Delaware DE Corp into Foreign Corp is a process of converting a Delaware Corporation into a corporation organized under the laws of a foreign jurisdiction. This process typically involves filing a Certificate of Conversion with the Delaware Secretary of State, which serves as a legal document declaring the nature of the conversion. Depending on the foreign jurisdiction, additional documents may be required for the conversion. Types of Delaware DE Corp into Foreign Corp conversions include: — Standard Conversion: A standard conversion involves the filing of a Certificate of Conversion with the Delaware Secretary of State and may require additional documents depending on the foreign jurisdiction. — Merger Conversion: A merger conversion is a process that involves the merging of a Delaware Corporation into a foreign corporation. The Delaware Corporation is the merging corporation and the foreign corporation is the surviving corporation. — Stock Sale Conversion: A stock sale conversion is a process whereby the stock of a Delaware Corporation is transferred to a foreign corporation. This conversion requires the filing of a Certificate of Conversion with the Delaware Secretary of State, as well as additional documents depending on the foreign jurisdiction.

Delaware DE Corp into Foreign Corp

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Delaware DE Corp Into Foreign Corp?

Creating legal documents can be quite a burden if you lack ready-to-use fillable forms. With the US Legal Forms online library of official paperwork, you can trust the templates you find, as each of them aligns with federal and state laws and has been verified by our specialists.

Therefore, if you need to convert Delaware DE Corp into Foreign Corp, our service is the ideal resource to obtain it.

