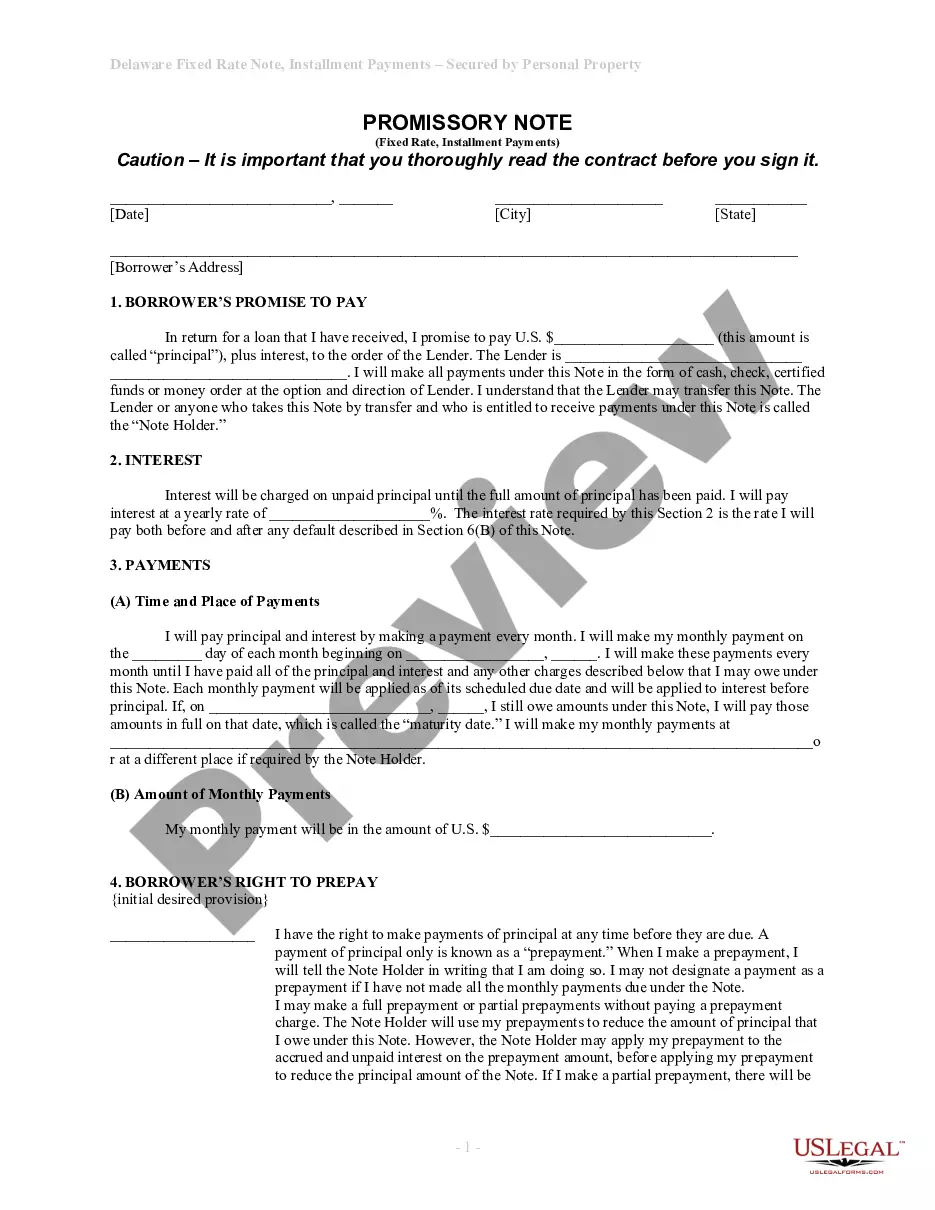

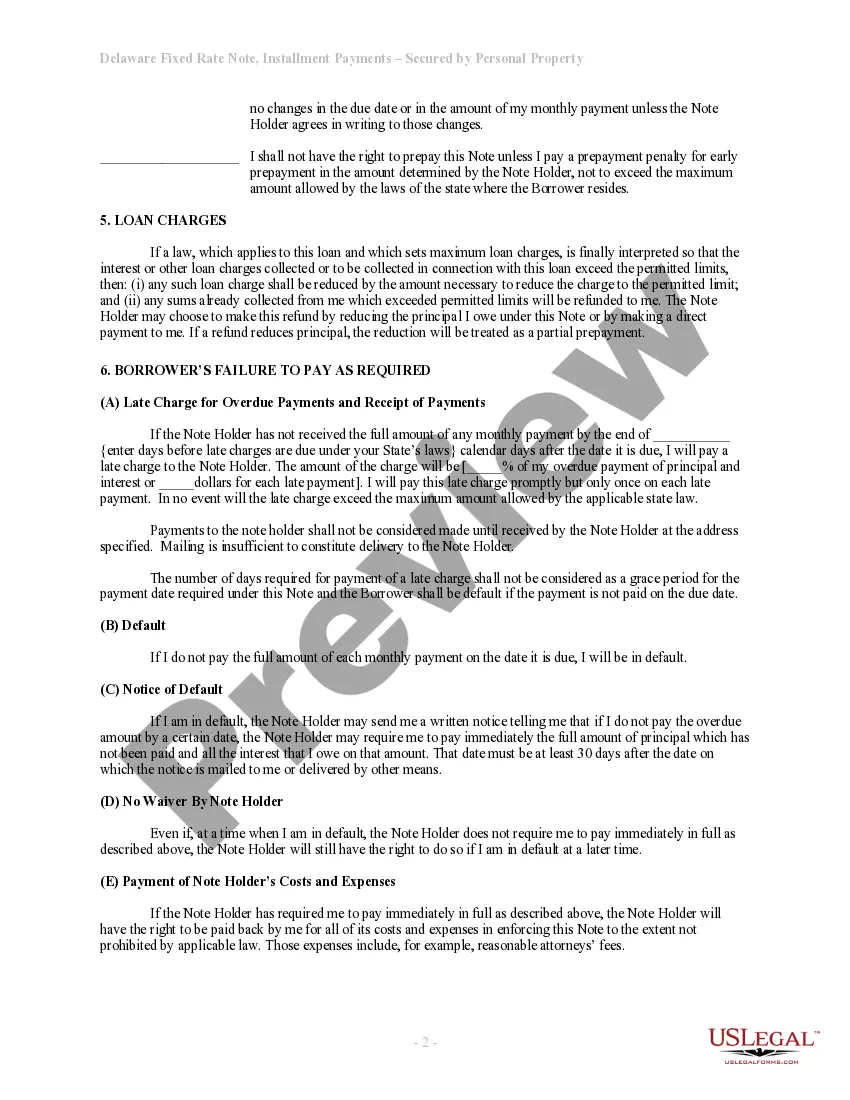

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Delaware Installments Fixed Rate Promissory Note Secured by Personal Property

Description Promissory Note Property

How to fill out Delaware Rate Contract?

The more papers you have to prepare - the more nervous you are. You can find thousands of Delaware Installments Fixed Rate Promissory Note Secured by Personal Property blanks on the internet, however, you don't know which of them to have confidence in. Remove the headache and make detecting exemplars more straightforward using US Legal Forms. Get accurately drafted documents that are composed to go with the state demands.

If you already possess a US Legal Forms subscription, log in to the account, and you'll find the Download button on the Delaware Installments Fixed Rate Promissory Note Secured by Personal Property’s web page.

If you have never used our service before, complete the sign up procedure using these recommendations:

- Ensure the Delaware Installments Fixed Rate Promissory Note Secured by Personal Property applies in the state you live.

- Re-check your decision by studying the description or by using the Preview functionality if they’re provided for the selected file.

- Click on Buy Now to begin the registration procedure and choose a costs plan that suits your expectations.

- Provide the asked for info to make your profile and pay for the order with your PayPal or credit card.

- Pick a handy document structure and take your example.

Access each sample you download in the My Forms menu. Simply go there to prepare new copy of your Delaware Installments Fixed Rate Promissory Note Secured by Personal Property. Even when preparing properly drafted forms, it’s nevertheless vital that you consider requesting the local lawyer to re-check filled in form to make sure that your record is accurately filled in. Do much more for less with US Legal Forms!

Installments Promissory Note Form popularity

Delaware Rate Complete Other Form Names

Delaware Rate Sample FAQ

The individual who promises to pay is the maker, and the person to whom payment is promised is called the payee or holder. If signed by the maker, a promissory note is a negotiable instrument.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

Whether a promissory note is a security is one of the most vexatious issues in US securities laws.In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

A promissory note is usually held by the party owed money; once the debt has been fully discharged, it must be canceled by the payee and returned to the issuer.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Although this case relates to state securities law claims, in applying the Reves test and holding that the Notes are not securities, the court has ruled squarely in favor of the long-held view in the loan industry that loans are not securities.

A note is a debt security obligating repayment of a loan, at a predetermined interest rate, within a defined time frame.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.