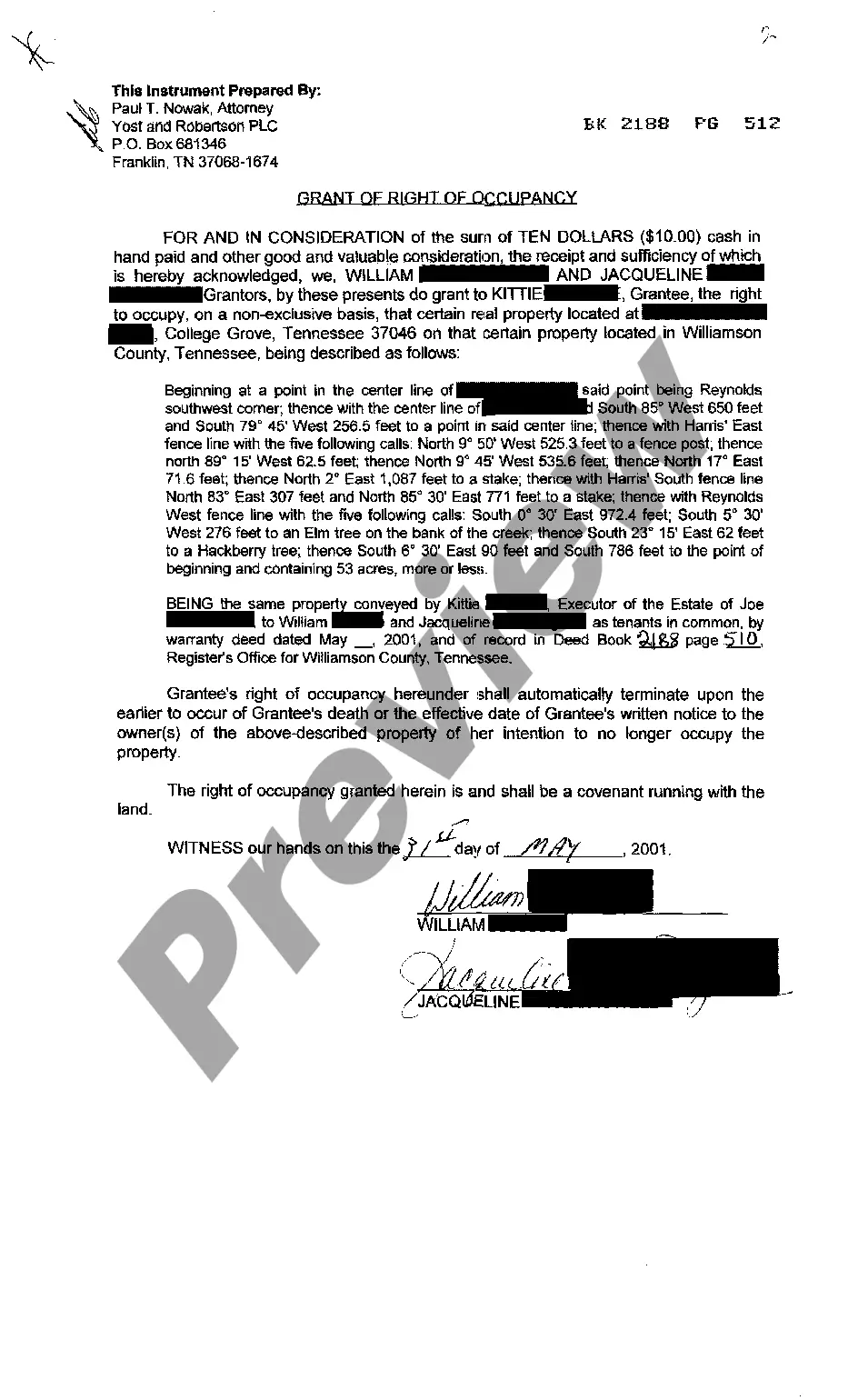

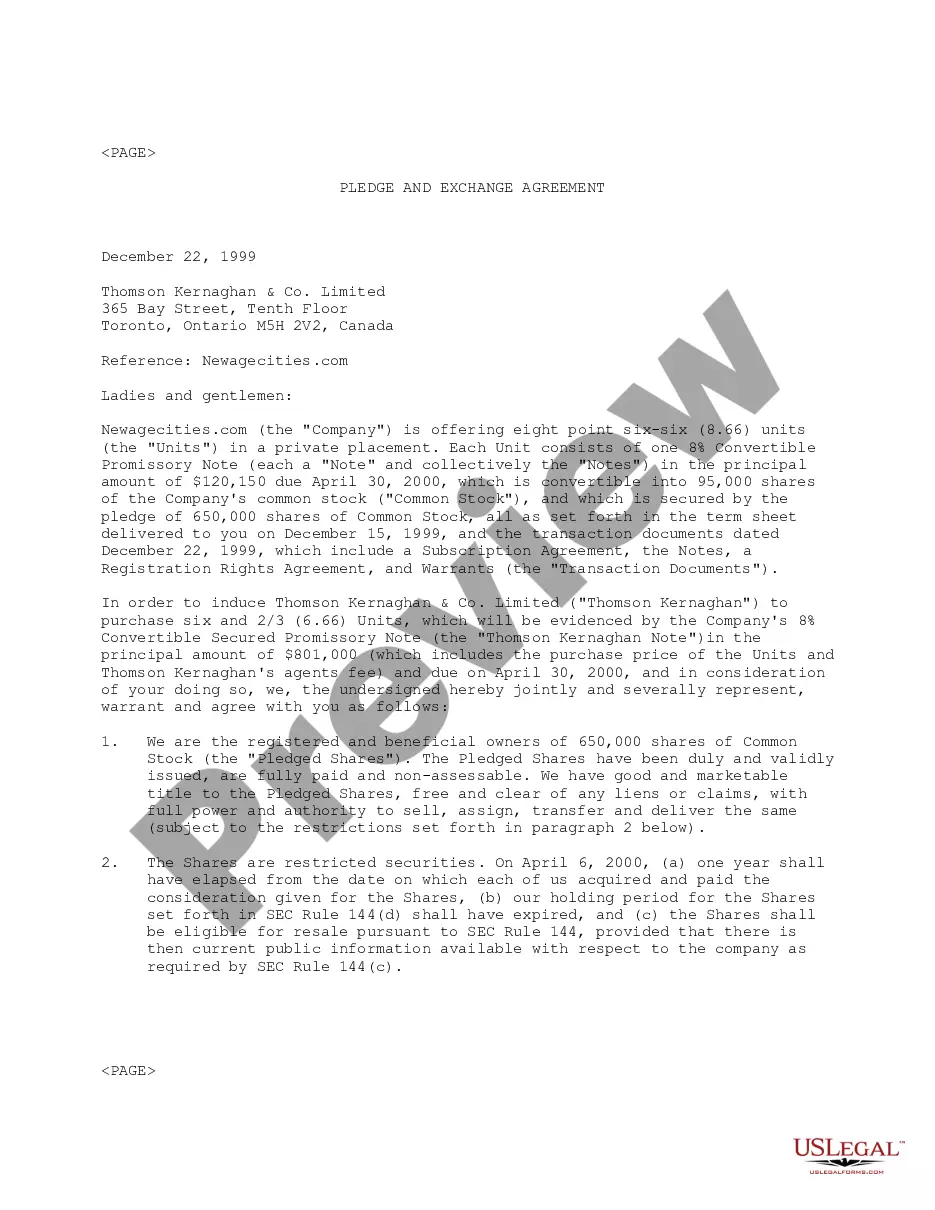

Delaware Insurance Certification Form is an official document that is used to verify the insurance coverage of the insured in the state of Delaware. It is typically used by insurance companies, employers, and lenders to ensure that the insured has adequate coverage. There are two types of Delaware Insurance Certification Forms which include the Standard Form and the Commercial Form. The Standard Form is used to certify the insurance coverage of individuals, while the Commercial Form is used to certify the insurance coverage of businesses. The Form requires the insured to provide information regarding their insurance policy, such as the type of coverage, the amount of coverage, and the duration of coverage. The Delaware Insurance Certification Form must be signed by both the insured and the insurance company in order to be valid.

Delaware Insurance Certification Form

Description

How to fill out Delaware Insurance Certification Form?

How much time and resources do you usually spend on drafting formal documentation? There’s a better way to get such forms than hiring legal specialists or spending hours searching the web for a suitable template. US Legal Forms is the premier online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Delaware Insurance Certification Form.

To get and complete a suitable Delaware Insurance Certification Form template, adhere to these simple steps:

- Examine the form content to ensure it meets your state requirements. To do so, read the form description or utilize the Preview option.

- In case your legal template doesn’t meet your needs, locate another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Delaware Insurance Certification Form. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full service.

- Register for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally reliable for that.

