Subject: Comprehensive Guide to Delaware Sample Letters for Estate Tax Matters Dear [State Tax Commission], I am writing to address an important matter regarding the estate of a deceased individual in the state of Delaware. This detailed description aims to provide you with essential information and sample letters pertaining to estate tax concerns. By understanding the estate taxation process, we can work together to ensure compliance and facilitate a smooth resolution. 1. Introduction to Delaware Estate Tax: Delaware has its own estate tax system, distinct from federal regulations. The estate tax is levied on the transfer of assets upon an individual's death, primarily based on the value of the estate. It is crucial to acknowledge that estate tax matters can be complex, requiring thorough attention and adherence to state guidelines. 2. Sample Letter Types: a. Delaware Estate Tax Filing Extension Request: In certain situations, it may be necessary to request an extension for filing the Delaware estate tax return (Form 900). This sample letter provides a template for taxpayers seeking an extension due to reasonable causes, such as the need for additional time to gather required information or unexpected circumstances. b. Notification of Death and Executor Appointment: When a decedent passes away, it is essential to notify the State Tax Commission promptly. This sample letter assists the executor in communicating the death, expressing the intention to fulfill tax responsibilities, and requesting guidance on further steps. c. Delaware Estate Tax Payment Plan Proposal: If the estate lacks sufficient liquidity to pay the estate tax liability promptly, a sample letter proposing a payment plan can be utilized. This letter outlines the estate's financial situation, offers a proposed payment schedule, and demonstrates the willingness to fulfill tax obligations. d. Letter Requesting Estate Tax Closing Letter: To finalize the estate administration process, taxpayers may wish to request an Estate Tax Closing Letter from the State Tax Commission. This document confirms that the estate has met its tax obligations, providing peace of mind for the executor and heirs. The sample letter includes the necessary details for submitting such a request. 3. Essential Considerations: In crafting any letter to the State Tax Commission concerning a decedent's estate, it is crucial to include vital information such as the decedent's name, estate identification number, contact details, and relevant dates. Moreover, maintaining a respectful and professional tone throughout the communication is highly recommended. 4. Seek Professional Advice: While the provided sample letters serve as useful starting points, it is essential to consult with a qualified tax professional or an attorney to tailor these documents to specific circumstances. They can offer invaluable guidance, ensuring compliance with state regulations and maximizing the efficiency of the tax filing process. In conclusion, navigating Delaware's estate tax requirements can be a complex undertaking. However, armed with these sample letters and a comprehensive understanding of the processes involved, taxpayers can confidently fulfill their tax obligations while working closely with the State Tax Commission. We trust that this detailed guide will assist you in effectively managing estate tax matters and fostering constructive communication between taxpayers and the commission. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code]

