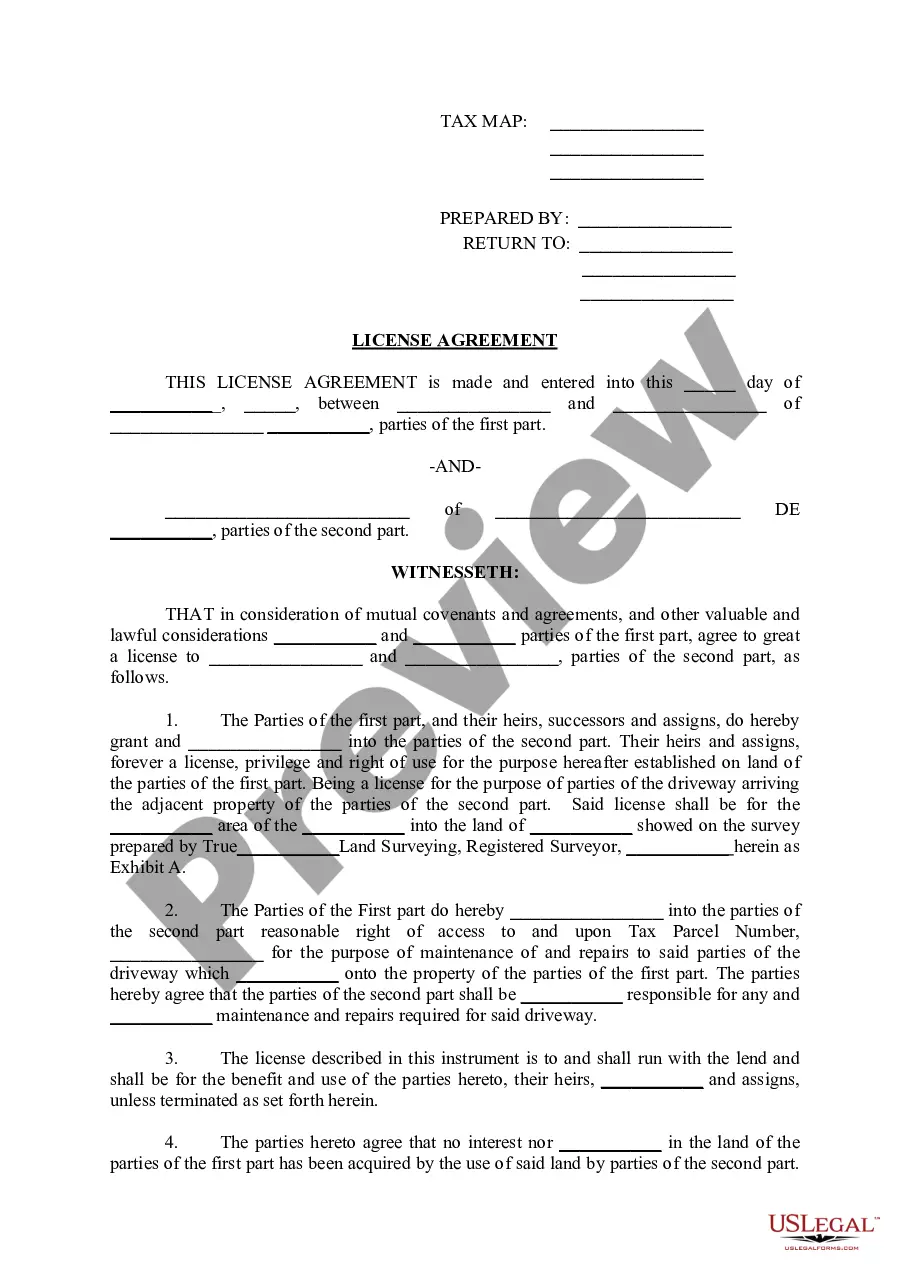

Delaware License Agreement

Description

How to fill out Delaware License Agreement?

