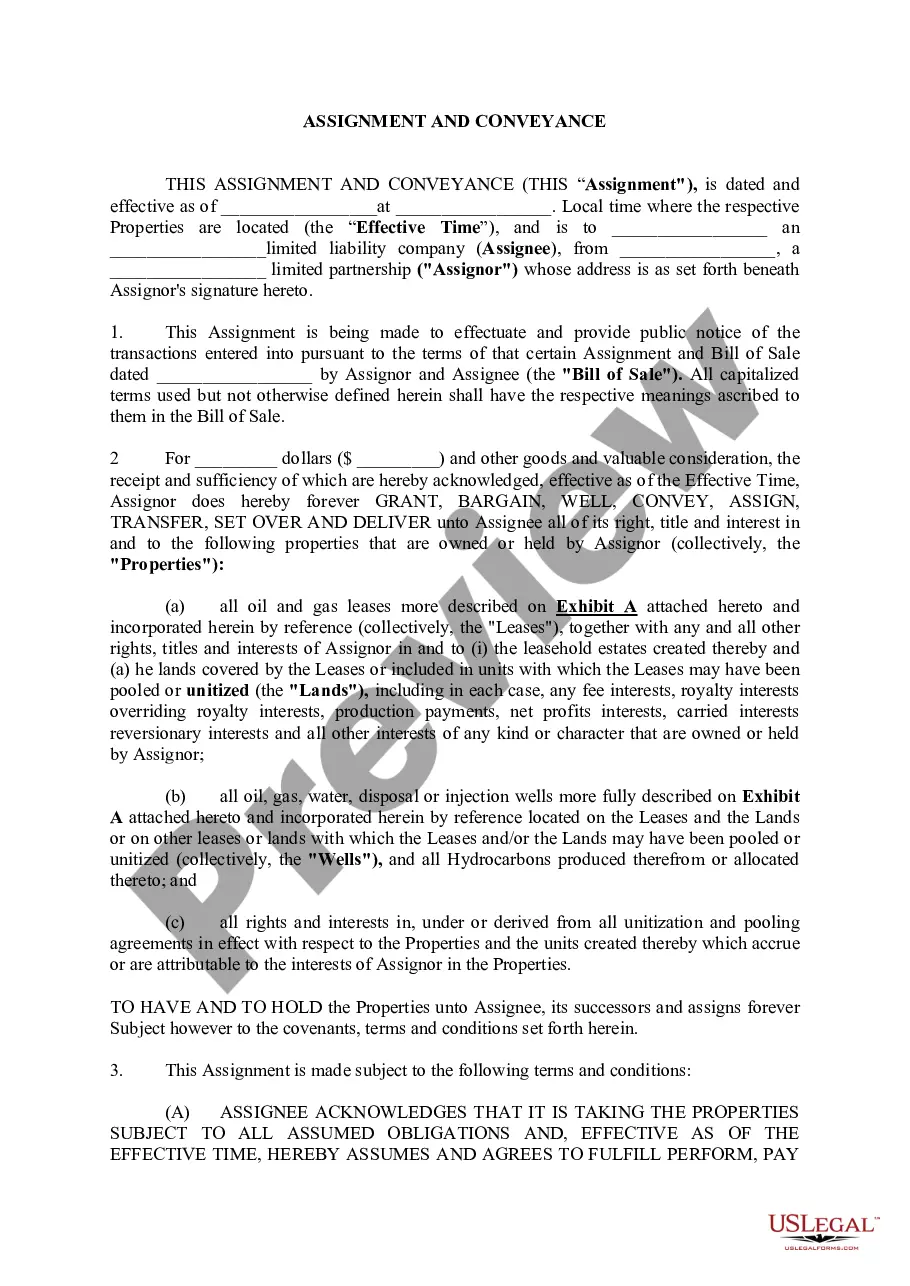

Delaware Accounts Receivable — Assignment refers to a financial practice where businesses located in Delaware transfer their accounts receivable (unpaid invoices or money owed by customers) to a third party in exchange for immediate cash flow. This strategy allows companies to secure immediate funds rather than waiting for their customers to make payments. In Delaware, Accounts Receivable — Assignment encompasses various types depending on the terms and conditions agreed upon between the assigning company and the assigned party. Some common types include: 1. General Accounts Receivable Assignment: This type involves the assignment of all outstanding invoices to the third party. It allows businesses to receive a lump sum payment for all their receivables but often requires a higher fee. 2. Partial Accounts Receivable Assignment: In this option, companies assign a specific portion of their accounts receivable to the assignee. It offers a more flexible approach, allowing businesses to access funds only for the selected invoices while maintaining control over others. 3. Recourse and Non-recourse Accounts Receivable Assignment: Recourse assignment implies that the assigning company bears the risk of non-payment by the customers. In contrast, non-recourse assignment transfers the risk of non-payment to the third party, thereby limiting the liability of the assigning company. 4. Factoring: Factoring is another type of accounts receivable assignment where businesses sell their invoices at a discounted rate to a factoring company. The factoring company then collects payments directly from customers and provides immediate cash to the business, deducting a fee or percentage as profit. 5. Invoice Financing: Invoice financing is a type of assignment where companies use their accounts receivable as collateral to secure a loan from a financial institution. The lender advances a percentage of the outstanding invoices' value, providing businesses with the required working capital while waiting for customer payments. Delaware companies often opt for accounts receivable assignment to optimize their cash flow, maintain liquidity, and manage operational expenses effectively. By leveraging this practice, businesses can avoid delays in receiving payment, invest in growth initiatives, cover immediate expenses, and reduce reliance on traditional financing options. In conclusion, Delaware Accounts Receivable — Assignment involves the transfer of outstanding invoices to a third party in exchange for immediate cash flow. Different types of assignments exist, including general, partial, recourse, non-recourse, factoring, and invoice financing. This financial strategy offers businesses in Delaware the opportunity to access working capital, mitigate risks, and accelerate their growth.

Delaware Accounts Receivable - Assignment

Description

How to fill out Delaware Accounts Receivable - Assignment?

Have you been in the place that you will need files for both business or person reasons virtually every day? There are tons of authorized record templates accessible on the Internet, but locating ones you can depend on is not straightforward. US Legal Forms delivers a large number of form templates, such as the Delaware Accounts Receivable - Assignment, that happen to be published to satisfy federal and state demands.

