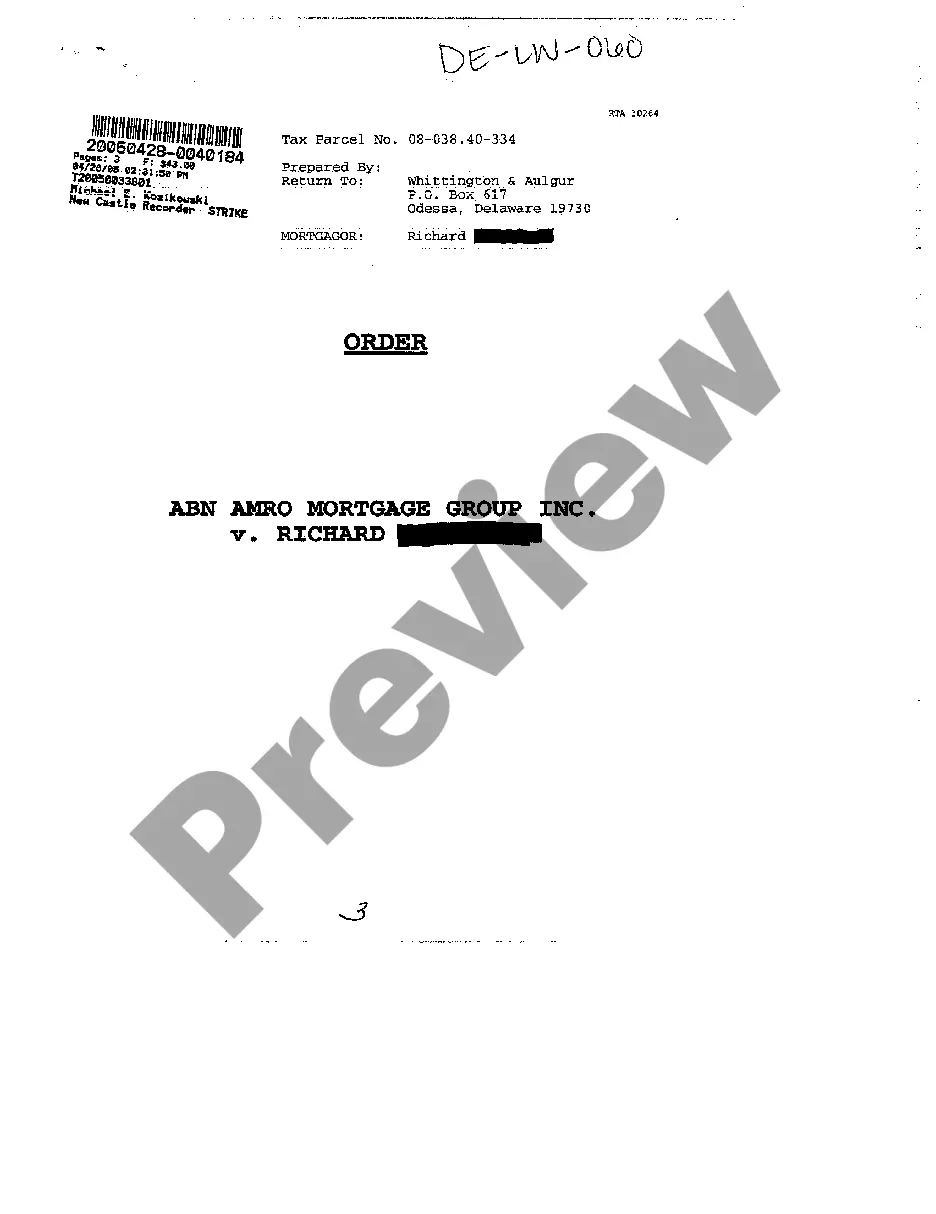

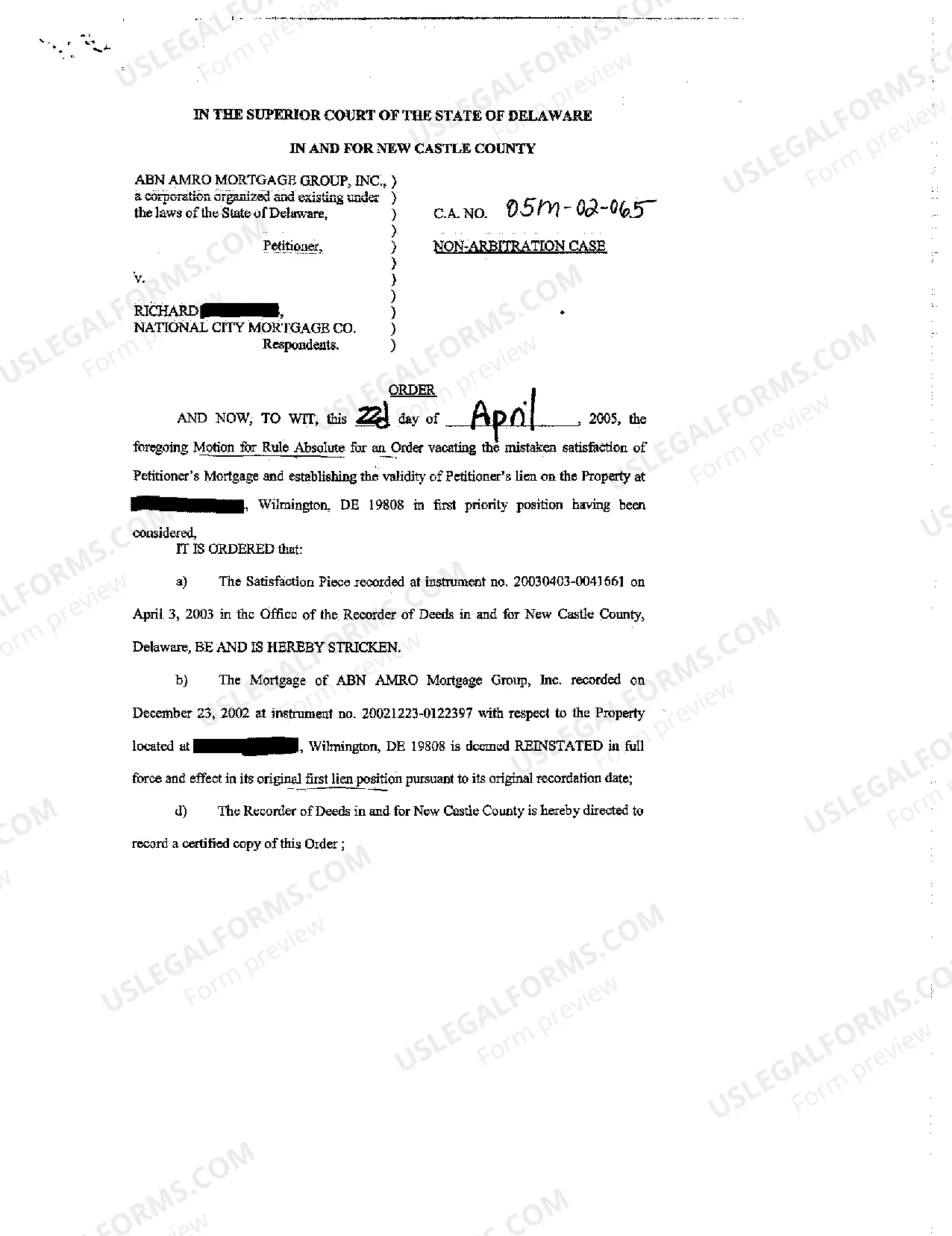

Delaware Order Granting Property Lien

Description

How to fill out Delaware Order Granting Property Lien?

Among countless paid and free templates that you get online, you can't be sure about their accuracy. For example, who created them or if they are qualified enough to deal with what you need them to. Always keep calm and make use of US Legal Forms! Get Delaware Order Granting Property Lien samples developed by skilled lawyers and get away from the costly and time-consuming procedure of looking for an lawyer and after that having to pay them to draft a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you are looking for. You'll also be able to access all your earlier acquired documents in the My Forms menu.

If you’re using our service for the first time, follow the instructions below to get your Delaware Order Granting Property Lien with ease:

- Make sure that the file you see is valid where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another template using the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and purchased your subscription, you can utilize your Delaware Order Granting Property Lien as often as you need or for as long as it continues to be valid where you live. Revise it in your favorite offline or online editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.

What Is a Fraudulent Lien?the claimant is owed money on another job by the same general contractor or property owner, but didn't file a lien on that project before time expired; or. the claimant wants to file a lien because of personal reasons generally related to the identity of the property owner.

2. States where the lien law doesn't require a written contract. In these states, contractors and suppliers are generally allowed to file a lien even if they don't have a written contract.These states typically permit parties with verbal, oral, or even implied contracts to claim lien rights.

Voluntary and Involuntary Liens. Creditors, such as a mortgage or car lender, can ask borrowers to put up the purchased property as collateral as part of the condition of the loan. Creditors With Involuntary Liens. Judgment Liens. Other Types of Involuntary Liens.

If a creditor gets a judgment against you, it can then place a lien on your property. The lien gives the creditor an interest in your property so that it can get paid for the debt you owe.And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

If you have unpaid debt of any kind, this can lead the creditors that you owe money to place a lien on your assets.In other cases, liens may be placed on property by a court order as a result of legal action.

How do property liens work? Property liens are legal claims against property granted by a court to a creditor when a debtor doesn't pay their debts. Liens are filed with the county office and sent to the property owner advising them of repossession of the asset(s).

A judicial lien is created when a court grants a creditor an interest in the debtor's property, after a court judgment.The lien is the first step by the judgment creditor in a process that will culminate in a sale of the attached property, to satisfy the judgment debt.