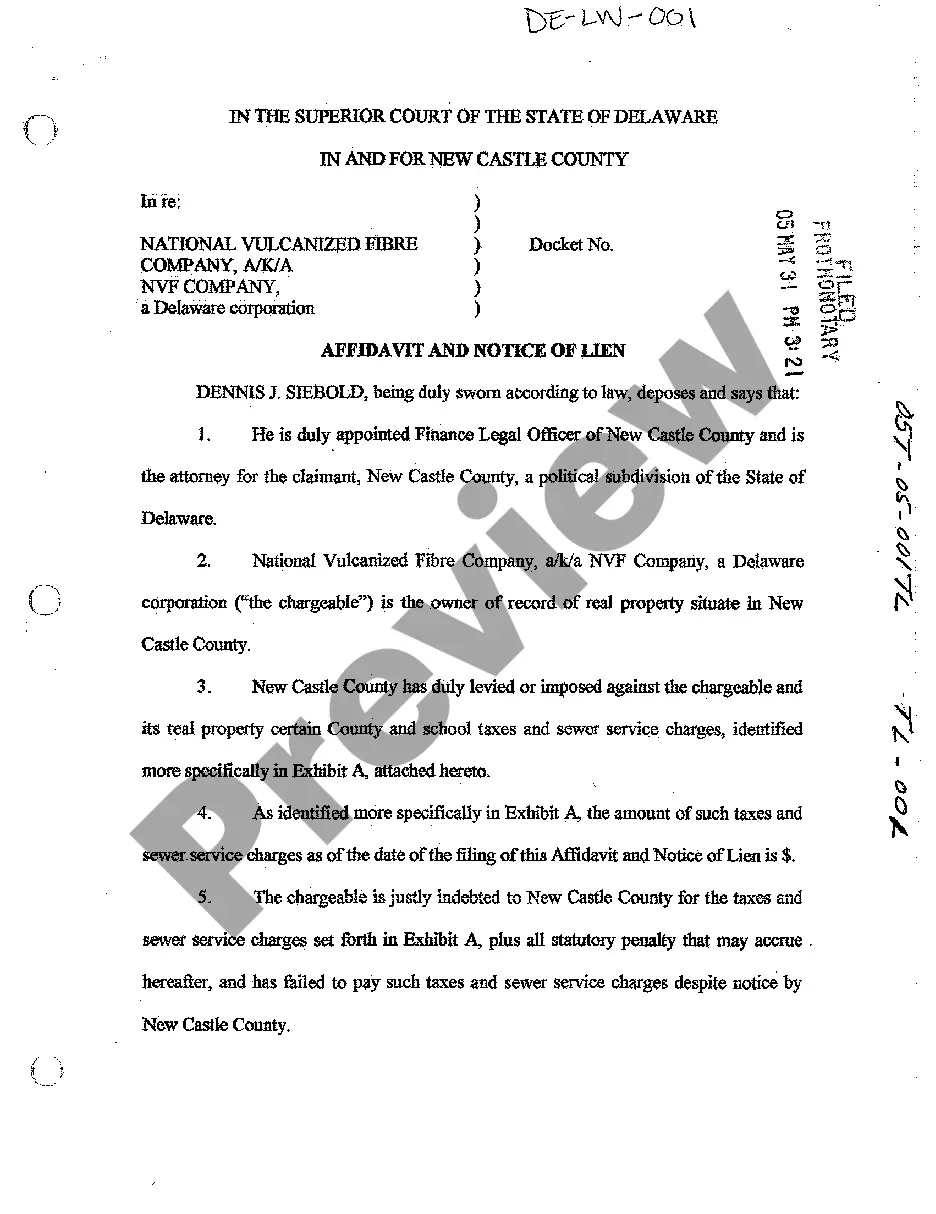

Delaware Affidavit and Notice of Lien for School Tax and Sewer Service

Description

How to fill out Delaware Affidavit And Notice Of Lien For School Tax And Sewer Service?

