The Delaware Schedule of Company Fees, Taxes and Deposits is an annual document that provides an overview of the various fees, taxes, and deposits that a business must pay to the state of Delaware. It is typically updated each year by the Delaware Secretary of State. There are three distinct types of Delaware Schedule of Company Fees, Taxes and Deposits: the Annual Report Fee, the Franchise Tax, and the Business License Tax. The Annual Report Fee is an annual fee paid to the state of Delaware to maintain the corporate records of the business. The current fee for filing an Annual Report is $50. The Franchise Tax is an annual tax paid to the state of Delaware based on the value of the business. The current tax rate is $250 per $1,000 of value. The Business License Tax is an annual tax paid to the state of Delaware based on the size and type of business. The current tax rate is determined by the type of business and is assessed on a sliding scale. The Delaware Schedule of Company Fees, Taxes and Deposits is an important document for businesses operating in Delaware, as it outlines all the various fees, taxes, and deposits that they must pay to the state.

Delaware Schedule of Company Fees, Taxes and Deposits

Description

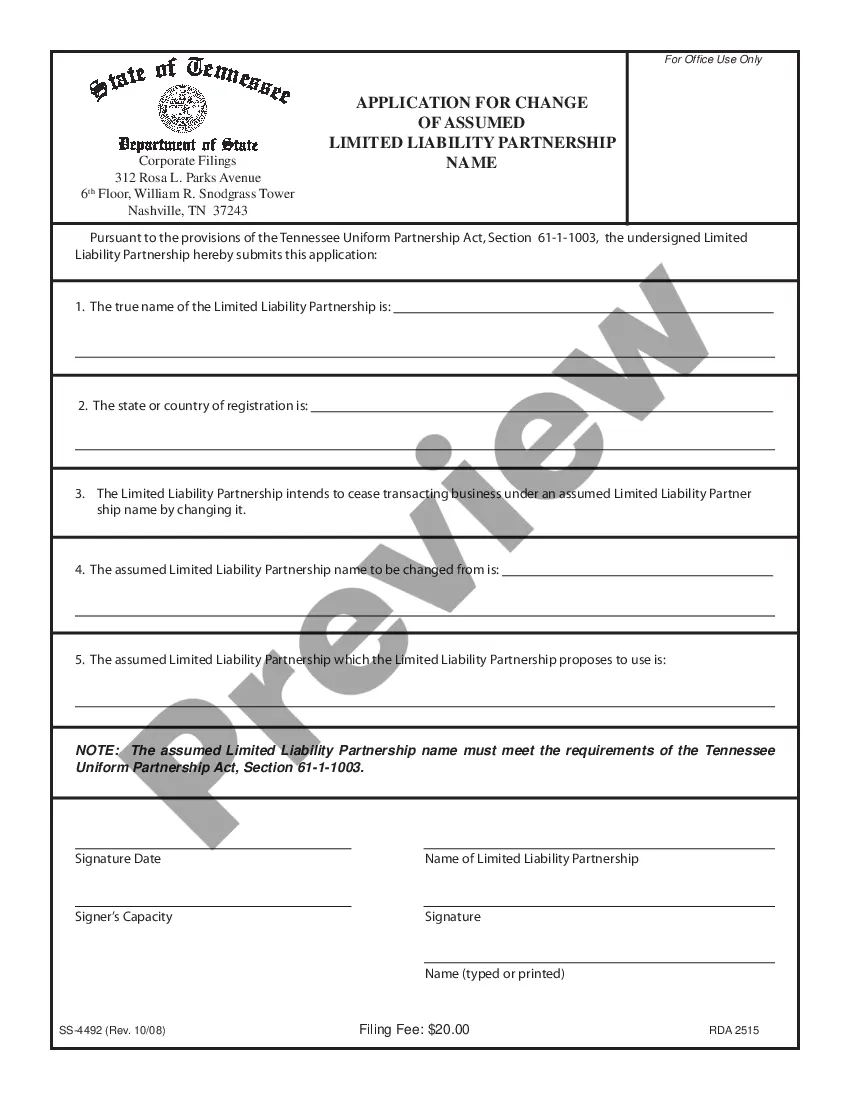

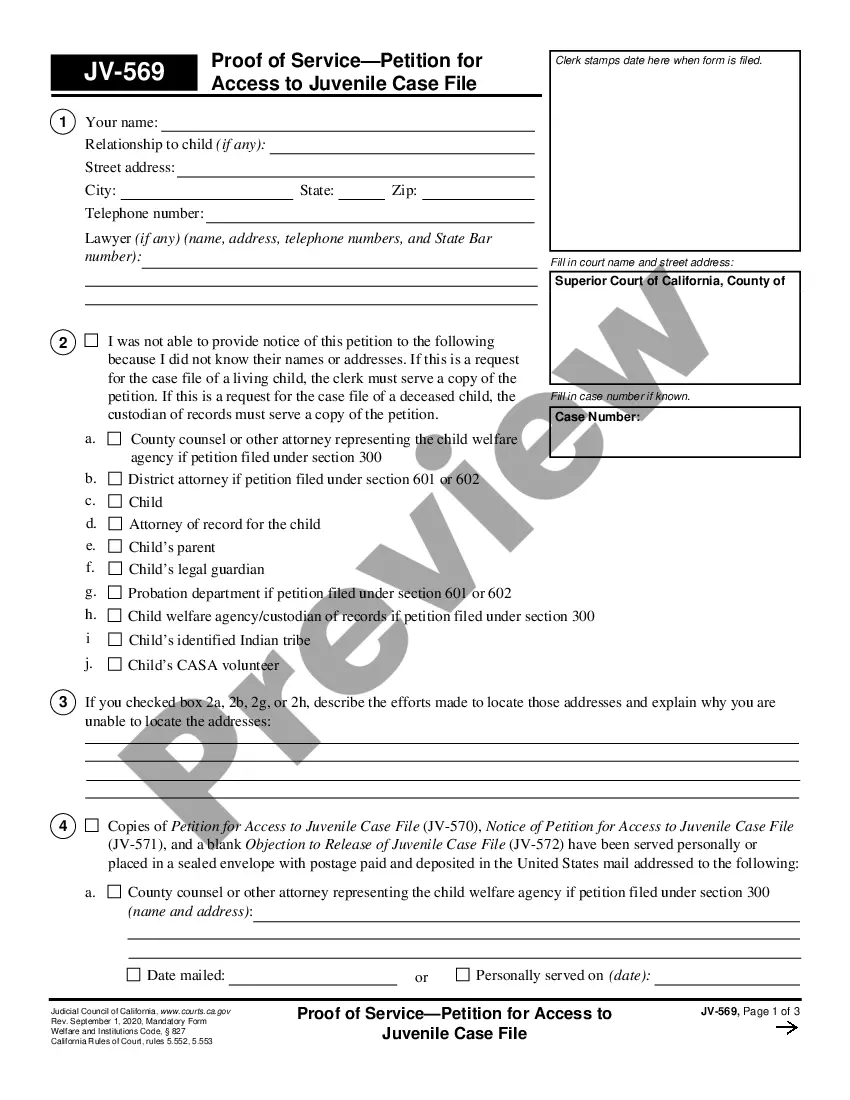

How to fill out Delaware Schedule Of Company Fees, Taxes And Deposits?

If you’re looking for a way to properly prepare the Delaware Schedule of Company Fees, Taxes and Deposits without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every personal and business scenario. Every piece of paperwork you find on our online service is drafted in accordance with federal and state regulations, so you can be certain that your documents are in order.

