Delaware CHART FOR DETERMINING AMOUNT of WAGES SUBJECT TO 10% ATTACHMENT

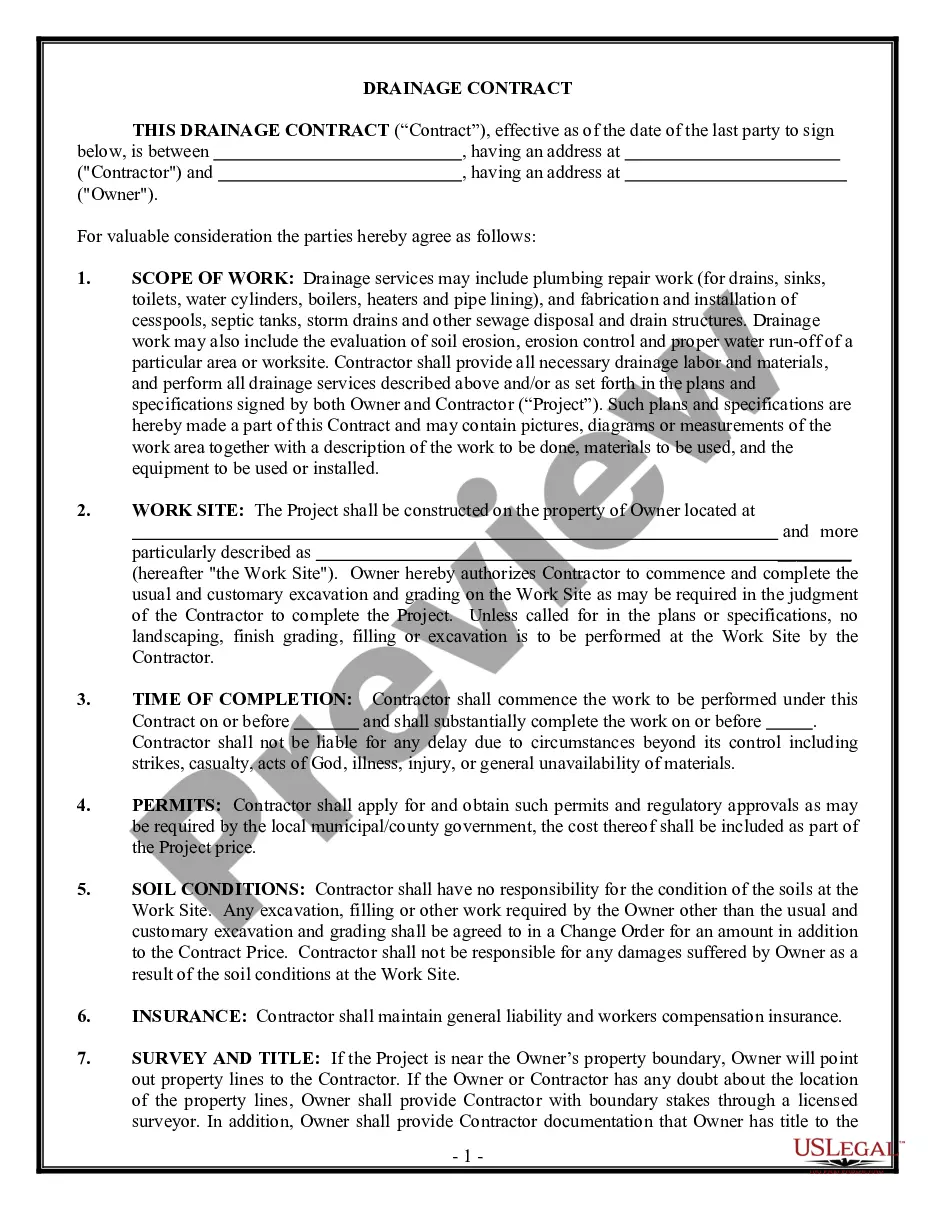

Description

How to fill out Delaware CHART FOR DETERMINING AMOUNT Of WAGES SUBJECT TO 10% ATTACHMENT?

The more documents you need to make - the more stressed you get. You can get a huge number of Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 10% blanks on the internet, however, you don't know those to have confidence in. Eliminate the headache to make finding exemplars more straightforward using US Legal Forms. Get accurately drafted forms that are published to satisfy state specifications.

If you already possess a US Legal Forms subscription, log in to the account, and you'll see the Download key on the Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 10%’s web page.

If you have never applied our service earlier, finish the sign up process with the following recommendations:

- Make sure the Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 10% applies in the state you live.

- Double-check your decision by studying the description or by using the Preview functionality if they are provided for the chosen file.

- Click Buy Now to begin the sign up procedure and select a costs plan that fits your preferences.

- Insert the asked for details to make your profile and pay for your order with your PayPal or bank card.

- Select a handy document structure and have your copy.

Find every template you get in the My Forms menu. Simply go there to fill in fresh version of your Delaware Chart for Determining Amount of Wages Subject to Attachment / Garnishment 10%. Even when preparing properly drafted templates, it’s still important that you think about asking your local legal professional to double-check filled out sample to make certain that your record is correctly filled in. Do much more for less with US Legal Forms!

Form popularity

FAQ

Social Security Benefits. Supplemental Security Income (SSI) Benefits. Veterans' Benefits. Civil Service and Federal Retirement and Disability Benefits. Military Annuities and Survivors' Benefits. Student Assistance. Railroad Retirement Benefits.

Disposable earnings are the income an employee receives after taxes and payment obligations have been met that can be spent or invested as they desire.The distinction between different types of deductions means that disposable earnings and take-home pay are not considered to be the same.

If you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court. You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

Determine disposable earnings by subtracting legally required deductions from the employee's gross wages. Legally required deductions are those that the government requires, such as federal income tax, Social Security tax and Medicare tax. The result is the disposable earnings, which are subject to wage garnishment.

If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.

Disposable earnings are the income an employee receives after taxes and payment obligations have been met that can be spent or invested as they desire. Some deductions, such as taxes and Social Security, are legally mandated and do not count towards an employee's disposable earnings.

For ordinary garnishments (i.e., those not for support, bankruptcy, or any state or federal tax), the weekly amount may not exceed the lesser of two figures: 25% of the employee's disposable earnings, or the amount by which an employee's disposable earnings are greater than 30 times the federal minimum wage (currently

(When it comes to wage garnishment, disposable income means anything left after the necessary deductions such as taxes and Social Security.) Either 25% or the amount by which your weekly income exceeds 30 times the federal minimum wage (currently $7.25 an hour), whichever is less.

If you make $500 per week after all taxes and allowable deductions, 25% of your disposable earnings is $125 ($500 × . 25 = $125). The amount by which your disposable earnings exceed 30 times $7.25 is $282.50 ($500 2212 30 A $7.25 = $282.50).