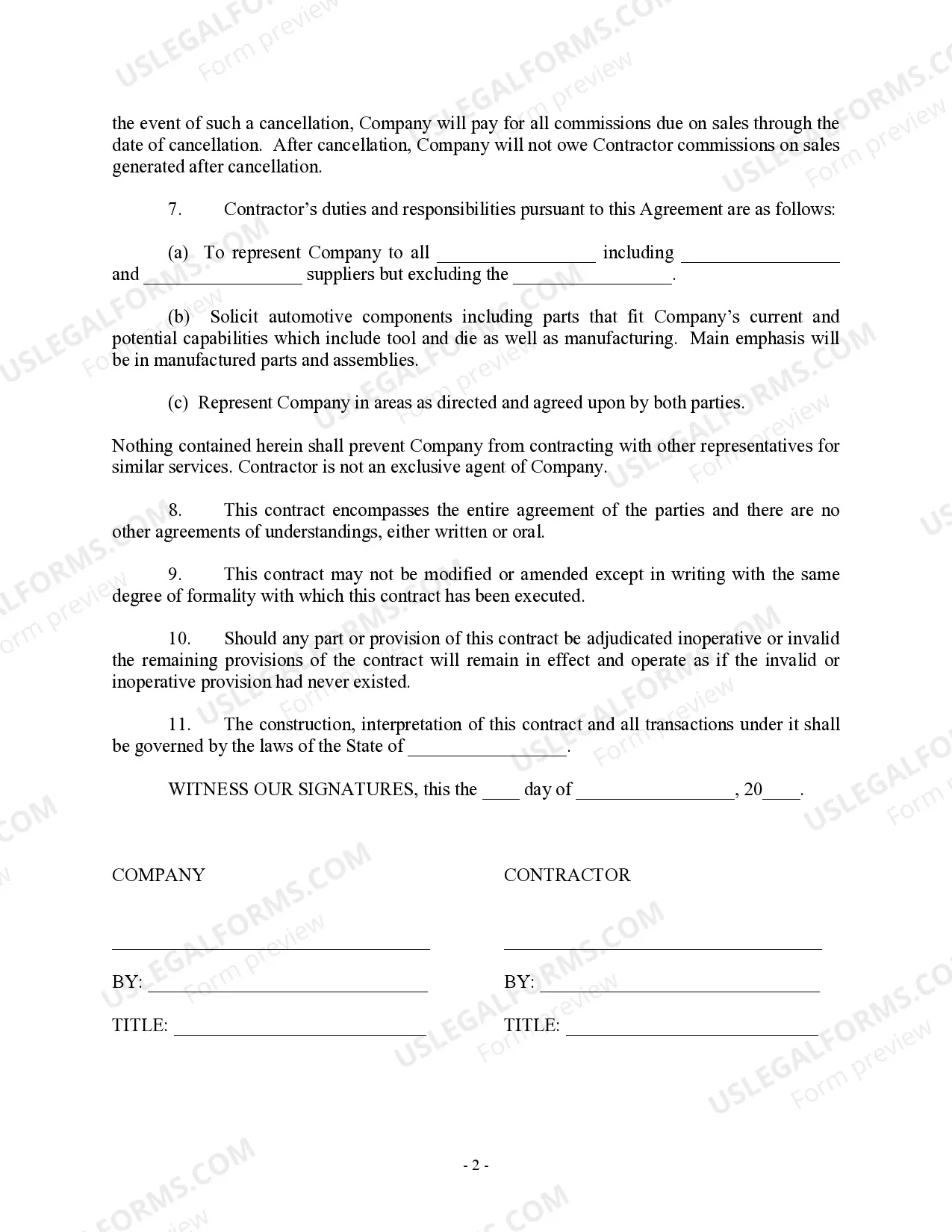

Delaware Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor refers to a legally binding document that outlines the terms and conditions between a self-employed individual and an employer in Delaware. This agreement grants the self-employed independent contractor the right to earn compensation based on a percentage of sales they generate for the employer. It is essential for both parties to clearly understand the agreement to ensure fair and transparent business dealings. The agreement typically includes various key elements such as: 1. Identification of the Parties: The agreement begins by clearly identifying the self-employed independent contractor and the employer, including their legal names and addresses. It is crucial to provide accurate information to avoid any disputes later. 2. Scope of Work: The agreement outlines the nature of the services the self-employed independent contractor will provide, including the specific duties, responsibilities, and obligations. This section helps in defining the parameters of the work relationship. 3. Compensation Terms: In this section, the agreement specifies that the self-employed independent contractor will receive a percentage of the sales revenue they generate for the employer. The exact percentage and the method of calculation should be clearly stated, providing clarity on how the compensation will be determined. 4. Payment Schedule: The agreement should specify the schedule on which the compensation will be paid to the self-employed independent contractor. It is common for the payment to be made on a regular basis, such as weekly, bi-weekly, or monthly. 5. Independent Contractor Status: It is important to establish that the self-employed individual is an independent contractor and not an employee. This distinction avoids legal issues related to employee benefits, tax obligations, and employer's responsibilities. 6. Duration and Termination Clause: The agreement should clearly state the duration of the contract, whether it is for a specific time period or an ongoing basis. Additionally, the terms under which either party can terminate the agreement should also be detailed. 7. Confidentiality and Non-Compete Clause: To protect the employer's proprietary information or trade secrets, this section deals with confidentiality and non-compete obligations of the self-employed independent contractor, preventing them from sharing or using such information for personal gain or competing against the employer. Other types of Delaware Employment Agreements — Percentage of Sale— - Self-Employed Independent Contractor may include variations in the compensation structure, such as tiered commission rates based on different levels of sales, or different commission rates for different products or services sold. The specific terms and conditions may vary depending on the industry, company policies, and negotiations between the parties involved. It is crucial for both parties to carefully review, understand, and sign the Delaware Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor to ensure legal protection and a clear understanding of their respective rights and obligations.

Delaware Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out Delaware Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

Discovering the right authorized file format could be a have difficulties. Naturally, there are plenty of templates available online, but how can you discover the authorized type you require? Make use of the US Legal Forms website. The service provides thousands of templates, such as the Delaware Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor, which can be used for company and private requirements. All of the varieties are checked out by pros and fulfill state and federal requirements.

Should you be previously registered, log in for your profile and then click the Download switch to have the Delaware Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor. Use your profile to search with the authorized varieties you possess ordered formerly. Proceed to the My Forms tab of the profile and acquire an additional backup in the file you require.

Should you be a fresh user of US Legal Forms, here are straightforward instructions that you should adhere to:

- Initially, make certain you have chosen the appropriate type for your personal metropolis/region. It is possible to look over the form making use of the Review switch and look at the form explanation to ensure it will be the best for you.

- When the type fails to fulfill your expectations, take advantage of the Seach discipline to get the proper type.

- Once you are certain that the form is proper, click on the Get now switch to have the type.

- Select the pricing prepare you desire and enter in the required details. Create your profile and pay money for the transaction making use of your PayPal profile or Visa or Mastercard.

- Opt for the submit structure and download the authorized file format for your device.

- Full, revise and print out and signal the attained Delaware Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

US Legal Forms is the largest local library of authorized varieties where you can find different file templates. Make use of the service to download expertly-produced paperwork that adhere to express requirements.