When you are previously informed about US Legal Forms internet site and have your account, just log in. Next, you can down load the Delaware Accounts Receivable - Assignment format.

Should you not offer an accounts and wish to start using US Legal Forms, adopt these measures:

- Obtain the form you will need and make sure it is to the appropriate metropolis/area.

- Take advantage of the Review option to check the form.

- Look at the information to ensure that you have selected the proper form.

- In case the form is not what you are looking for, take advantage of the Search area to obtain the form that meets your needs and demands.

- Whenever you get the appropriate form, just click Purchase now.

- Pick the prices strategy you need, complete the specified info to generate your money, and buy an order with your PayPal or bank card.

- Select a handy paper format and down load your copy.

Discover all of the record templates you may have purchased in the My Forms menus. You can obtain a further copy of Delaware Accounts Receivable - Assignment any time, if possible. Just select the necessary form to down load or print out the record format.

Use US Legal Forms, one of the most comprehensive collection of authorized kinds, in order to save time as well as stay away from mistakes. The service delivers expertly produced authorized record templates that you can use for a selection of reasons. Make your account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

In Delaware, the assignment agreement is the main document in which the assignor assigns its property to the assignee in trust for the assignor's creditors. The Delaware Code does not have a prescribed form of an assignment agreement, so general principles of contract and trust law apply.

Assignment of receivables would mean sale of the lease rentals, not the asset. In that case, the leased asset still remains the property of the assignor ? that is, the assignor has retained the residual interest in the asset. However, it would be different if the lessor sells the asset that has been leased out.

Accounts receivable factoring is a source of debt financing available to businesses that sell on credit terms. The borrower assigns or sells its accounts receivable (or specific invoices) in exchange for cash today.

An ABC is a liquidation process governed by state law by which a company (referred to as the assignor or the debtor) assigns all of its assets to an assignee (typically, a professional firm specializing in ABCs) that will manage the liquidation process and distribute the assets' proceeds to the company's creditors in ...

However, pledging is general because all accounts receivable serve as collateral security for the loan. On the other hand, assignment is specific because specific accounts receivable serve as collateral security for the loan. Assignment may be done either on a nonnotification or notification basis.

What are the journal entries for assigning Accounts Receivable as collateral for a loan? The entry to record assignment of Accounts Receivable as collateral would be a credit to cash, and a debit to assign Accounts Receivable. The cash account is debited because the company gave up the assigned receivables.

Accounts Receivable are amounts due from customers from the sale of services or merchandise on credit. They are usually due in 30 ? 60 days. They are classified on the Balance Sheet as current assets.