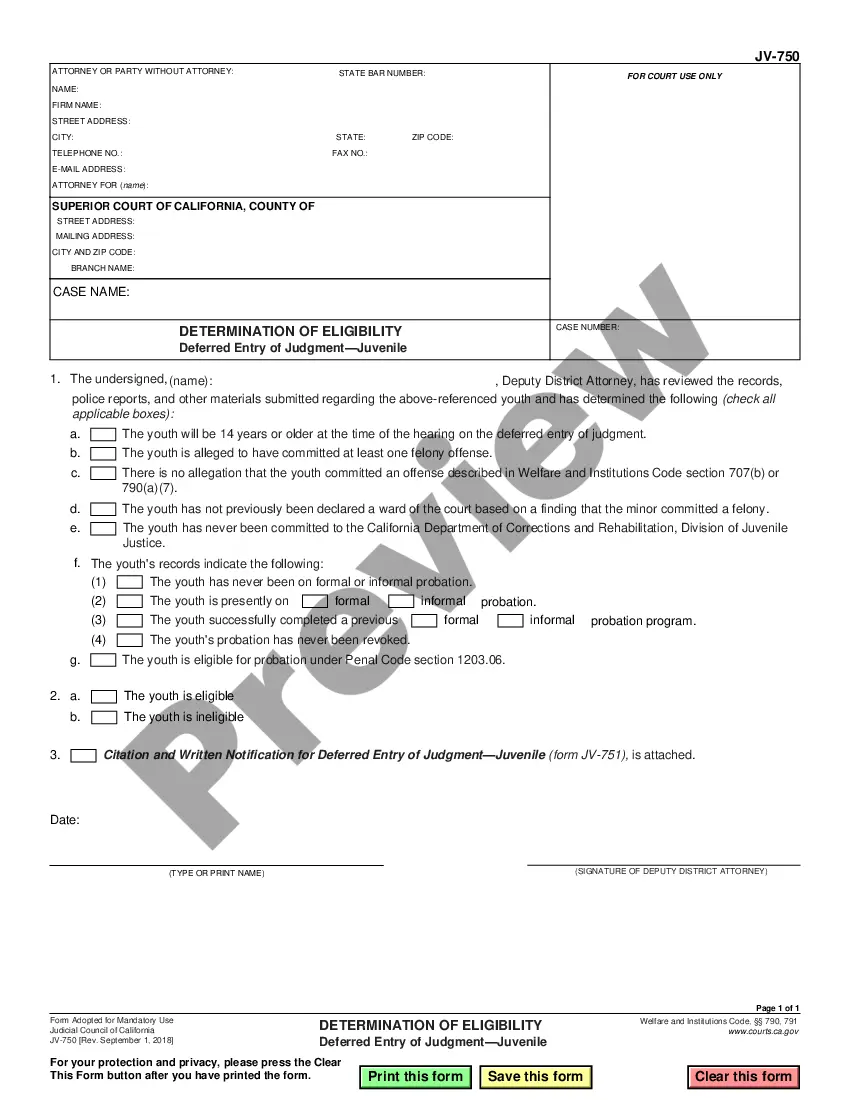

The Delaware Medicare Supplement Refund Calculation Form is a document used by Delaware residents to calculate the amount of refund they are eligible for from their Medicare Supplement insurance premiums. This form is used to determine the number of months for which a Medicare supplement refund is due and the amount of the refund. There are two types of Delaware Medicare Supplement Refund Calculation Form: one for individuals and one for couples. The form requires detailed information about the individual or couple's Medicare Supplement plan, including the effective date, the premium amount, any changes in the plan, and the number of months covered by the plan. Once the information is entered into the form, it will calculate the amount of refund due to the individual or couple.

Delaware Medicare Supplement Refund Calculation Form

Description

How to fill out Delaware Medicare Supplement Refund Calculation Form?

If you’re searching for a way to appropriately prepare the Delaware Medicare Supplement Refund Calculation Form without hiring a legal representative, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business scenario. Every piece of documentation you find on our web service is drafted in accordance with federal and state regulations, so you can be sure that your documents are in order.

Follow these simple instructions on how to obtain the ready-to-use Delaware Medicare Supplement Refund Calculation Form:

- Make sure the document you see on the page complies with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the form name in the Search tab on the top of the page and choose your state from the dropdown to locate an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Delaware Medicare Supplement Refund Calculation Form and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Delaware license plates are unique, featuring a prominent blue and gold design. They also include a variety of specialty plates that support local organizations and causes. Understanding the specifics of these plates can be crucial, especially when dealing with transactions. If you're navigating the complexities of vehicle sales, the Delaware Medicare Supplement Refund Calculation Form available on uslegalforms can assist you in managing your responsibilities efficiently.

Some states, including Florida and New York, require that you return your license plates when you sell your vehicle. This requirement varies widely from state to state, so it's important to check local regulations. If you are unsure, resources like the Delaware Medicare Supplement Refund Calculation Form can provide clarity on how such procedures may impact your vehicle transactions. Always confirm the rules in your state to avoid any surprises.

Filling out Medicare Form CMS 1763 requires a few simple steps. Start by providing basic personal information, such as your name and Medicare number. Next, clearly indicate your reason for requesting to terminate your Medicare coverage. Additionally, you can find guidance on completing this form effectively through the Delaware Medicare Supplement Refund Calculation Form, which helps you understand any potential refunds you may be eligible for.

Yes, Delaware has a state tax return that residents must file if they meet specific income criteria. This form helps you report your income, calculate your taxes owed, and claim any applicable deductions. The Delaware Medicare Supplement Refund Calculation Form can be an essential resource for accurate reporting and maximizing refunds.

Filing a tax return is mandatory if your income exceeds particular thresholds set by the state. In Delaware, even low income individuals may need to file to claim certain credits or refunds. Using the Delaware Medicare Supplement Refund Calculation Form can clarify your filing requirements and help ensure compliance.

Yes, if you have income or meet certain thresholds, you must file a Delaware tax return. This applies to residents and non-residents with Delaware-sourced income. Utilizing the Delaware Medicare Supplement Refund Calculation Form can simplify the process of determining what you owe or what refunds you might receive.

Yes, as a Delaware resident, you typically need to file a separate state tax return. This requirement applies even if you are filing a federal return. The Delaware Medicare Supplement Refund Calculation Form can help you determine the relevant deductions or exemptions that may apply to your situation, ensuring you meet state obligations.