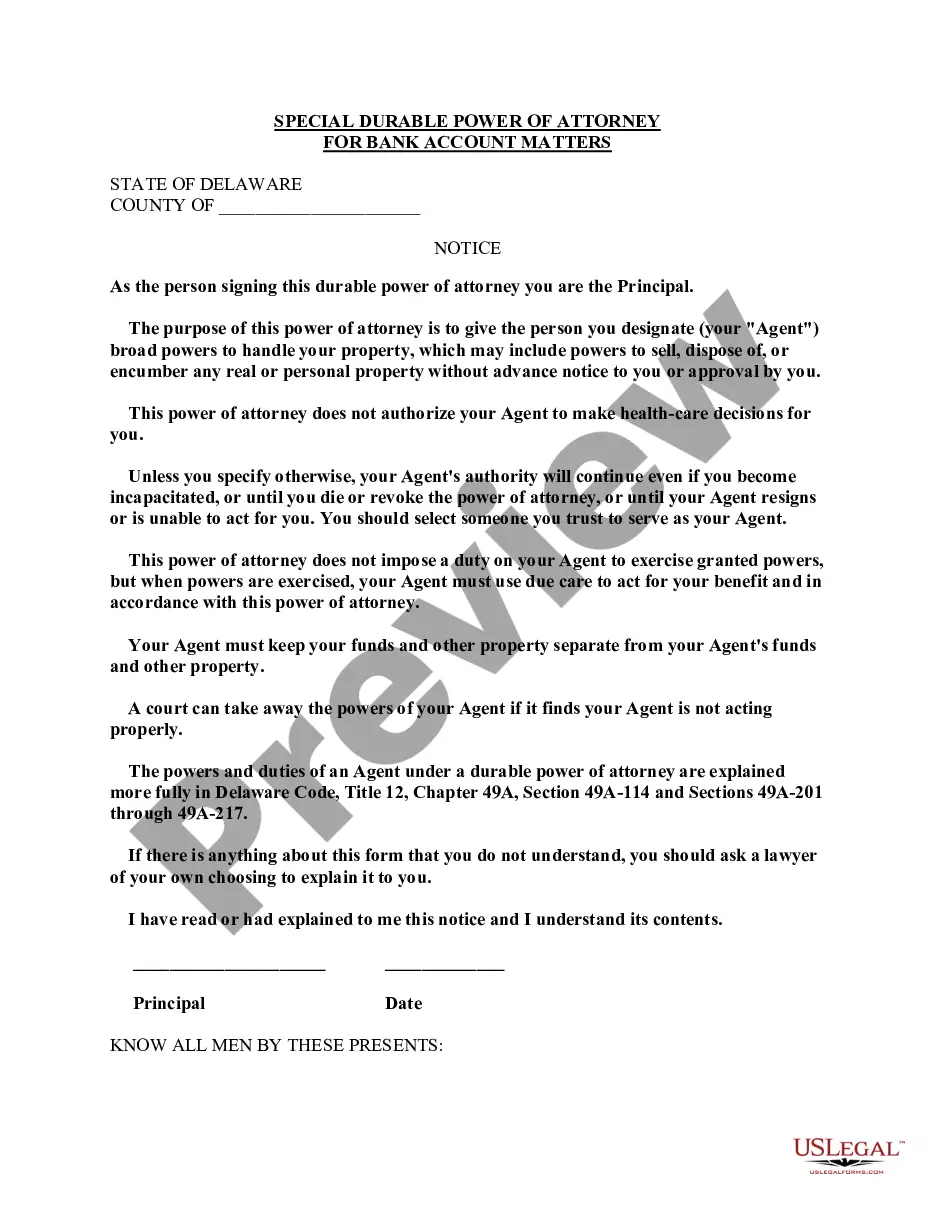

Delaware Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Delaware Special Durable Power Of Attorney For Bank Account Matters?

The more paperwork you have to make - the more anxious you feel. You can get thousands of Delaware Special Durable Power of Attorney for Bank Account Matters blanks on the web, still, you don't know which ones to have confidence in. Remove the headache to make finding exemplars easier using US Legal Forms. Get expertly drafted forms that are published to meet state demands.

