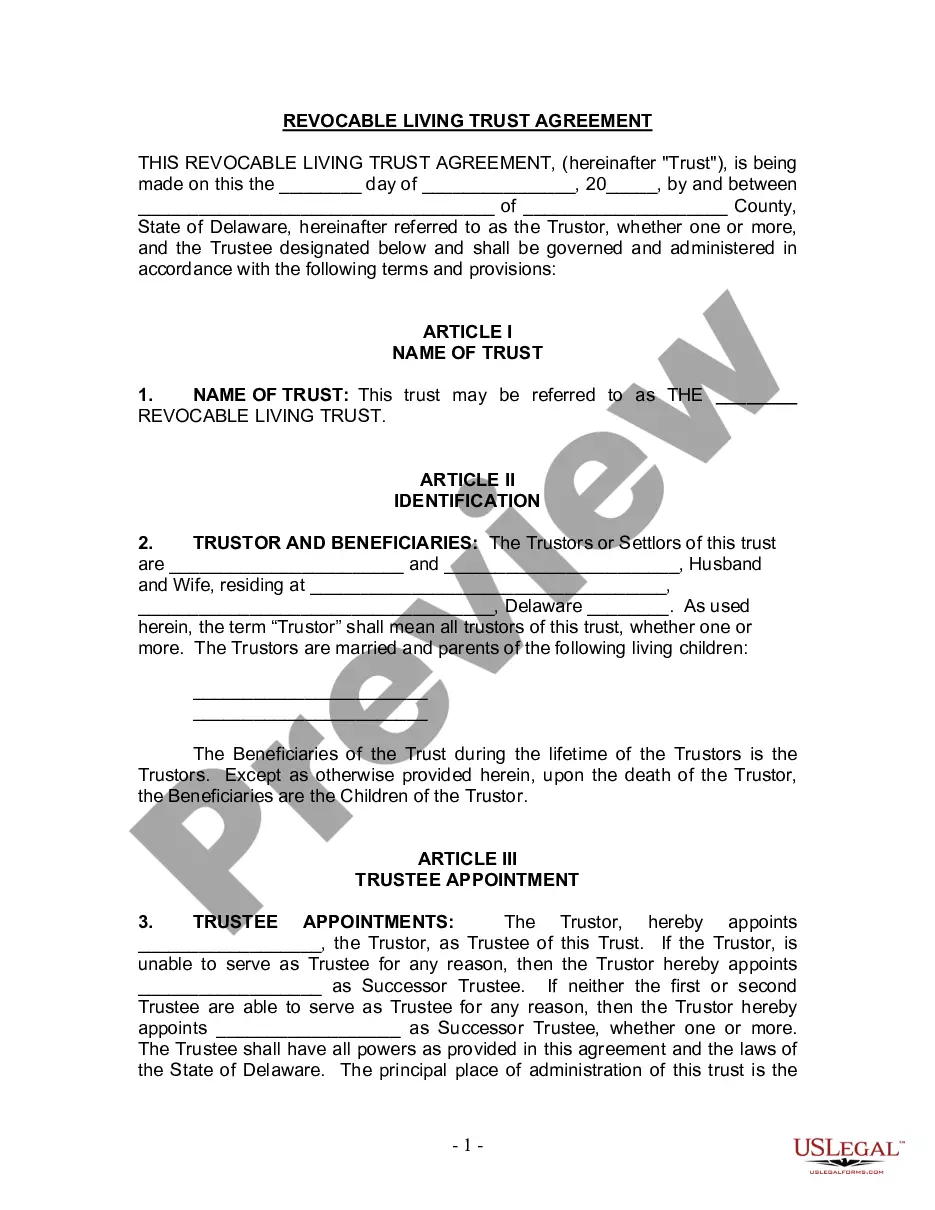

This form is a living trust form prepared for your State. A living trust is a trust established during a person's lifetime in which a perssn's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Delaware Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Delaware Living Trust For Husband And Wife With Minor And Or Adult Children?