Among numerous free and paid samples that you’re able to get on the net, you can't be sure about their accuracy. For example, who made them or if they’re qualified enough to take care of what you need those to. Always keep relaxed and utilize US Legal Forms! Discover Delaware Affidavit and Notice of Lien for School Tax and Sewer Service samples created by professional lawyers and get away from the high-priced and time-consuming process of looking for an attorney and then having to pay them to draft a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you’re seeking. You'll also be able to access your previously saved samples in the My Forms menu.

If you’re utilizing our platform the first time, follow the guidelines below to get your Delaware Affidavit and Notice of Lien for School Tax and Sewer Service fast:

- Make sure that the file you discover is valid where you live.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another sample using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

Once you have signed up and bought your subscription, you may use your Delaware Affidavit and Notice of Lien for School Tax and Sewer Service as often as you need or for as long as it remains valid in your state. Edit it with your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Delaware operates as a tax lien state, meaning unpaid taxes create liens against the property. This process allows local governments to recover owed taxes through the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Understanding this system is important if you're investing in real estate, as it impacts ownership rights. Consider consulting US Legal Forms for clear information and assistance regarding tax policies in Delaware.

To file a lien on property in Delaware, you need to complete the relevant forms, such as the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Next, you must submit the completed forms to the appropriate county office. Proper filing ensures a legal claim that can secure the debt you are owed. Using US Legal Forms simplifies this process by providing you with the necessary documents and guidance.

Yes, Delaware is classified as a tax lien state. This means that when property taxes are unpaid, the local government can place a lien on the property through a process that often involves the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Understanding the implications of this designation can help property owners and investors navigate potential tax issues effectively. By utilizing resources like uslegalforms, you can stay informed and take the necessary steps to address liens properly.

In Delaware, a lien can typically remain on a property for 10 to 20 years, depending on the type of lien. For municipal or school taxes, the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service may be in place for a long duration to secure the tax obligation. It's essential to act timely to address any liens, as they may hinder your property sale or refinancing options. Knowledge of these timelines can empower you to take appropriate actions.

In Delaware, judgments generally do expire after a period of 5 years if they are not renewed. This means that if a creditor does not take action to renew the judgment, it can no longer be enforced. Understanding this timeline is crucial for anyone dealing with debts or liens, including the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Being informed can help you make better decisions regarding your obligations.

To conduct a lien search in Delaware, you can start by visiting the county recorder's office or accessing their online database. This process will help you identify any existing liens, including the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Additionally, using uslegalforms can streamline your search and provide you with necessary documentation. It’s always a good idea to check for liens before purchasing a property to avoid any unexpected issues.

In Delaware, a lien usually remains on your property for 10 years. This includes the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service, which can be renewed if necessary. It is crucial to address any outstanding obligations promptly to avoid prolonged complications. You can consult professionals or use resources from uslegalforms to navigate this process effectively.

Generally, property tax liens, including those stemming from unpaid school taxes or sewer service fees, have the highest priority in Delaware. These liens take precedence over most other types of liens, such as mortgage liens or judgement liens. Knowing this is crucial for property owners and creditors alike, as the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service solidifies this claim to ensure recovery of amounts owed.

A certificate of release of tax lien is a document issued to confirm that a tax lien has been satisfied and released from the property. This document is essential for property owners to prove that they have resolved their tax debts, particularly those associated with the Delaware Affidavit and Notice of Lien for School Tax and Sewer Service. Having this certificate not only clears the title but also can facilitate future transactions related to the property.

To place a lien on a property in Delaware, you must file a Delaware Affidavit and Notice of Lien for School Tax and Sewer Service with the appropriate county office. The process typically involves preparing the necessary documentation, detailing the amounts owed, and submitting it to local authorities. By correctly completing this process, you ensure that your lien is valid and recognized, which aids in recovering funds owed to you.