Delaware Instructions for the Fraud Reporting Form

Description

How to fill out Delaware Instructions For The Fraud Reporting Form?

How much time and resources do you typically spend on composing official paperwork? There’s a better option to get such forms than hiring legal experts or wasting hours searching the web for an appropriate blank. US Legal Forms is the leading online library that offers professionally designed and verified state-specific legal documents for any purpose, such as the Delaware Instructions for the Fraud Reporting Form.

To obtain and prepare an appropriate Delaware Instructions for the Fraud Reporting Form blank, follow these simple steps:

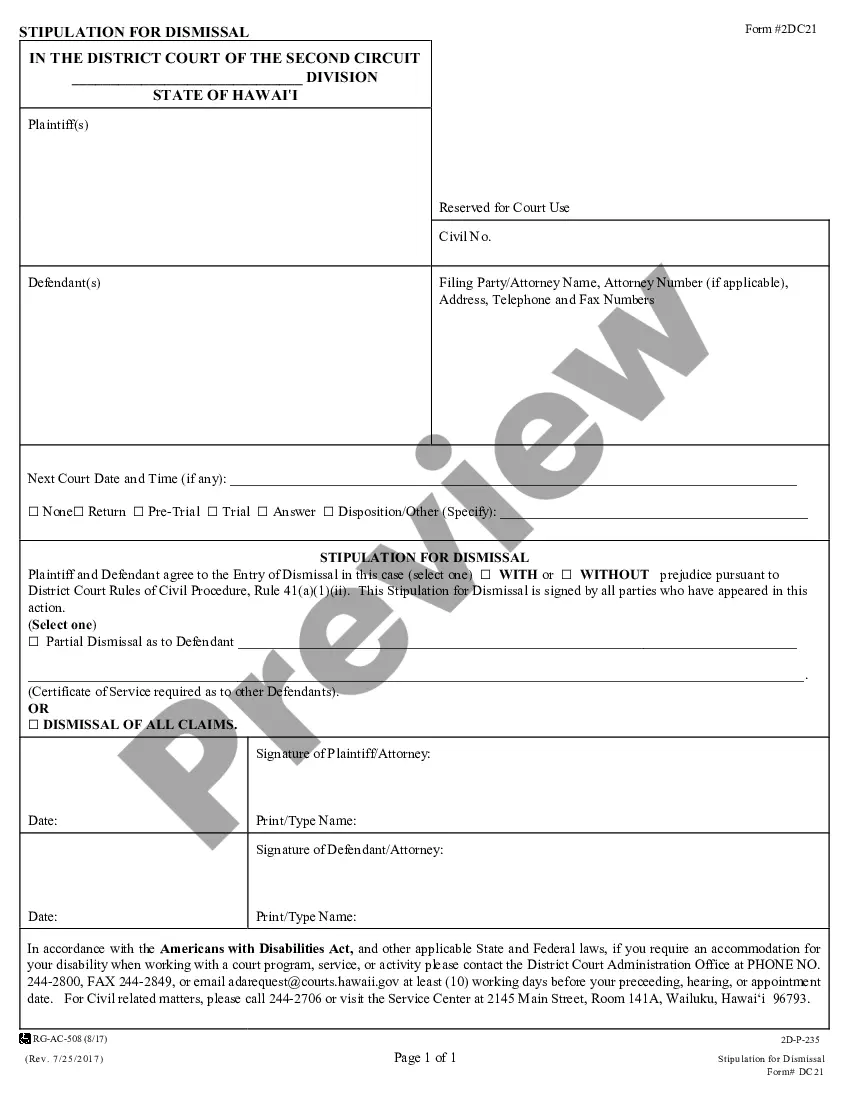

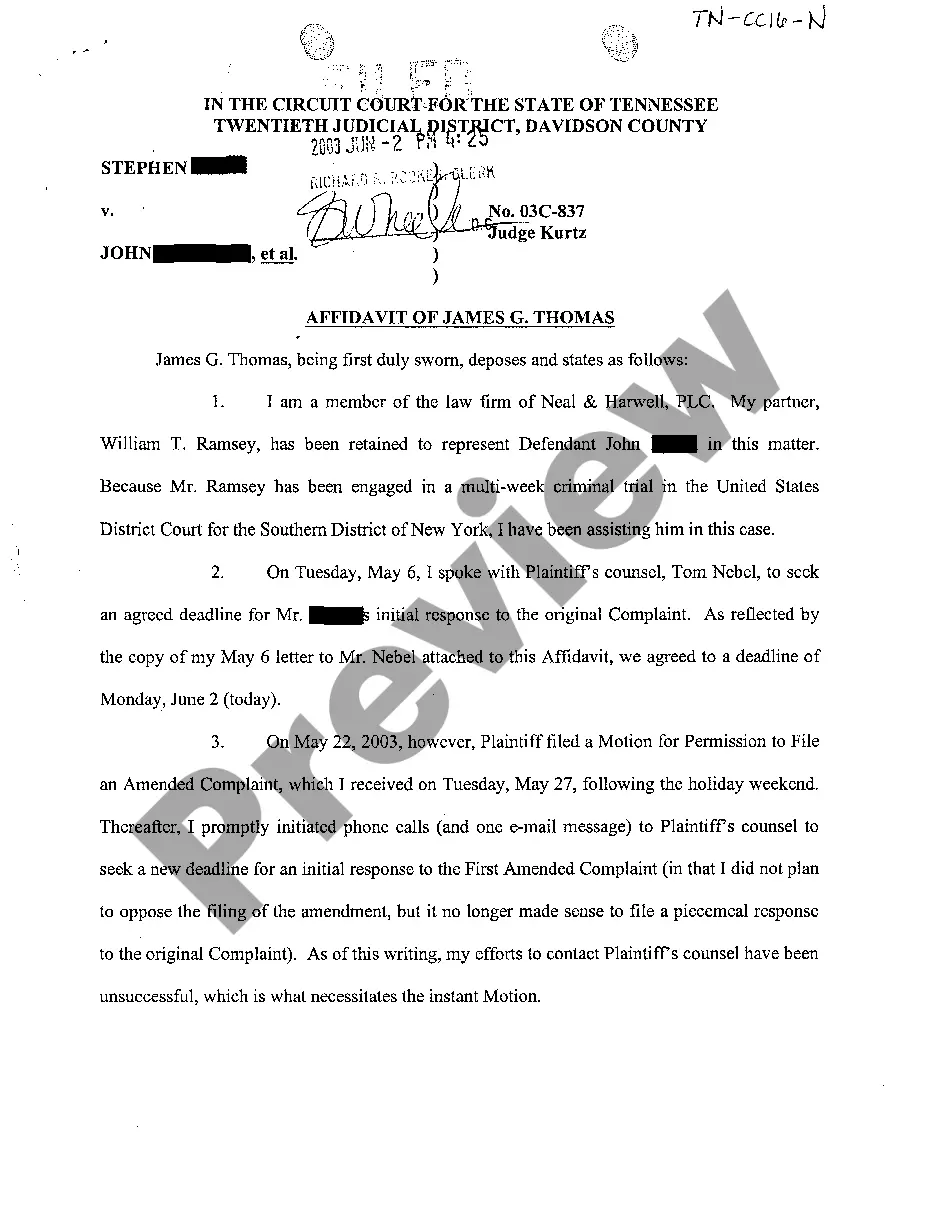

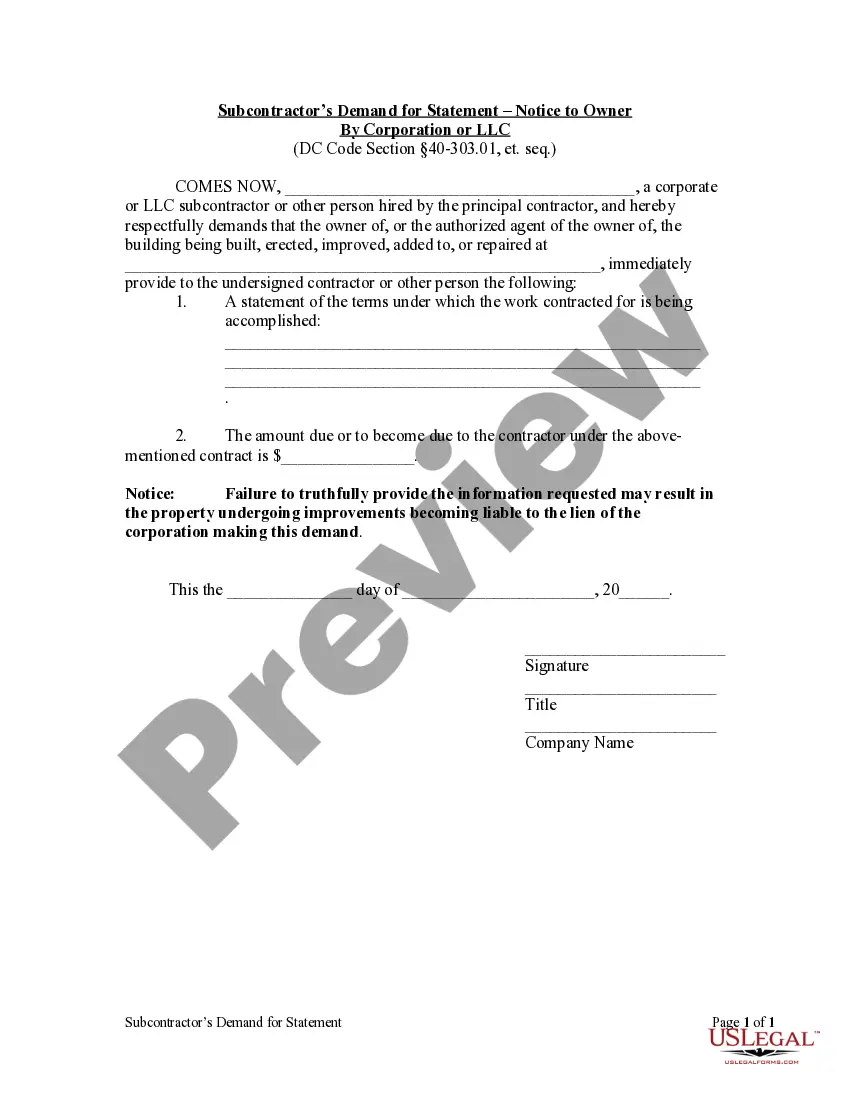

- Look through the form content to ensure it meets your state requirements. To do so, read the form description or utilize the Preview option.

- In case your legal template doesn’t satisfy your needs, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Delaware Instructions for the Fraud Reporting Form. If not, proceed to the next steps.