The more paperwork you need to make - the more worried you feel. You can get thousands of Delaware Living Trust for Husband and Wife with Minor and or Adult Children templates online, but you don't know which of them to have confidence in. Eliminate the headache and make finding samples less complicated with US Legal Forms. Get professionally drafted documents that are composed to meet state specifications.

If you currently have a US Legal Forms subscribing, log in to the profile, and you'll see the Download button on the Delaware Living Trust for Husband and Wife with Minor and or Adult Children’s webpage.

If you’ve never applied our website before, complete the registration process using these directions:

- Check if the Delaware Living Trust for Husband and Wife with Minor and or Adult Children is valid in your state.

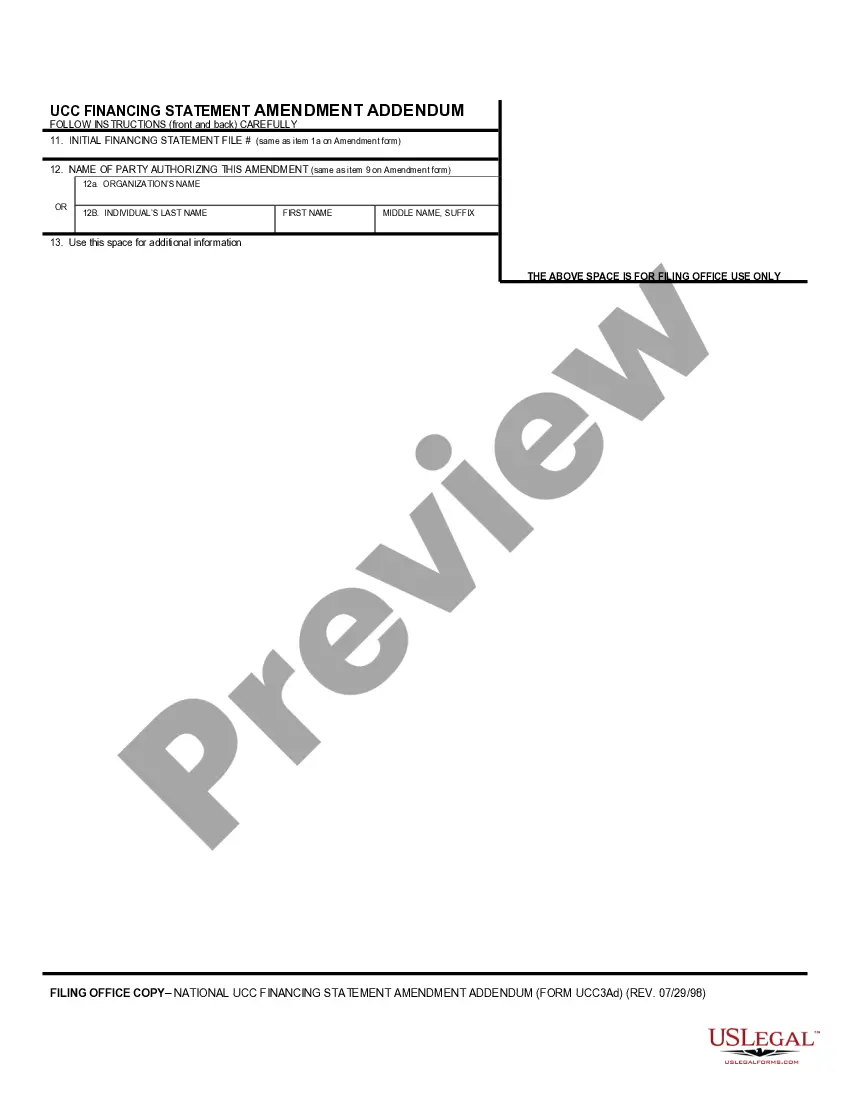

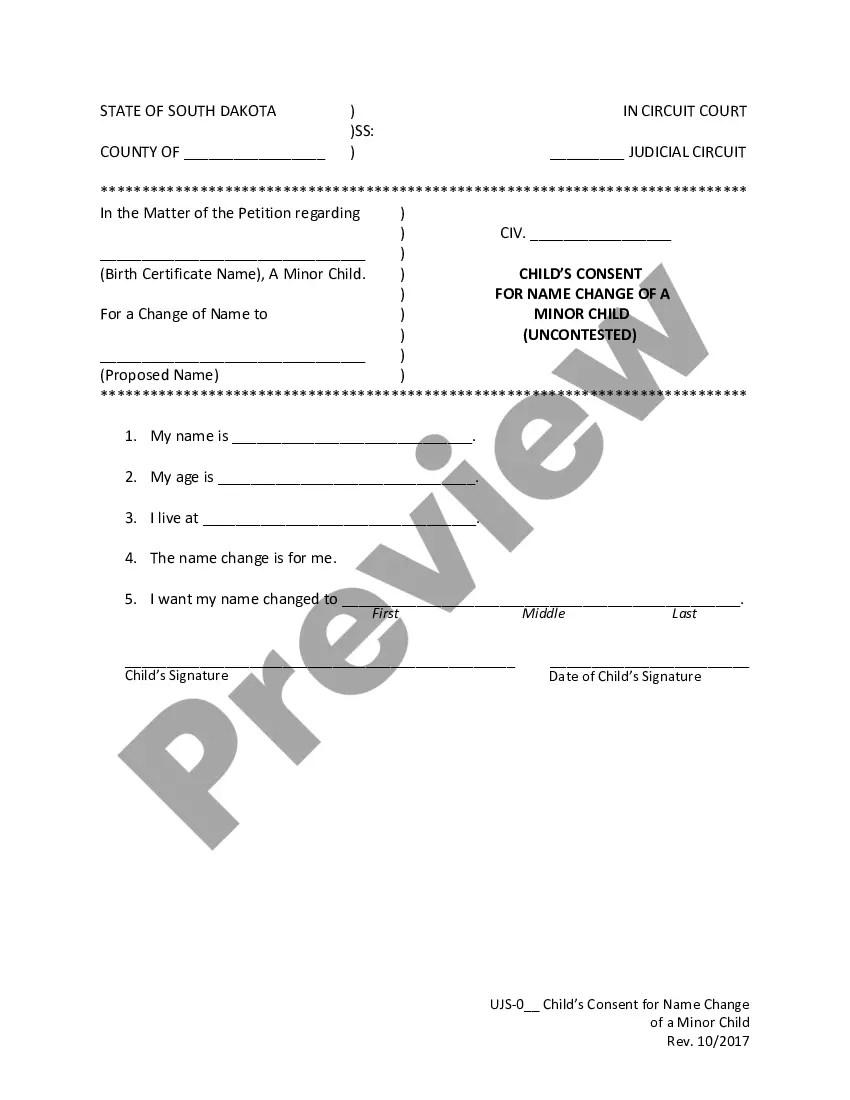

