Delaware Chapter 11 Debtor(s) Certification of Plan Completion and Request for Discharge

Description

How to fill out Delaware Chapter 11 Debtor(s) Certification Of Plan Completion And Request For Discharge?

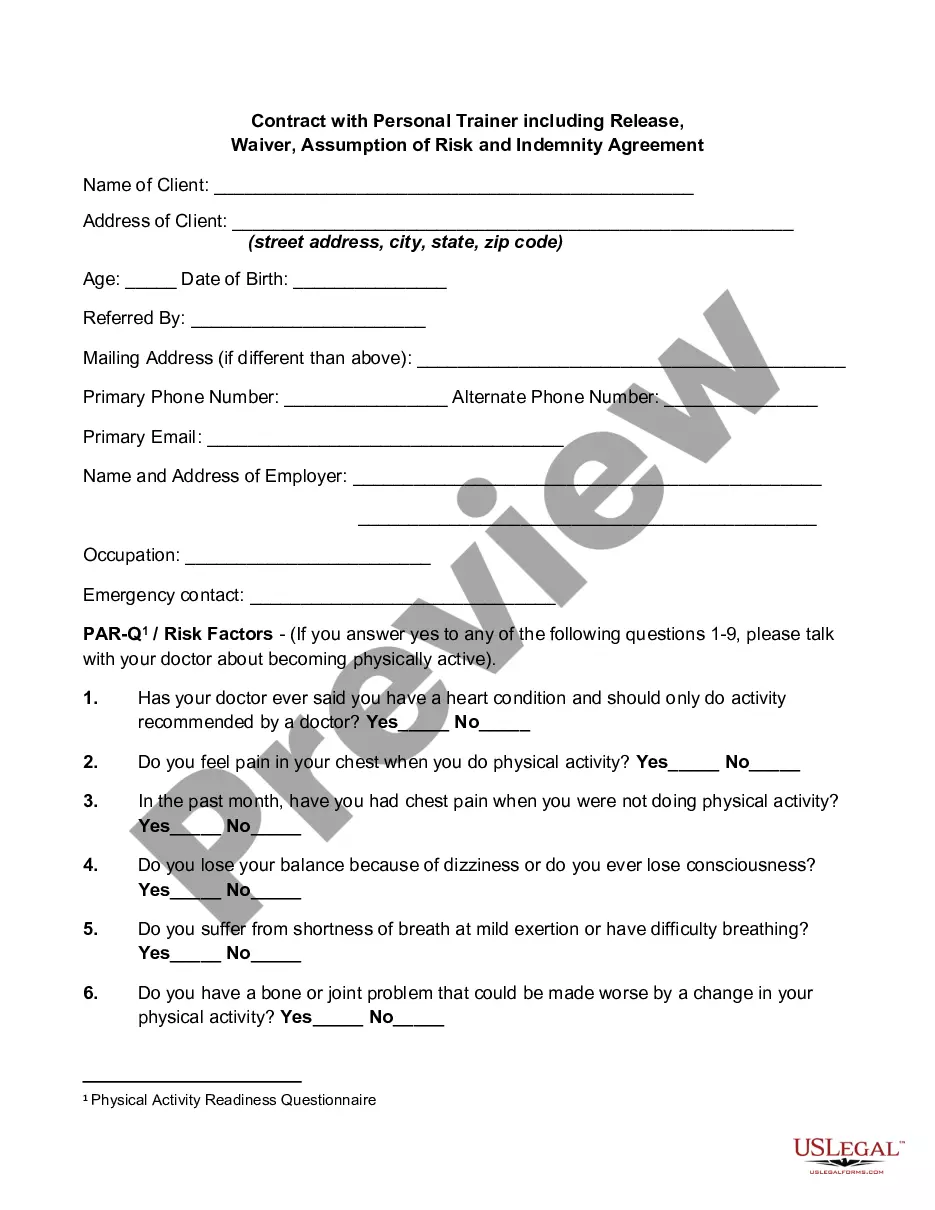

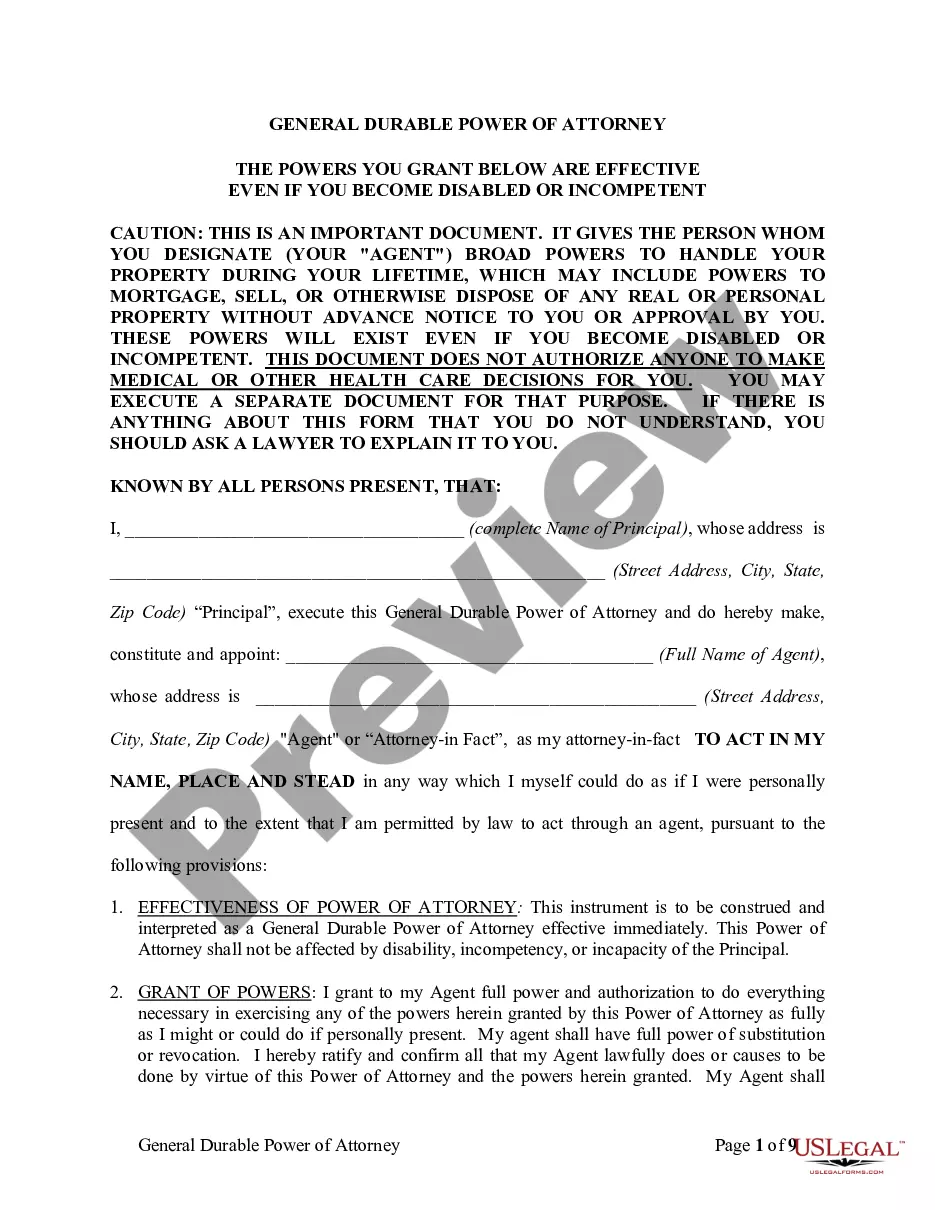

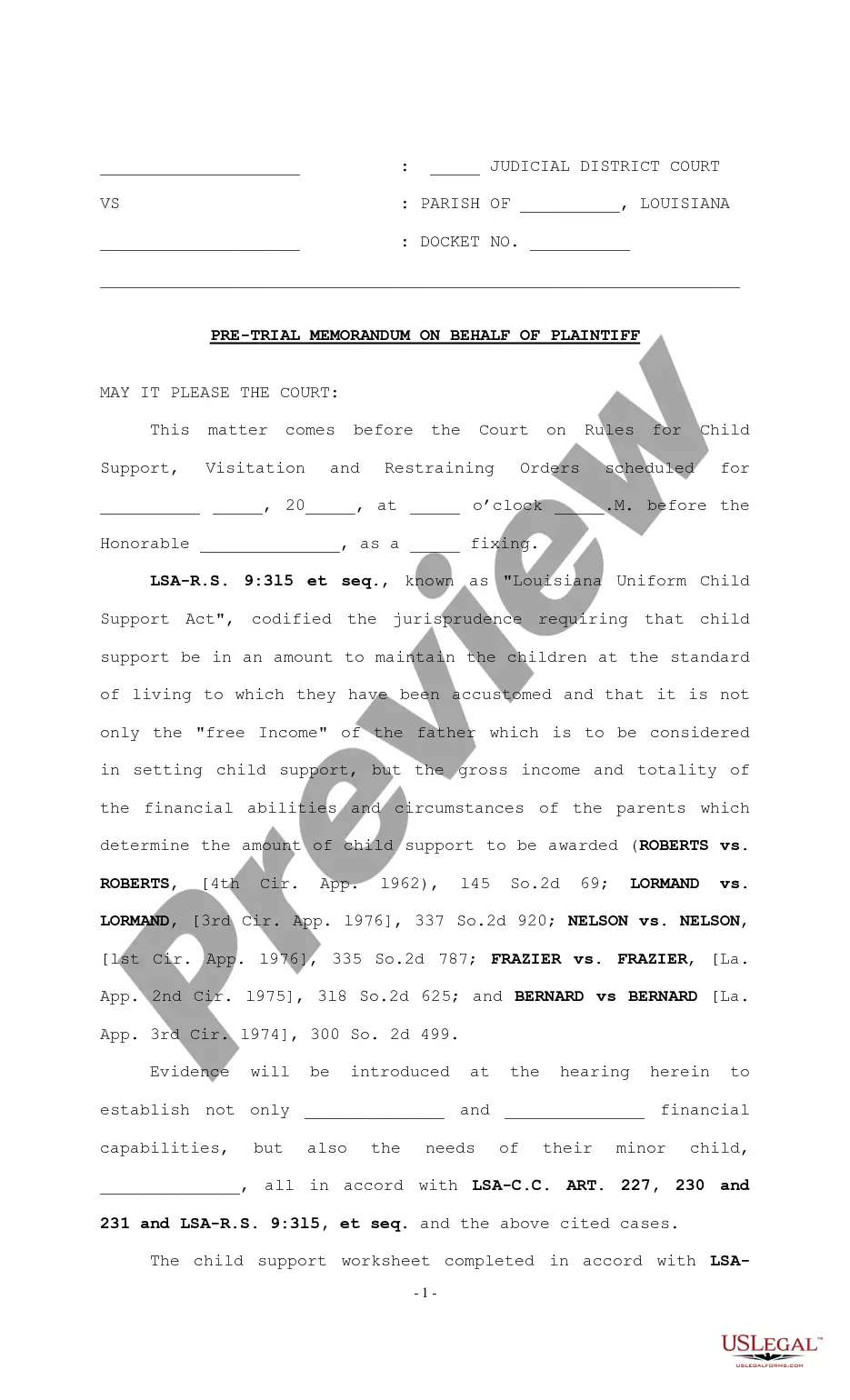

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state regulations and are examined by our experts. So if you need to prepare Delaware Chapter 11 Debtor(s) Certification of Plan Completion and Request for Discharge, our service is the perfect place to download it.