- Click Buy now once you find the right blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely reliable for that.

- Download your Delaware Instructions for the Fraud Reporting Form on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our library is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Pick them up anytime and re-complete your paperwork as frequently as you need.

Save time and effort preparing legal paperwork with US Legal Forms, one of the most reliable web services. Join us now!

Form popularity

FAQ

Report Tax Fraud If you suspect someone is committing tax fraud, you can fight back by contacting the Criminal Investigation Unit via email or calling our confidential TAX FRAUD HOTLINE at (302) 577-8958.

It shall be unlawful for any provider, by means of a false statement or representation, or by concealment of, or failure to disclose any material fact, or by any other fraudulent scheme or device on behalf of the provider or others to obtain or attempt to obtain payments or any other property, under any public

Step 1: Contact the police. If you are not sure which law enforcement agency to contact, please call the Attorney General's Consumer Protection Unit at (800) 220-5424. The Consumer Protection Unit can help you get in touch with the proper police agency, and can answer any other Identity Theft questions you may have.

The law prohibits business from making false statements about their own goods or services or the goods and services offered by other businesses. If you are unable to fill out the following Consumer Complaint Form, please call (800) 220-5424 or e-mail consumer.protection@delaware.gov for assistance.

To Report Insurance Fraud Punishment can include fines of up to $10,000 and up to 2 years in jail. Fraud can happen in auto insurance, homeowners insurance, life insurance, health insurance and workers compensation insurance. More about Auto Insurance Fraud.

You can report suspicious activity by calling 1-800-55-FRAUD (1-800-553-7283) or by utilizing this form.