Certificate of Conversion From Limited Partnership To Non-Delaware Entity

Description

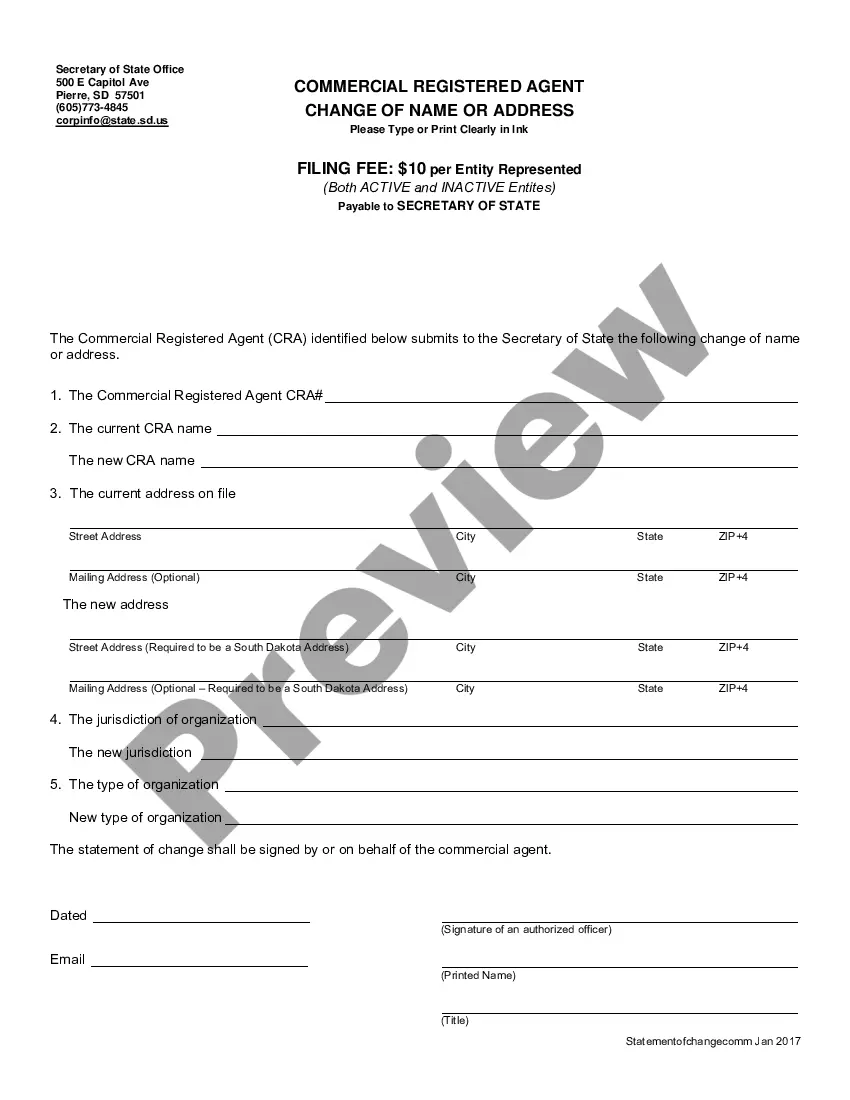

How to fill out Certificate Of Conversion From Limited Partnership To Non-Delaware Entity?

