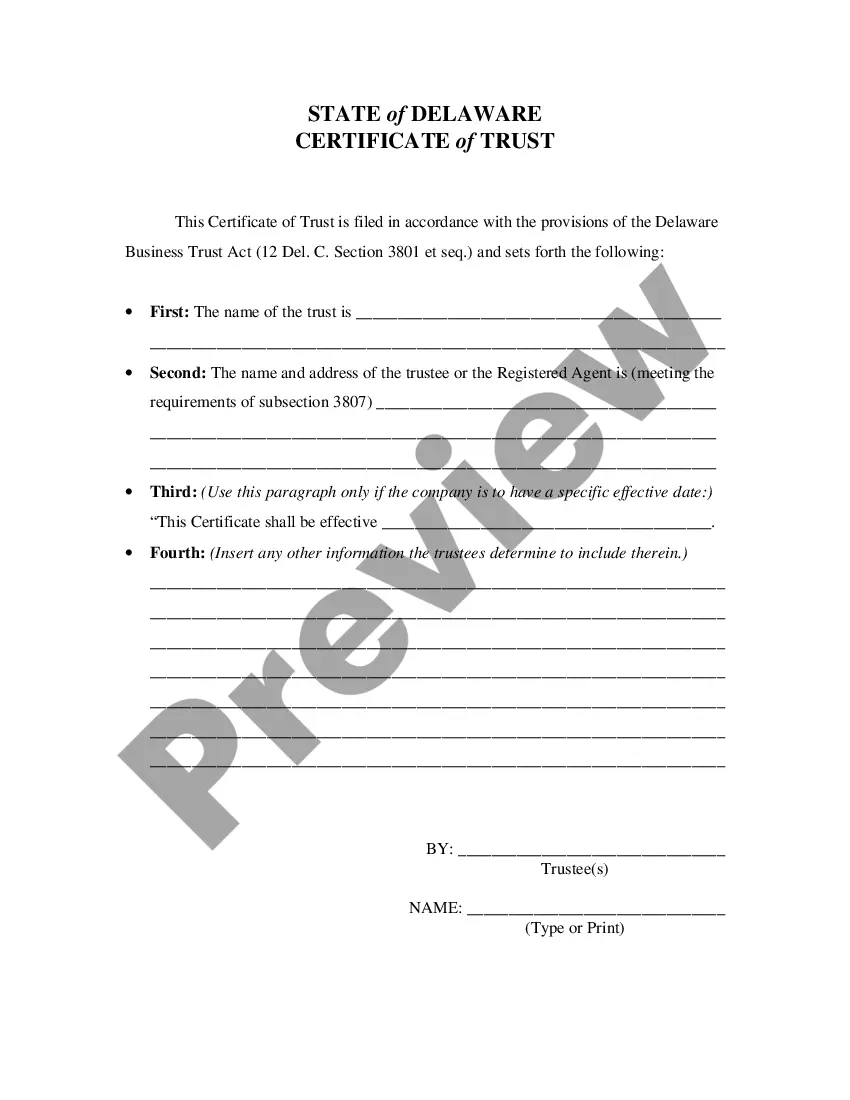

A Delaware Certificate of Correction of Statutory Trust is a legal document used to make amendments or corrections to an existing Delaware Statutory Trust. The Certificate is filed with the Delaware Secretary of State and serves to legally confirm a change to the trust’s formation documents, such as the trust’s name, trustee, beneficiary, or other information. There are three types of Delaware Certificate of Correction of Statutory Trust: Certificate of Correction of Statutory Trust, Certificate of Restatement of Statutory Trust, and Certificate of Merger of Statutory Trusts. The Certificate of Correction is used to make amendments or changes to the trust’s governing instrument; the Certificate of Restatement is used to restate the trust’s governing instrument in its entirety; and the Certificate of Merger is used to merge multiple Delaware Statutory Trusts into a single trust.

Delaware Certificate of Correction of Statutory Trust

Description

How to fill out Delaware Certificate Of Correction Of Statutory Trust?

How much time and resources do you frequently allocate to creating official documents.

There’s a better option to acquire such forms than employing legal experts or spending hours searching online for a fitting template. US Legal Forms stands as the premier online repository that provides professionally prepared and validated state-specific legal papers for any purpose, such as the Delaware Certificate of Correction of Statutory Trust.

