Delaware TTP INFORMATION SHEET

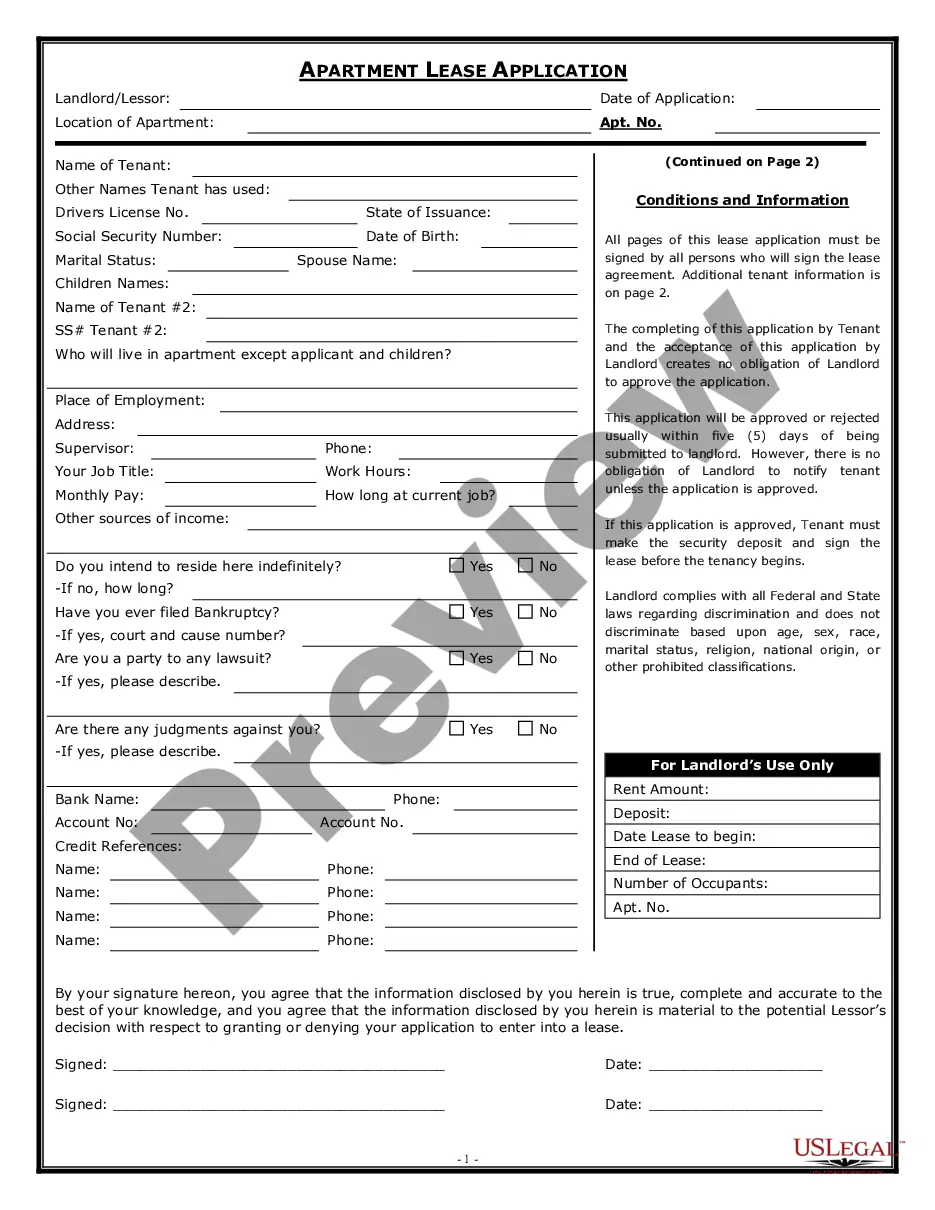

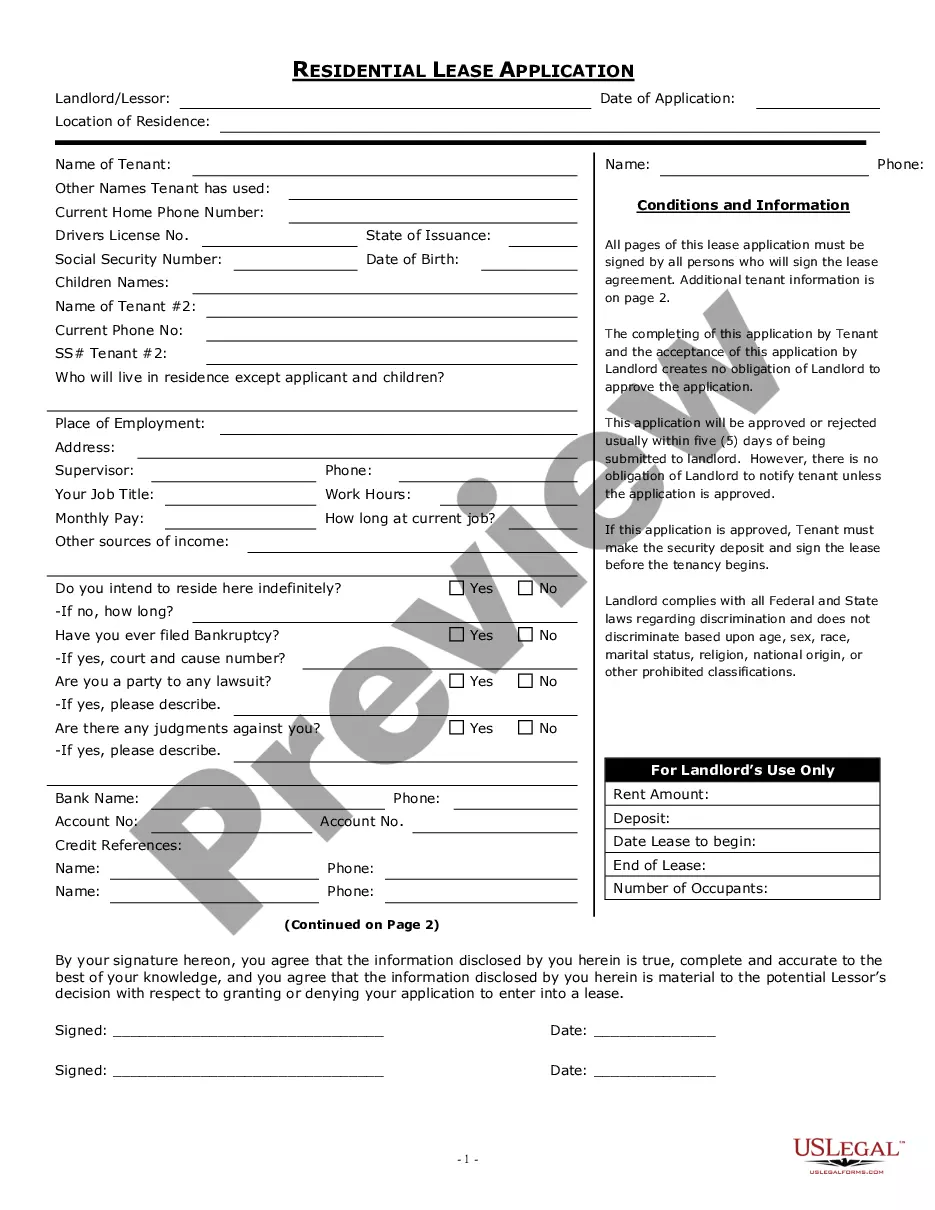

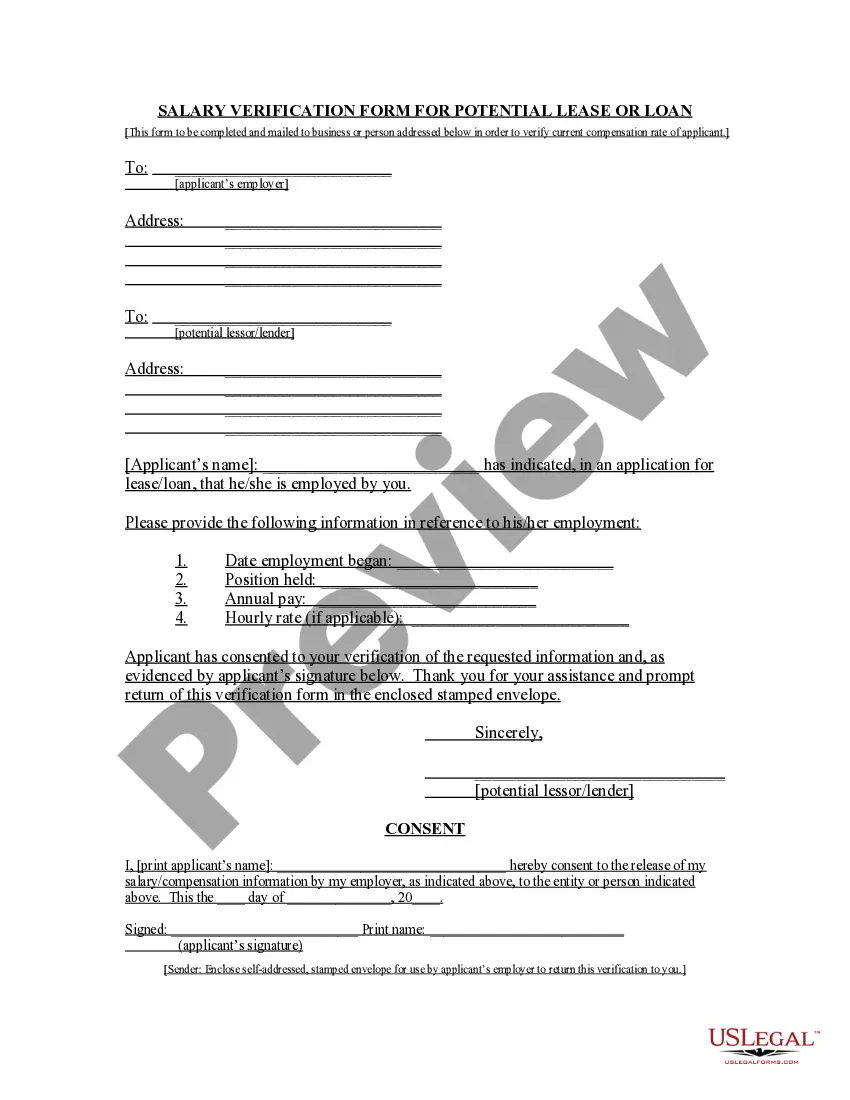

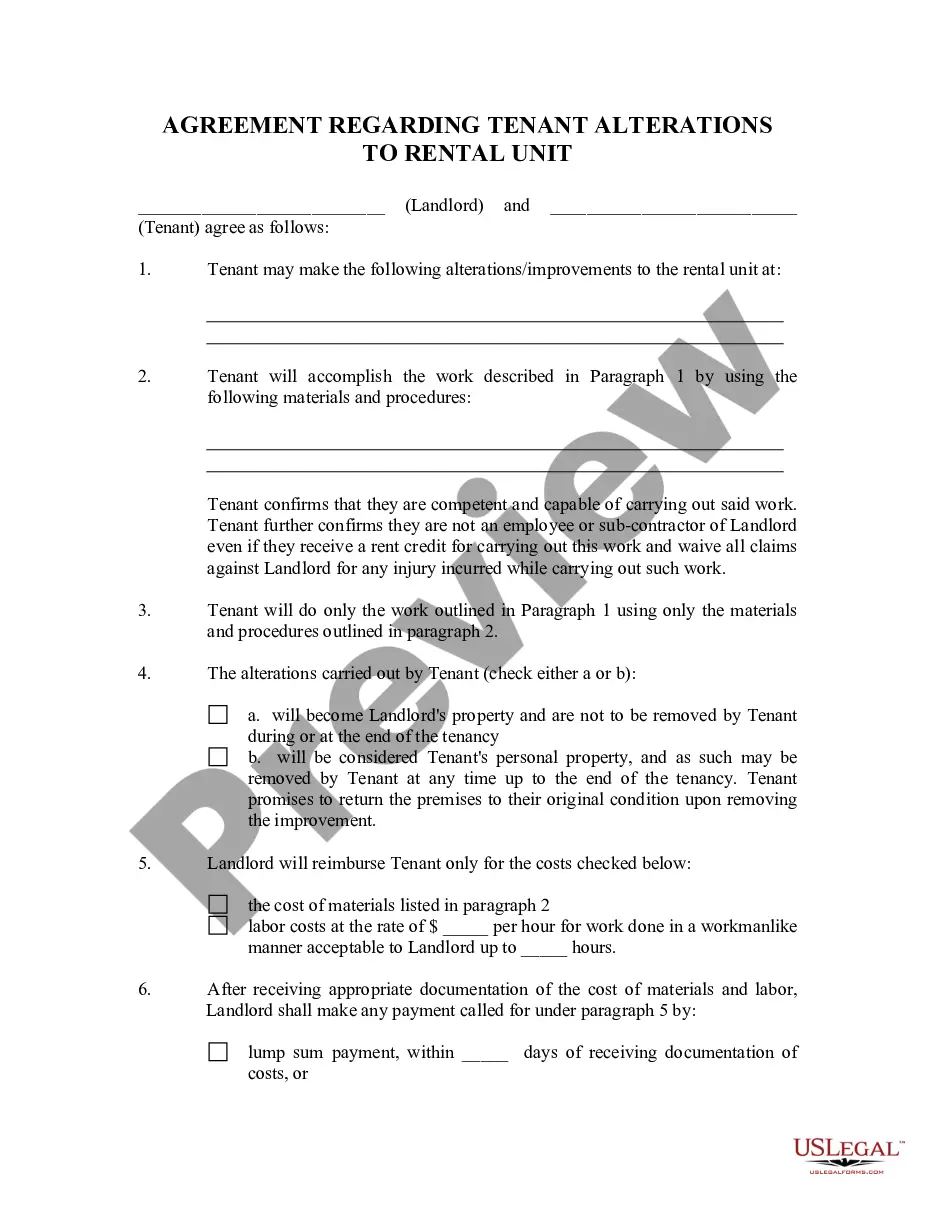

Description

How to fill out Delaware TTP INFORMATION SHEET?

If you’re looking for a way to appropriately complete the Delaware TTP INFORMATION SHEET without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of formal templates for every private and business situation. Every piece of paperwork you find on our online service is drafted in accordance with federal and state regulations, so you can be sure that your documents are in order.

Adhere to these simple instructions on how to acquire the ready-to-use Delaware TTP INFORMATION SHEET:

