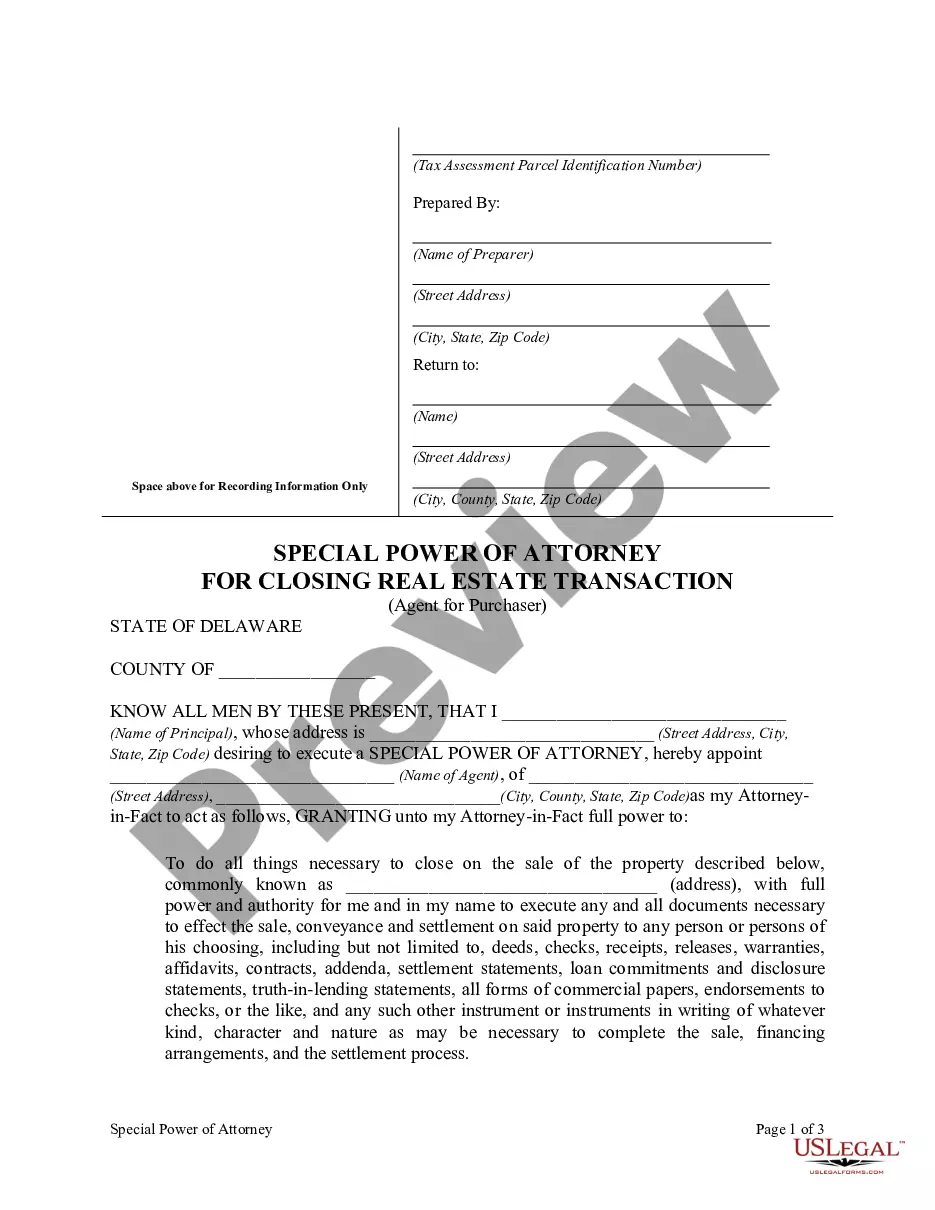

Delaware Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser

Description

How to fill out Delaware Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

The larger quantity of documents you must prepare - the more nervous you become.

You can find countless Delaware Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser templates online, yet, you remain uncertain about which ones to trust.

Eliminate the inconvenience and simplify finding examples using US Legal Forms.

Hit Buy Now to initiate the registration process and select a payment plan that matches your needs. Provide the required information to establish your account and complete the payment with PayPal or credit card. Choose a preferred file format and acquire your template. Access each document you receive in the My documents section. Simply navigate there to complete a new version of your Delaware Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser. Even when using expertly drafted templates, it remains essential to consider consulting a local attorney to double-check the completed document to ensure that your record is filled out correctly. Achieve more for less with US Legal Forms!

- Obtain professionally crafted forms that comply with state requirements.

- If you already have a US Legal Forms subscription, Log In to your account, and you will see the Download option on the page for the Delaware Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser.

- If you have not used our service previously, complete the registration process by following these steps.

- Confirm that the Delaware Special or Limited Power of Attorney for Real Estate Purchase Transaction by Purchaser is accepted in your state.

- Re-evaluate your choice by reviewing the description or utilizing the Preview feature if it's available for the selected document.

Form popularity

FAQ

If a power of attorney is not notarized in Delaware, it may not be accepted by third parties, such as banks or real estate companies. The lack of notarization can lead to complications in executing transactions. It's essential to have this step completed to ensure the legality of your power of attorney doc. Using uSlegalforms can help you avoid this problem by guiding you through the notarization process.

To give someone power of attorney in Delaware, you must complete and sign the appropriate document, clearly specifying the powers you are granting. It is also recommended to have the document notarized for legal efficacy. This legal mechanism allows the individual to act on your behalf in real estate purchases. For a streamlined process, uSlegalforms offers templates and guidance.

In Delaware, a power of attorney generally must be notarized to be legally effective. This requirement helps in confirming the identity of the person granting the power and adds an additional layer of security. A properly notarized document supports your interests during real estate transactions. Consider using uSlegalforms for easy document preparation.

Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office.

If it is signed by two witnesses, they must witness either (1) the signing of the power of attorney or (2) the principal's signing or acknowledgment of his or her signature. A durable power of attorney that may affect real property should be acknowledged before a notary public so that it may easily be recorded.

In notarizing a power of attorney, the notary is authenticating the identity of the person signing. Notaries play an important role when executing a power of attorney.The principal signs the POA and the notary signs and stamps the document.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

In many states, notarization is required by law to make the durable power of attorney valid. But even where law doesn't require it, custom usually does. A durable power of attorney that isn't notarized may not be accepted by people with whom your attorney-in-fact tries to deal.

The following states require two or more witnesses to sign the power of attorney but do not require notarization of the document: Alabama, Connecticut, Delaware, District of Columbia, Georgia, Indiana, Louisiana, Maine, Massachusetts, Michigan, Missouri, Montana, Nevada, New York, Oregon, Oklahoma, Pennsylvania, South

GPA is also an illicit way of investing unaccounted money in the real estate sector. When asked about the consequences of a GPA transaction, Mukesh Jain, Lawyer and Founder, Mukesh Jain & Associates, says, Generally, it is not advisable to purchase a property through the holder of a power of attorney.