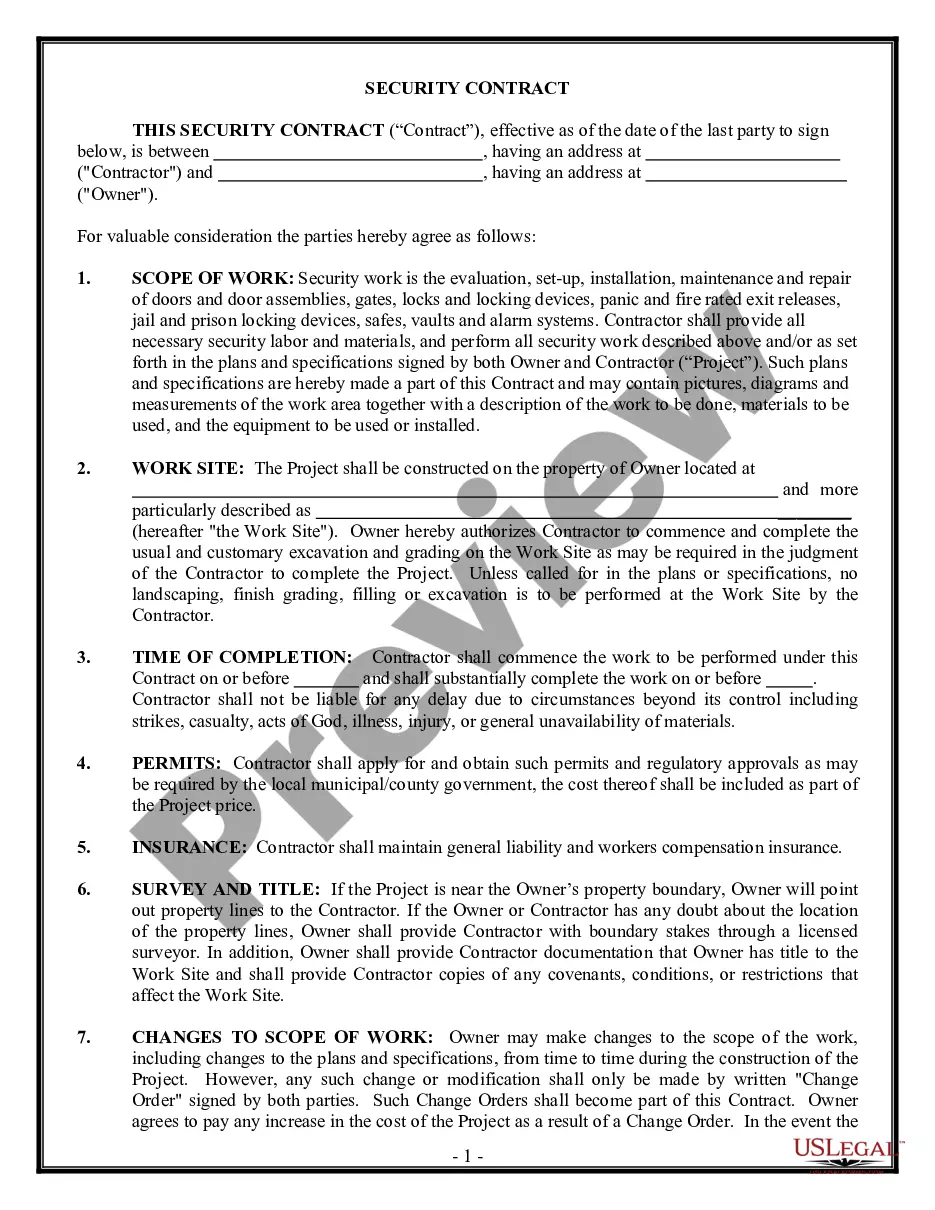

Child Support Calculation Sheet with instructions: This is an official Delaware Family Court form that complies with all applicable Delaware codes and statutes. USLF amends and updates all Delaware forms as is required by Delaware statutes and law.

Delaware Child Support Calculation Sheet with instructions

Description Delaware Child Support Calculator

How to fill out Delaware Child Support Calculation Sheet With Instructions?

The more papers you need to create - the more anxious you become. You can get a huge number of Delaware Child Support Calculation Sheet with instructions templates online, but you don't know those to rely on. Eliminate the hassle and make getting samples far more convenient with US Legal Forms. Get accurately drafted documents that are written to satisfy state requirements.

If you already have a US Legal Forms subscription, log in to the account, and you'll see the Download key on the Delaware Child Support Calculation Sheet with instructions’s web page.

If you’ve never used our service before, finish the sign up procedure with the following recommendations:

- Make sure the Delaware Child Support Calculation Sheet with instructions is valid in the state you live.

- Double-check your decision by reading the description or by using the Preview function if they are provided for the selected record.

- Click Buy Now to get started on the sign up procedure and choose a pricing plan that meets your preferences.

- Insert the requested data to make your account and pay for the order with your PayPal or credit card.

- Select a prefered document type and take your example.

