A Delaware Loan Assumption Agreement is a legal document that outlines the terms and conditions for transferring an existing loan from one party to another. It is a contract that allows a new borrower to assume the responsibility for the outstanding loan balance, including the remaining payments and any associated fees or interest. In Delaware, there are various types of Loan Assumption Agreements available, depending on the nature of the loan and the specific circumstances. Some common types include: 1. Residential Loan Assumption Agreement: This agreement is used when a homeowner wants to transfer their existing mortgage to another party, typically upon selling their property. The new borrower takes over the remaining debt and becomes responsible for making future payments. 2. Commercial Loan Assumption Agreement: In the case of a commercial property or business, this agreement allows a new borrower to assume the existing loan and related obligations. It is commonly used when a business or property is being sold or transferred to a new owner. 3. Student Loan Assumption Agreement: This type of agreement is specific to educational loans. It enables a new borrower, such as a family member or a spouse, to take over the responsibility of repaying the student loan debt from the original borrower. 4. Assumable Mortgage Agreement: In certain cases, a mortgage loan may have an assumable feature that allows a new borrower to take over the loan without changing its terms. This type of agreement allows the new borrower to assume the mortgage debt, interest rate, and repayment schedule. 5. Assumption and Modification Agreement: This agreement combines loan assumption with modification, allowing the new borrower to negotiate changes to the terms of the original loan, such as interest rates, repayment periods, or payment amounts. When entering into a Delaware Loan Assumption Agreement, it is crucial for both parties to understand the terms and obligations involved. The agreement should clearly outline the responsibilities of the new borrower, including payment schedules, interest rates, and any additional fees or charges. It is also essential to ensure compliance with Delaware state laws and regulations governing loan assumption transactions. In summary, a Delaware Loan Assumption Agreement is a legally binding document that allows for the transfer of an existing loan from one party to another. Different types of Loan Assumption Agreements exist in Delaware, including residential, commercial, student, assumable mortgage, and assumption and modification agreements. It is crucial for all parties involved to carefully review and understand the terms and obligations outlined in the agreement to ensure compliance and a smooth transfer of the loan.

Delaware Loan Assumption Agreement

Description

How to fill out Delaware Loan Assumption Agreement?

US Legal Forms - one of the largest libraries of lawful kinds in the United States - gives an array of lawful record themes you may download or print out. Using the internet site, you can get a huge number of kinds for company and specific uses, sorted by groups, says, or keywords and phrases.You will discover the most up-to-date versions of kinds much like the Delaware Loan Assumption Agreement in seconds.

If you currently have a membership, log in and download Delaware Loan Assumption Agreement through the US Legal Forms library. The Obtain switch will appear on each and every type you view. You have accessibility to all earlier delivered electronically kinds inside the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, listed below are easy recommendations to obtain started:

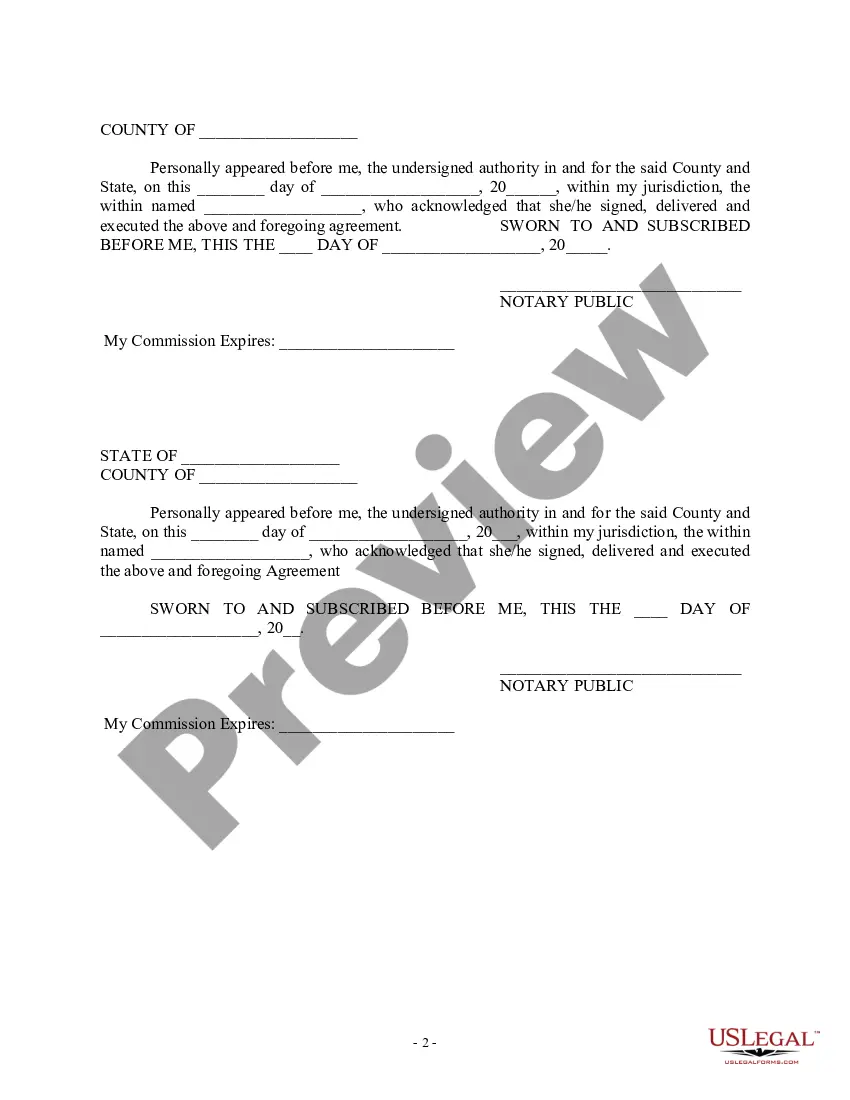

- Make sure you have picked the correct type for your personal metropolis/region. Click the Review switch to examine the form`s content. See the type information to actually have selected the proper type.

- If the type does not fit your needs, make use of the Look for field near the top of the display to find the one that does.

- Should you be happy with the form, affirm your selection by clicking the Buy now switch. Then, choose the prices plan you want and supply your references to sign up for an profile.

- Approach the deal. Utilize your Visa or Mastercard or PayPal profile to accomplish the deal.

- Choose the formatting and download the form on the system.

- Make alterations. Fill out, edit and print out and signal the delivered electronically Delaware Loan Assumption Agreement.

Every design you put into your bank account lacks an expiration day which is yours eternally. So, if you would like download or print out another version, just visit the My Forms segment and click on about the type you will need.

Obtain access to the Delaware Loan Assumption Agreement with US Legal Forms, one of the most considerable library of lawful record themes. Use a huge number of professional and condition-certain themes that fulfill your small business or specific needs and needs.