If you have a US Legal Forms subscription, log in to your account, and you'll find the Download key on the Delaware Special Durable Power of Attorney for Bank Account Matters’s webpage.

If you’ve never applied our service earlier, complete the signing up procedure with the following directions:

- Ensure the Delaware Special Durable Power of Attorney for Bank Account Matters applies in the state you live.

- Re-check your choice by reading through the description or by using the Preview functionality if they are provided for the chosen record.

- Click Buy Now to get started on the registration procedure and select a costs program that fits your needs.

- Provide the asked for information to make your profile and pay for the order with the PayPal or credit card.

- Pick a handy file structure and get your duplicate.

Access every template you get in the My Forms menu. Simply go there to produce a new version of your Delaware Special Durable Power of Attorney for Bank Account Matters. Even when preparing properly drafted web templates, it’s still essential that you think about requesting your local lawyer to double-check filled in sample to ensure that your document is correctly filled out. Do much more for less with US Legal Forms!

Form popularity

FAQ

Writing a simple power of attorney letter involves clearly stating who the principal is, who the agent is, and detailing the powers granted to the agent. For a Delaware Special Durable Power of Attorney for Bank Account Matters, be specific about the financial transactions the agent can manage. It’s advisable to use clear and straightforward language to prevent misunderstandings, and utilizing platforms like US Legal Forms can streamline this process by providing templates and guidance.

A durable power of attorney should contain the principal's information, the agent's information, and a clear statement of powers granted to the agent. For the Delaware Special Durable Power of Attorney for Bank Account Matters, it is important to detail the financial accounts covered and any specific powers the agent can exercise. Including limitations and instructions is also essential to provide specific guidance regarding the agent's role.

Yes, in Delaware, a durable power of attorney must be notarized to be legally valid. This notarization serves as a safeguard against fraud and assures all parties involved that the document was executed voluntarily and with proper understanding. Therefore, for those using a Delaware Special Durable Power of Attorney for Bank Account Matters, ensuring notarization is crucial to uphold the powers granted within the document.

A preparation statement for a durable power of attorney serves a similar purpose, specifying the agent's powers while ensuring that these powers remain effective even if the principal becomes incapacitated. In the context of a Delaware Special Durable Power of Attorney for Bank Account Matters, it should explicitly mention the types of financial matters the agent can handle. Clarity in this statement helps prevent disputes and ensures compliance with Delaware law.

The preparation statement for a power of attorney outlines the authority that the agent will have over the principal's financial matters. For a Delaware Special Durable Power of Attorney for Bank Account Matters, this statement should clearly specify which financial accounts are covered and the powers granted. It's essential to include details such as the effective date and any limitations on the agent's powers.