Find every template you obtain in the My Forms menu. Simply go there to prepare new duplicate of the Delaware Child Support Calculation Sheet with instructions. Even when using expertly drafted forms, it is nevertheless crucial that you consider asking your local attorney to twice-check filled in form to make certain that your record is accurately completed. Do much more for less with US Legal Forms!

Delaware Child Support Formula Form popularity

Form Col Child Support Other Form Names

FAQ

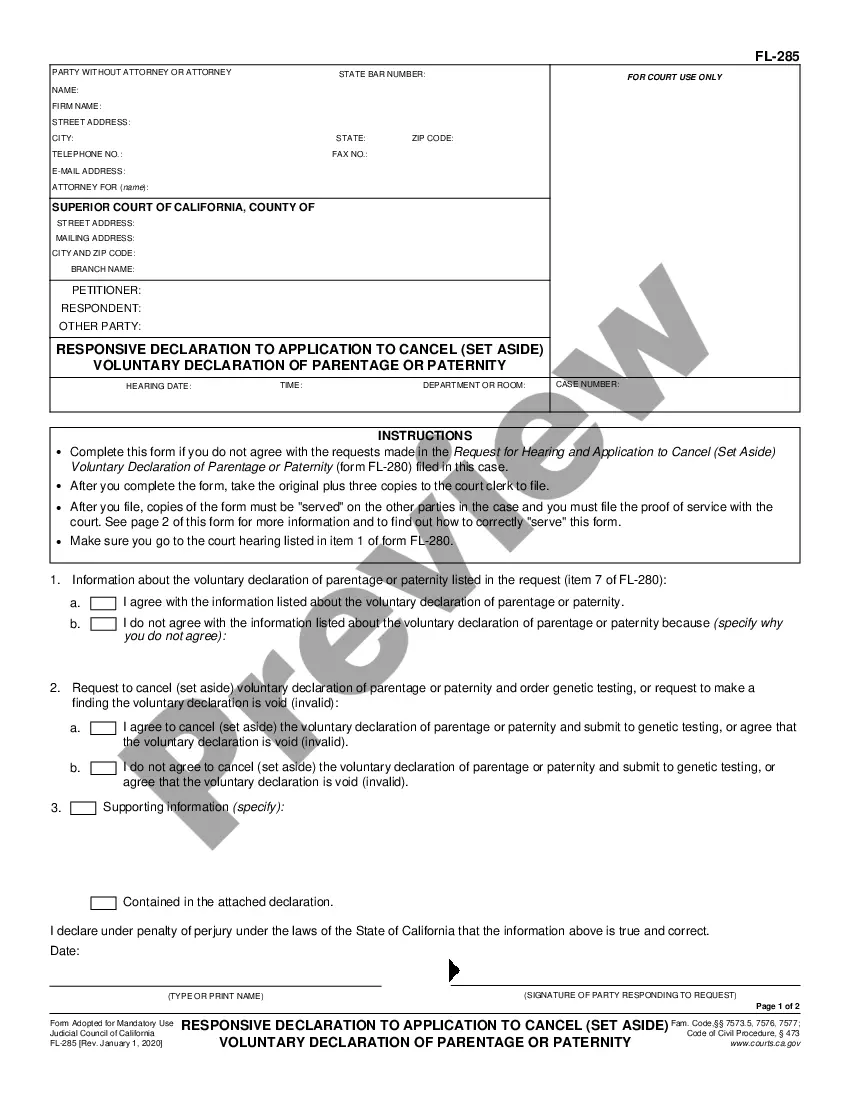

Just in case you didn't believe it was complicated, here is the formula California uses to calculate child support: CS = K (HN - (H%) (TN)). Here's what the letters mean: CS is the child support amount.

The flat percentage of the non-custodial parent's income that must be dedicated to child support is 25% percent for one child. The non-custodial parent will pay $625 a month.

The three basic principles of the Melson formula are 1) parents are entitled to sufficient income to meet their basic needs; 2) parents shouldn't be permitted to retain more income than required to meet their basic needs; and 3) the child(ren) are entitled to share in any additional income and benefit from a

Using the amount on line 150 on your income tax return (or notice of assessment from the Canada Revenue Agency), and then minus any union dues from that amount. Looking at your pay stubs for a full year and adding up what you were paid each month (before all the taxes were taken off)

The guideline states that the paying spouse's support be presumptively 40% of his or her net monthly income, reduced by one-half of the receiving spouse's net monthly income. If child support is an issue, spousal support is calculated after child support is calculated.

Each parent will be responsible for a percentage of the primary support obligation, calculated by dividing the parent's net available income by the combined net available income.

Child support is a percentage (roughly 20% for 1 child, and an additional 10% for each additional child) of the combined gross income of the parents, which is then split between both parents, depending on other factors.

Each parent will be responsible for a percentage of the primary support obligation, calculated by dividing the parent's net available income by the combined net available income.

CHILD SUPPORT BASED ON GROSS INCOME CSA advises parties that this is what the children would be entitled to if the two parents were still together. But they would only be entitled to a net amount if the two parents were still together.