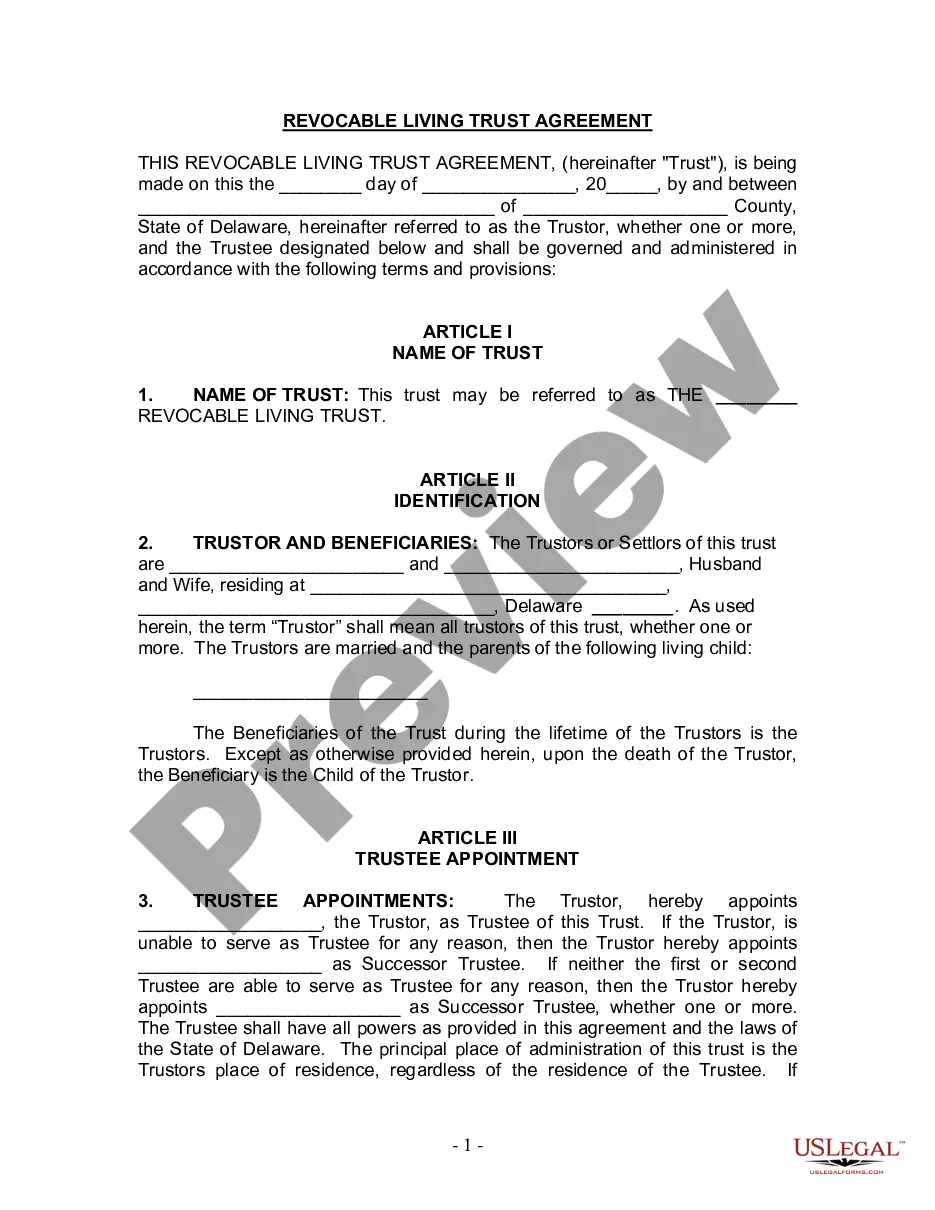

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Delaware Living Trust for Husband and Wife with One Child

Description

How to fill out Delaware Living Trust For Husband And Wife With One Child?

The more paperwork you need to make - the more anxious you get. You can find thousands of Delaware Living Trust for Husband and Wife with One Child blanks online, nevertheless, you don't know those to trust. Remove the hassle and make detecting exemplars more straightforward using US Legal Forms. Get accurately drafted documents that are created to go with the state specifications.

If you already possess a US Legal Forms subscription, log in to your account, and you'll find the Download button on the Delaware Living Trust for Husband and Wife with One Child’s page.

