Delaware Promissory Note - Fill-in Form

Description

How to fill out Delaware Promissory Note - Fill-in Form?

The greater number of papers you have to prepare - the more nervous you become. You can get a huge number of Delaware Promissory Note - Fill-in Form blanks on the web, but you don't know which ones to rely on. Remove the hassle to make detecting samples more convenient with US Legal Forms. Get expertly drafted documents that are created to satisfy state demands.

If you have a US Legal Forms subscribing, log in to your account, and you'll see the Download key on the Delaware Promissory Note - Fill-in Form’s web page.

If you’ve never used our service earlier, finish the sign up procedure with the following steps:

- Make sure the Delaware Promissory Note - Fill-in Form applies in your state.

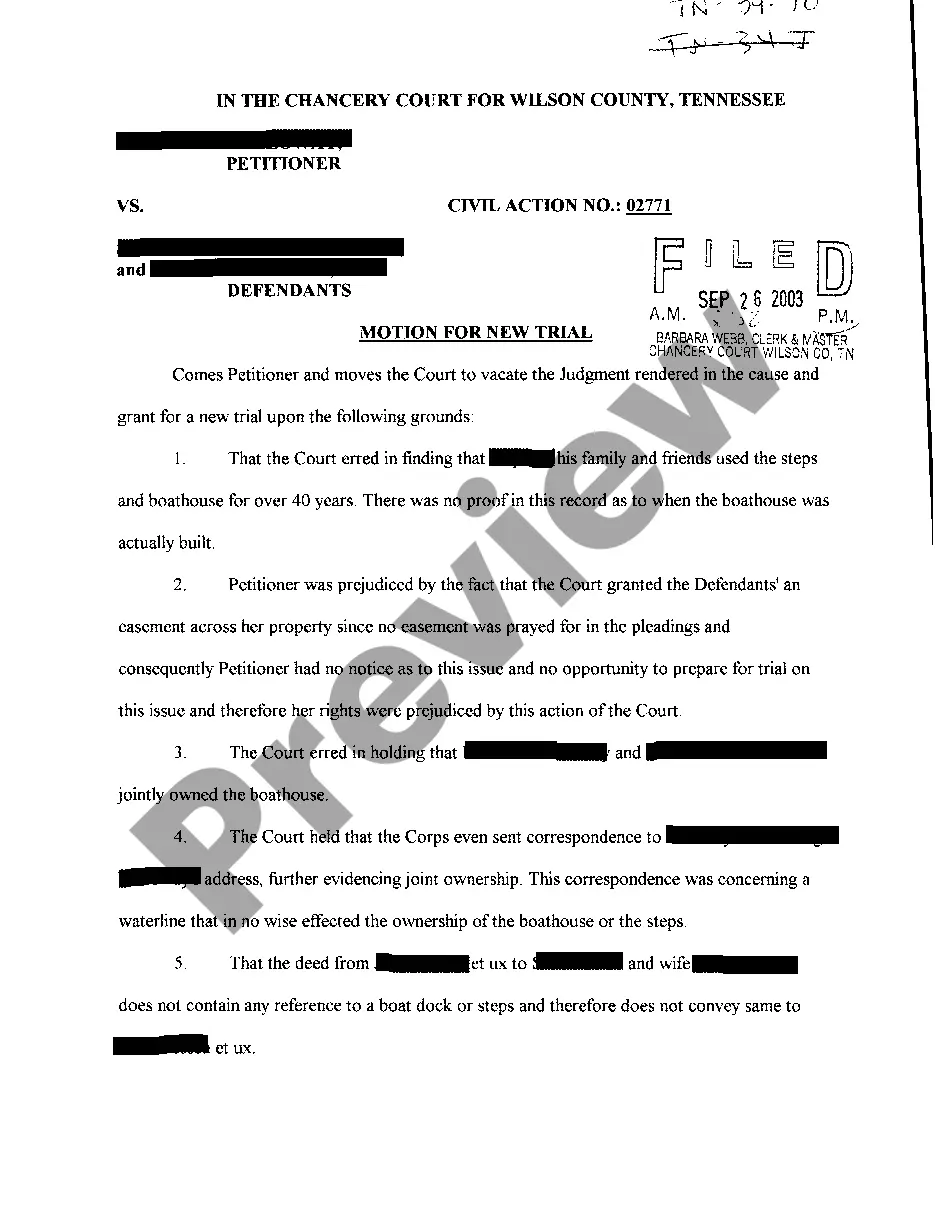

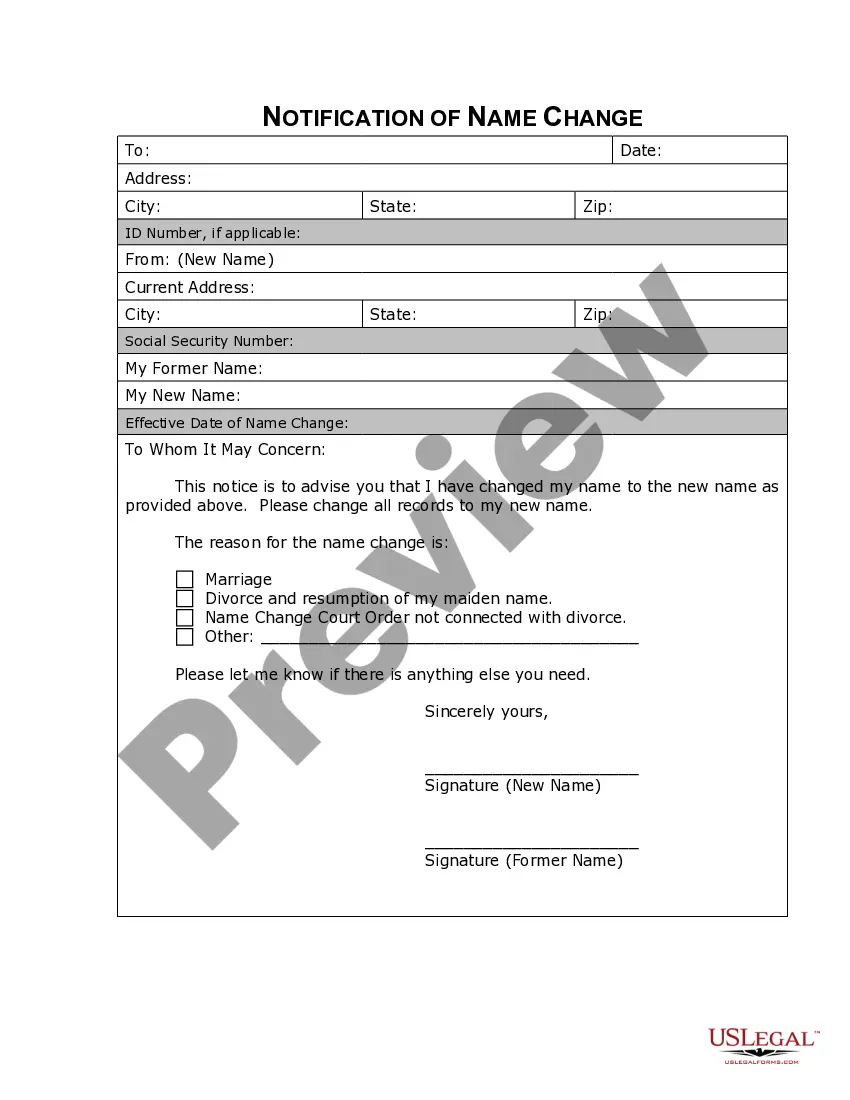

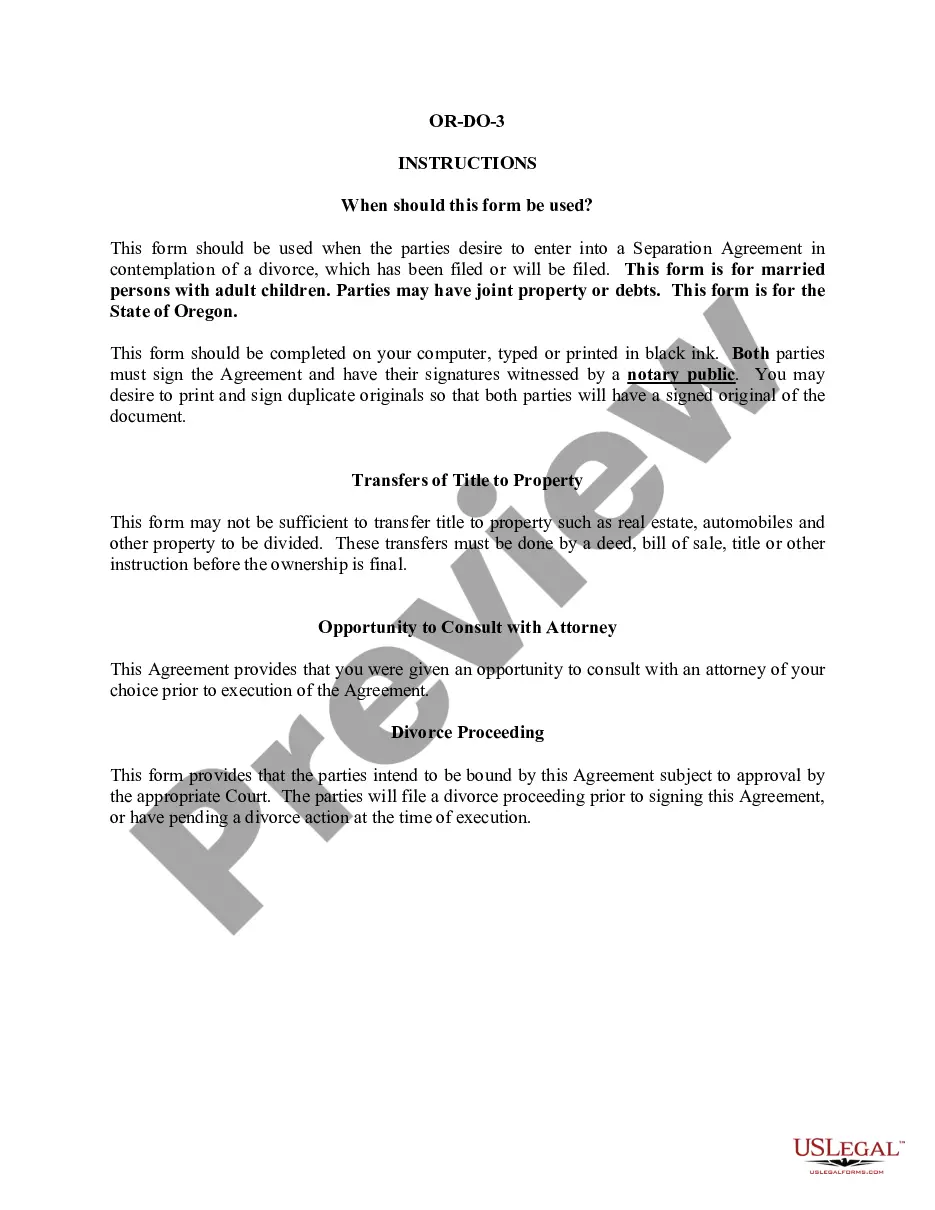

- Re-check your choice by studying the description or by using the Preview mode if they’re provided for the chosen document.

- Simply click Buy Now to begin the sign up process and select a costs plan that meets your requirements.

- Provide the requested information to create your profile and pay for the order with the PayPal or bank card.

- Choose a convenient document structure and have your example.

Find each template you obtain in the My Forms menu. Simply go there to produce a fresh copy of your Delaware Promissory Note - Fill-in Form. Even when using expertly drafted web templates, it’s nevertheless vital that you think about asking the local legal professional to re-check filled in sample to ensure that your document is correctly completed. Do more for less with US Legal Forms!

Form popularity

FAQ

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

A promissory note or promissory letter is a legal instrument that details a contractual agreement between two parties. When the parties are in agreement and sign the promissory note, it becomes a legally binding instrument that obligates both parties to perform according to their agreement.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Date. The promissory note should include the date it was created at the top of the page. Amount. Loan terms. Interest rate. Collateral. Lender and borrower information. Signatures.