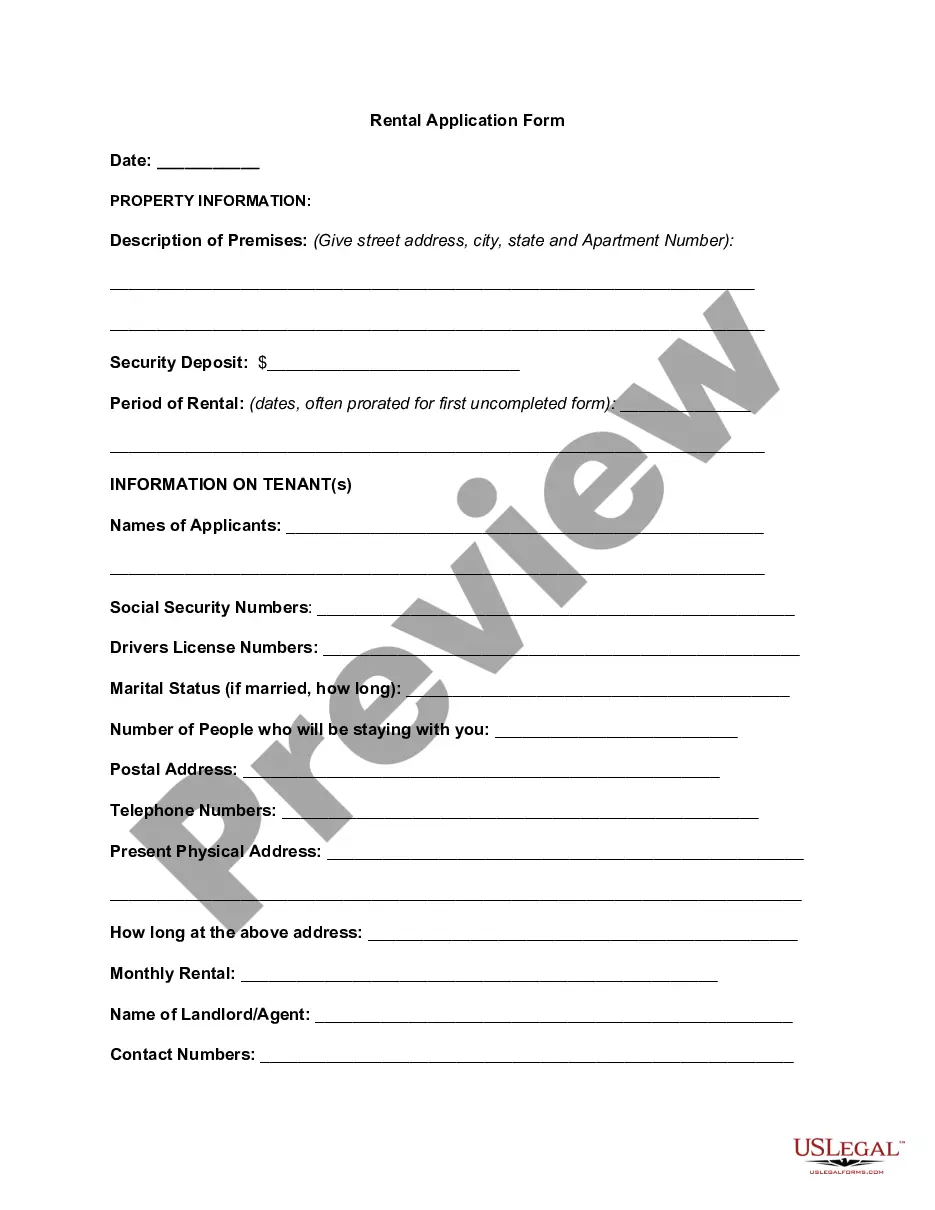

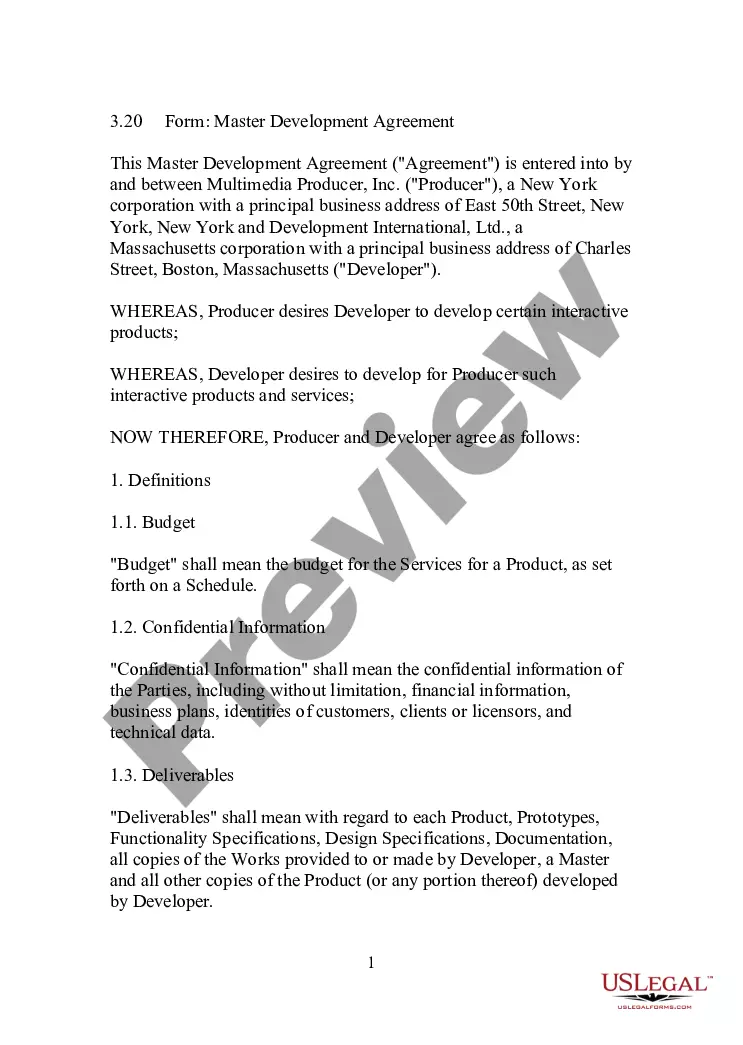

Here’s a brief guide for you: Document compliance check. You should carefully review the content of the form you wish to ensure it fulfills your requirements and complies with your state laws. Previewing your document and examining its general overview will assist you in doing just that.

- Acquiring your Delaware DE Corp into Foreign Corp from our collection is as simple as pie.

- Previously approved users with an active subscription only need to Log In and click the Download button after finding the appropriate template.

- Subsequently, if needed, users can access the same template from the My documents section of their profile.

- However, even if you are new to our service, signing up with a valid subscription will only take a few moments.

Form popularity

FAQ

Yes, a Delaware corporation must file a Delaware tax return, even if it operates as a foreign corporation in other states. Filing a tax return helps ensure compliance with Delaware regulations regarding income generated within the state. Moreover, maintaining good standing as a Delaware DE Corp into Foreign Corp allows you to enjoy the benefits of Delaware’s business-friendly environment. For assistance in navigating the complexities of tax filings, consider using the US Legal Forms platform, which offers resources to simplify the process.

Foreign companies often choose to incorporate in Delaware for several reasons. The state offers a flexible business-friendly legal environment, favorable tax treatment, and an efficient court system specializing in business disputes. Additionally, Delaware's reputation attracts global companies, making it easier for foreign firms to gain credibility in the U.S. market.

To register your foreign corporation in Delaware, first gather the required documents, including the Certificate of Good Standing from your home state. Then, file the Certificate of Authority with the Delaware Division of Corporations. This process ensures that your foreign corporation operates legally within Delaware, allowing you to thrive in this business-friendly environment.

Yes, you can register your business in Delaware even if you do not live there. Delaware welcomes businesses from all over, making it an attractive option for foreign and domestic entrepreneurs. However, you must appoint a registered agent who resides in Delaware to handle legal documents on your behalf.

While Delaware is a popular choice for incorporation, some disadvantages exist. Companies may face higher legal and annual fees compared to other states. Additionally, if your business operates in another state, you might need to register as a foreign entity there, creating additional paperwork and costs.

Yes, a foreign corporation can merge into a Delaware LLC, but the process involves specific steps. Typically, the foreign corporation must adhere to the laws of its home state and the Delaware laws as well. It's prudent to consult with legal professionals to ensure all requirements are met and the merger is executed correctly.

To register a foreign corporation in Delaware, start by selecting a unique name that complies with state laws. You will then need to file a Certificate of Authority with the Delaware Division of Corporations. Make sure to provide necessary documentation, such as a good standing certificate from your home state, to complete the registration.

Yes, when converting a Delaware DE Corp into a Foreign Corp, you must have a plan of conversion. This plan outlines the process, details the management structure, and includes necessary approvals. Having a well-prepared plan helps streamline the entire conversion process and ensures compliance with state regulations.

Yes, you can merge a foreign corporation into a Delaware LLC, but there are specific steps involved. You'll need to ensure compliance with both the laws of the foreign corporation’s home state and Delaware regulations. The merger process typically involves filing appropriate documents with the state and properly notifying all parties involved. The uslegalforms platform can assist you in this endeavor, ensuring a smooth transition as you convert your Delaware DE Corp into a Foreign Corp.

To dissolve a Delaware C Corp, you must first obtain board approval for the dissolution. Next, you will need to file a Certificate of Dissolution with the Delaware Secretary of State. It is also essential to settle any outstanding debts and notify your shareholders. Using the uslegalforms platform can simplify this process, providing you with the necessary templates and guidance for converting your Delaware DE Corp into a Foreign Corp.