- Download your Delaware Insurance Certification Form on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you securely store in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us now!

Form popularity

FAQ

The FR 19 form is a certification of insurance, confirming that a vehicle owner maintains the necessary insurance coverage as required by Delaware law. This form is particularly important for motorists who have had their insurance lapse or have been involved in certain traffic violations. It serves to restore driving privileges once proof of insurance is established. Consider using our platform to quickly complete your Delaware Insurance Certification Form or FR 19 form as needed.

For homeowners, liability insurance is crucial to protect against potential lawsuits resulting from accidents on your property. While Delaware does not mandate a specific minimum, a common recommendation is at least $100,000 in personal liability coverage. It safeguards your assets and future earnings from claims. To obtain your Delaware Insurance Certification Form, our platform can guide you through the process efficiently.

The minimum insurance cover required for vehicles in Delaware includes liability insurance, which protects you from claims resulting from accidents. You must carry at least $25,000 for one person's bodily injury, $50,000 for injuries to multiple persons, and $10,000 for property damage. This basic coverage helps ensure that drivers are held accountable financially. Registering your Delaware Insurance Certification Form is essential to prove you are compliant with these laws.

A certificate of insurance form is a document that verifies the existence of an insurance policy. This form details the coverage provided and is often required for contracts, leases, or legal documents. It demonstrates you hold the necessary insurance, giving peace of mind to all parties involved. You can easily manage and obtain your Delaware Insurance Certification Form through our platform.

