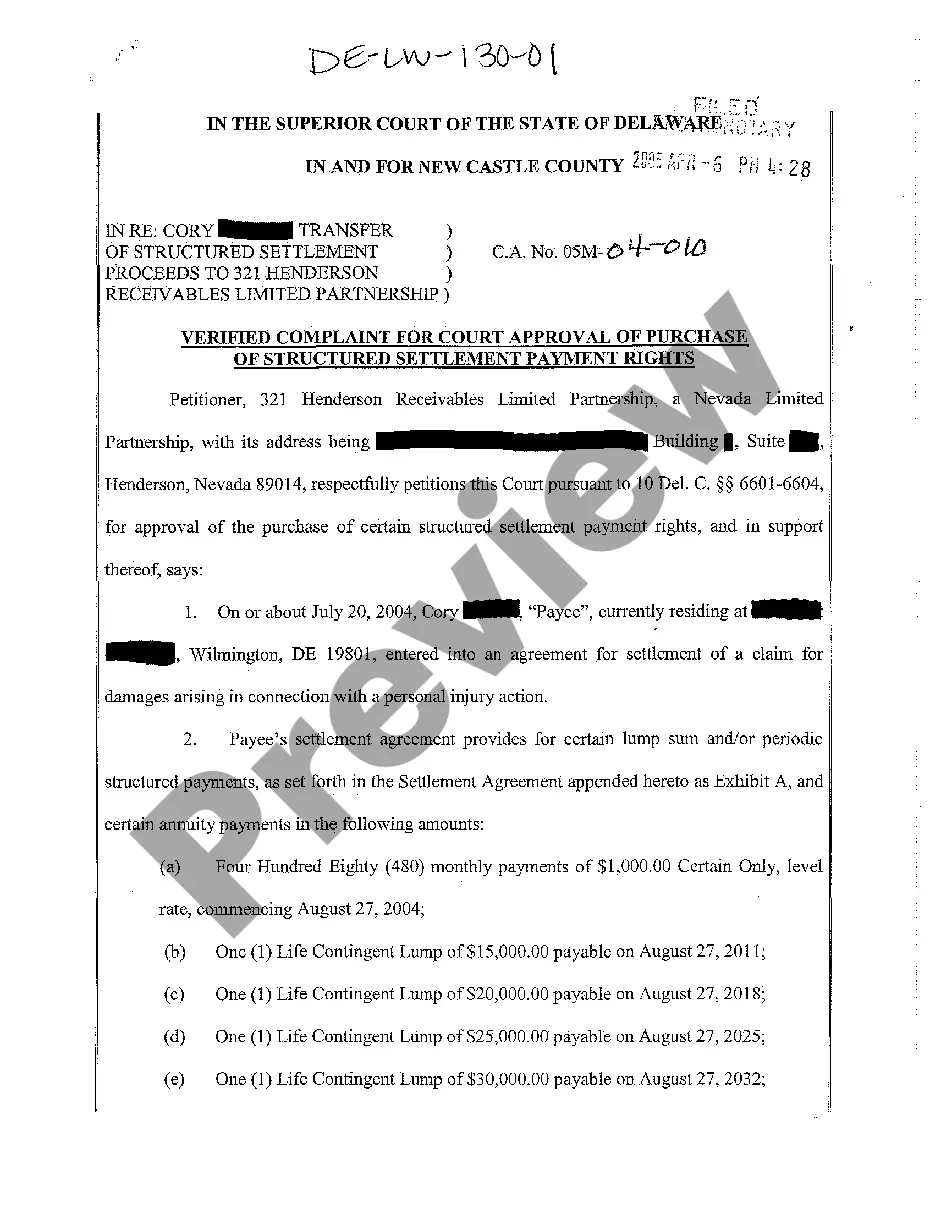

Delaware Verified Complaint for Court Approval of Purchase of Structured Settlement Payment Rights

Description

How to fill out Delaware Verified Complaint For Court Approval Of Purchase Of Structured Settlement Payment Rights?

Among lots of paid and free samples that you can get on the net, you can't be sure about their accuracy. For example, who created them or if they’re qualified enough to take care of the thing you need these to. Always keep relaxed and utilize US Legal Forms! Get Delaware Verified Complaint for Court Approval of Purchase of Structured Settlement Payment Rights samples made by skilled legal representatives and avoid the costly and time-consuming procedure of looking for an lawyer or attorney and then paying them to draft a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the file you’re searching for. You'll also be able to access all your earlier acquired documents in the My Forms menu.

If you’re using our website for the first time, follow the tips below to get your Delaware Verified Complaint for Court Approval of Purchase of Structured Settlement Payment Rights easily:

- Make sure that the document you discover applies where you live.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another template utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you’ve signed up and purchased your subscription, you may use your Delaware Verified Complaint for Court Approval of Purchase of Structured Settlement Payment Rights as often as you need or for as long as it stays valid in your state. Revise it in your preferred editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

How Is a Settlement Paid Out? Compensation for a personal injury can be paid out as a single lump sum or as a series of periodic payments in the form of a structured settlement. Structured settlement annuities can be tailored to meet individual needs, but once agreed upon, the terms cannot be changed.

A structured settlement is when part or all of the settlement amount is paid to the plaintiff over a period of years. Part of the settlement will generally be paid to the plaintiff and his/her lawyer immediately after the settlement as a lump sum, and the rest will be structured over a period of years.

A structured settlement is when part or all of the settlement amount is paid to the plaintiff over a period of years. Part of the settlement will generally be paid to the plaintiff and his/her lawyer immediately after the settlement as a lump sum, and the rest will be structured over a period of years.

How Do Structured Settlement Purchasing Companies Make Money? Factoring companies generally take anywhere from 9 to 18 percent to cover their operating costs and turn a profit.

In order to cash out your settlement annuity, you sell your right to receive certain payments that are due under your settlement agreement. The companies that buy the rights to these payments, and give you cash, are called factoring companies.

You can sell your structured settlement to a factoring company for immediate cash. Although you must first obtain court approval, you have the legal right to sell your payments, either in part or in full, to a structured settlement buyer.

Typically, this fee amounts to approximately 9 to 15 percent of the total value of the annuity or structured settlement.

The qualified assignment fee (ranging from $0 to $750) is commissionable with some companies. In other cases it is not. Insurance laws in effect in most states expressly prohibit reduction of commissions or rebating. There are different market based structured settlement options for both plaintiffs and attorney.