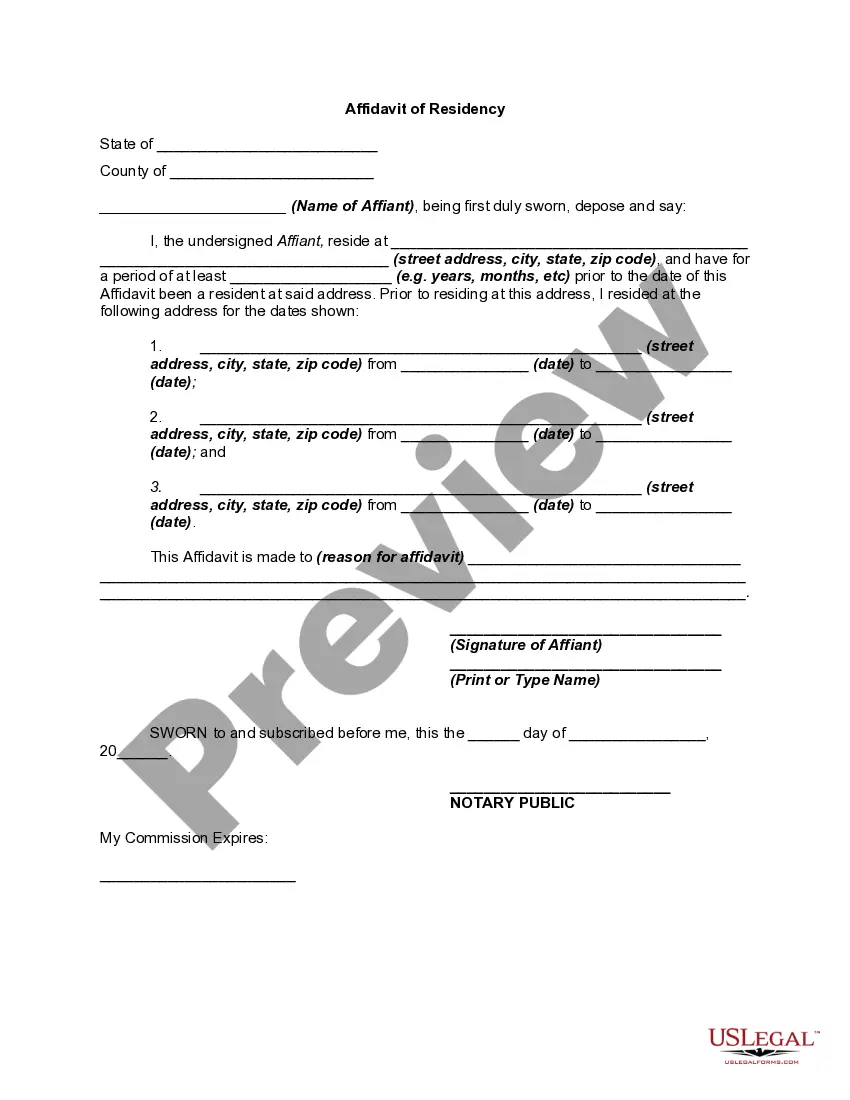

Obtaining your Delaware Chapter 11 Debtor(s) Certification of Plan Completion and Request for Discharge from our catalog is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they find the correct template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

