In equity sharing both parties benefit from the relationship. Equity sharing, also known as housing equity partnership (HEP), gives a person the opportunity to purchase a home even if he cannot afford a mortgage on the whole of the current value. Often the remaining share is held by the house builder, property owner or a housing association. Both parties receive tax benefits. Another advantage is the return on investment for the investor, while for the occupier a home becomes readily available even when funds are insufficient.

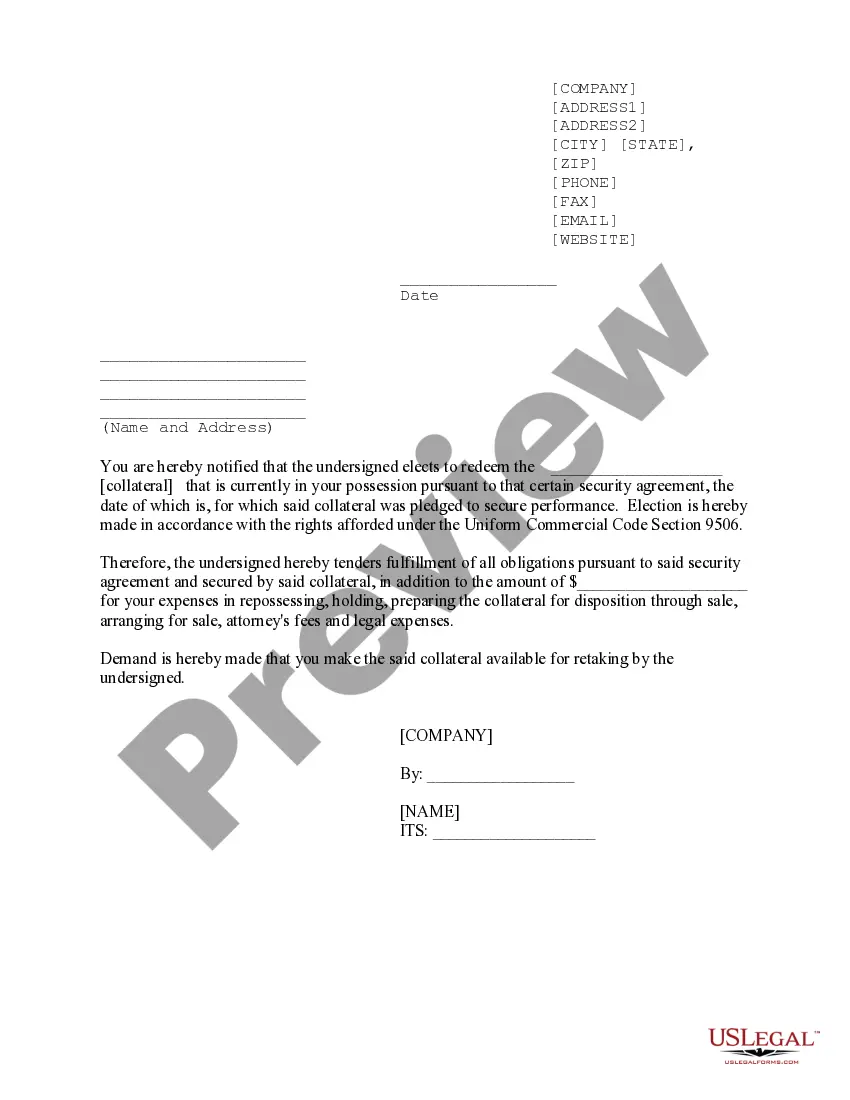

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Equity Share Agreement is a legally binding contract commonly used in the state of Delaware to establish an arrangement between multiple parties regarding the ownership and distribution of equity in a company. This agreement outlines the rights, responsibilities, and obligations of each party involved, aiming to ensure a fair and transparent division of equity. Key Elements of a Delaware Equity Share Agreement: 1. Equity Distribution: The agreement defines the allocation and distribution of equity among shareholders or partners involved. It specifies the percentage of ownership each party holds and outlines any conditions or restrictions on the transfer of shares. 2. Capital Contribution: The agreement may detail the initial capital investment required from each party to acquire their respective equity shares. It clarifies the amount, payment schedule, and mode of contribution (cash, assets, services) for each shareholder. 3. Voting Rights: The agreement determines the voting rights associated with each equity share. It outlines voting procedures, decision-making processes, and any specific voting thresholds required for different matters, such as electing directors, approving major business decisions, or amending the agreement itself. 4. Management and Control: This section outlines the responsibilities and powers of the company's management, including the board of directors or managing partners. It defines how decisions will be made, the appointment of key officers, and any specific roles assigned to certain shareholders. 5. Dividend Distribution: If applicable, the agreement addresses how dividends or profits will be distributed among equity holders. It can outline the frequency, method, and formula for dividend calculations and any limitations or restrictions on distributions. 6. Buyout or Exit Strategies: The agreement may include provisions for buyout or exit strategies if a shareholder or partner decides to leave the company or sell their equity. It may stipulate the valuation methodology, conditions, and procedures for buying out a departing equity holder. Types of Delaware Equity Share Agreements: 1. Preferred Equity Share Agreement: This type of agreement grants specific privileges, often to preferred shareholders, such as priority in receiving dividends or liquidation proceeds, conversion rights to common stock, or anti-dilution protection. 2. Restricted Stock Agreement: This agreement is used when equity shares are subject to certain restrictions or vesting periods. It outlines the terms and conditions under which the shares may be earned or forfeited, ensuring that shareholders meet specific requirements before fully owning their shares. 