Follow these straightforward guidelines on how to acquire the ready-to-use Delaware Schedule of Company Fees, Taxes and Deposits:

- Make sure the document you see on the page complies with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the document title in the Search tab on the top of the page and select your state from the dropdown to locate an alternative template if there are any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your Delaware Schedule of Company Fees, Taxes and Deposits and download it by clicking the appropriate button.

- Upload your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

When assessing a Delaware LLC annual fee, you need to know that it costs $300 to maintain your LLC. The tax is usually due on June 1. Such a fee stems from the state's Annual Franchise tax, which is the right or privilege to conduct business in the state.

LLC/Partnership Tax Information All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report.

The Delaware LLC Annual Franchise Tax is a set fee of $300 per year. Keeping your Delaware LLC active involves some yearly tasks. The most important is paying the Delaware Annual Franchise Tax. Every Delaware LLC must pay its franchise tax each year to stay in Good Standing with the state.

LLC/Partnership Tax Information All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report.

A. Yes. Delaware requires every corporation filing a Delaware corporate income tax return to attach a completed copy of a pro forma federal tax return, including all schedules and attachments.

Business Tax Forms 2022-2023 Corporations incorporated in Delaware but not conducting business in Delaware are not subject to corporate income tax, 30 Del.C, Section 1902(b)(6) but do have to pay Franchise Tax administered by the Delaware Department of State.