This form is a model Authority to Cancell Lien. Lienholder files with court certifying that indebtedness has been satisfied and lien should be cancelled. Adapt to fit your specific facts and circumstances.

Delaware Authority to Cancel

Description

How to fill out Authority To Cancel?

Are you currently in a location where you need documents for both administrative or particular purposes almost every day.

There are numerous legal document templates available online, yet finding reliable versions is challenging.

US Legal Forms offers thousands of template formats, such as the Delaware Authority to Cancel, that are designed to comply with state and federal standards.

Once you find the correct document, click Get now.

Select the pricing plan you want, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Delaware Authority to Cancel template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you need and ensure it is for the correct state/county.

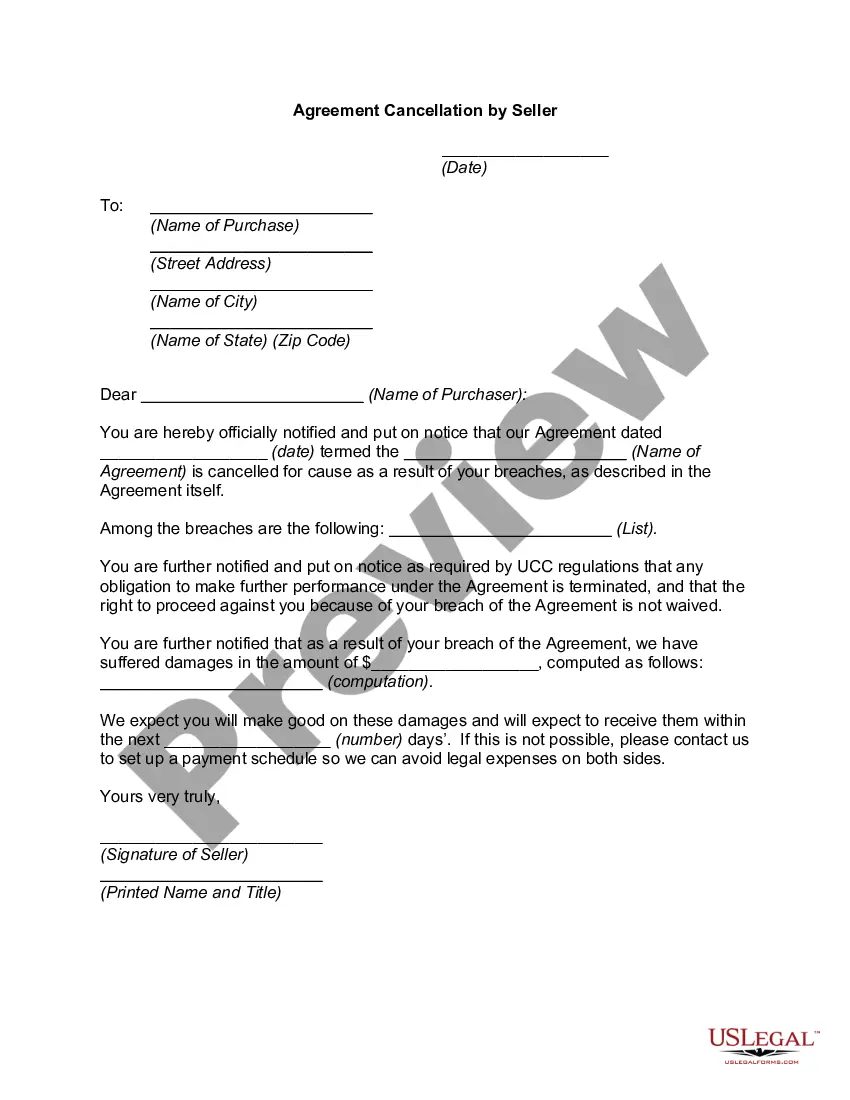

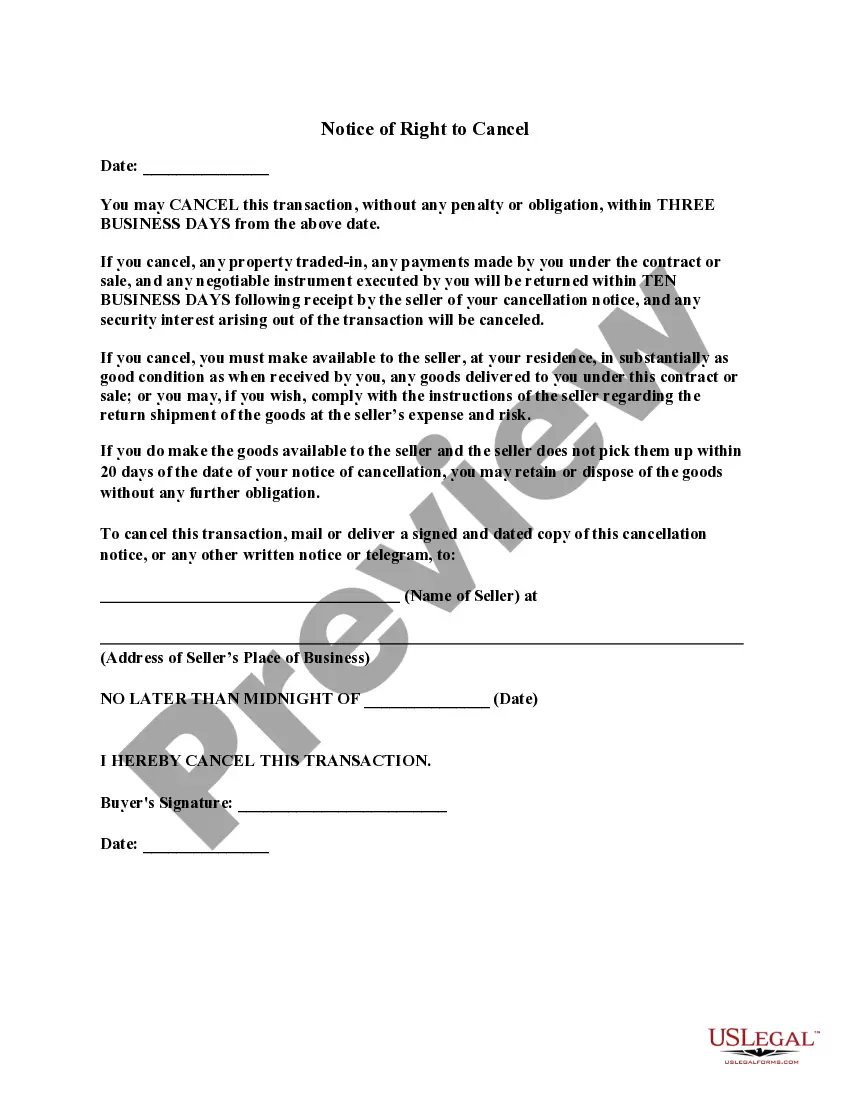

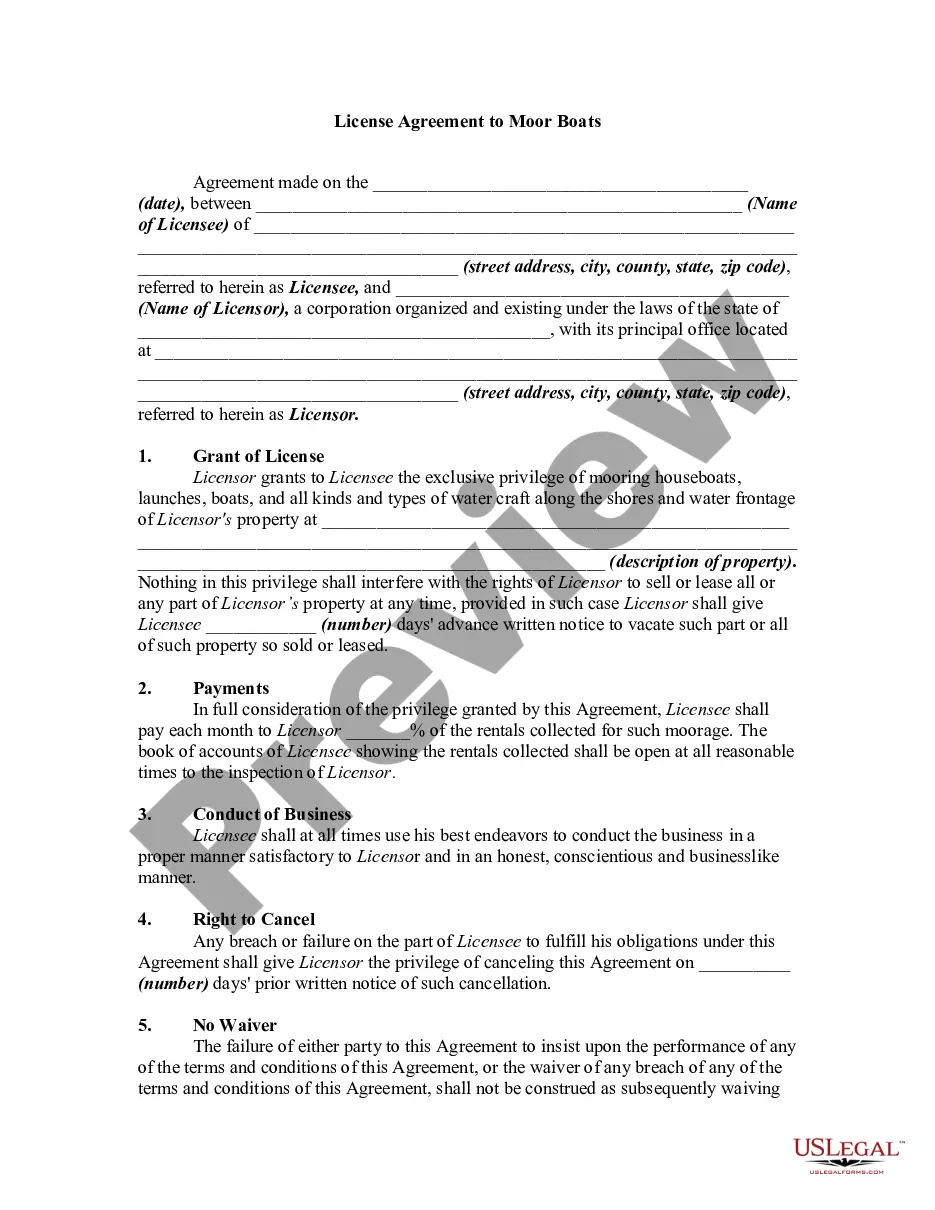

- Utilize the Review option to evaluate the document.

- Check the summary to ensure you have selected the appropriate template.