Another advantage of our library is that you can access previously downloaded documents that you securely save in your profile under the My documents section. Retrieve them anytime and re-complete your forms as often as necessary.

Conserve time and effort in drafting legal documents with US Legal Forms, one of the most dependable online services. Enroll with us today!

- Browse through the form details to ensure it complies with your state regulations. To do this, review the form overview or utilize the Preview option.

- If your legal template doesn’t fulfill your requirements, find another one using the search function at the top of the page.

- If you possess an account with us, Log In and download the Delaware Certificate of Correction of Statutory Trust. Otherwise, continue to the subsequent steps.

- Click Buy now upon locating the correct document. Choose the subscription plan that best suits your needs to unlock our library’s complete offerings.

- Register for an account and complete the payment for your subscription. You can process your payment with either your credit card or via PayPal - our service is entirely secure for that.

- Retrieve your Delaware Certificate of Correction of Statutory Trust on your device and complete it using a hard copy or electronically.

Form popularity

FAQ

At the end of a Delaware Statutory Trust's term, the trust typically dissolves, and its assets are distributed according to the trust agreement. The trust's termination should follow the legal requirements outlined in its formation documents. It's important to properly address any final transactions and distributions to avoid legal complications. If any issues arise during this process, obtaining a Delaware Certificate of Correction of Statutory Trust can help clarify and resolve documentation concerns.

A Delaware Statutory Trust serves several purposes, primarily in the realm of real estate investments and asset protection. It allows investors to pool resources and share in the income generated from the trust's activities. This structure also provides liability protections and tax benefits. When properly formed, including the relevant documentation like a Delaware Certificate of Correction of Statutory Trust, it can enhance the overall effectiveness of your trust.

No, a Delaware Statutory Trust is not classified as a disregarded entity for tax purposes. It operates as its own entity, distinct from the trustees or beneficiaries involved. As a result, it may have specific tax implications that you should understand fully. If you encounter issues in your trust's formation documentation, a Delaware Certificate of Correction of Statutory Trust can rectify those matters.

Absolutely, a Delaware Statutory Trust functions as a legal entity under Delaware law. It possesses the ability to own assets and engage in business transactions independently. This status allows for various legal protections and operational advantages, particularly when combined with proper documentation, such as a Delaware Certificate of Correction of Statutory Trust if necessary.

Yes, a Delaware Statutory Trust can indeed be sued. As a distinct legal entity, it holds the capacity to enter into contracts, own property, and face legal action. This is crucial to understand when considering the implications of forming a trust. It's also important to consider the potential need for a Delaware Certificate of Correction of Statutory Trust if there are discrepancies in the trust documentation.

Yes, you can form your own Delaware Statutory Trust by filing the appropriate paperwork with the state of Delaware. This includes preparing the Delaware Certificate of Correction of Statutory Trust, which may address any necessary changes to your trust documents. It is advisable to seek guidance to navigate the legal requirements smoothly. Utilizing services like uslegalforms can ensure that you complete this process correctly and efficiently.

You can create your own Delaware Statutory Trust by following state guidelines and drafting the necessary documents. The Delaware Certificate of Correction of Statutory Trust allows you to amend certain deficiencies in the original documents, ensuring they comply with legal requirements. Using a trusted platform like uslegalforms can simplify the process, making sure you meet all important specifications. This way, you can tailor your trust to suit your unique needs.

A Delaware Statutory Trust typically lasts as long as its governing documents dictate. Generally, it remains in effect until the trust’s termination date or until the objectives detailed in the Delaware Certificate of Correction of Statutory Trust are achieved. Trusts can also have provisions for extension if necessary. Consulting with professionals can help you ensure your trust meets your long-term goals.

A traditional trust often requires greater flexibility in management and allows for various roles like revocable and irrevocable terms. In contrast, a Delaware Statutory Trust operates under specific legal guidelines that offer distinct tax benefits and limited liability. Understanding these differences is vital, especially when considering the implications of a Delaware Certificate of Correction of Statutory Trust for your investment strategy.

While Delaware Statutory Trusts offer unique benefits, they also involve risks. Market fluctuations can impact property values, and changes in regulations may affect your investment. Therefore, due diligence is essential, and working with experts can help mitigate risks. Leveraging services like USLegalForms can be advantageous when navigating the complexities of the Delaware Certificate of Correction of Statutory Trust.