The Delaware Life and Health Retaliatory Statement is a document published by the Delaware Department of Insurance that provides guidance on how insurance companies act when they are retaliating against a policyholder for filing a complaint. This document outlines the prohibited retaliatory actions, including cancellation or non-renewal of a policy, increasing the premiums for a policy, or refusing to provide coverage for a service or claim. It also outlines the procedures that must be followed by an insurance company in order to properly process a complaint and the rights of the policyholder during the complaint process. There are two types of Delaware Life and Health Retaliatory Statements: the Standard Form and the Standardized Form. The Standard Form outlines the specific actions that an insurance company can take in response to a complaint, while the Standardized Form provides a summary of the rights and responsibilities of both the policyholder and the insurance company in the complaint process.

Delaware Life and Health Retaliatory Statement

Description

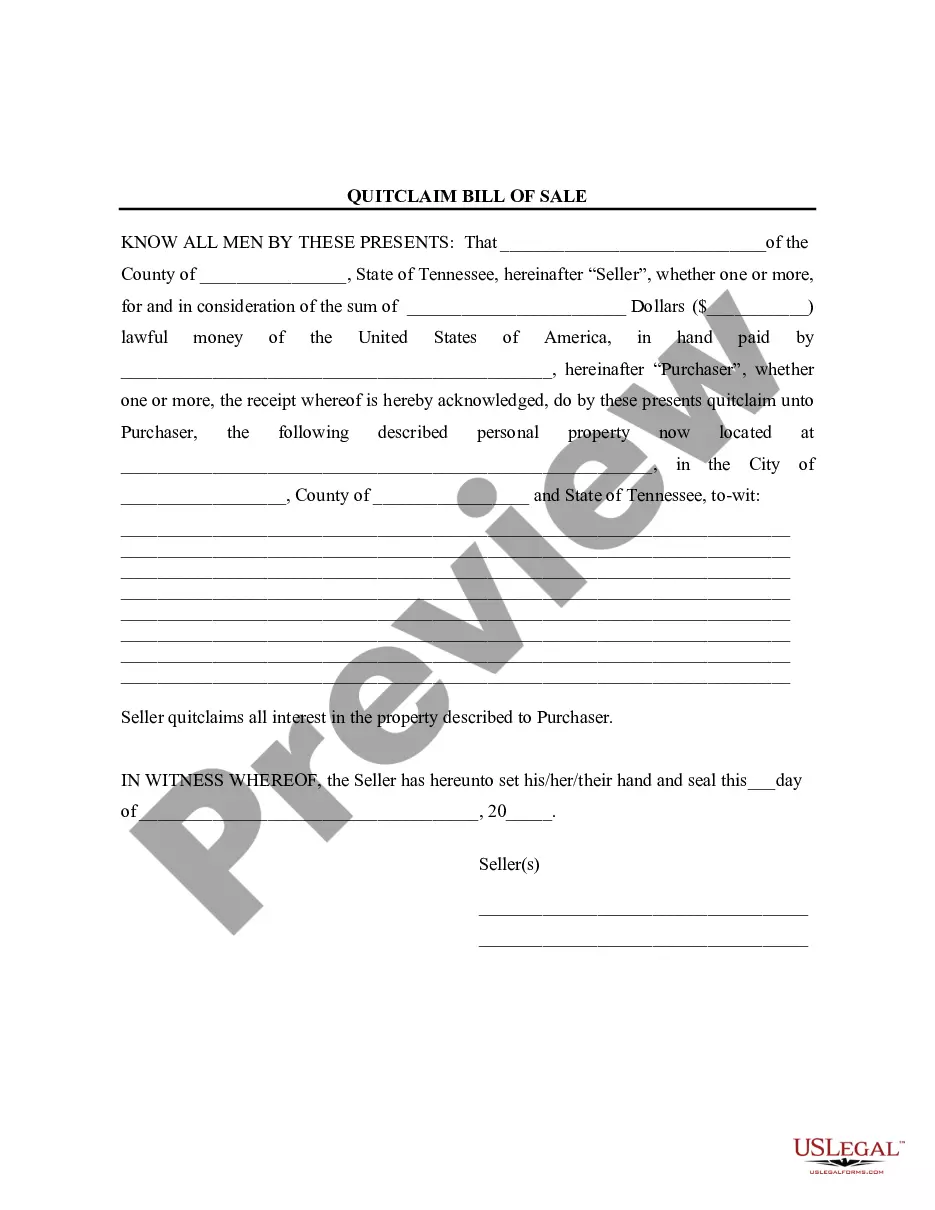

How to fill out Delaware Life And Health Retaliatory Statement?