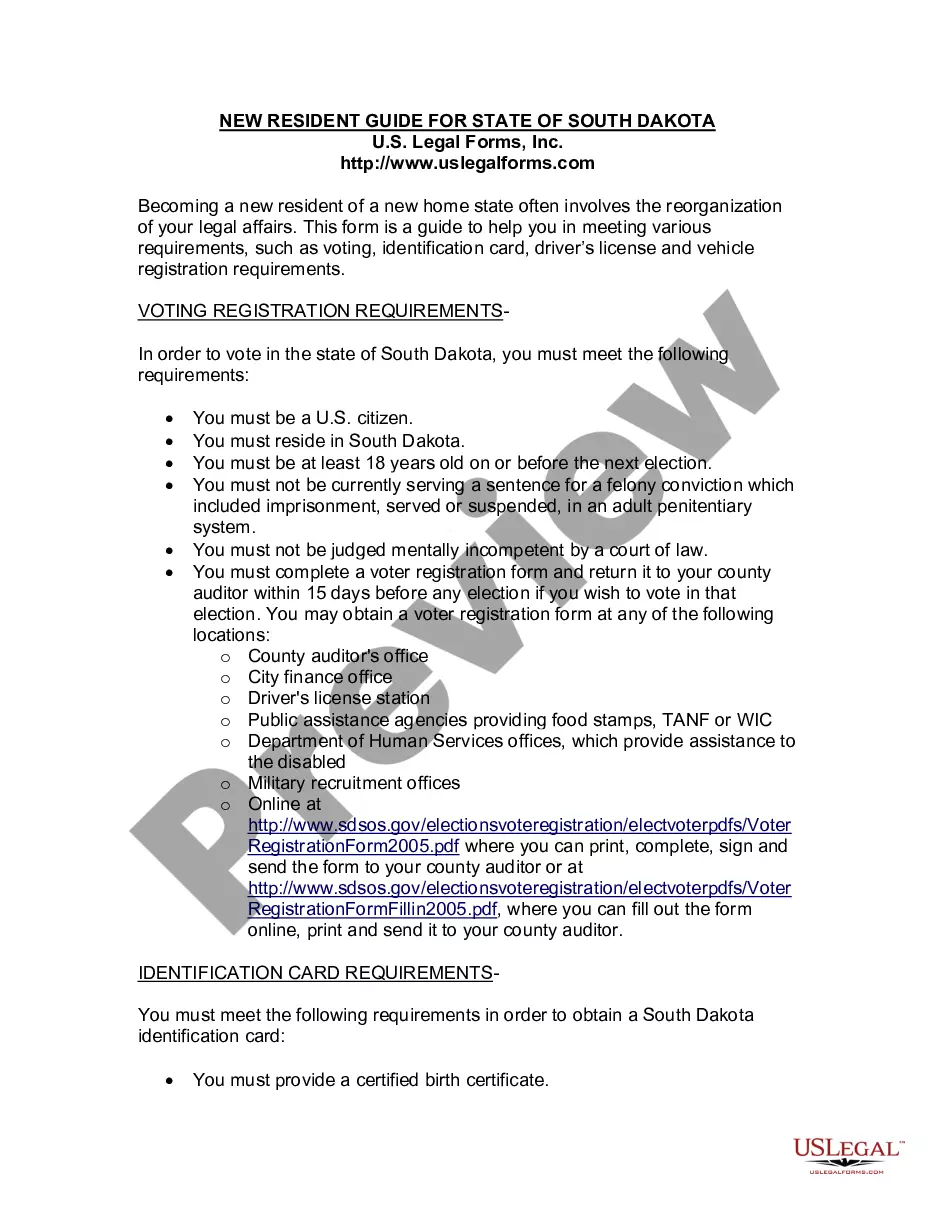

If you’re looking for a way to properly complete the Certificate of Conversion From Limited Partnership To Non-Delaware Entity without hiring a legal professional, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every individual and business scenario. Every piece of paperwork you find on our online service is created in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these simple guidelines on how to obtain the ready-to-use Certificate of Conversion From Limited Partnership To Non-Delaware Entity:

- Ensure the document you see on the page complies with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and choose your state from the list to locate an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to get your Certificate of Conversion From Limited Partnership To Non-Delaware Entity and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Dissolution. Dissolution of a limited partnership is the first step toward termination (but termination does not necessarily follow dissolution). The limited partners have no power to dissolve the firm except on court order, and the death or bankruptcy of a limited partner does not dissolve the firm.

Steps to Cancel a Delaware LLC Consult the LLC Operating Agreement.Take a Member Vote.Appoint a Manager to Wind up the LLC's Affairs.Payoff Creditors, Current and Forseeable, before paying Members.Pay The Delaware Franchise Tax.Pay the LLC's members.File a Certificate of Cancellation.

Does Delaware allow statutory conversions? Yes, Delaware does allow statutory conversions. To convert from an LLC to a C corporation, you will need to file a Certificate of Conversion and a Certificate of Incorporation with the Delaware Division of Corporations.

The fee to file the Certificate of Conversion is $164.00 for a 1 page document. Please add $9 for each additional page. A Certificate of Incorporation is required to be filed simultaneously with the Certificate of Conversion. Enclosed for your convenience, please find a form for a Stock Certificate of Incorporation.

Judicial dissolution. On application by or for a partner the Court of Chancery may decree dissolution of a limited partnership whenever it is not reasonably practicable to carry on the business in conformity with the partnership agreement.

To close their business account, partnerships need to send the IRS a letter that includes the complete legal name of their business, the EIN, the business address and the reason they wish to close their account.

The Certificate of Formation is the document you receive from the state of Delaware once your LLC is filed and approved by the Delaware Secretary of State, Division of Corporations. The Delaware LLC Certificate of Formation is akin to a birth certificate for your newly-created Delaware LLC.

Delaware Entity Dissolution Information A limited partnership can file a statement of cancellation with the Delaware Department of State, Division of Corporations. The filing will include a fee of $200. The dissolution of a limited partnership occurs when: The winding up process has been completed.