3. Shareholder Agreement: While not exclusive to Delaware, a shareholder agreement complements the Equity Share Agreement by addressing additional matters, such as non-compete clauses, dispute resolution mechanisms, confidentiality provisions, or the right of first refusal for share transfers. In summary, a Delaware Equity Share Agreement is a comprehensive contract specifying the distribution, ownership, voting rights, and management of equity in a company. By entering into this agreement, all parties involved can establish clear guidelines and safeguards for their equity interests and ensure harmonious corporate governance.Delaware Equity Share Agreement is a legally binding contract commonly used in the state of Delaware to establish an arrangement between multiple parties regarding the ownership and distribution of equity in a company. This agreement outlines the rights, responsibilities, and obligations of each party involved, aiming to ensure a fair and transparent division of equity. Key Elements of a Delaware Equity Share Agreement: 1. Equity Distribution: The agreement defines the allocation and distribution of equity among shareholders or partners involved. It specifies the percentage of ownership each party holds and outlines any conditions or restrictions on the transfer of shares. 2. Capital Contribution: The agreement may detail the initial capital investment required from each party to acquire their respective equity shares. It clarifies the amount, payment schedule, and mode of contribution (cash, assets, services) for each shareholder. 3. Voting Rights: The agreement determines the voting rights associated with each equity share. It outlines voting procedures, decision-making processes, and any specific voting thresholds required for different matters, such as electing directors, approving major business decisions, or amending the agreement itself. 4. Management and Control: This section outlines the responsibilities and powers of the company's management, including the board of directors or managing partners. It defines how decisions will be made, the appointment of key officers, and any specific roles assigned to certain shareholders. 5. Dividend Distribution: If applicable, the agreement addresses how dividends or profits will be distributed among equity holders. It can outline the frequency, method, and formula for dividend calculations and any limitations or restrictions on distributions. 6. Buyout or Exit Strategies: The agreement may include provisions for buyout or exit strategies if a shareholder or partner decides to leave the company or sell their equity. It may stipulate the valuation methodology, conditions, and procedures for buying out a departing equity holder. Types of Delaware Equity Share Agreements: 1. Preferred Equity Share Agreement: This type of agreement grants specific privileges, often to preferred shareholders, such as priority in receiving dividends or liquidation proceeds, conversion rights to common stock, or anti-dilution protection. 2. Restricted Stock Agreement: This agreement is used when equity shares are subject to certain restrictions or vesting periods. It outlines the terms and conditions under which the shares may be earned or forfeited, ensuring that shareholders meet specific requirements before fully owning their shares. 3. Shareholder Agreement: While not exclusive to Delaware, a shareholder agreement complements the Equity Share Agreement by addressing additional matters, such as non-compete clauses, dispute resolution mechanisms, confidentiality provisions, or the right of first refusal for share transfers. In summary, a Delaware Equity Share Agreement is a comprehensive contract specifying the distribution, ownership, voting rights, and management of equity in a company. By entering into this agreement, all parties involved can establish clear guidelines and safeguards for their equity interests and ensure harmonious corporate governance.