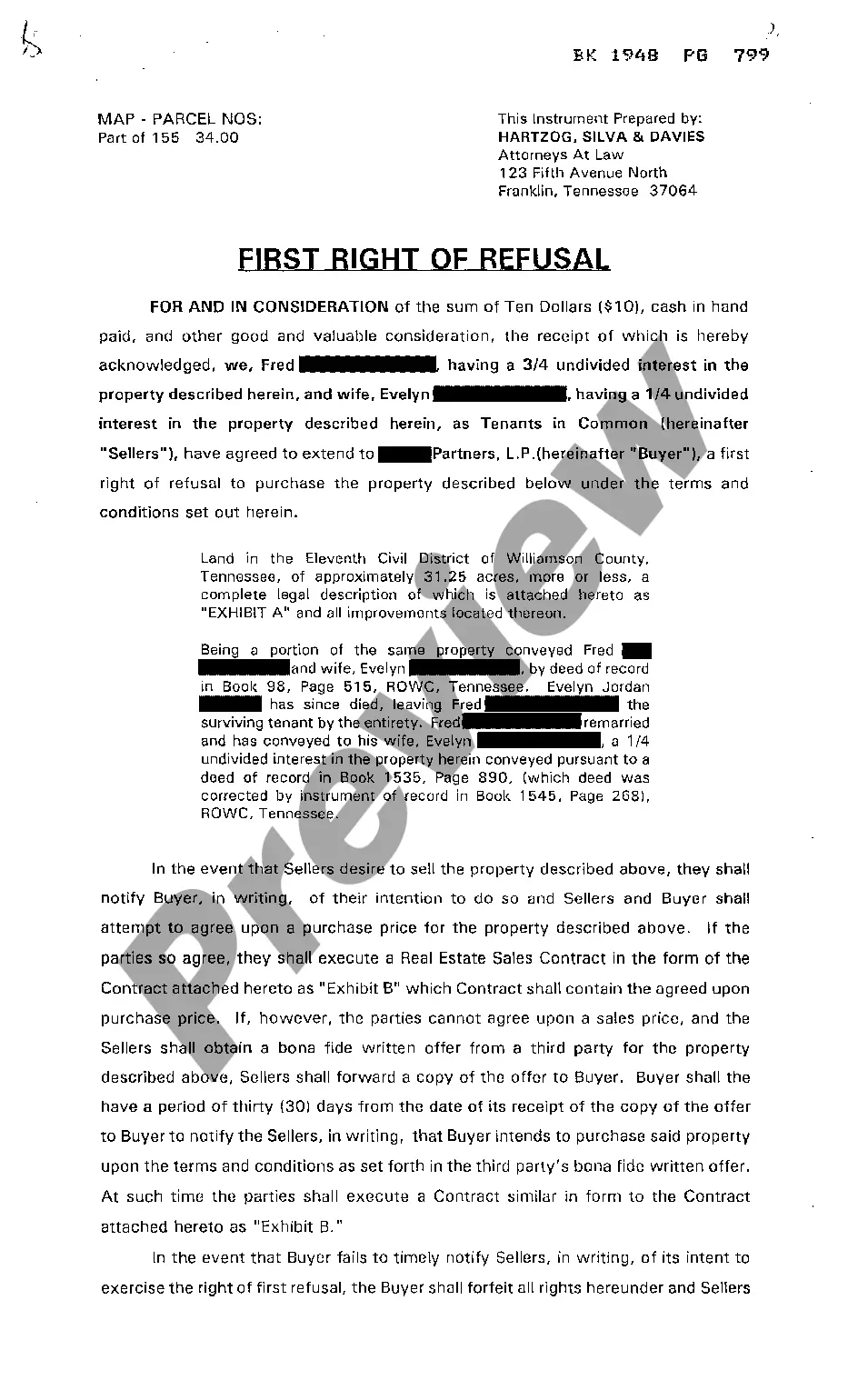

The Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies is a standardized form issued by the Delaware Department of Insurance that provides a detailed calculation of the insurer's benchmark ratio since inception for individual policies. The form is used by insurers to calculate their benchmark ratio for individual policies in Delaware, which is the ratio of the insurer's loss ratio to the aggregate loss ratio of all companies in the same line of insurance in Delaware. The form requires the insurer to provide information on the number of policies and the total premium and losses for each line of insurance, as well as the aggregate numbers for the entire company. There are two types of Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies: one for individual policies with no term limits and one for individual policies that have term limits.

Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies

Description

How to fill out Delaware Reporting Form For The Calculation Of Benchmark Ratio Since Inception For Individual Policies?

US Legal Forms is the easiest and most budget-friendly method to locate suitable official templates.

It’s the largest online collection of business and personal legal documents crafted and verified by attorneys.

Here, you can discover printable and fillable templates that meet federal and local standards - just like your Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies.

Review the form description or preview the document to ensure you’ve selected the one that meets your requirements, or search for another one using the search tab above.

Click Buy now when you’re confident of its suitability with all the criteria, and choose your preferred subscription plan.

- To acquire your template simply requires a few easy steps.

- Users who already hold an account with an active subscription just need to Log In to the site and download the document onto their device.

- Afterward, they can access it in their profile under the My documents tab.

- And here’s how you can obtain a professionally prepared Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies if you are visiting US Legal Forms for the first time.

Form popularity

FAQ

Yes, Delaware has various state tax forms for individuals and businesses. These forms cater to different tax situations and ensure proper compliance with state laws. Among these, the Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies is vital for accurately reporting your insurance policies.

Yes, filling out tax forms electronically is a convenient option available in Delaware. This allows you to complete and submit forms from the comfort of your home, minimizing paperwork. If you’re using the Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies, digital tools can help streamline this task.

Form 5403 in Delaware is related to the calculation of benchmarks for insurance companies. This specific form is crucial for accurately assessing insurance policies held in Delaware. Understanding how to fill out the Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies can help you navigate this requirement.

Yes, Delaware offers e-file options for various state tax forms, making it easier for you to submit your information electronically. This convenience streamlines the process and allows you to track your submission. When dealing with the Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies, e-filing can enhance your efficiency.

Yes, you can file your Delaware state taxes online, which makes the process quick and straightforward. You may find that using the online system reduces errors and speeds up your filing. For added support, you can utilize the Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies to ensure accurate reporting.

The form PIT RES stands for Personal Income Tax Resident form in Delaware. This form is specifically for individuals who reside in Delaware and need to report their income for tax purposes. If you're unsure about using the Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies, consider consulting resources that guide you through Delaware's tax requirements.

Yes, filing a Delaware tax return may be necessary if you have income sourced in Delaware. Individuals and businesses earning income within the state must report this on the appropriate forms. Remember, understanding your obligations regarding the Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies can simplify your reporting process.

Delaware offers income tax breaks for seniors, especially those aged 60 and above. Seniors may qualify for specific exemptions and deductions, which can effectively reduce their taxable income. Understanding these benefits can help seniors maximize their retirement income. When navigating these factors, the Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies can be a helpful resource.

The standard deduction in Delaware is set annually and varies by individual circumstances. Generally, the amount is designed to benefit taxpayers and can effectively decrease your taxable income. Being aware of the latest standard deduction figures is essential for accurate tax preparation. The Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies can provide guidance and updates on these amounts.

Yes, Delaware allows taxpayers to take standard deductions, which can lower your taxable income. The state uses a specific standard deduction amount, varying by filing status. Knowing the details about deductions can optimize your tax situation, making the Delaware Reporting Form for the Calculation of Benchmark Ratio Since Inception for Individual Policies a valuable tool for your financial planning.