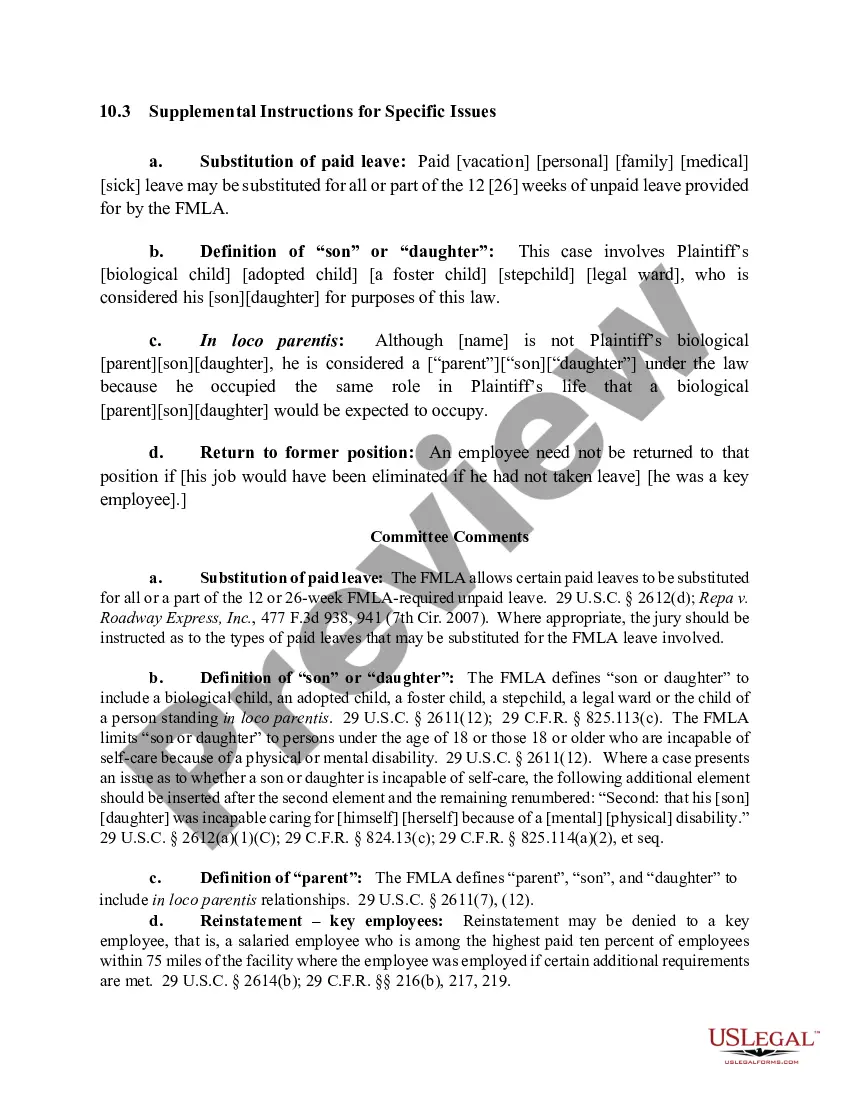

- Document compliance verification. You should carefully examine the content of the form you want and ensure whether it satisfies your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

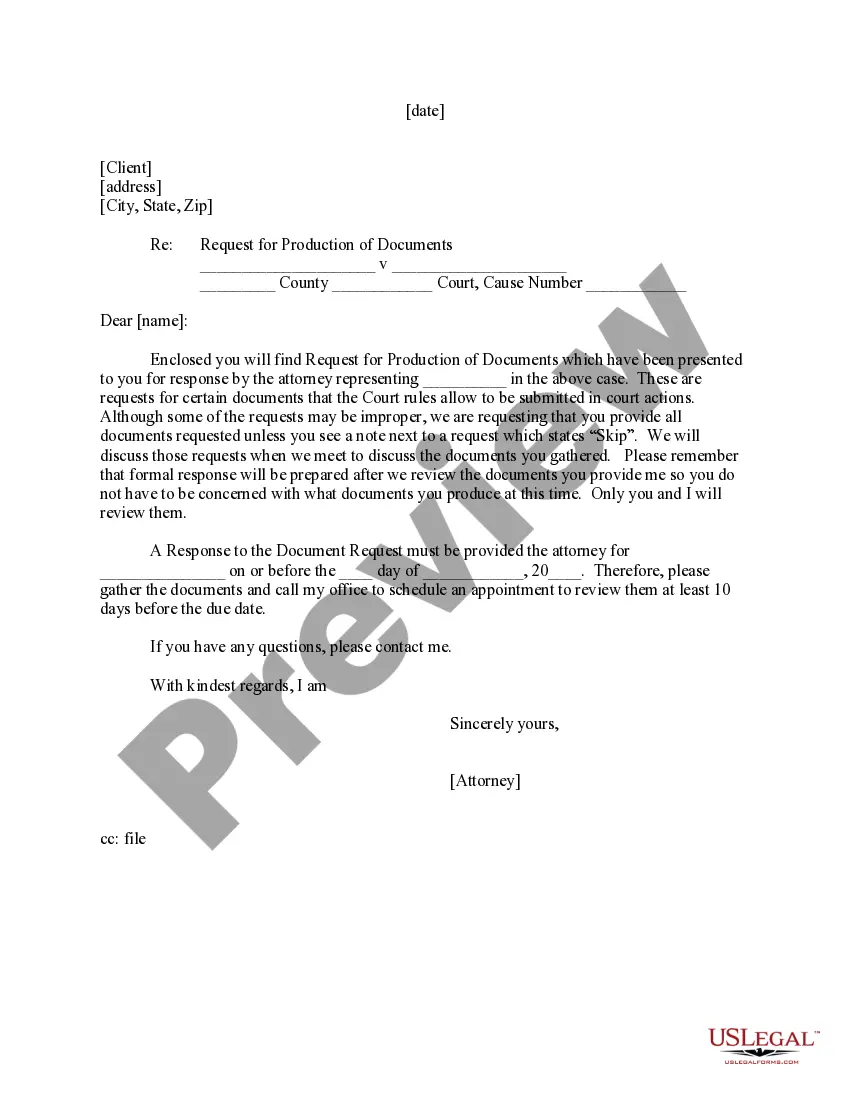

- Template download and further usage. Choose the file format for your Delaware Chapter 11 Debtor(s) Certification of Plan Completion and Request for Discharge and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to get any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

The rights of Unsecured Creditors include: a share in any available funds, but only after costs of liquidation, priority payments and in particular, the Secured Creditors have been paid. an opportunity to take part in choosing the Liquidator in a Creditor's Voluntary Winding Up.

