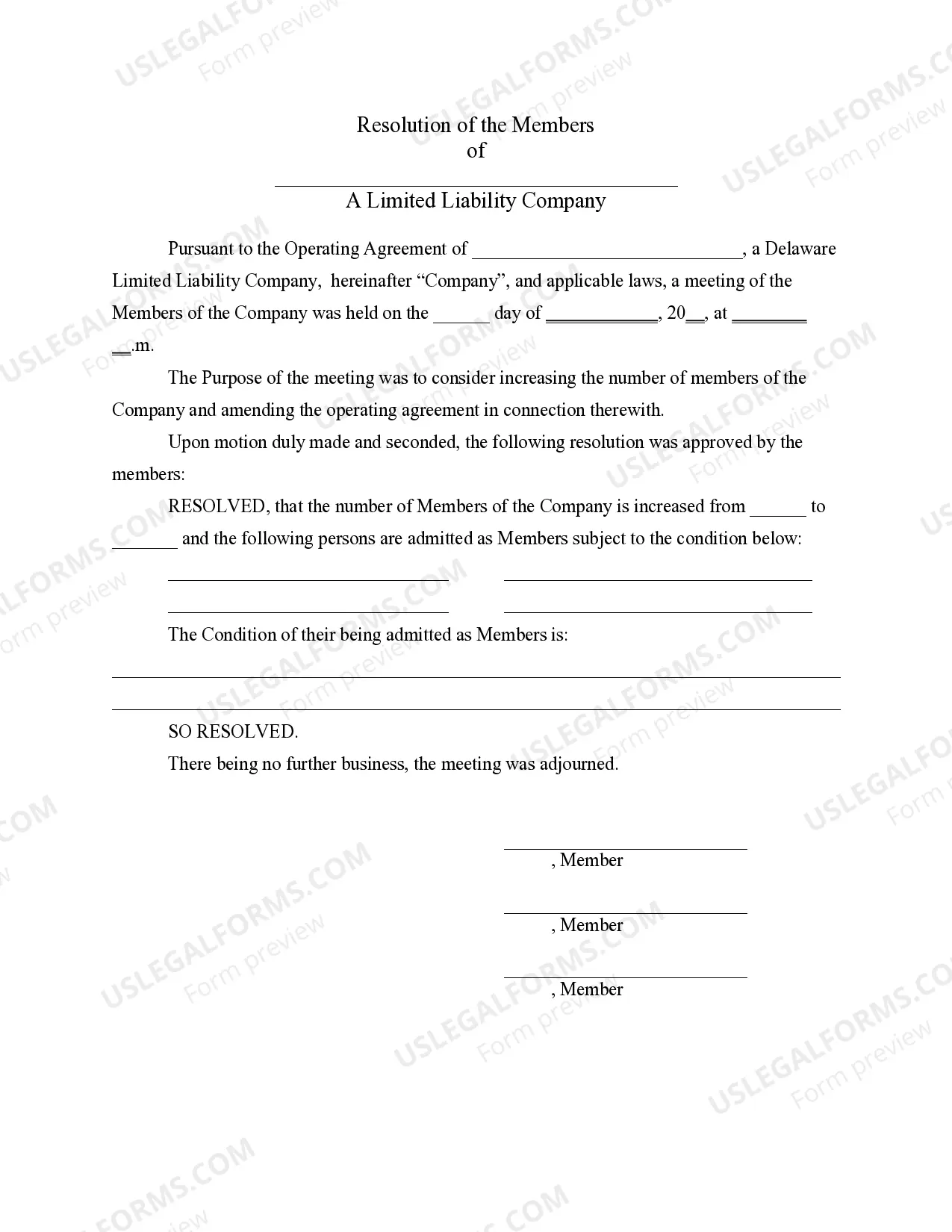

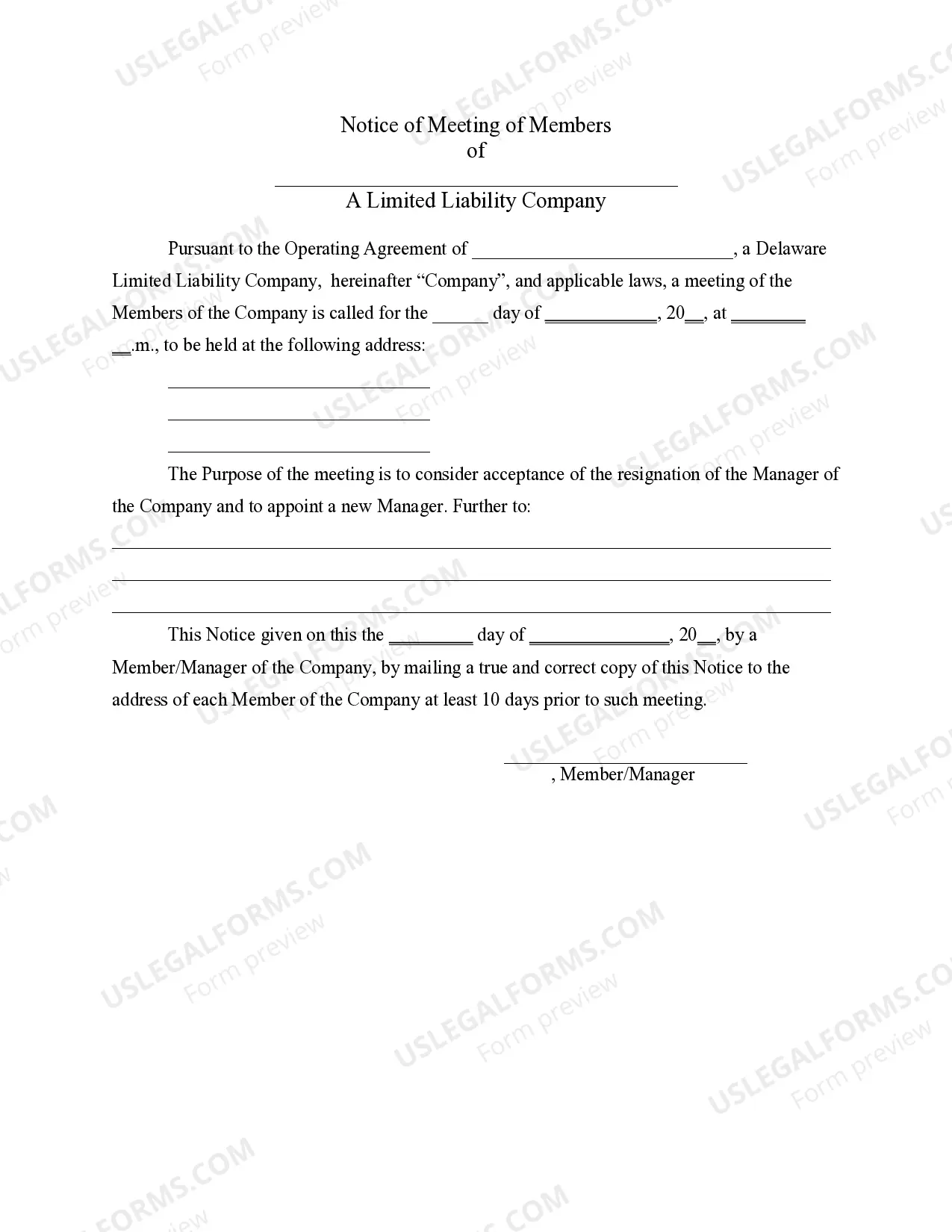

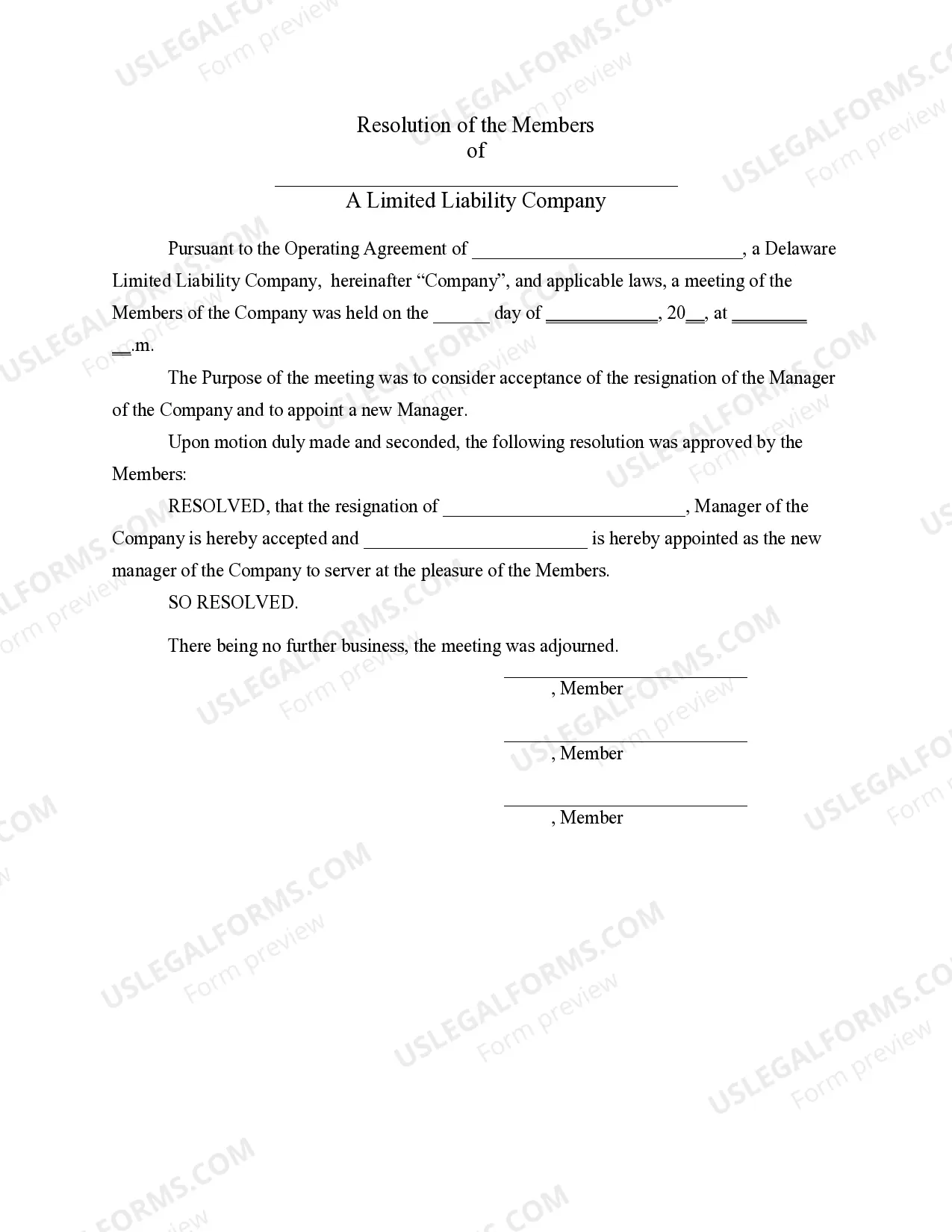

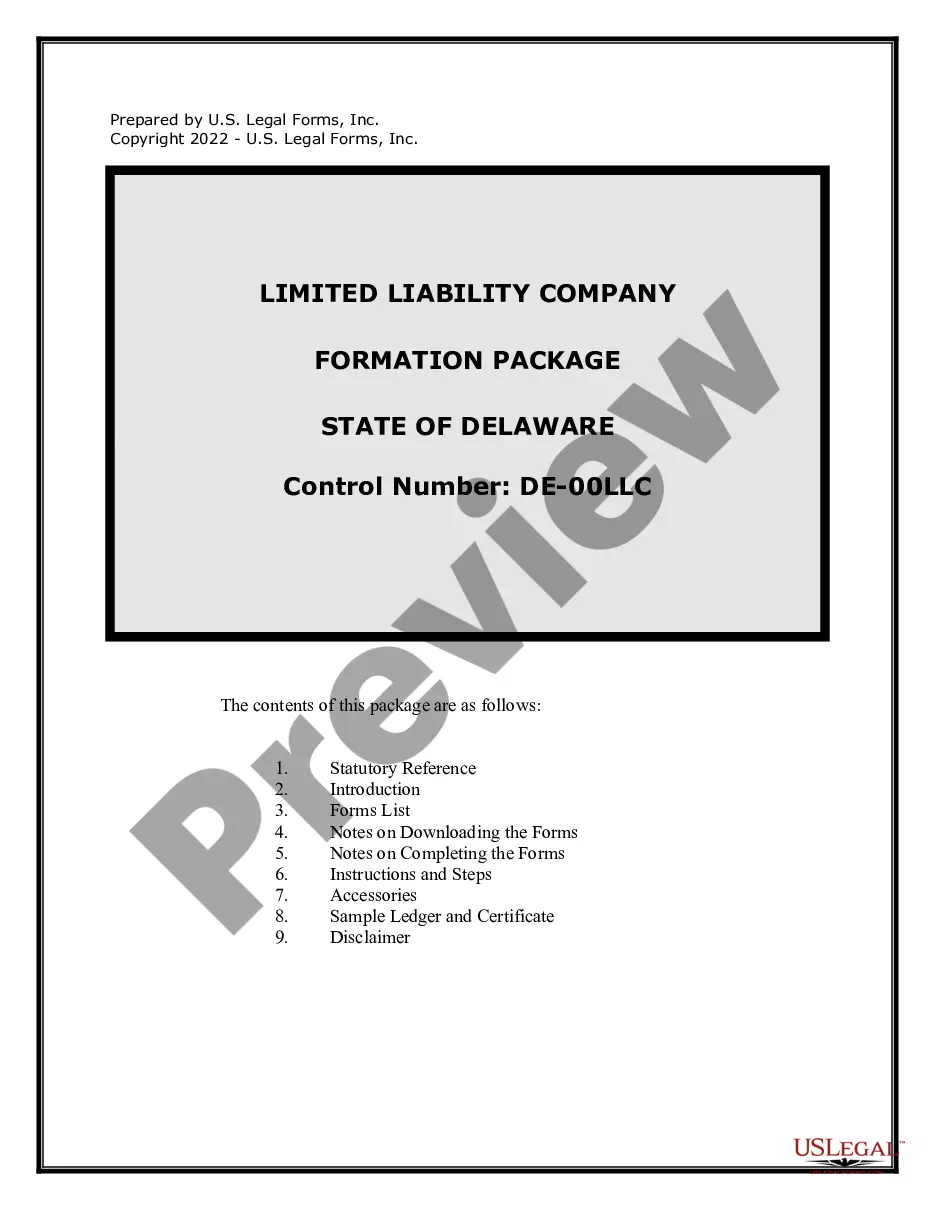

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

Delaware LLC Notices, Resolutions and other Operations Forms Package

Description Limited Liability Company

How to fill out Delaware LLC Notices, Resolutions And Other Operations Forms Package?

The greater number of papers you should prepare - the more stressed you are. You can find a huge number of Delaware LLC Notices, Resolutions and other Operations Forms Package blanks online, but you don't know which ones to rely on. Remove the headache and make finding exemplars easier using US Legal Forms. Get accurately drafted forms that are written to go with the state specifications.

