Delaware Order on Rule to Show Cause, Bankruptcy) (Failure to upload creditor matrix

Description

How to fill out Delaware Order On Rule To Show Cause, Bankruptcy) (Failure To Upload Creditor Matrix?

How much time and resources do you typically spend on composing formal documentation? There’s a greater option to get such forms than hiring legal specialists or wasting hours browsing the web for a suitable blank. US Legal Forms is the leading online library that provides professionally drafted and verified state-specific legal documents for any purpose, like the Delaware Order on Rule to Show Cause, Bankruptcy) (Failure to upload creditor matrix.

To obtain and complete an appropriate Delaware Order on Rule to Show Cause, Bankruptcy) (Failure to upload creditor matrix blank, adhere to these easy steps:

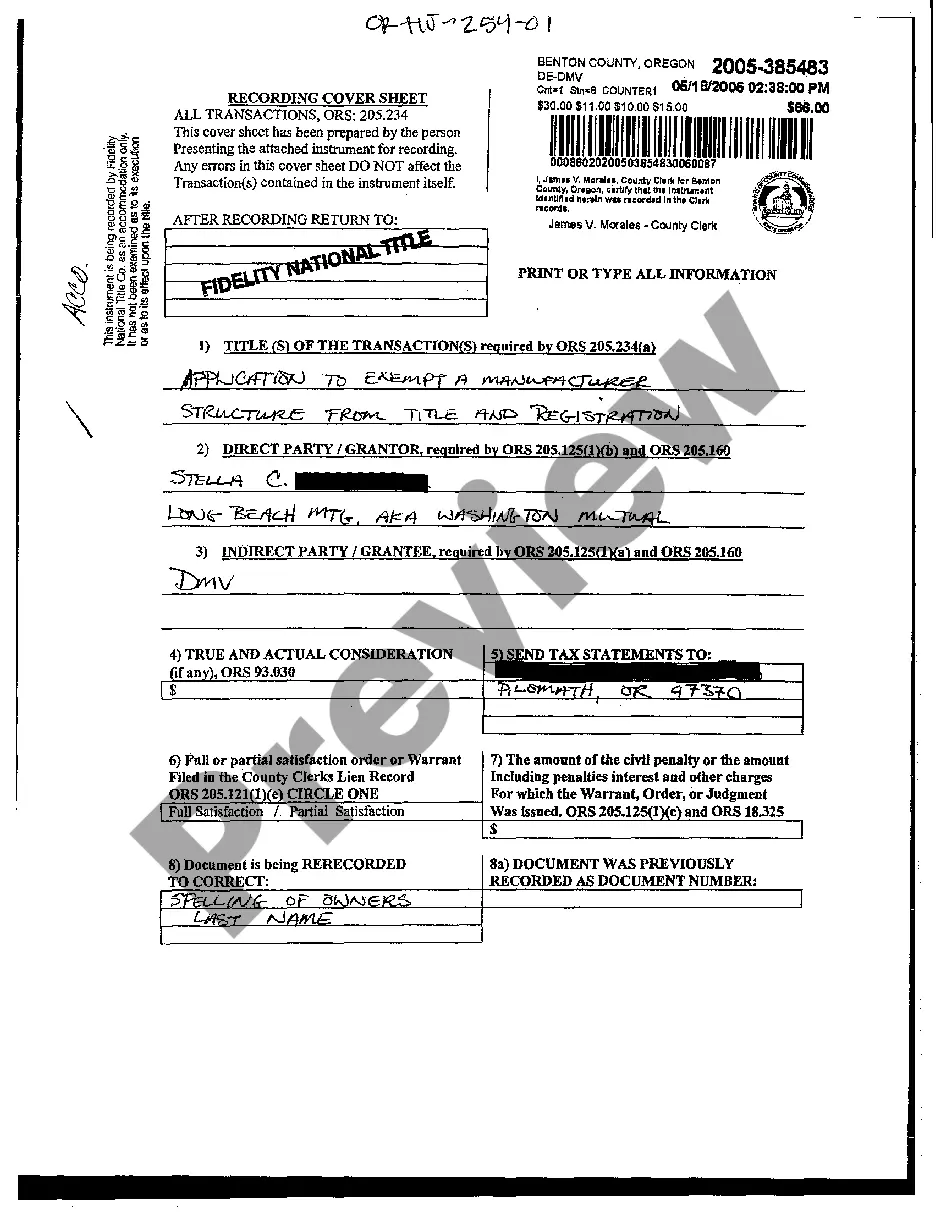

- Look through the form content to ensure it meets your state requirements. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, locate another one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Delaware Order on Rule to Show Cause, Bankruptcy) (Failure to upload creditor matrix. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Opt for the subscription plan that suits you best to access our library’s full service.

- Create an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally reliable for that.

- Download your Delaware Order on Rule to Show Cause, Bankruptcy) (Failure to upload creditor matrix on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you safely store in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing legal paperwork with US Legal Forms, one of the most reliable web solutions. Join us now!

Form popularity

FAQ

Yes, most secured debt can be discharged in bankruptcy. In Chapter 7 cases, that means your personal liability for the debt is wiped out with the Chapter 7 discharge. But since secured debts are connected to collateral, you don't get to keep the collateral unless you pay the debt.

Secured creditors generally get priority, while unsecured creditors are paid pro-rata on their claims. The intent of Chapter 7 is to give the debtor a ?fresh start? and for the creditors to recover as much as they otherwise would've been able to under non-bankruptcy law.

Among other reasons, the court may deny the debtor a discharge if it finds that the debtor: failed to keep or produce adequate books or financial records; failed to explain satisfactorily any loss of assets; committed a bankruptcy crime such as perjury; failed to obey a lawful order of the bankruptcy court;

Secured creditors have other rights in bankruptcy, including the right to receive postpetition interest, fees, costs, and charges and to receive adequate protection for any decrease in the value of their interest in the collateral resulting from any use, sale, lease, or grant of a lien.

A creditor matrix contains each creditor's name and mailing address. This information is used for noticing and claims information. The debtor is required to provide a list of ALL creditors.

In a Chapter 13, an objection to confirmation is basically a written statement from the Chapter 13 Trustee or a creditor of the debtor that there is something wrong with the case that needs to be fixed before the confirmation hearing.

The choice in a Chapter 7 bankruptcy with secured debt is all-or-nothing: if you want to keep the house or car that is secured by the lien, then you must keep making the payments on the loan; if you want to get rid of the secured debt, the lender has the right to take back the property.

Secured Creditors in Chapter 7 The discharge of debt at the end of chapter 7 only affects personal debts, not liens on property. That means a secured creditor keeps the right to repossess the property. However, it also means that any debt over the value of the collateral is discharged at the end of bankruptcy.