Delaware mandates specific minimum coverage for all registered vehicles. This includes a minimum of $25,000 for bodily injury for one person and $50,000 for all individuals involved, as well as $10,000 for property damage. This insurance protects you against potential financial loss from accidents. Completing the Delaware Insurance Certification Form confirms your compliance with these requirements.

In Delaware, the law requires drivers to maintain liability insurance coverage. The minimum amount required includes $25,000 for injury or death of one person, $50,000 for injury or death of multiple people, and $10,000 for property damage. This ensures that you are financially protected in case of an accident. The Delaware Insurance Certification Form serves as proof of this coverage.

You can typically show proof of insurance online by accessing your insurance provider's website or mobile app. Look for a digital copy of your Delaware Insurance Certification Form, which serves as proof of your coverage. Many providers allow you to download or email this document, making it convenient to present when needed. Always keep a digital copy handy to avoid any issues while on the road.

Being a no-fault state means that individuals involved in an accident typically claim their own insurance for medical expenses, regardless of who caused the accident. This system helps reduce the need for lengthy legal battles and speeds up compensation. However, having the appropriate Delaware Insurance Certification Form is essential for ensuring you have coverage when needed. Understanding this system can simplify your claims process significantly.

Personal injury protection (PIP) is not required in Delaware, but it is available as an optional coverage. Many drivers choose to add PIP to their policies for added security, as it covers medical expenses regardless of fault in an accident. If you decide to include PIP, ensure your Delaware Insurance Certification Form reflects this coverage. Be sure to discuss your options with your insurance agent.

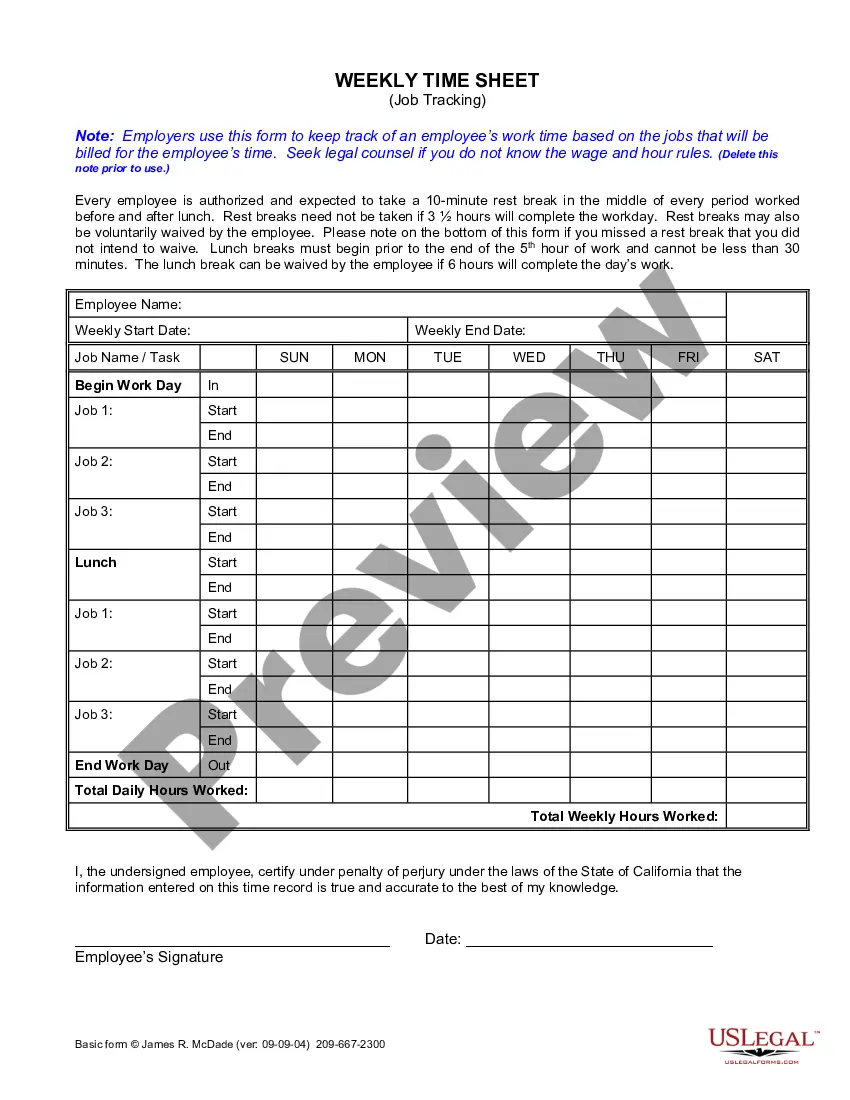

Filling out a motor insurance claim form involves several steps. Start by providing your personal information, vehicle details, and the specifics of the accident. Include clear descriptions and attach supporting documents, like the Delaware Insurance Certification Form, which proves that your vehicle was insured at the time of the incident. If you need help, consider using resources from USLegalForms to guide you through the process.