If you have a US Legal Forms subscription, log in to the profile, and you'll find the Download option on the Delaware LLC Notices, Resolutions and other Operations Forms Package’s page.

If you have never used our service earlier, complete the registration procedure with the following instructions:

- Ensure the Delaware LLC Notices, Resolutions and other Operations Forms Package applies in your state.

- Double-check your option by reading through the description or by using the Preview mode if they are available for the selected document.

- Simply click Buy Now to begin the sign up process and choose a rates plan that suits your requirements.

- Insert the requested data to create your profile and pay for your order with your PayPal or bank card.

- Choose a hassle-free file structure and have your example.

Access each file you obtain in the My Forms menu. Simply go there to produce a fresh duplicate of the Delaware LLC Notices, Resolutions and other Operations Forms Package. Even when having professionally drafted forms, it’s nevertheless vital that you think about requesting the local lawyer to re-check filled out form to make sure that your document is accurately filled in. Do much more for less with US Legal Forms!

Delaware Llc Other Form popularity

Delaware Llc Operations Other Form Names

FAQ

Yes, a Delaware LLC must file articles of organization to officially form the business. This document establishes your company as a legal entity in Delaware. Once filed, you will have access to essential resources, including the Delaware LLC Notices, Resolutions and other Operations Forms Package, which helps manage your company efficiently.

Yes, a Delaware LLC must file articles of organization with the state to establish its legal existence. These articles outline essential information about your LLC and are critical for compliance. Using our Delaware LLC Notices, Resolutions and other Operations Forms Package simplifies the process and ensures you have all necessary documents prepared correctly.

Yes, even though Delaware does not impose state income tax on LLCs, you still need to file a tax return for your LLC. Additionally, the annual franchise tax is a requirement that keeps your business compliant. You can find the necessary forms and guidance in our Delaware LLC Notices, Resolutions and other Operations Forms Package to help streamline this process.

To dissolve a Delaware corporation, you need to adopt a resolution that confirms the decision to dissolve. This resolution should then be filed with the state, following the guidelines outlined in your Delaware LLC Notices, Resolutions and other Operations Forms Package. Ensuring all paperwork is correctly submitted helps prevent future legal complications.

Yes, LLCs in Delaware must file an annual report to remain compliant. This report helps the state keep track of your business activities. The process is simple and can be managed through our Delaware LLC Notices, Resolutions and other Operations Forms Package. Staying on top of this requirement is crucial for your LLC's good standing.

Section 18-607 of the Delaware Limited Liability Company Act pertains to the powers and limitations of Delaware LLCs regarding distributions and member rights. Understanding this section helps ensure compliance with state laws and protects member interests. Utilizing the Delaware LLC Notices, Resolutions, and other Operations Forms Package can help you navigate this aspect efficiently and confidently.

While not legally required, having an operating agreement is crucial for a Delaware LLC. It helps prevent misunderstandings among members and outlines key operational procedures. To create an effective agreement, consider using the Delaware LLC Notices, Resolutions, and other Operations Forms Package for comprehensive templates and guidance tailored to your needs.

Yes, you can draft your own operating agreement for your LLC. However, it's essential to ensure that it meets all legal requirements and accurately reflects your business's needs. Using tools and resources from the Delaware LLC Notices, Resolutions, and other Operations Forms Package can guide you through the process, ensuring you cover all critical aspects.

The Delaware LLC tax loophole refers to the lack of an income tax for LLCs formed in Delaware that do not conduct business in the state. Consequently, businesses may benefit financially by incorporating there and utilizing the state's favorable tax structure. By understanding this loophole, you can strategically plan your business operations while ensuring compliance through resources like the Delaware LLC Notices, Resolutions, and other Operations Forms Package.

While an LLC can function without an operating agreement, it is not advisable. Operating without one may lead to disputes among members regarding management and profit distribution. Utilizing the Delaware LLC Notices, Resolutions, and other Operations Forms Package allows you to establish clear guidelines and minimize potential conflict.