- If the document is not what you are looking for, use the Research field to find the document that meets your needs and criteria.

Form popularity

FAQ

Certificate of Cancellation means the certificate required to be filed with the Secretary of State of the State of Delaware pursuant to Section 18-203 of the Act in connection with a dissolution of the Company.

To dissolve your domestic corporation in Delaware, you must provide the completed Certificate of Dissolution form to the Department of State by mail, fax or in person, along with the filing fee. Include a Filing Cover Memo with your name, address and telephone/fax number to enable them to contact you if necessary.

Delaware's General Corporation Law ("GCL") provides for voluntary dissolution through a stockholder vote at a stockholder meeting. Before the vote, your board of directors must adopt a resolution to dissolve, submit it to the stockholders, and call the stockholder meeting to vote on the matter.

A Delaware Certificate of Cancellation is a legal document you will submit to the state of Delaware when you wish to formally dissolve your LLC. Countless tasks must be performed to close an LLC in Delaware, including dissolving and winding up the business.

If you don't file the Certificate of Cancellation, the LLC will continue to accumulate Delaware franchise tax annually. Failure to settle the tax will lead to an administrative dissolution when the franchise tax goes into arrears.

Steps to Cancel a Delaware LLCConsult the LLC Operating Agreement.Take a Member Vote.Appoint a Manager to Wind up the LLC's Affairs.Payoff Creditors, Current and Forseeable, before paying Members.Pay The Delaware Franchise Tax.Pay the LLC's members.File a Certificate of Cancellation.More items...

Steps to Cancel a Delaware LLCConsult the LLC Operating Agreement.Take a Member Vote.Appoint a Manager to Wind up the LLC's Affairs.Payoff Creditors, Current and Forseeable, before paying Members.Pay The Delaware Franchise Tax.Pay the LLC's members.File a Certificate of Cancellation.More items...

To withdraw your foreign Delaware Corporation in Delaware, you must provide the completed Foreign Corporation Certificate of Withdrawal form to the Department of State by mail, fax or in person, along with the filing fee.

The certificate of cancellation cancels your LLC's certificate of formation. There is a $200 fee to file the certificate. Your filing usually will be processed in 2-3 weeks.