If you’ve never tried our website earlier, complete the sign up procedure with the following recommendations:

- Check if the Delaware Living Trust for Husband and Wife with One Child applies in your state.

- Re-check your selection by reading the description or by using the Preview functionality if they are provided for the chosen document.

- Click Buy Now to begin the sign up process and select a rates plan that meets your expectations.

- Provide the requested data to make your account and pay for the order with the PayPal or bank card.

- Choose a prefered document type and take your sample.

Find each template you get in the My Forms menu. Simply go there to prepare fresh copy of the Delaware Living Trust for Husband and Wife with One Child. Even when preparing properly drafted templates, it is nevertheless important that you consider asking your local legal representative to twice-check filled out sample to make certain that your document is accurately filled in. Do much more for less with US Legal Forms!

Form popularity

FAQ

Whether a husband and wife should have separate living trusts often depends on their financial goals and family dynamics. Utilizing a Delaware Living Trust for Husband and Wife with One Child encourages joint asset management while allowing for personalized provisions. However, in certain situations, separate trusts may provide peace of mind and clarity in asset management. It's wise to assess your individual needs and consult with a trusted legal professional to determine the most beneficial approach for your family.

A husband and wife may consider separate trusts to address specific financial or legal needs such as individual asset protection, debt management, or distinct distribution preferences. By utilizing a Delaware Living Trust for Husband and Wife with One Child, each spouse can maintain control over their assets while still providing for their child. This arrangement can also be beneficial in situations involving prior marriages or unique financial circumstances. Ultimately, separate trusts can offer customized solutions that align with each partner's goals.

The best living trust for a married couple often depends on individual circumstances, but a Delaware Living Trust for Husband and Wife with One Child is designed to be flexible and effective. This type of trust allows couples to decide how they want their assets divided and offers peace of mind knowing their child will benefit directly. Additionally, these trusts can simplify the estate administration process and reduce tax implications. Ultimately, consulting with a legal expert can help couples choose the most suitable trust for their unique situation.

Delaware has specific laws that govern the creation and management of living trusts. The state encourages individuals to establish trusts by offering various legal frameworks that enhance asset protection and tax benefits. Notably, a Delaware Living Trust for Husband and Wife with One Child can provide clear directives for asset distribution while also minimizing probate hassles. By understanding Delaware's trust laws, couples can confidently manage their estate and ensure their child’s future.

Setting up a Delaware Living Trust for Husband and Wife with One Child involves several key steps. First, you need to decide on the trust's terms, including how assets will be managed and distributed. Then, you should draft the trust document, which outlines these terms clearly and designates you and your spouse as trustees. Finally, it’s important to fund the trust by transferring ownership of your assets into it, ensuring that they are protected and managed according to your wishes.

Setting up a trust in Delaware typically involves several key steps. You should begin with defining your goals, then draft your Delaware Living Trust for Husband and Wife with One Child document. This includes naming your assets and beneficiaries, as well as appointing a trustee. To streamline the process, consider using uslegalforms, where you can find guided templates tailored to your needs.

Many people choose to set up trusts in Delaware because the state offers favorable laws and flexible options. The Delaware Living Trust for Husband and Wife with One Child provides privacy and avoids probate, streamlining asset distribution. Additionally, Delaware has a strong legal framework that supports the rights of trustees and beneficiaries, making it an attractive option.

To start a trust in Delaware, you need to first define your objectives and determine how the Delaware Living Trust for Husband and Wife with One Child will fit into your estate plan. After that, you can draft the trust agreement, outlining your wishes and designating a trustee. Working with an experienced attorney or using platforms like uslegalforms can simplify this process and ensure legal compliance.

Yes, having a spouse as a trustee for your Delaware Living Trust for Husband and Wife with One Child can be beneficial. It allows you to maintain control over the trust assets and make decisions together. Furthermore, this arrangement can provide security and trust between partners. It ensures both parties are actively involved in managing the assets.

Putting your house in a trust can offer many advantages for a married couple. A Delaware Living Trust for Husband and Wife with One Child protects your home from probate and eases the passing of ownership to your heirs. By doing this, you maintain control and can change the terms of the trust as your life circumstances evolve. It also provides peace of mind knowing that your assets are protected and managed according to your wishes.