Delaware Form PF-4 is a form used by corporations and limited liability companies (LCS) registered in the State of Delaware for filing a statement of dissolution with the Delaware Secretary of State. The form is available for different types of entities, including corporations, limited liability companies, and limited partnerships. The form requires the dissolution statement to be signed by the Secretary of State, all members of the company, and any other persons authorized to sign the document. The form also requires information about the company’s registered agent, registered office, and all members of the company. Delaware Form PF-4 must be accompanied by a $50 filing fee. There are three types of Delaware Form PF-4: one for corporations, one for LCS, and one for limited partnerships.

Delaware Form PF-4

Description

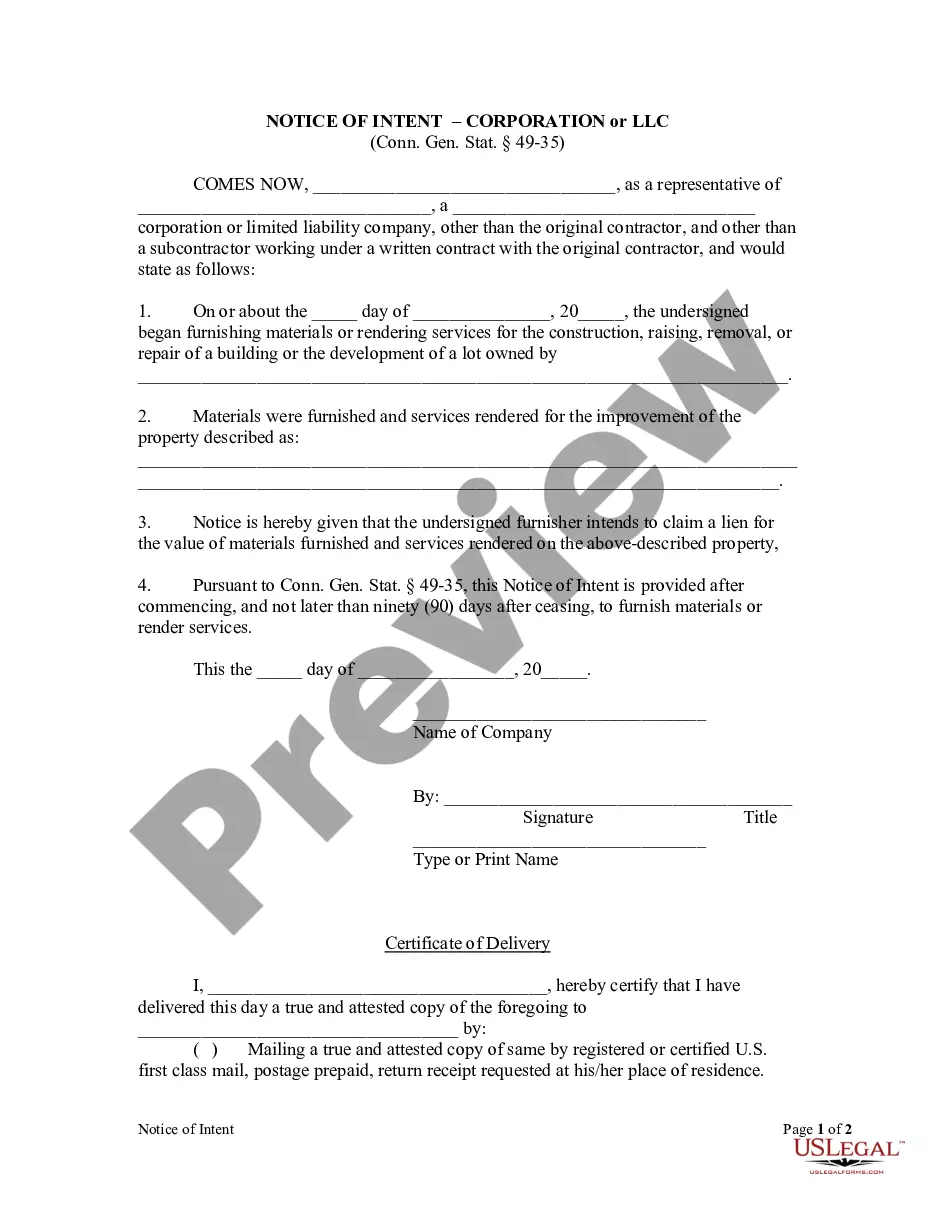

How to fill out Delaware Form PF-4?

US Legal Forms is the most straightforward and profitable way to locate suitable legal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and verified by lawyers. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your Delaware Form PF-4.

Obtaining your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a properly drafted Delaware Form PF-4 if you are using US Legal Forms for the first time:

- Read the form description or preview the document to make sure you’ve found the one meeting your demands, or locate another one utilizing the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you prefer most.

- Create an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Delaware Form PF-4 and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual fill-out or import it to an online editor to fill it out and sign more efficiently.

Take advantage of US Legal Forms, your reliable assistant in obtaining the corresponding formal paperwork. Give it a try!

Form popularity

FAQ

The Delaware Tax Power of Attorney Form allows a Principal to grant permission to an individual, business entity or tax attorney to assist with tax preparation or to represent the Principal in the event of questionable issues with tax returns before the Internal Revenue Service.

Cost to Form an LP: The state of Delaware charges a filing fee of $200 to form a limited partnership.

If your refund is in a status of Pending, please allow 10-12 weeks for it to process. If you have any questions please contact the Delaware Division of Revenue at (302) 577-8200.

Who Must File? 1. Non-Residents ? File a tax return if you have any gross income during the tax year from sources in Delaware. If your spouse files a married filing separate return and you had no Delaware source income, you do NOT need to file a Delaware return.

You are a part-year resident of Delaware if you were domiciled in Delaware for part (but not all) of 2022. Even if you were not domiciled in Delaware in 2022, if you spent more than 183 days in Delaware in 2022 and maintained a place of abode there, you are considered a resident.

State Taxes If you don't live in Delaware and you sell Delaware real estate, your gains will be taxed at a rate of 6.75%. Real estate taxes can be complicated, especially when you're selling property. Make sure you talk to your real estate agent about your potential tax liability.

First of all, Delaware does not have any state taxes, sales taxes, or inheritance taxes. Additionally, it imposes zero tax on Social Security benefits and offers up to $12500 exclusion from pension incomes for retirees aged 60 or above. Delaware's property tax is also very low, with a median rate of . 53%.

As a resident of Delaware, the amount of your pension and 401K income that is taxable for federal purposes is also taxable in Delaware. However, person's 60 years of age or older are entitled to a pension exclusion of up to $12,500 or the amount of the pension and eligible retirement income (whichever is less).