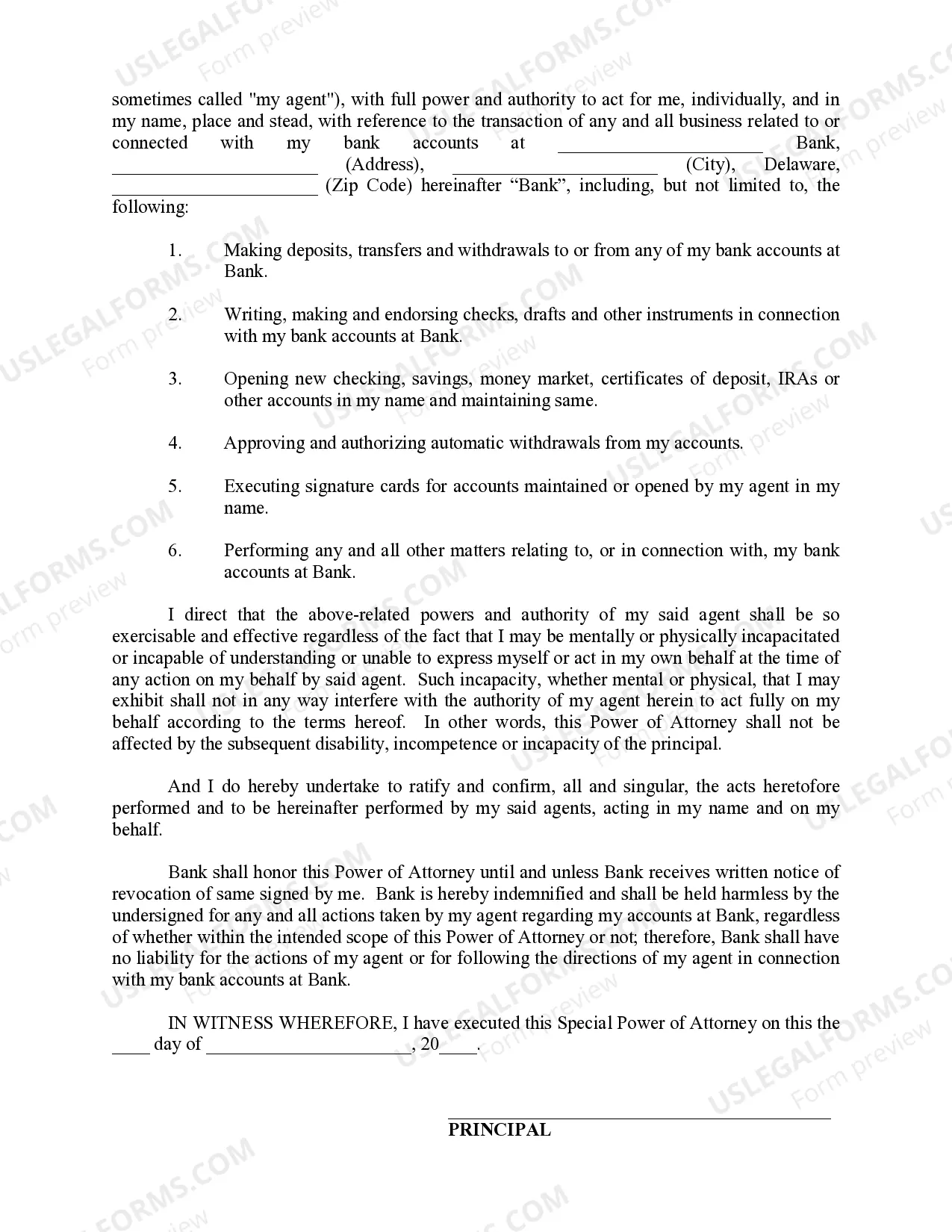

A Delaware Special Durable Power of Attorney for Bank Account Matters allows an appointed agent to manage your bank account on your behalf. This includes activities like paying bills, making withdrawals, and overseeing transactions. When you set up a POA, your agent gains the authority to act within the limits defined in the document. Using a reliable service like US Legal Forms can help you create a comprehensive POA that meets bank requirements and fits your specific needs.

Banks tend to be strict about a Delaware Special Durable Power of Attorney for Bank Account Matters due to the need for security and fraud prevention. They require specific language and formats to ensure that the document is valid and clear. This helps them to protect both the bank and the account holder. Therefore, having a well-structured POA is crucial in ensuring that your banking matters are handled smoothly.

One disadvantage of a Delaware Special Durable Power of Attorney for Bank Account Matters includes the potential for misuse by the agent. If the agent does not act in the principal's best interest, it can lead to financial mismanagement. Additionally, once you grant power, you may find it difficult to revoke if your circumstances change. It's essential to choose a trusted person as your agent to minimize these risks.

To submit a power of attorney to a bank, you typically need to provide the original document along with identification for both the agent and the account holder. Banks often have specific requirements, so it is advisable to contact your financial institution beforehand. Utilizing a Delaware Special Durable Power of Attorney for Bank Account Matters through a reliable platform like US Legal Forms can simplify this process, ensuring all necessary documentation meets the bank's standards.

A durable power of attorney for deposit accounts is a legal document that authorizes someone to handle financial matters related to bank accounts when you are unable to do so. In the context of a Delaware Special Durable Power of Attorney for Bank Account Matters, it ensures that your designated agent retains the authority to act even if you become incapacitated. This arrangement safeguards your financial interests and provides peace of mind, knowing someone trustworthy is managing your finances.