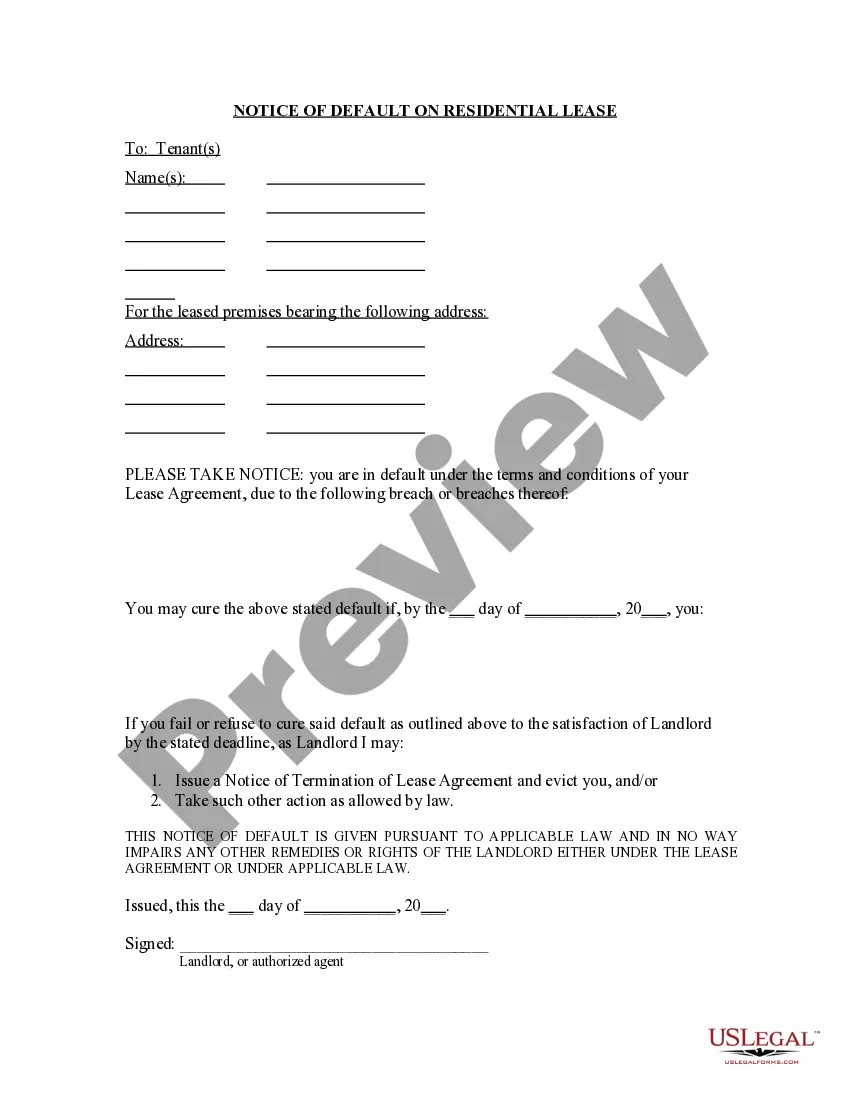

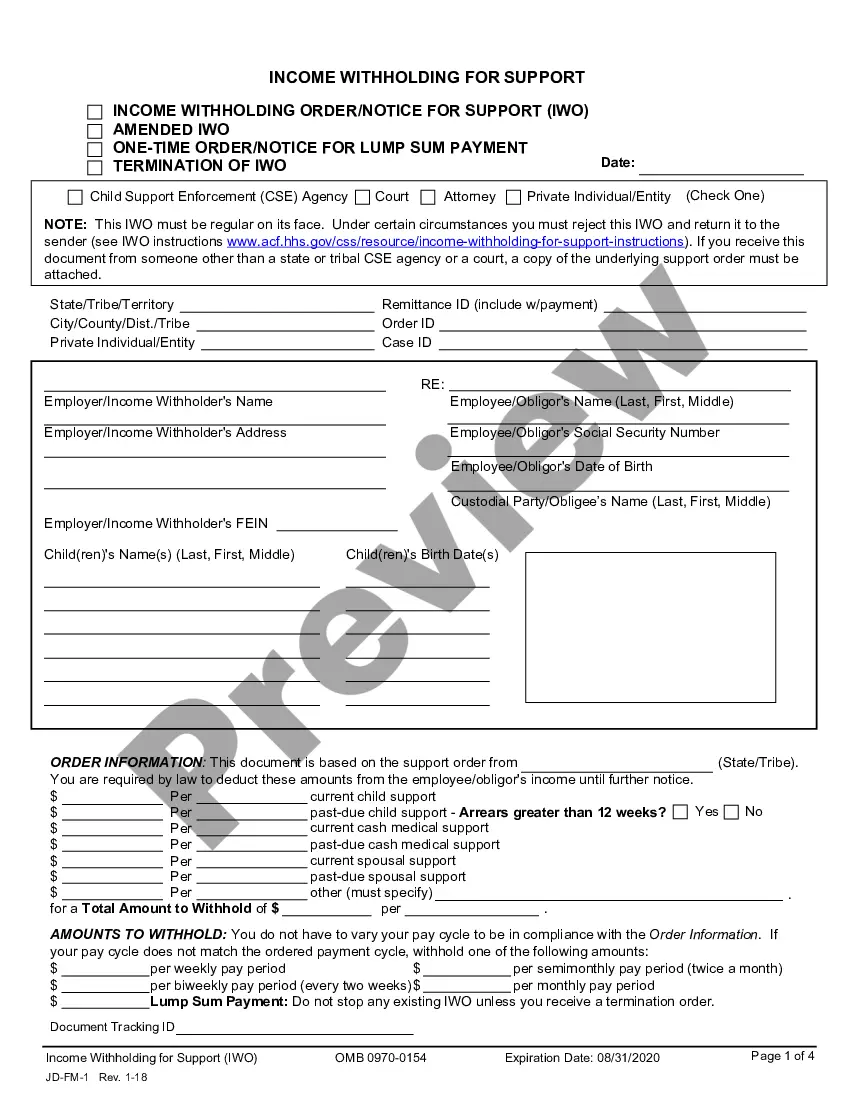

- Make sure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and select your state from the dropdown to locate another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Delaware TTP INFORMATION SHEET and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

First of all, Delaware does not have any state taxes, sales taxes, or inheritance taxes. Additionally, it imposes zero tax on Social Security benefits and offers up to $12500 exclusion from pension incomes for retirees aged 60 or above. Delaware's property tax is also very low, with a median rate of . 53%.

Personal Income Tax forms are available for photocopying at many Delaware public libraries. Please contact your local library branch for availability. You may download and print Personal Income Tax Forms and Business Tax Forms directly from our website, or call (302) 577-8209 to have forms mailed to you.

Delaware's Gross Receipts Tax is a tax on the total gross revenues of a business, regardless of their source. This tax is levied on the seller of goods or services, rather than on the consumer.

In plain language, the taxpayer is entitled to receive a refund for the amounts paid through withholding because the claim for refund was filed within three years of the original return and by the last possible date of the lookback period under Notice 2023-21 (i.e., July 15, 2020, plus three years).

New lookback period applies Notice 2023-21 specifies that the filing dates were postponed, not extended. Therefore, the lookback period was not extended by Notice 2020-23 or 2021-21 and remained at three years unless a taxpayer actually secured an extension to file.

Fixing the problem. This new guidance, found in Notice 2023-21, disregards the periods from April 15, 2020, to July 15, 2020 (for 2019 returns), and from April 15, 2021, to (for 2020 returns), when determining the beginning of the lookback period.

In plain language, the taxpayer is entitled to receive a refund for the amounts paid through withholding because the claim for refund was filed within three years of the original return and by the last possible date of the lookback period under Notice 2023-21 (i.e., July 15, 2020, plus three years).

The lookback period is the five-year period before the excess benefit transaction occurred. The lookback period is used to determine whether an organization is an applicable tax-exempt organization.