If you’re looking for a method to effectively finish the Delaware Life and Health Retaliatory Statement without engaging a lawyer, then you’ve come to the right place. US Legal Forms has established itself as the most comprehensive and esteemed collection of formal templates for every individual and business scenario. Every document you discover on our web service is crafted in alignment with federal and state regulations, ensuring that your paperwork is properly organized.

Follow these straightforward directions on how to acquire the ready-to-use Delaware Life and Health Retaliatory Statement.

Another significant benefit of US Legal Forms is that you will never misplace the documents you purchased - you can access any of your downloaded forms in the My documents tab of your profile whenever you require it.

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by examining its text description or browsing through the Preview mode.

- Input the document name in the Search tab located at the top of the page and select your state from the dropdown list to find another template if there are discrepancies.

- Repeat the content verification step and click Buy now when you are assured that the paperwork adheres to all the requirements.

- Log in to your account and click Download. Create an account with the service and choose a subscription plan if you don’t already possess one.

- Utilize your credit card or the PayPal option to settle your US Legal Forms subscription. The template will be ready for download immediately after.

- Decide on the format in which you wish to save your Delaware Life and Health Retaliatory Statement and download it by clicking the suitable button.

- Import your template into an online editor to complete and sign it quickly or print it out to prepare your physical copy manually.

Form popularity

FAQ

To change your name on your insurance license in Delaware, submit the required documentation to the Delaware Department of Insurance. This usually includes proof of your legal name change along with a form specific to this request. Make sure that your updated information complies with the Delaware Life and Health Retaliatory Statement, as it ensures your professional standing.

To change your last name on your insurance, reach out to your current insurance provider with the necessary documentation, such as a marriage certificate or court order. They will guide you through the process and clarify any implications regarding the Delaware Life and Health Retaliatory Statement.

To obtain your life insurance license in Delaware, you must first complete the required pre-licensing education courses. Afterward, you’ll need to pass the state’s licensing exam. Ensure you’re familiar with the Delaware Life and Health Retaliatory Statement, as it relates to your licensing process.

To change your name in your insurance letter, contact your insurance provider directly. You may need to provide legal documents that verify your name change. It’s important to keep your records updated to ensure they align with the Delaware Life and Health Retaliatory Statement requirements.

The commissioner of insurance typically does not have the authority to create laws; that power resides with the state legislature. Instead, the Commissioner interprets and enforces existing laws to protect consumers and ensure fair practices within the industry. It’s important to understand this distinction, especially when considering legal documents such as the Delaware Life and Health Retaliatory Statement.

In most states, the chief responsibility of the Insurance Commissioner is to regulate the insurance industry and protect consumers. This includes enforcing laws, monitoring market practices, and addressing complaints against insurers. By overseeing elements like the Delaware Life and Health Retaliatory Statement, the Commissioner ensures a transparent and accountable insurance system.

The insurance commission serves several key functions, including regulating insurer practices, overseeing solvency, and protecting consumer rights. This department also assesses filings such as the Delaware Life and Health Retaliatory Statement to ensure compliance with state regulations. By executing these functions, the commission plays a vital role in maintaining the integrity of the insurance market.

The primary purpose of an Insurance Commissioner is to safeguard the interests of insurance consumers in the state. This office ensures that insurance companies operate fairly and within the law, creating a secure marketplace. The Delaware Life and Health Retaliatory Statement is one of many aspects that the Commissioner evaluates to foster stability in the insurance sector.

The Delaware Life and Health Insurance Guaranty Association offers protection to policyholders in the event that an insurance company becomes insolvent. This association provides a safety net for customers regarding life and health insurance claims, ensuring that they still receive benefits. Understanding this protection is crucial when considering the implications of the Delaware Life and Health Retaliatory Statement.

The Delaware Insurance Commissioner oversees the regulation of the insurance industry in Delaware. This role includes ensuring that insurance companies comply with state laws and protecting consumers from unfair practices. By managing the Delaware Life and Health Retaliatory Statement process, the Commissioner aims to maintain a fair and competitive environment for both insurers and policyholders.