An unsecured creditor must first file a legal complaint in court and obtain a judgment before proceeding with collection through wage garnishment and other types of liquidated borrower-owned assets.

Most Chapter 11 debtors receive a moratorium on the payment of most of their general unsecured debts for the period between the filing of the case and the confirmation of a plan. This period usually lasts for six to twelve months.

After a company goes into liquidation, unsecured creditors cannot commence or continue legal action against the company, unless the court permits. It is possible for a company in liquidation to also be in receivership.

Does a Chapter 11 bankruptcy erase a business's debts? Not exactly. Creditors often have to accept less under a court-approved reorganization plan. But the idea is for the business to keep earning money so it can pay back as much as possible.

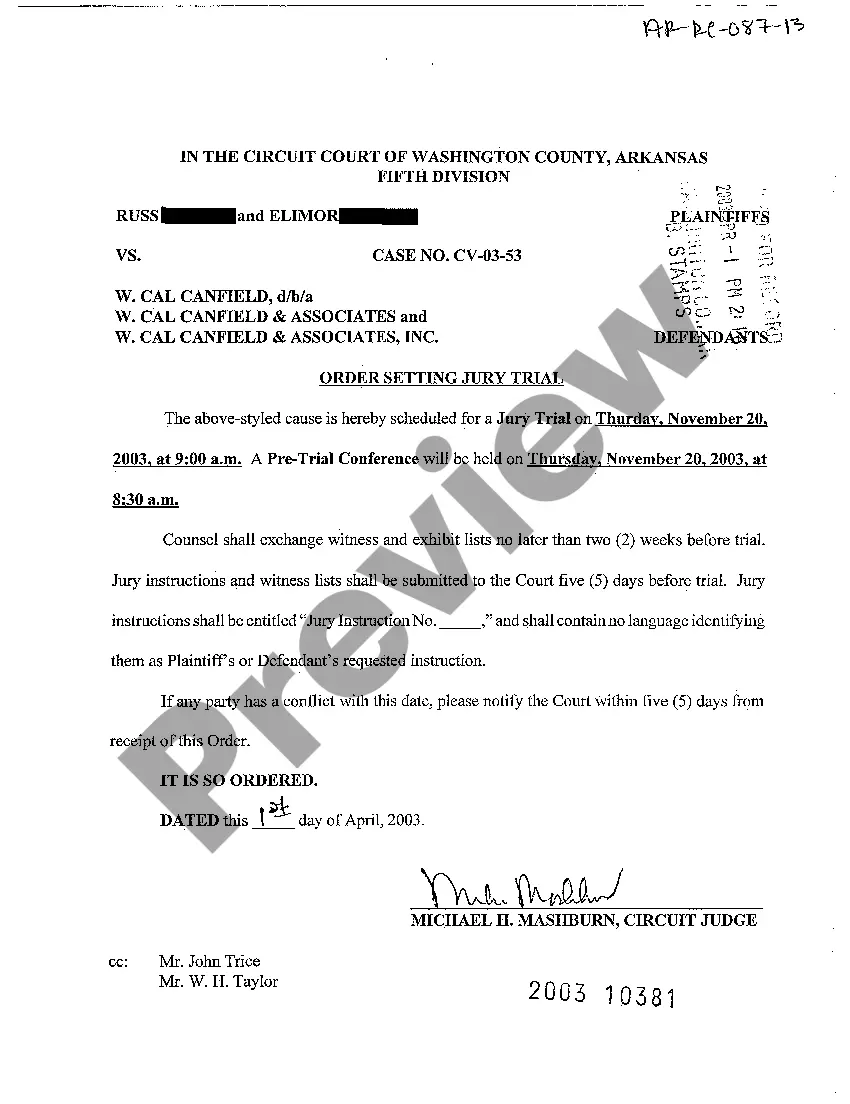

A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains ?in possession,? has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

The automatic stay requires creditors to cease actions against the debtor and the debtor's property as described in 11 U.S.C. § 362(a). The automatic stay remains in effect until the case is closed or dismissed or, in an individual case, until the granting or denial of the debtor's discharge, whichever happens first.

What Is a Proof of Claim? A proof of claim is an essential element in the bankruptcy process. It documents your right as a creditor to repayment from the debtor. A debtor's chapter 11 bankruptcy filing may significantly impact a creditor and can jeopardize its ability to handle its own financial responsibilities.