Delaware Sample Letter to State Tax Commission concerning Decedent's Estate

Description

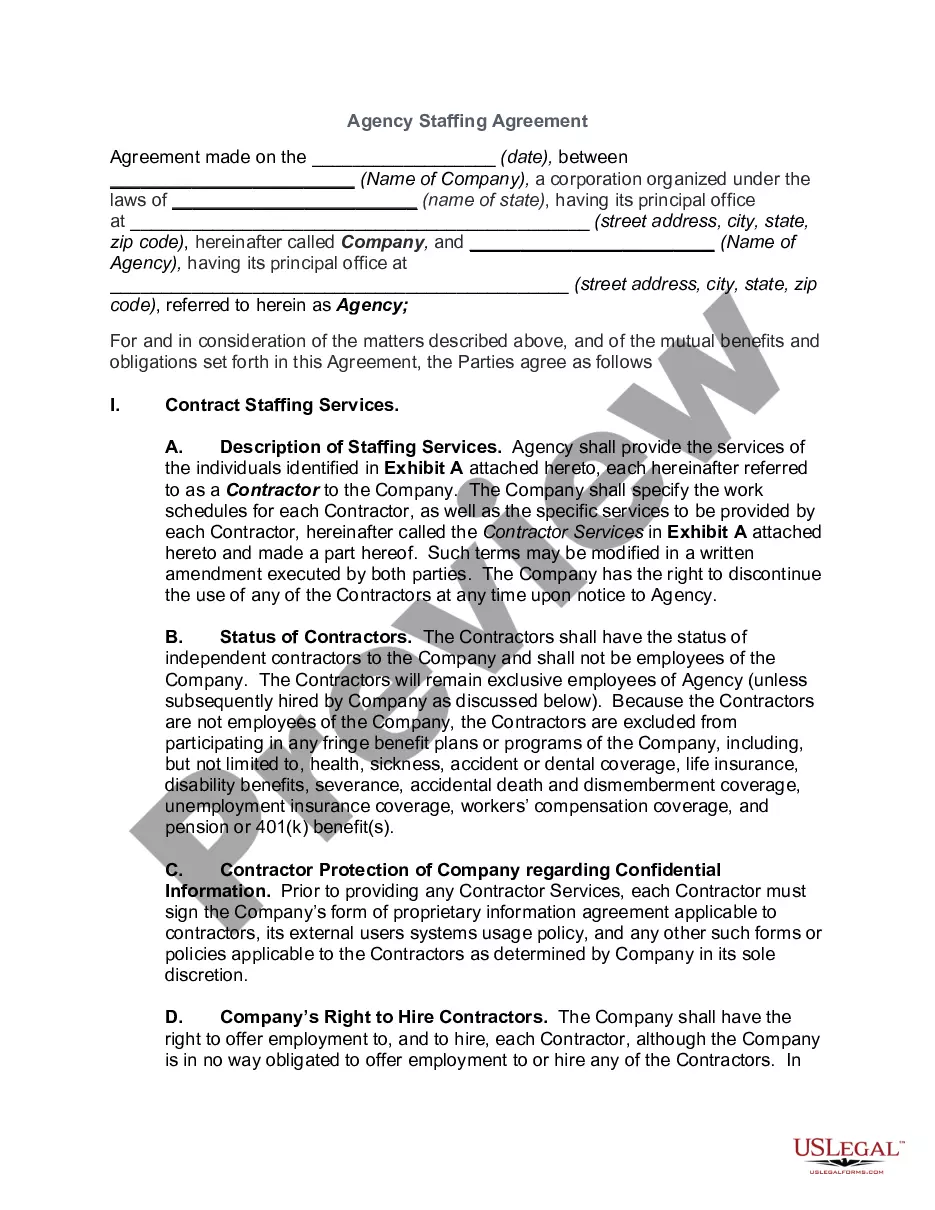

How to fill out Delaware Sample Letter To State Tax Commission Concerning Decedent's Estate?

If you need to complete, acquire, or print out legal papers layouts, use US Legal Forms, the greatest assortment of legal varieties, which can be found on-line. Utilize the site`s basic and handy look for to discover the documents you require. Different layouts for organization and individual functions are sorted by types and states, or key phrases. Use US Legal Forms to discover the Delaware Sample Letter to State Tax Commission concerning Decedent's Estate with a couple of mouse clicks.

When you are currently a US Legal Forms buyer, log in to the account and click on the Down load switch to have the Delaware Sample Letter to State Tax Commission concerning Decedent's Estate. You may also accessibility varieties you formerly downloaded within the My Forms tab of your account.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Ensure you have selected the shape for that appropriate metropolis/country.

- Step 2. Utilize the Review option to look over the form`s content. Don`t forget to see the description.

- Step 3. When you are unhappy with all the form, use the Search discipline near the top of the screen to discover other variations in the legal form design.

- Step 4. After you have located the shape you require, click on the Acquire now switch. Choose the prices program you choose and add your credentials to sign up for the account.

- Step 5. Process the purchase. You should use your bank card or PayPal account to finish the purchase.

- Step 6. Select the file format in the legal form and acquire it on the system.

- Step 7. Complete, modify and print out or indication the Delaware Sample Letter to State Tax Commission concerning Decedent's Estate.

Every single legal papers design you get is your own property permanently. You have acces to each and every form you downloaded inside your acccount. Go through the My Forms area and pick a form to print out or acquire again.

Contend and acquire, and print out the Delaware Sample Letter to State Tax Commission concerning Decedent's Estate with US Legal Forms. There are millions of specialist and state-certain varieties you can utilize for your organization or individual demands.