Use US Legal Forms to get a printable Delaware License Agreement. Our court-admissible forms are drafted and regularly updated by professional lawyers. Our’s is the most complete Forms catalogue on the web and offers cost-effective and accurate samples for consumers and attorneys, and SMBs. The documents are grouped into state-based categories and a number of them might be previewed before being downloaded.

To download samples, customers need to have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For those who don’t have a subscription, follow the tips below to quickly find and download Delaware License Agreement:

- Check out to make sure you get the proper template with regards to the state it is needed in.

- Review the document by reading the description and by using the Preview feature.

- Hit Buy Now if it is the template you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms provides a large number of legal and tax samples and packages for business and personal needs, including Delaware License Agreement. Over three million users have utilized our platform successfully. Choose your subscription plan and have high-quality forms in just a few clicks.

Form popularity

FAQ

LLCs choose Delaware due to the state's pro-business climate, which facilitates easy formation and operation of businesses. Additionally, the absence of a minimum capital requirement and the ability to structure operating agreements flexibly are appealing features. Delaware's laws nurture innovative businesses, making it easier to draft favorable Delaware License Agreements. This supportive environment attracts startups and established companies alike.

Yes, if your LLC operates in Delaware or generates income within the state, you must file a Delaware tax return. Even if your LLC is not generating income, Delaware requires an annual franchise tax. Staying compliant with tax regulations is crucial to maintaining the status of your Delaware License Agreement. Entrepreneurs should consider consulting a tax professional to navigate these requirements efficiently.

Having an LLC in Delaware comes with several advantages, including limited liability protection and potential tax benefits. Business owners can enjoy privacy, as Delaware does not require member or manager names to be disclosed publicly. Furthermore, because of the state's favorable regulatory environment, entering into a Delaware License Agreement often provides peace of mind for entrepreneurs. Choosing Delaware can enhance your business's credibility in the eyes of investors and partners.

Delaware is preferred for LLCs primarily due to its business-friendly laws and efficient legal system. The state offers flexible management structures and provides strong protections for owners. Additionally, Delaware's Court of Chancery specializes in business law, ensuring timely and fair resolutions. As a result, many entrepreneurs find that establishing a Delaware License Agreement is beneficial for their business operations.

Filling out a license agreement starts with understanding the key elements that need to be included, like terms of use, duration, and payment details. First, clearly define the parties involved and the rights being granted. Then, ensure that both parties review and agree to all terms. Using the uslegalforms platform can streamline this process by providing customizable templates specifically designed for your Delaware License Agreement.

No, a Delaware LLC is not required to maintain a physical office in Delaware. You can operate your business from anywhere, even outside the state. However, it is crucial to have a registered agent with a physical address in Delaware for receiving important legal documents. This setup can simplify compliance and help you stay organized with your Delaware License Agreement.

To obtain your Delaware business license, first ensure that your business is registered with the Delaware Secretary of State. Next, you can complete the application online or in person at your local Department of Finance office. Once you submit the application along with the required fees, your Delaware License Agreement will be processed, allowing you to operate legally in the state. It’s essential to stay updated on any local laws or additional permits you may need.

While Delaware does not mandate an operating agreement for LLCs, having one is highly recommended for clarity and protection. An operating agreement outlines the management structure and operational guidelines of your business. By drafting a solid Delaware License Agreement alongside your operating agreement, you can enhance your business's legal foundation.

Certain individuals may be exempt from holding a Delaware driver's license, such as military personnel stationed in Delaware, or individuals visiting the state temporarily. It's important to check if your situation qualifies for exemption under Delaware law. Understanding these nuances can be easier with a Delaware License Agreement, which can clarify any specific requirements.

To establish proof of residency in Delaware, you can use documents such as a utility bill or a bank statement that displays your name and address. Alternatively, a lease agreement or a government-issued document can also serve as acceptable proof. Ensuring that these documents are up to date is vital for your Delaware License Agreement.