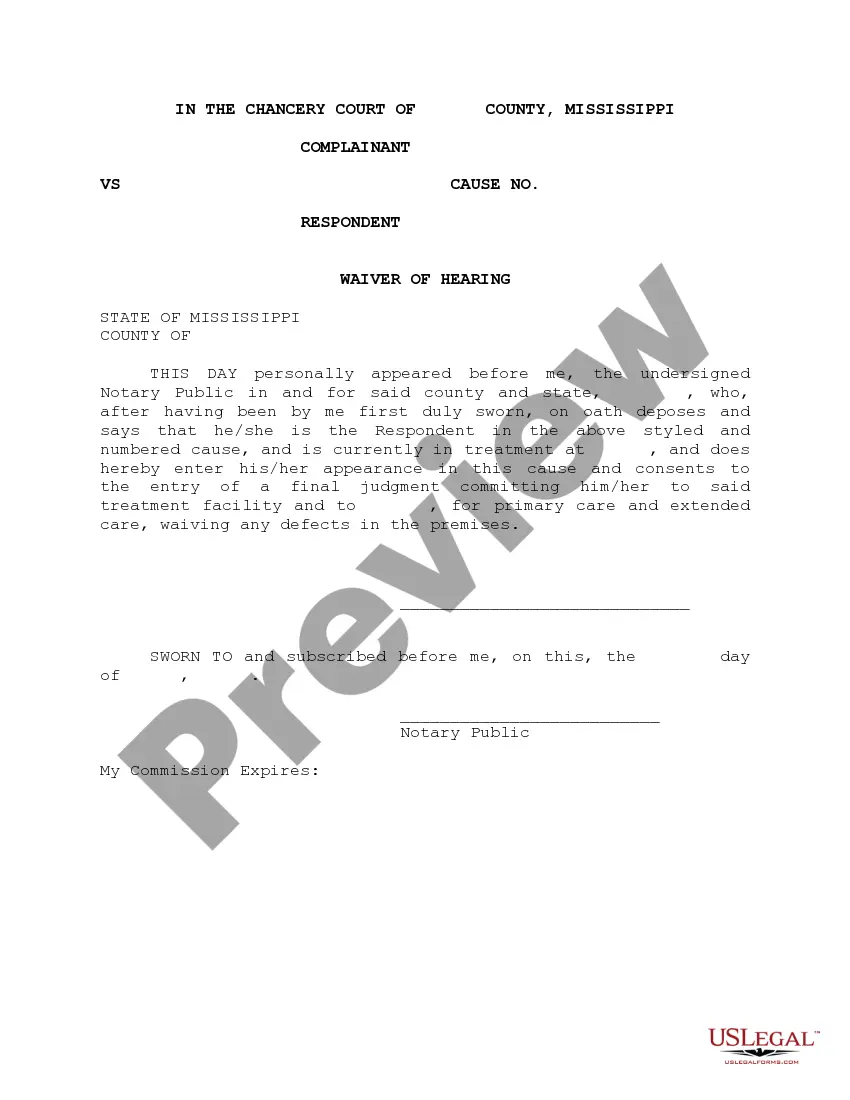

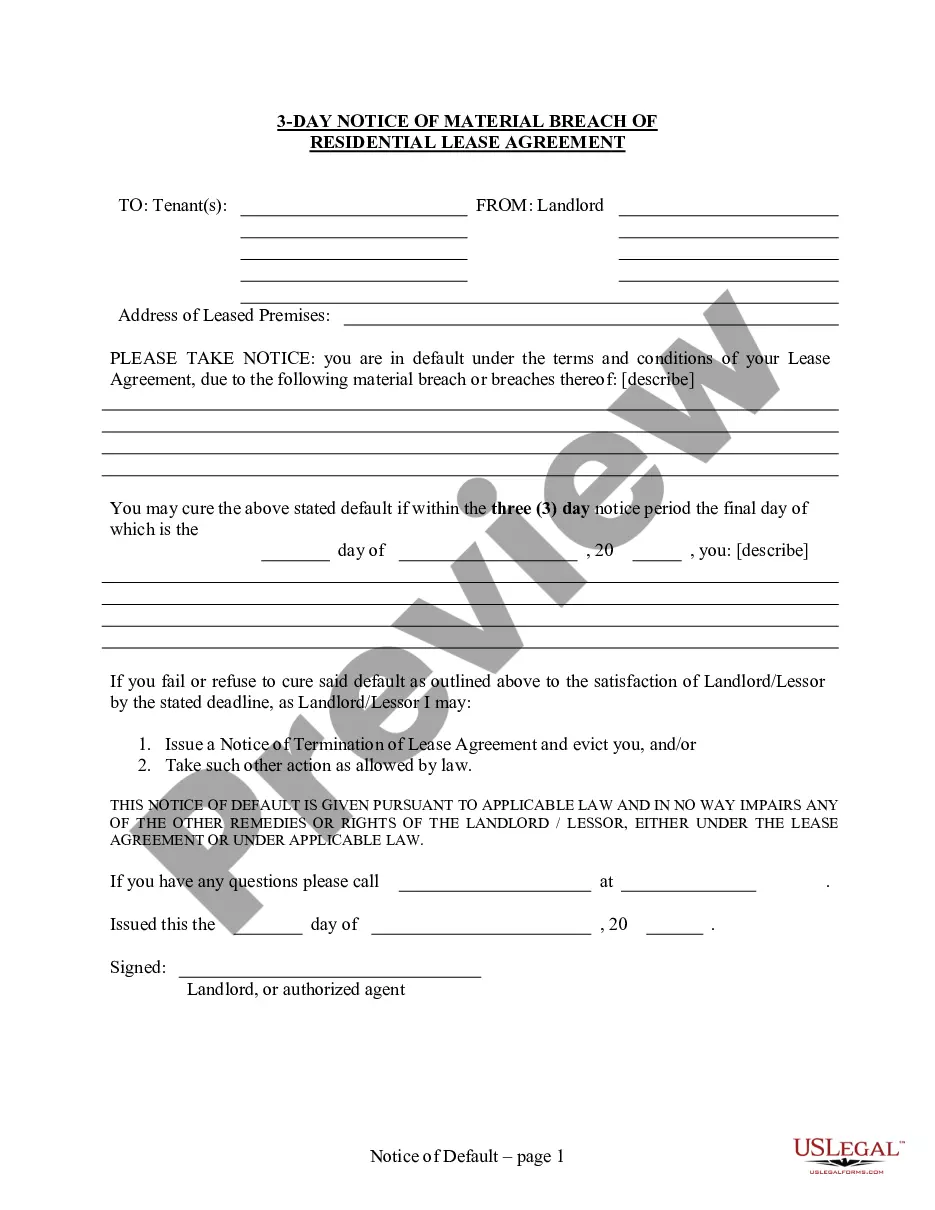

- Double-check your choice by studying the description or by using the Preview functionality if they’re provided for the selected file.

- Click Buy Now to begin the registration process and select a rates program that meets your needs.

- Insert the asked for data to make your profile and pay for your order with the PayPal or credit card.

- Select a handy file type and get your example.

Access each document you obtain in the My Forms menu. Simply go there to produce a new copy of your Delaware Living Trust for Husband and Wife with Minor and or Adult Children. Even when preparing professionally drafted templates, it is nevertheless essential that you think about requesting the local legal professional to double-check filled out sample to make sure that your document is correctly filled in. Do much more for less with US Legal Forms!

