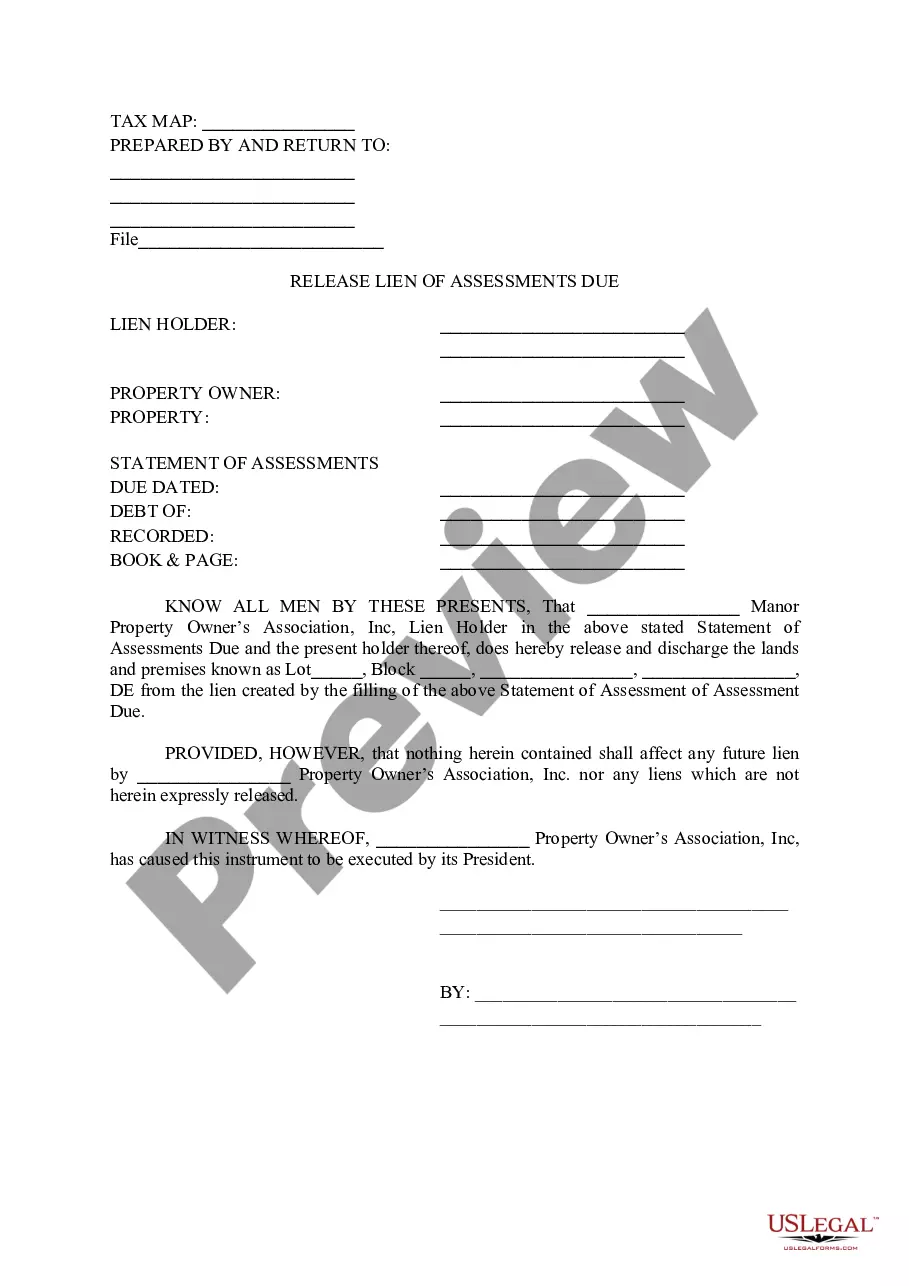

Delaware Release Lien of Assessments Due

Description

How to fill out Delaware Release Lien Of Assessments Due?

Use US Legal Forms to obtain a printable Delaware Release Lien of Assessments Due. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms library on the web and offers reasonably priced and accurate templates for customers and lawyers, and SMBs. The documents are grouped into state-based categories and a number of them can be previewed prior to being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Hit Download next to any form you want and find it in My Forms.

For those who do not have a subscription, follow the tips below to quickly find and download Delaware Release Lien of Assessments Due:

- Check to ensure that you get the proper template with regards to the state it’s needed in.

- Review the document by looking through the description and by using the Preview feature.

- Click Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Make use of the Search engine if you want to find another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Delaware Release Lien of Assessments Due. Over three million users have utilized our platform successfully. Choose your subscription plan and have high-quality forms in just a few clicks.

Form popularity

FAQ

A lien release is a document that is filed in the public land records as the official notice that the lien is removed. Once payment has been received, a contractor has a duty to remove any lien that was filed against the property.

The main purpose of a lien waiver is to provide protection to the paying party. In exchange for such payment, the lien waiver waives the payee's right to file a lien for the exact value of the payment they have received.

In California, only the lien holder the mortgage lender can remove the lien. California law is fairly strict, however, as it give the lender just 30 days to issue and record the appropriate release.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

The car (vehicle) lien release form is a document that is used by a lending institution or entity after a borrower has paid the loan in full and the borrower would like to retrieve the title to their vehicle.

Depending on state laws, paper titles are generally mailed and electronic titles and/or liens are released to the motor vehicle agency approximately 10 business days after the payoff is received. Allow 15-30 days for receipt of your title based on mail time and/or motor vehicle agency process.

About the release form This form should be filed with the recorder's office in the Texas county where the lien was originally recorded. Texas law requires claimants to file a lien release within 10 days after the lien is satisfied, or upon request from the property owner.

In California, only the lien holder the mortgage lender can remove the lien. California law is fairly strict, however, as it give the lender just 30 days to issue and record the appropriate release.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more: