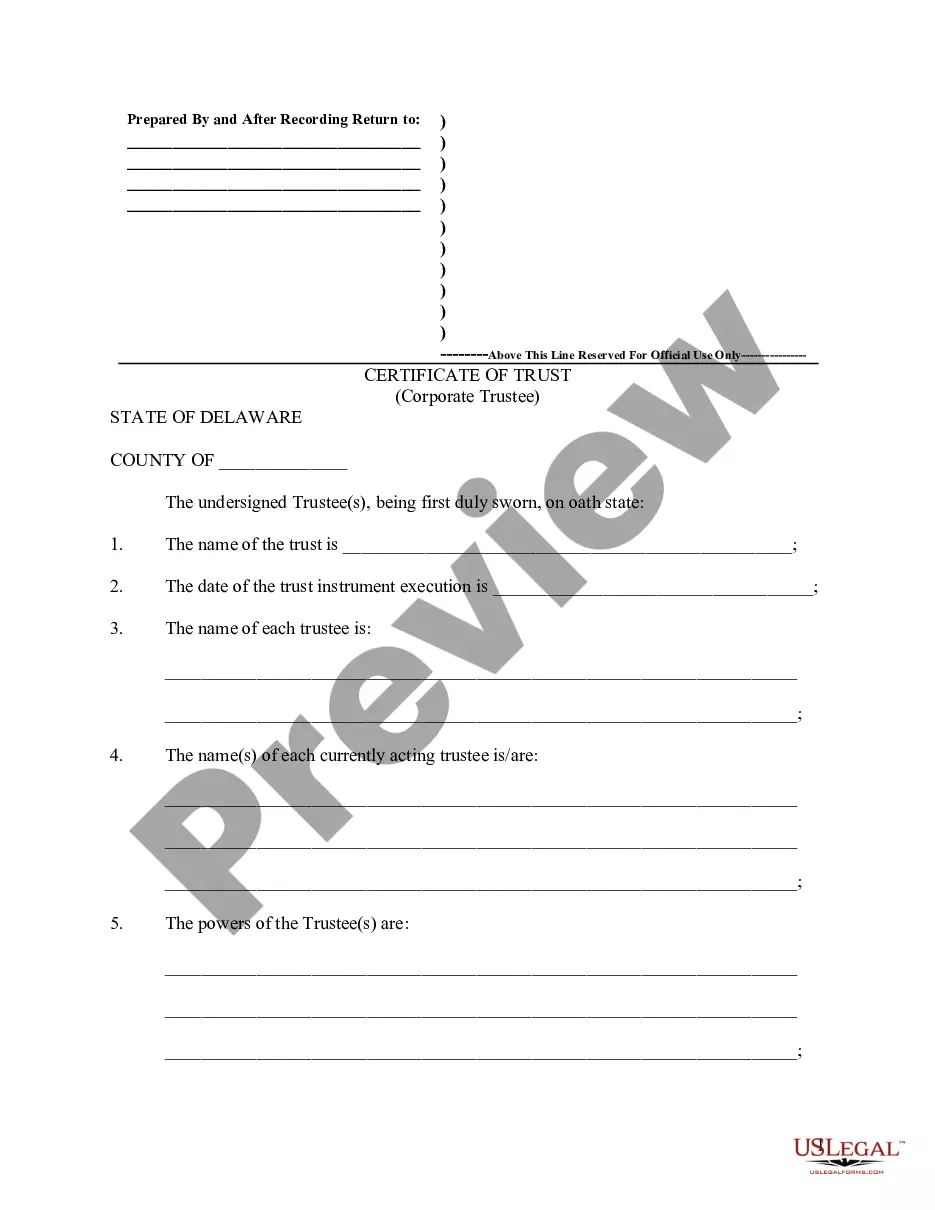

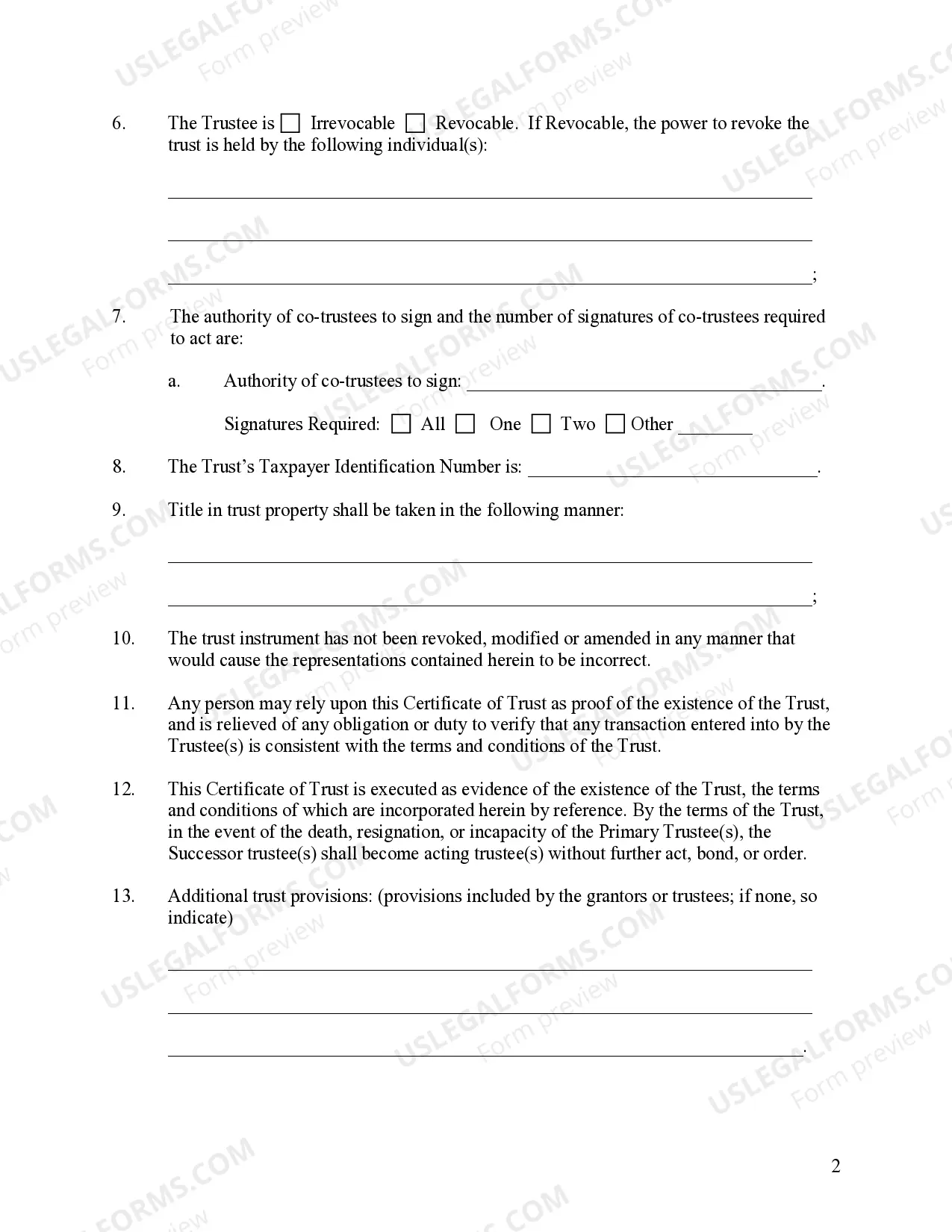

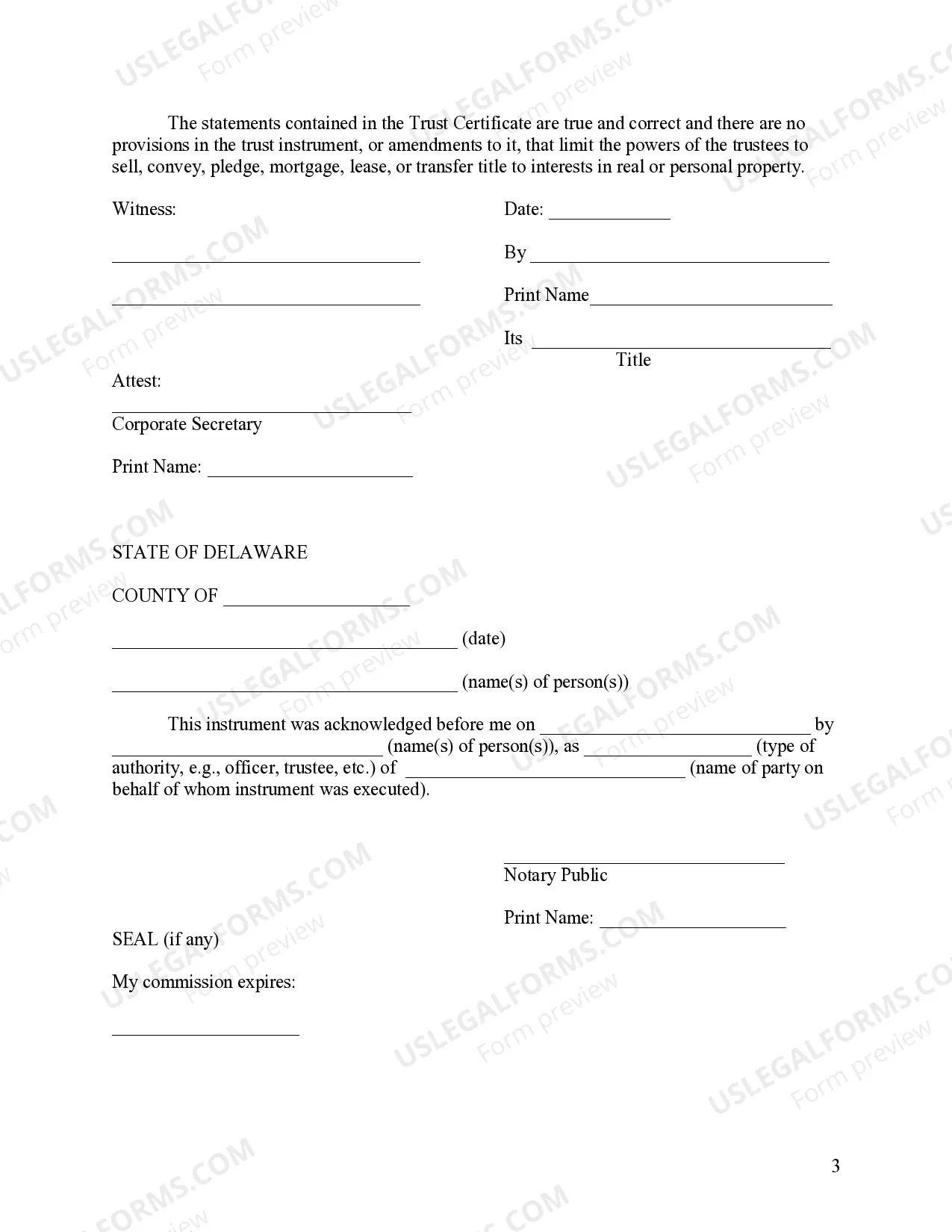

This is a certificate of trust for filing evidence of a trust without having to record the entire trust document. The corporate trustee may present a certification of trust to

any person in lieu of providing a copy of the trust instrument to establish

the existence or terms of the trust. A certification of trust may be executed

by the trustee voluntarily or at the request of the person with whom the

trustee is dealing.

Delaware Certificate of Trust by Corporation

Description

How to fill out Delaware Certificate Of Trust By Corporation?

The more paperwork you should create - the more anxious you become. You can get a huge number of Delaware Certificate of Trust by Corporation blanks on the internet, nevertheless, you don't know which ones to trust. Get rid of the hassle to make finding samples more straightforward with US Legal Forms. Get professionally drafted forms that are written to go with the state specifications.

If you already have a US Legal Forms subscribing, log in to the profile, and you'll see the Download option on the Delaware Certificate of Trust by Corporation’s webpage.

If you have never used our website earlier, complete the registration procedure using these directions:

- Check if the Delaware Certificate of Trust by Corporation is valid in the state you live.

- Double-check your selection by reading through the description or by using the Preview function if they’re available for the chosen document.

- Click on Buy Now to begin the registration process and select a rates plan that suits your preferences.

- Insert the requested details to make your account and pay for the order with the PayPal or credit card.

- Pick a practical file structure and acquire your duplicate.

Find each document you obtain in the My Forms menu. Simply go there to produce a new version of your Delaware Certificate of Trust by Corporation. Even when preparing expertly drafted templates, it is still essential that you consider requesting the local lawyer to double-check filled out form to make certain that your document is correctly filled in. Do much more for less with US Legal Forms!

Form popularity

FAQ

What is a Delaware statutory trust and why use it? A DST is an ownership model through a separate legal entity that allows co-investment among sponsors and accredited investors to purchase beneficial interest into either a single asset or across a portfolio of properties.

Unless otherwise provided in the governing instrument of a statutory trust, such delegation by a trustee of a statutory trust shall be irrevocable if it states that it is irrevocable.

Depending on the context, a Delaware statutory trust can be outfitted as a corporation or partnership for tax purposes, or designed not to be a business entity at all, where instead the beneficial owners' interests are treated as grantor trusts.

The Delaware Statutory Trust (DST), however, is a statutory entity, created by filing a Certificate of Trust with the Delaware Division of Corporations, and governed by Chapter 38, Part V, Title 12 of the annotated Delaware Code (See 12 ? 3801 through 3862).

A Delaware statutory trust is an independent legal entity created under the provisions of the Delaware Statutory Trust Act, 12 Del.

Purchasing a Security From a DST Sponsor. The DST Sponsor, or affiliate of the Sponsor, is the Trustee of the DST. 1031 Exchange. Investors can buy into a DST through a 1031 exchange. DST Secondary Marketplace.

A DST is easy to form and maintain. The DST Act does require that the trust have a Delaware resident trustee, but business decisions and management of the trust may be (and in the context of a structured finance transaction, typically are) delegated to out of state co-trustees and managers.

A Delaware statutory trust (DST) is a legally recognized trust that is set up for the purpose of business, but not necessarily in the U.S. state of Delaware. It may also be referred to as an Unincorporated Business Trust or UBO.