Form popularity

FAQ

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

So yes California law does seem to allow a trust to be a joint tenant.It has to be the person who transfers it to the trust. So, for example, Able and Buddy own a property together as joint tenants. Able wants to transfer his half to his trust.

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

Cash Accounts. Rafe Swan / Getty Images. Non-Retirement Investment and Brokerage Accounts. Non-qualified Annuities. Stocks and Bonds Held in Certificate Form. Tangible Personal Property. Business Interests. Life Insurance. Monies Owed to You.

Choose the type of trust. Identify the assets you want to put in the living trust, and gather the relevant documents. Choose a trustee who will manage assets in the trust. Create the trust document using online software or with the help of an estate planning lawyer. Sign the document in front of a notary public.

Property you put in a living trust doesn't have to go through probate, which means that the assets won't get tied up in court for months and maybe years. However, you don't have to put bank accounts in a living trust, and sometimes it's not a good idea.

Unfortunately for you and your other siblings, the Will generally does not override the Deed.Background: A key feature of the Joint Tenancy Deed is that, upon death of a joint tenant, it passes full ownership by automatic succession to the survivor without probate and with a minimum of paperwork.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

A trust can be used to manage estate taxes, shelter assets from creditors and pass on wealth to future generations. A family trust is a specific type of trust that families can use to create a financial legacy for years to come.